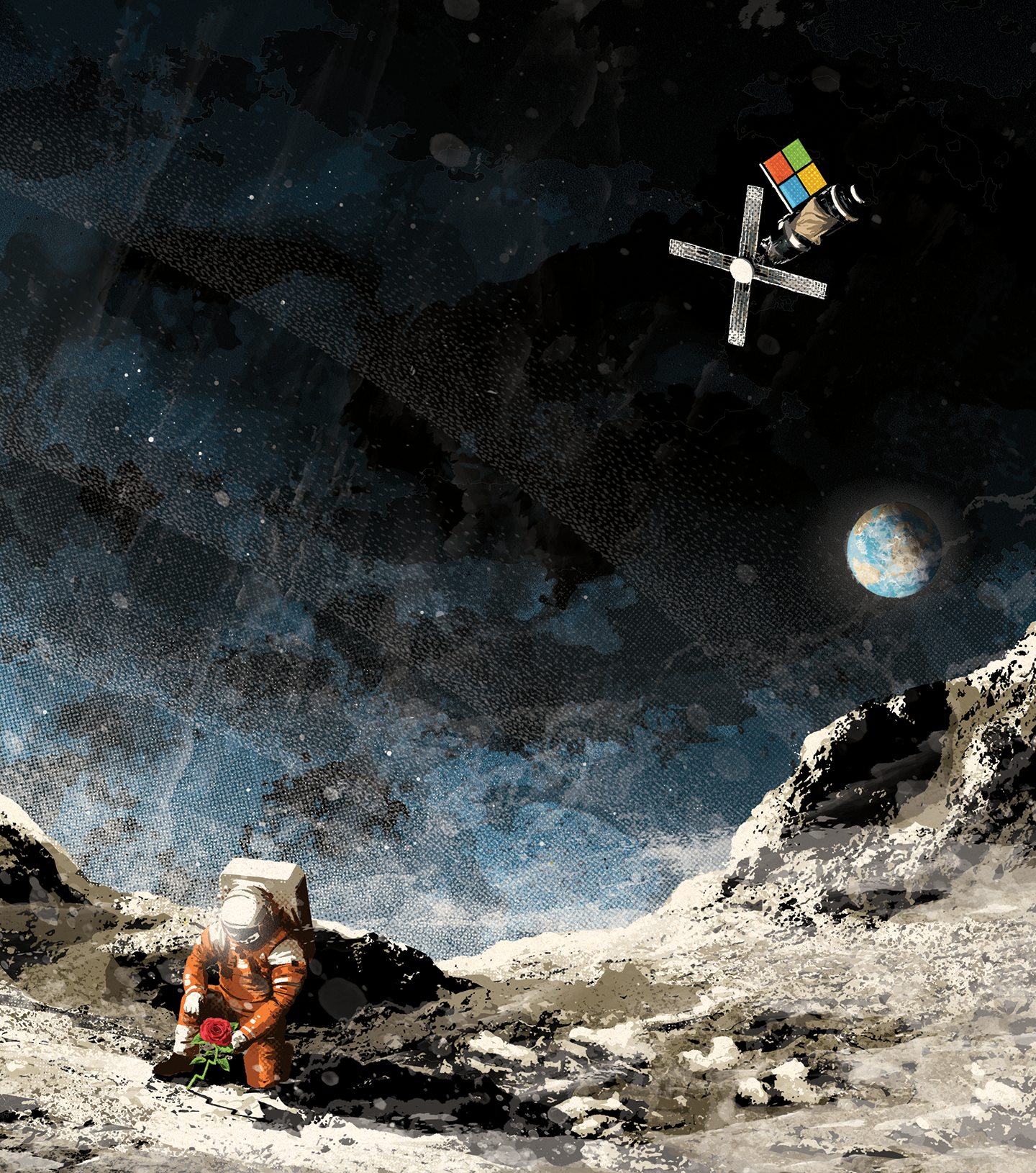

Illustrations by Mark Smith

Please remember that the value of an investment can fall and you may not get back the amount invested. Past performance is not a guide to future returns. This article originally featured in Baillie Gifford’s Autumn 2023 issue of Trust magazine.

Satya Nadella’s Microsoft is a company transformed. When he took charge nearly a decade ago, the firm was struggling to stay relevant in a smartphone world dominated by Apple and Google. Moreover, it was riven with internal tensions.

Nadella knew he needed to create a cultural shift. In his autobiography, Hit Refresh, he recalls a moment three years into the task when he knew things weren’t moving fast enough. He gathered 150 executives in a room and told them their job was to “find the rose petals in a field of s**t”.

“Not my best line of poetry,” he wrote. “But I wanted these people to stop seeing all the things that are hard and start seeing things that are great and helping others see them too.”

In other words, they needed to focus on future growth rather than managing Microsoft’s response to the declining personal computer market.

“It involved shifting focus from one-off fees for the latest version of its Windows operating system to subscriptions to cloud-connected versions of its productivity apps and services, with automated updates,” explains Malcolm MacColl.

“That encouraged large enterprise customers to trial its latest products since they no longer faced high upfront costs or the need to invest in as much IT support.”

