1972-1979

Early years

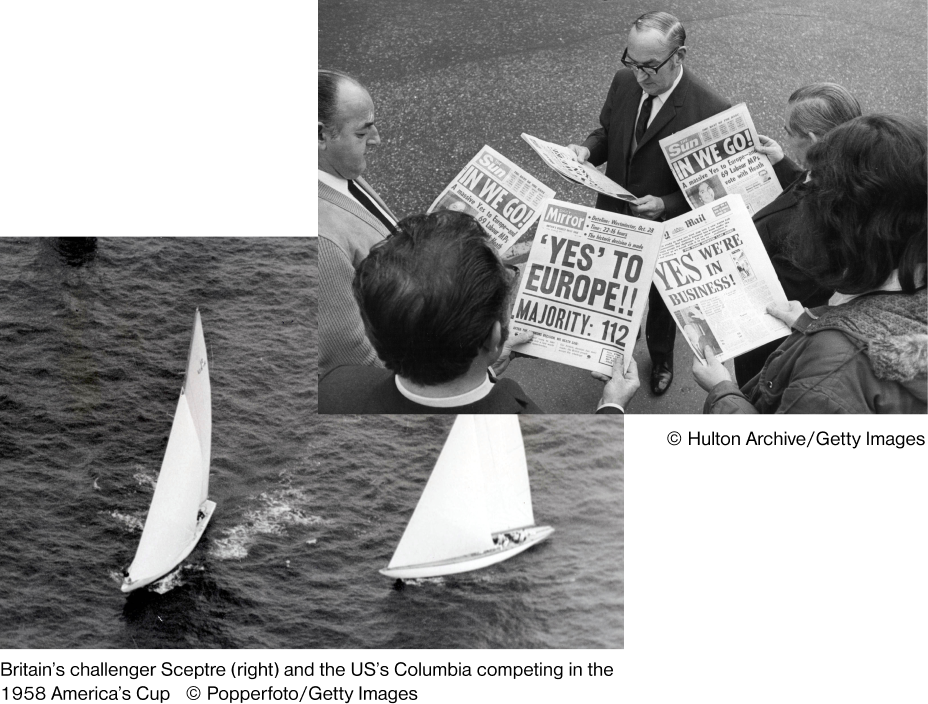

In 1972, the year Britain entered the European Economic Community (EEC), F&C Eurotrust was spun out from Foreign & Colonial Investment Trust, one of many new companies aiming to give investors a new way to invest in Europe. With nearly £10m in assets, its largest holdings included Nestlé, Siemens and Peugeot. But initially strong performance quickly ran into the market-destabilising oil shocks and exchange controls that hampered the global economy in that decade.

1980-1990

The roaring eighties

The 1980s proved better for the Trust as inflation reduced and stock markets soared. A merger with the £9m Nordic Investment Trust in 1988 and a £20m rights issue the same year led the Trust to grow almost tenfold in size. By 1989, when the Berlin Wall fell, assets totalled £59m. The reunification of Europe after more than 40 years of division opened up new possibilities, although it would be many years before the Trust invested behind the former iron curtain.

1990-2005

Turbulent times

After the Trust raised more funds through a 1991 rights issue, the effective devaluation of sterling following 1992’s Black Wednesday and the UK’s exit from the European Exchange Rate Mechanism boosted investments in stronger European currencies. By 1993, the Trust’s net assets exceed £100m and by the end of 1997 they were soaring towards £250m. But the run of success was brought to a jarring halt by the bursting of the tech bubble, the shock of 9/11 and another Iraq war. Only in 2002 did the first glimmers of recovery appear.

2005-2010

Rebalancing and reviewing

By the middle of the noughties, the Trust had become one of the largest in its peer group. The portfolio was rebalanced to focus on companies either offering undervalued organic growth or set to benefit from restructuring, cost cutting or profitability improvements. But it struggled to match its comparative indices and suffered painful setbacks in the late 2000s banking crisis, or credit crunch, helping to prompt a review of management arrangements.

2010-2019

Edinburgh Partners

Under Dr Sandy Nairn, new manager Edinburgh Partners applied its 'value investment' to the now renamed European Investment Trust for the next nine years. The portfolio was also heavily rebalanced to focus on a company’s dividend yield, dividend growth prospects and balance sheet strength, including holdings such as Nokia, Vivendi and Amadeus. But underperformance and a stubbornly wide discount led to another rethink on investment style.

2019-present

Enter Baillie Gifford

Following a review, the board appointed Baillie Gifford and a change of name to the Baillie Gifford European Growth Trust. The new managers, Stephen Paice and Moritz Sitte, and later Chris Davis, repositioned the portfolio to target investment returns from capital growth, filling the portfolio with companies they thought could grow outstandingly, with a particular bias towards the fast-growing tech sector, as well as family-led companies such as Richemont and Kering.

Summing up

Over 50 years, Baillie Gifford European Growth Trust has witnessed the continent’s evolution and overcome numerous challenges, exploiting the robustness and flexibility of the investment trust structure to move with the times. Even in today’s still-volatile era, its managers find plenty of grounds for optimism.

IMPORTANT INFORMATION AND RISK FACTORS

This communication was produced and approved in November 2022 and has not been updated subsequently. It represents views held at the time of presentation and may not reflect current thinking.

This communication should not be considered as advice or a recommendation to buy, sell or hold a particular investment. This communication contains information on investments which does not constitute independent investment research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned. Investment markets and conditions can change rapidly and as such the views expressed should not be taken as statements of fact nor should reliance be placed on these views when making investment decisions.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund Manager and Company Secretary of the Trust.

A Key Information Document for the Baillie Gifford European Growth Trust plc is available at bailliegifford.com

All data is source Baillie Gifford & Co unless otherwise stated.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The Trust’s risk could be increased by its investment in private companies. These assets may be more difficult to sell, so changes in their prices may be greater.

The Trust can borrow money to make further investments (sometimes known as ‘gearing’ or ‘leverage’). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust’s investments fall in value, any invested borrowings will increase the amount of this loss.

Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

The Trust’s risk is increased as it holds fewer investments than a typical investment trust and the effect of this, together with its long term approach to investment, could result in large movements in the share price.

The Trust can make use of derivatives which may impact on its performance.

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

This information has been issued and approved by Baillie Gifford & Co Limited and does not in any way constitute investment advice.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| European Growth Investment Trust plc | 1.2 | -7.6 | 54.2 | 25.2 | -47.7 |

| NAV | -2.1 | -4.6 | 37.5 | 23.9 | -40.1 |

| FTSE Europe ex UK Index | 2.4 | 6.9 | -0.3 | 23.0 | -15.3 |

Performance source: Morningstar, FTSE, total return in sterling

Past performance is not a guide to future returns