Key Points

- We have mined International All Cap Strategy’s archives for examples of our thinking dating back to the early 1990s

- They range from insights into specific companies, including ASML and Richemont, to our consideration of political events, such as Brexit

- They also show how we have developed our thinking about corporate governance and sustainability, among other issues

© Ho/AP/Shutterstock

Please remember that the value of an investment can fall and you may not get back the amount invested.

Below we present extracts from three decades worth of research notes and reports. They serve as snapshots of our thinking over the period.

Each example is rooted to its time. But we think it’s possible to draw four critical lessons:

1. Consistency matters most of all in difficult times

We achieved past success by remaining committed to our fundamental strategy and process as long-term growth investors – bottom-up stock-picking with three, five or ten-year windows in mind. And we have not diverged from this, even at time when our performance has temporarily lagged benchmark indexes.

2. You don’t have to get everything right

We will inevitably make investment decisions that do not play out as we hope. But so long as we stick to our research processes and investment philosophies, over the long term we should get more right than we do wrong, and that is what ultimately drives performance.

3. Uncertainty is a fact of life, and an opportunity

It’s impossible to know the outcome of major macroeconomic events, such as elections or interest rate decisions, in advance. However, these give us a chance to step back and consider where long-term growth will come from and invest accordingly.

4. Not everything that seems new really is

Just because something has a new name does not mean it didn’t exist before. For instance, sustainability has risen in prominence over recent years. But we were discussing the same considerations under the initialism SRI (socially responsible investment) more than two decades ago.

1991

Top 10 holdings:

1992

Vodafone is the UK’s leading cellular phone operator. Although the economic downturn has caused the rate of new subscribers to slow, penetration levels are still relatively low and the long-term growth prospects are good, so we added to the holding.

1994

In Britain, if the opinion polls are to be believed, the ruling Conservative Party is as unpopular as it has ever been, while the prospects for the economy are better than for many years. Exports are growing at an 8 per cent rate; productivity is improving; the current account deficit, which many had expected to deteriorate in traditional British fashion, has declined to almost negligible levels and, above all, inflation remains low.

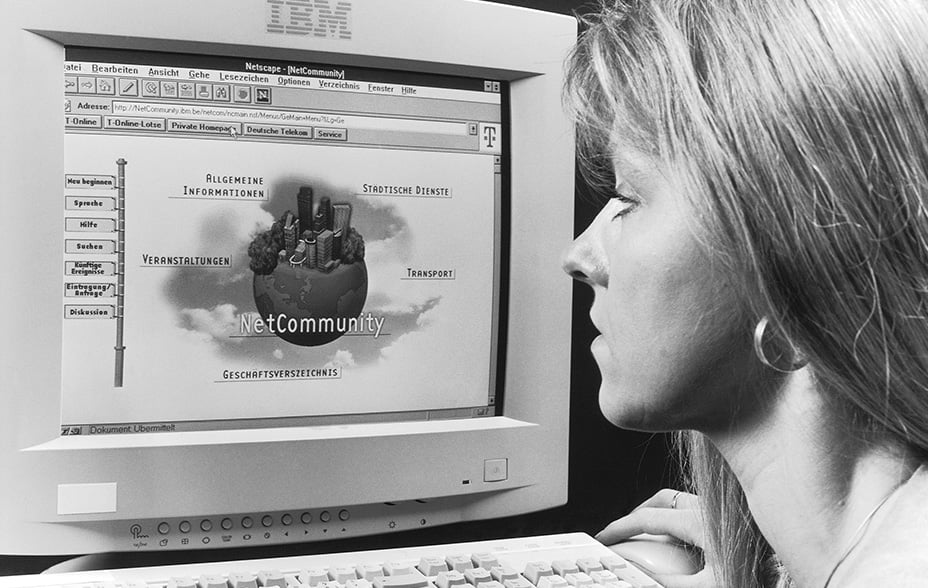

1998

Multimedia and internet-based applications are growing at an exponential rate as the data wave continues to outdo expectations. More interesting is the question of what sort of businesses these will be in five or ten years’ time – the bulls of the internet believe it will have a double-digit percentage of the global retail market and point to the success of the bookselling niche as evidence of what can happen with critical mass.

