Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Autumn 2023 issue of Trust magazine.

Could the birthplace of paper, printing, the clock, silk, the compass and gunpowder regain its ancient position as the world’s invention hub? A foreshadowing of that came in 2016 when China became the world’s number one source of patent applications. China now leads in 37 out of 44 vital technologies of the future, according to a report by the Australian Strategic Policy Institute earlier this year.

From digital communications, computer science and research into embryo cells to audio-visual technology and energy, the breadth and depth of Chinese intellectual property creation confound presumptions about a planned economy’s ability to generate original ideas. Meanwhile, China’s investment in research and development is narrowing the gap with the biggest spender, the US.

Innovative companies continue to benefit from a vast and fiercely competitive domestic market, supportive government spending and huge amounts of accessible data, plus the pick of nearly five million science, technology, engineering and maths graduates per year.

We’ve selected four great products and processes that helped earn their creators a place in the Baillie Gifford China Growth Trust portfolio. Together they indicate the scope of China’s urge to originate.

The Qilin battery

CATL

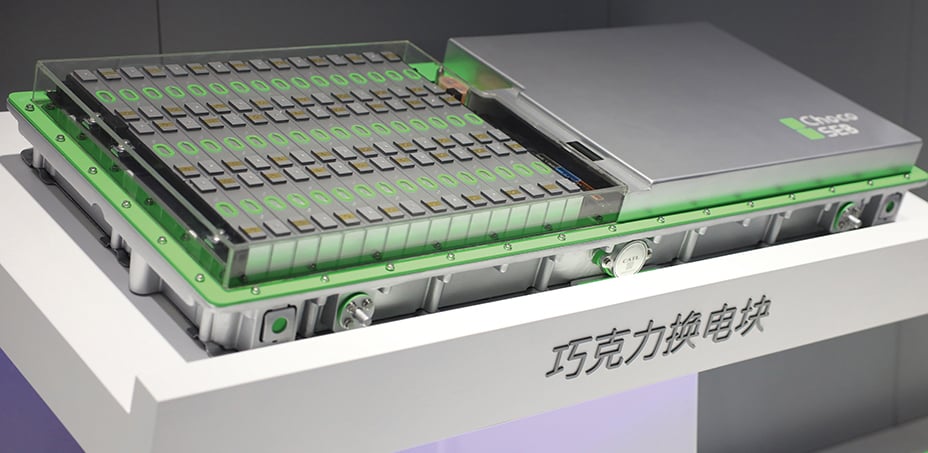

Named after a Chinese mythical beast, CATL’s Qilin ‘cell-to-pack’ (CTP) battery for electric vehicles (EVs) began mass production in the spring of this year. It will consolidate CATL’s position as the world’s most advanced EV battery maker and main supplier to Tesla, NIO, Ford, BMW and others.

The new power pack offers an all-round improvement in performance, range, charging speed, safety, efficiency and lifespan. It leads in energy density, safety and rapid rechargeability. The big innovation? A radically streamlined structure that replaces previous batteries’ separate internal parts with a single elastic layer sandwiched between two power-producing cells.

CATL Choco-SEB battery module

© Visual China Group/Getty Images

Tony Wang, investment analyst with Baillie Gifford’s China A-Shares Team, said: “Battery performance and safety are mainly a matter of heat control. Qilin’s shape-shifting interlayer ensures even heat dispersal, protecting the cells from stress and damage while maintaining the optimum temperature. And when it comes to recharging, the more efficient temperature-management function enables the Qilin battery to go from 10 to 80 per cent charge in only 10 minutes.” Standard batteries take 20 to 40 minutes.

CATL’s game-changing new model has achieved the highest energy density of any battery in existence. It packs in 25 per cent more energy compared to the next-best battery, allowing drivers to roam 620 miles on a single charge.

Deloitte expects annual EV sales to grow from 2.5 million in 2020 to 11 million in 2025, and 31 million by 2030.

The Apsara Stack cloud service

Alibaba Cloud

Cloud computing gives users remote access to updatable, flexible and secure computing resources far beyond what they could host themselves.

