Overview

ISIN

GB0007873697SEDOL

0787369Investment proposition

Aims to be a core investment for private investors seeking income. Its objective is to grow the dividend at a faster rate than inflation by increasing capital and growing income. The focus of the portfolio is on global equities but investments are also made in bonds, property and other asset types.

Share price and charges

Price

507.00pNAV at fair

556.78pNAV at book

537.43pPremium (+) or discount (-) at fair

-8.9%Premium (+) or discount (-) at book

-5.7%Ongoing charges*

0.58%Fund facts

Active share

86%**

Fund launch date

1873

AIC Investment Sector

Global Equity Income

Benchmark

FTSE All-World Index

**Relative to FTSE All-World Index. Source: Baillie Gifford & Co, FTSE.

An income that grows ahead of inflation is valuable. Better still if that income is resilient through thick and thin. SAINTS has delivered annual dividend increases for over fifty years and we are wholly focussed on doing so in the future.

Meet the managers

Meet the directors

Property managers

Ratings

As at: 31 October 2025

Regulatory news announcements

Regulatory news announcements which are released to the London Stock Exchange can be accessed via their service.

The Association of Investment Companies

Further information on investment trusts and the investment trust sector can be found on The Association of Investment Companies website.

Risk Warnings

Risk Introduction

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested. The level of income is not guaranteed. The specific risks associated with the Trust include:

Currency

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

Emerging Markets

The Trust invests in emerging markets, which includes China, where difficulties with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

Gearing

The Trust can borrow money to make further investments (sometimes known as "gearing" or "leverage"). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

Liquidity

Values for securities which are difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

Derivatives

The Trust can make use of derivatives which may impact on its performance.

Property

The Trust has some direct property investments, which may be difficult to sell. Valuations of property are only estimates based on the valuer's opinion. These estimates may not be achieved when the property is sold.

Corporate Bond

Corporate bonds are generally perceived to carry a greater possibility of capital loss than investment in, for example, higher rated UK government bonds. Bonds issued by companies and governments may be adversely affected by changes in interest rates and expectations of inflation.

Premium Risk

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

Buy-backs

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

Regulation of Investment Trusts

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

Index disclaimer

Important information

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. The information in this area is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances should the information in this area be made available to “retail clients” as defined by the Corporations Act.

The information in this area contains general information only. It does not take into account any person’s objectives, financial situation or needs.

Fund performance

Periodic Performance

As at: 30 November 2025

1 Year | 3 Years | 5 Years | 10 Years | |

|---|---|---|---|---|

Share Price | 2.5% | 8.1% | 31.0% | 165.9% |

NAV | 1.4% | 18.4% | 48.5% | 205.6% |

Benchmark* | 14.2% | 52.1% | 81.4% | 250.6% |

Discrete Performance

As at: 30 September 2025

30/09/2020 – 30/09/2021 | 30/09/2021 – 30/09/2022 | 30/09/2022 – 30/09/2023 | 30/09/2023 – 30/09/2024 | 30/09/2024 – 30/09/2025 | |

|---|---|---|---|---|---|

Share Price | 16.3% | -7.2% | 12.8% | 6.5% | 2.2% |

NAV | 19.7% | 4.5% | 7.3% | 11.4% | 2.3% |

Benchmark* | 22.7% | -3.6% | 11.1% | 20.2% | 17.4% |

Performance

As at: 30 November 2025

Source: Morningstar, FTSE.

Performance figures appear in GBP. Benchmark data is limited to a 5 year period from the current date.

The graph has been rebased to 100.

Discount/premium history at fair

As at: 30 November 2025

Source: Morningstar. Premium/Discount of share price to NAV at fair.

If the graph shows negative figures this means that the share price is lower than the NAV at fair – this is known as trading at a Discount.

If the graph shows positive figures this means that the share price is higher than the NAV at fair - this is known as trading at a Premium.

Active Share

As at: 30 November 2025

Relative to FTSE All-World Index. Source: Baillie Gifford & Co, FTSE.