© ullstein bild/Getty Images

1999

Our Investment Policy Committee has taken into account the influence of the millennium bug before the new year, and the potential for various levels of disruption after it. Our stock-picking has been influenced by problems and opportunities facing general sectors and individual companies. We have made every reasonable effort to be fully compliant and to provide a normal standard of service ourselves on 4 January.

As usual, our response will be pragmatic and company oriented. We shall continue to favour the main winners in the new economy, while increasing our efforts to identify those companies which have been prematurely consigned to the scrapheap of history.

2000

The combination of ASML’s manufacturing and commercialising primacy with Silicon Valley Group’s record of innovation and access to the best of US technology and suppliers offers this combination of companies the prospect of clear dominance in the field of lithography. We feel this situation will become apparent as the world moves into the next generation of even smaller and more sophisticated chips.

We have [started] our programme for addressing socially responsible investment (SRI) at the companies in which we invest. In doing so, our focus has been on the possible business risks that may be associated with companies’ ineffective management and of social, environmental and ethical matters, and on the positive benefits for companies where these are managed well.

2001

At the heart of our approach to investment is a wish to invest in, and hold on to, successful companies with superior growth prospects. There are two ways to make money in the stock market: through the growth of the underlying business or the revaluation of that business. We invest with a growth bias because we believe it is easier to beat the market by getting the growth right, rather than by trying to anticipate the value that other investors will put on a company.

Investing in real, sustainable growth has been a successful strategy for as long as there have been stock markets. There is no reason to think that this will change. Investors’ confidence in companies’ growth prospects rises and falls; this creates opportunities – and risks, as we saw last year. In the long run, growth is very valuable, often more valuable than the stock market is prepared to believe. Growth is devalued when investors panic. That is what is happening now.

2002

We have always stressed the importance of detailed, bottom-up analysis of the companies in which we invest our clients’ money. We prefer companies whose cash flow can be traced with reasonable clarity as it passes through the accounts – this was the basis on which we avoided Enron.

2003

Adidas has a strong base in Europe and the fast growing Asian markets, and we expect it to establish itself as the clear number two behind Nike in the US market.

© FilmMagic/Getty Images

There is no doubt that growth is harder to find than it used to be, and more precarious once achieved; but it is also more valuable, and the returns to investors are likely to be commensurately greater.

2004

The commoditisation of consumer products, whether they are as simple as a tin of beans or as complicated as a computer, is an inexorable process. Thus, many companies traditionally viewed as fast growing will continue to see their growth stall. The beneficiaries in this environment will be either low cost, high volume producers, or those that offer a genuinely differentiated product.

2005

Small versus large is less important than picking the right companies to invest in. In our view, fundamental analysis of individual companies remains the best way to construct a portfolio of high conviction, well researched stock ideas. In other words, buying shares in the right companies is more important than their size.

2006

Scale can work very well as an edge in luxury. Advertising and distribution advantages seem clear – margins and returns should rise to scale over time so long as you avoid cheapening the allure. For this reason, I can forgive Richemont paying what they admitted was a high price to buy LMH [Les Manufactures Horologères] watches in 2001. It strengthened their position hugely and, to me at least, illustrates that the company is being run for real long-term durable value creation and feels no pressing need to maximise short-term returns.

While the timings, magnitudes and perhaps most importantly the causes of rises and falls are unpredictable, markets or at least their constituents, nonetheless do conform to some recognisable patterns. Companies which consistently produce superior earnings growth do outperform markets over longer-term periods. Because of this, investment based on individual stock assessment has a far greater chance of succeeding (adding value) than that based on guesswork.

2007

The most important events in the first three months of this year have been the emergence of a crisis in the American sub-prime mortgage market, and the continuing rise of private equity. There are two aspects of the situation which are of particular interest to investors: will these defaults cause a widespread financial crisis, and will they affect the confidence of consumers in general?