Apsara Stack was turbocharged by the demands of Alibaba’s ecommerce websites, which require glitch-free processing of hundreds of thousands of transactions per second. Rio Tu, a Baillie Gifford investment manager based in Shanghai describes how, a decade ago, the Apsara Stack platform became the first in the world to co-ordinate 5,000 computer servers. At its disposal were oceans of data from its huge user base to train on, as well as parent company Alibaba’s keen commercial instincts. Says Tu: “These factors have helped Apsara Stack to surpass Amazon Web Services, Microsoft’s Azure and Google Cloud in key areas of processing power, storage capacity and security, according to the tech consultancy Gartner”. In May, Alibaba announced that it would float its $12bn-revenue cloud operation as an independent company.

Alibaba Cloud booth at the firm’s Apsara Conference 2022

© China News Services/Getty Images

Apsara was an early leader in ‘distributed architecture’: dispersing applications across multiple locations rather than using a central hub. This system earned its spurs by supporting Chinese ecommerce bonanzas such as Singles Day and the state rail ticketing app, which handles billions of daily visits, especially in the lead-up to public holidays.

While traditional cloud-based systems struggled to process such vast flows of data, Apsara’s patented software boosts the network’s response to fluctuating demand.

The ‘three follows’ strategy

WuXi AppTec

WuXi AppTec is a global leader in outsourced drug discovery and development. It tests and manufactures a range of drugs, gene therapies and medical devices on behalf of pharma and biotech companies. As well as helping these clients to pursue cures for diseases such as hepatitis, influenza and Zika virus, it helps speed their drugs’ progress to market.

WuXi has pioneered what it calls its ‘three follows’ strategy: ‘follow the science’, ‘follow the customer’ and – its big differentiator – ‘follow the molecules’.

The novelty lies in combining complementary skillsets from normally separate realms. For example, WuXi’s pre-clinical contract research subsidiary helped develop a drug compound for Pfizer to treat Covid-19 called Paxlovid. The company was then able to offer Pfizer a competitive service in the very different area of manufacturing the drug.

Says Louise Lin, investment analyst for Baillie Gifford’s China A-Shares Team, “Helped by China’s massed ranks of talented chemical and biological science graduates, WuXi has come up with many new ways of optimising drug development and manufacturing. The sheer volume of research data the firm has amassed since its foundation in 2000 gives it a strong head start against would-be imitators. Competitors in China and elsewhere struggle to replicate WuXi’s manufacturing experience and network of contracts.”

The monocrystalline solar panel

LONGi

The most efficient solar panels are those made with wafers sliced from a single silicon crystal. This minimises the chance of internal defects, making it easier for electricity to pass through. Panels made from these ‘monocrystalline’ wafers can collect more energy from the sun.

The technology has been around since the 1950s, but LONGi was a pioneer in enabling these kinds of sleek, black panels to compete with the cheaper, less efficient polycrystalline type in use since the 1970s. Such innovations earned LONGi its position as the number one global maker of solar wafers and panels.

As Freddy Zhu, an investment analyst for Baillie Gifford’s A-Shares Team explains: “They did it by directing research and development investment into the search for new ways to produce more panels at lower costs. LONGi’s patented techniques include a diamond wire cutting method, which allows thinner, faster wafer slicing. Also, the company’s advanced furnace control system which increases the formation of silicon ingots while reducing contamination.”

LONGi’s lower prices and increased market share led others to follow its lead, helping to make monocrystalline panels standard over the last decade. Now the top global producer of wafers and modules, the company played a big role in China’s achievement of ‘grid parity’ – equality of cost with fossil fuel energy – about three years ago.

Additional reporting by Baillie Gifford’s Shanghai-based investment research team: Rio Tu, Louise Lin, Freddy Zhu and Tony Wang.

Important information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

Baillie Gifford China Growth Trust invests in emerging markets, where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The Trust’s exposure to a single market and currency could increase risk.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

58411 10035557