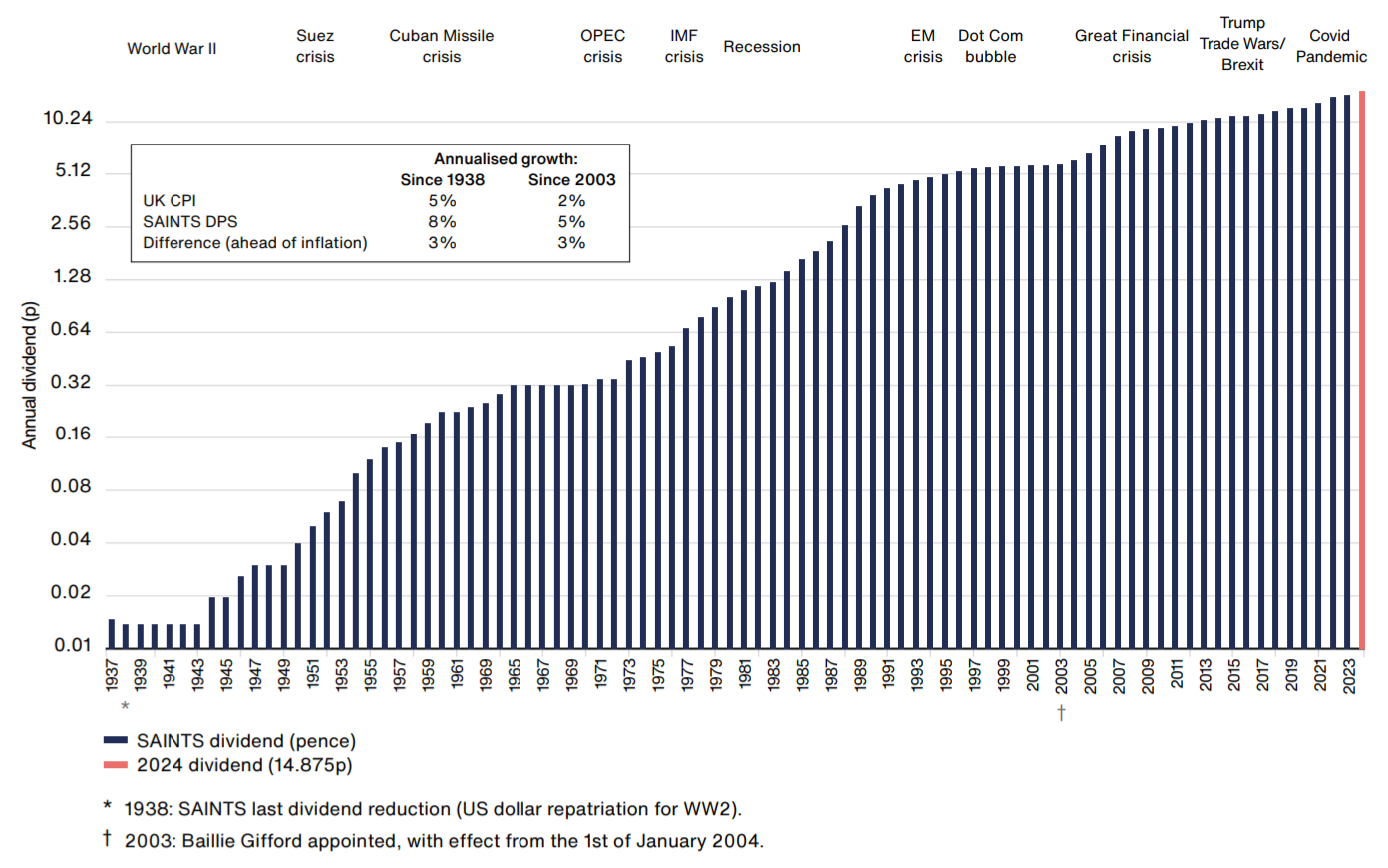

Dividend Growth Vs Inflation

As at: 31 December 2024

Figures rebased to 100 at 31 December 2014.