Empowering the planet

Nadella also updated co-founder Bill Gates’ original mission of “a PC on every desk and every home” to the more expansive “empower every person and every organisation on the planet to achieve more”. This signalled that Microsoft wasn’t worried whether people used an Android phone, iPad or Linux computer server so long as they used Word, LinkedIn or its Azure cloud computing platform.

The firm is secretive about its number of regular users, but industry experts suggest the approach has paid off, with more than 360 million people now working with one or more of its Microsoft 365 apps every day. And over time, the company became more cohesive.

The turnaround earned the stock a place as a ‘stalwart’ in Monks’ portfolio – the Trust’s description for established, dependable companies that increase their profits year after year. It took a stake in the business in 2019 and subsequently added to it twice. It’s now among the Trust’s biggest holdings.

“Microsoft’s ‘moat’ is famously wide. But Nadella brought something new – dynamism, openness and renewed entrepreneurial spirit,” adds MacColl.

Targeted takeovers

Nadella also looked outside the company for growth under a strategy he calls “no regrets investing”. This follows the principle that there should be multiple ways to win, and even if the outcome isn’t ideal, there will still be some benefits.

It’s led to several multi-billion-dollar takeovers, including the professional social network LinkedIn, the code-sharing platform GitHub and, most recently, the attempted $69bn purchase of Activision Blizzard, the maker of the Call of Duty video games.

“They are all pioneers in their respective fields that fill gaps in Microsoft’s cloud-focused ecosystem rather than means to increase scale for its own sake,” says MacColl.

Nadella’s approach has also led the firm to take sizeable stakes in partners of strategic importance, including the London Stock Exchange and ChatGPT creator OpenAI. When Microsoft first invested in the latter in 2019, the idea was that even if the artificial intelligence lab failed to develop a commercial product, Microsoft would at least gain experience in building advanced computing infrastructure that it could rent out via Azure to train others’ AI models.

As it turned out, OpenAI’s ‘generative AI’ tech advanced faster than anyone expected. Its ability to create human-like writing and imagery in response to conversational requests is now integral to many Microsoft products.

App upgrades

It started with GitHub Copilot, a tool that gives software engineers coding suggestions based on queries they pose in natural language. Then Microsoft’s Bing search tool gained a way to give you chat-based answers.

Soon, the Office apps will let you build slide presentations in seconds and turn notes typed in Teams into polished prose. And the firm has teased a reimagined Windows interface that will let you control your computer by typing in requests rather than clicking through folders and menus.

“It marks an exciting new computing paradigm that has the potential to unlock long-term growth over the decades ahead,” says MacColl. “But it’s also important in the shorter term because it gives Microsoft an opening to convince users of competing products to jump ship.”

Microsoft’s productivity apps now promise a cohesive experience that will be hard for others to replicate. You will be able to ask for an automatically created PowerPoint presentation based on notes you typed into Word, sales projections you stored in Excel and customer relationship records you saved in Dynamics.

The results might not be perfect, but you should find editing and improving the slides much quicker than starting from scratch. The more products in Microsoft’s suite you use, the better the AI should get and the more productive they become.

AI-enhanced earnings

In July, the firm revealed it would charge companies a monthly top-up fee of $30 (£23) per employee to add the Copilot features. News of the AI revenue stream propelled its shares into a higher orbit.

Elsewhere, Nadella has spoken about bringing competition to a sector that Alphabet’s Google has dominated for decades.

“Predicting the next steps with Bing is difficult, but it appears Microsoft could meaningfully disrupt the search market,” says MacColl. “They don’t have an incumbent advertising business to protect.”

And these are just the start of Microsoft’s AI ambitions. The firm recently revealed how it controlled spending on the use of computer chips specialising in the task: 85 per cent of the budget goes to fund research and development in areas that are already showing promise, and 15 per cent goes to teams exploring ideas that “are counterintuitive or non-obvious or outright contrarian” on the condition they pursue them in a disciplined manner.

This is precisely the type of strategic capital investment that Monks looks for: where the aim is to develop transformational innovations over what may be long periods rather than solely focusing on the next financial results.

“Nadella has demonstrated the value which can be created through ambitious deployment of capital and the importance of reinvention within even the most powerful businesses,” says MacColl. “He has also shown why culture is such a critical component of success. It will be fascinating to see whether Microsoft can continue to flex and open up new opportunities.”

Six years after summoning senior colleagues to that petal-seeking pep talk, Microsoft’s CEO has revitalised the company and cleared the ground for fresh shoots of growth.

But what even the poetry-loving leader can’t have predicted is that his firm’s software would now be capable of being prompted by his vivid imagery to create verse of its own:

Satya Nadella, a master of tech,

Made Microsoft a dominant spec.

Some petals he plucked

From fields of muck

With Monks by his side on the trek.

Microsoft is also held by The Scottish American Investment Company.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| The Monks Investment Trust | 9.5 | 15.3 | 30.2 | -32.1 | 6.8 |

Source: Morningstar, share price, total return.

Past performance is not a guide to future returns.

Important Information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

58913 10035839