Every sector of the economy will be affected by climate change if the current trends persist, either directly, as result of changes in the regulatory, commercial or natural environment, or indirectly, via the impact on economic activity and inflation. For investors, the greatest opportunities lie within those sectors that will be directly affected.

2008

The credit crisis is like a badly written soap opera in which too many new characters are introduced on a weekly basis. We have met the monoline bond insurers; now we have been introduced to the Auction Rate Securities. How many other miscreants lurk in the wings?

© Sipa/Shutterstock

Despite the very weak background, our objective remains clear. We are long-term investors whose job is to identify companies that will grow their earnings more strongly than the market. We endeavour not to become distracted by the short-term behaviour of markets and, indeed, recognise that there may be opportunities among companies whose shares have been punished unfairly amidst the recent turmoil.

2009

Online clothing shopping is becoming increasingly popular, helped by greater customer confidence in the concept, while the development of the ASOS ‘brand’ is, we believe, progressing in a very exciting way. ASOS has a very broad range of product lines available on its site, which it updates regularly. The entrepreneurial management team has several growth initiatives in place to maintain the company’s lead, and we believe the business has the potential to be many times larger looking out over the next five to ten years.

2010

We believe that the internet is a good example of a situation where investors tend to become very excited by short-term potential, but ultimately underestimate the actual impact of developments over the longer run. This is where we believe we can add most value.

2011

The ‘4Q research framework’ is adopted, asking four questions about companies being considered as potential holdings and to justify the place of those already in the portfolio:

Will this company be significantly larger in five years?

Are management sensible guardians of our clients’ capital?

Valuation: why is this growth not reflected in the current share price?

What would make us sell?

2012

We acquired a small position in Mesoblast, an interesting biotech company researching and developing stem cell treatments for heart failure and other debilitating diseases… there is a high chance that its share price could fall by 100 per cent, but also a decent chance that it could rise to a multiple of its current level. We endeavour to rationally weigh up the probability of one outcome against the other, although it’s always hard to completely ignore the fear of looking daft if it doesn’t work out. We do however hope that other investors are even more fearful of ridicule than we are, and that this might be the opportunity.

2013

King Lear – O, that way madness lies; let me shun that.

Central bankers could do worse than re-visit their old Shakespeare texts. Attempts to manage and cajole expectations, and expectations of expectations, in fickle financial markets are clearly difficult, and can often prompt unintended consequences.

2014

In 10 years’ time, it is likely that we will all look back with wide eyes and ask: “Did all those changes really happen over such a short time period?” [Since 2008], in the UK, we have had amendments to the Corporate Governance Code; the introduction of the Stewardship Code; a binding vote on remuneration policies; changes to the Audit Report, and an EU Audit Directive now requiring the mandatory re-tendering of contracts for auditors. We also have the European Commission’s Shareholder Rights Directive, and Integrated Reporting is a common topic of discussion and debate.

Sitting behind a desk in Edinburgh is a very comfortable place to be when analysing garment companies and assessing their approaches to working conditions, pay scales, what the correct minimum age for employees is and whether subcontracting to an unaudited supplier factory is acceptable or not. Companies’ sustainability reports tend to describe the issues in black and white terms with a list of actions that are unacceptable and others that require improvement and monitoring. In reality, it is not that simple.

2015

On 12 December 2015, the Paris Agreement was signed by 195 nations after two weeks of negotiations. Whilst this is a phenomenal feat of diplomatic prowess, it is not quite time to open the champagne. Targets are vague, country-level binding reduction targets are absent and there are no punitive measures for non-compliance. Accordingly, the true success of the Paris Agreement will be measured by what happens in the next 10–15 years.

It usually doesn’t feel like it at the time, but in this context the inevitable wobbles in equity markets (such as the recent quarter) can often be good news: you get to buy even more of these great businesses at even better prices.

2016

2016 was a year that emphasised the futility of political/macro predictions. There were surprises with Brexit in the UK, the election of Donald Trump in the US, as well as new prime minister in Italy and a suspended president in South Korea. Indeed, with the war in Syria and the broader mass migration into Europe dominating the news, political and geopolitical uncertainty seemed to be the new normal by year end.