Source: LSEG/Baillie Gifford & Co. The Consumer Price Index (CPI) is a measure of inflation that is used in the Government's target for inflation.

Long-term dividend record

No dividend reductions in the past eighty years

Fund portfolio holdings

The list of top 10 holdings that this fund invests in.

As at: 30 November 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | Microsoft | 3.7% |

| 2 | TSMC | 3.6% |

| 3 | Apple | 3.6% |

| 4 | Procter & Gamble | 2.7% |

| 5 | CME Group | 2.6% |

| 6 | Coca-Cola | 2.5% |

| 7 | Atlas Copco | 2.5% |

| 8 | Analog Devices | 2.2% |

| 9 | Roche | 2.2% |

| 10 | Deutsche Börse | 2.1% |

Property portfolio

More detail on the property portfolio of the Scottish American Investment Company can be found within the annual report.

Insights

Key articles, videos and podcasts relating to the fund:

Filters

Insights

The science behind investing

From nanotechnology to investing, Olivia Knapp explores the chemistry of good research.

Profile of a returning industry veteran

After nearly 20 years leading global equity teams, explore why Alistair Way returns to Baillie Gifford.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

Tomorrow’s income aristocrats

Income investing has been shaken by the coronavirus, but how will this affect the dividend payers of the future? Baillie Gifford investment manager James Dow gives us a glimpse of the potential star performers of tomorrow.

Should income investors go global

What are “the good, the bad and the unbelievably great” of global investing? In the second episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by James Dow to challenge the conventional wisdom that if you’re investing for a regular income you should stick with blue chip UK companies.

The science behind investing

From nanotechnology to investing, Olivia Knapp explores the chemistry of good research.

Profile of a returning industry veteran

After nearly 20 years leading global equity teams, explore why Alistair Way returns to Baillie Gifford.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

Tomorrow’s income aristocrats

Income investing has been shaken by the coronavirus, but how will this affect the dividend payers of the future? Baillie Gifford investment manager James Dow gives us a glimpse of the potential star performers of tomorrow.

Should income investors go global

What are “the good, the bad and the unbelievably great” of global investing? In the second episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by James Dow to challenge the conventional wisdom that if you’re investing for a regular income you should stick with blue chip UK companies.

AGM and voting

When you invest in an investment trust you become a shareholder and have a say on how the Company is run. You also have a right to attend the Company's annual general meeting (AGM).

How to vote

The following link will take you through to The Association of Investment Trusts' (AIC) website where there is information on how to vote your shares if you hold them via one of the major platforms.

How to attend the AGM

If you hold your shares through a platform, it is not always obvious how to attend an AGM. The following link will take you through to The Association of Investment Trusts’ (AIC) website where there is information on how your platform can help you attend this important shareholder meeting. If you do not see your provider listed, please contact your provider directly and ask them to assist.

SAINTS corporate calendar

Our corporate calendar provides details of the regulatory events that occur over the year. This includes dates for reports, results, dividend payments and the AGM.

| Event | Month (each year) |

| Final results announced | February |

| Interim results announced | August |

| Financial year end date | 31 December |

| Annual general meeting | April |

| Dividends payable | April, June, September, December |

AGM

SAINTS annual general meeting (AGM) was held on Tuesday 8 April 2025. You can read a summary of the results of the voting on AGM resolutions here.

Voting

A breakdown of the votes cast by Baillie Gifford over the previous quarter on behalf of the investment trust is available in the Proxy voting disclosure.

Registrar

Computershare Investor Services PLC maintains the share register on behalf of the Company. Queries regarding shares registered in your own name can be directed to:

Computershare Investor Service PLC,

The Pavilions,

Bridgwater Road,

Bristol,

BS99 6ZZ

T: +44 (0)370 707 1282

Documents

You can access any literature about the Fund here.

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.