© Bob Daemmrich/Alamy Stock Photo

Charles Darwin applies just as much to companies and countries: “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

2017

Olympus, the Japanese camera and endoscope manufacturer, was forced to admit to a long-running accounting fraud in 2011. Despite clear evidence of historic mismanagement and fraud, we decided to remain invested in the company. We believed that the steps the company had taken to remove those responsible and improve board oversight demonstrated its commitment to addressing past acts. Importantly, we also believed that the endoscope business would prosper if the company could address the current issues. This illustrates why we don’t consider a blanket ‘sell and move on’ policy to be the most constructive or the most rewarding when poor corporate behaviour is identified. We believe it can be profitable and ethically justifiable to back businesses which are addressing previous shortcomings and are taking seriously their obligation to improve.

2018

We have taken a holding in Spotify, the global music streaming platform that originated in Sweden. Compared to other streaming services, Spotify has a competitive advantage due to the greater amount of data it possesses, enabling it to better understand its customers. This allows it to provide a better discovery platform for its users, which we believe will be key to user experience, and differentiation.

Those of you who have been reading these letters and meeting us over the years will be familiar with our constant refrain that we are bottom-up stock pickers; we do not take holdings simply because a company ticks some thematic box. However, you should not take that as meaning that we ignore the broad shifts in the industries within which our companies operate, in fact the opposite is true. We are always on the lookout for the attractive combination of companies with strong franchises which also operate in industries that are experiencing long-term tailwinds. This combination of underlying industry momentum together with resilient franchises often leads to the strongest long-term growth in share prices.

2019

Sustainability has gone into the mainstream, and over the next decade, it will start to have a financial impact on all businesses – we may be approaching the limits of conventional economic growth and the future winners will be the companies that are offering solutions to society’s challenges such as climate change.

(We have taken a stake in Nibe). Its products, particularly ground source heat pumps, are far more energy efficient and cleaner than heating a building with oil or gas, helping contribute towards a low carbon economy. Nibe’s highly entrepreneurial management team has been involved in running the company since a management buyout in 1989 and we believe is well placed to grow the business.

2020

Our thoughts are with everyone who is affected by the spread of the virus, and we know that with schools closing and travel severely restricted many people are working hard to juggle home, family and work responsibilities. In these difficult times we particularly value the support of you, our clients, who have almost without exception responded with calm consideration to market disarray and volatility. This makes our job much easier by allowing us to focus on the investment task in hand.

We do not seek to dismiss the distress and tragedy that have resulted from [Covid] and the inconvenience of the sudden changes in living and working habits that have followed. However, we think it is appropriate to recognise the way in which technology, ingenuity and innovation have helped mitigate some of these challenges and indeed have created business opportunities.

2021

The 4Q framework is expanded to include a fifth question on sustainability:

What are the environmental and social implications for this company?

As long-term investors we recognise that the workers are an integral component of company success. We are surrounded by new digital entrants that have transformed the way we shop, eat, travel, socialise, find work and bank. The pace of innovation and growth has been remarkable. But it comes at a risk that the workers are marginalised or reduced to an as yet unavoidable non-digital cost.

To borrow a saying from Dabo Swinney, the Clemson Tigers college football coach, “continue to do common things in an uncommon way”. With your portfolio, we remain focused, not frantic. We focus on what can go right, not wrong. We look to the future, not the past.

Read more from the anthology:

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this communication are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Developed EAFE All Cap Composite |

9.3 |

0.5 |

9.0 |

36.8 |

-35.0 |

|

MSCI EAFE Index |

7.4 |

1.6 |

-4.7 |

32.9 |

-17.3 |

|

1 Year |

5 Years |

10 Years |

|

|

Developed EAFE All Cap Composite |

-35.0 |

1.3 |

5.6 |

|

MSCI EAFE Index |

-17.3 |

2.7 |

5.9 |

Source: Baillie Gifford & Co and underlying index provider(s). USD.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Past performance is not a guide to future results.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. The firm is currently awaiting authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

23201 10011649