Your capital is at risk

Artificial Intelligence (AI) is revolutionising the business landscape across the globe. This transformative technology, with its ability to automate tasks, analyse vast amounts of data, and make informed decisions, is ushering in a new era of efficiency and productivity. The benefits of AI are not confined to specific sectors or regions; they are universal, making AI a game-changer for every business on earth.

OK, I’ll level with you. I didn’t write that, my ‘AI intern’ did… in about 2.8 seconds. It’s done a decent job; you could mistake its words for the generic musings of any market commentator.

The image to the right was also created by AI but took a glacially slow 15 seconds in comparison.

My simple prompt was: “Create a picture of a Scottish person using AI in their business.”

I especially like the bagpipe-shaped Alexa-like device on the table, the Scottish flag placed subtly on the shelf in the background and the dram of whisky on the side.

If you haven’t yet experienced your eureka moment with AI, it’s likely just around the corner.

At Baillie Gifford, we are fortunate to have recognised AI’s potential long ago, when we witnessed the profound transformation AI was bringing to companies in our portfolios.

Since our initial investment in Amazon in 2004, for example, it has been leveraging machine learning to suggest books to its customers and power its search capabilities. In fact, the company has been using machine learning effectively since day one.

Now AI is becoming accessible to all. It’s infiltrating every aspect of society, giving rise to new business structures, enhancing companies’ competitive edges and completely overhauling some sectors.

But how do we keep track of such a rapidly moving technology and decipher where the value will fall? Importantly, how should you view this disruptive technology’s impact on your life, and what steps can you take to reap the potential rewards?

You may even wonder if the rest of this article was written by a human at all – read on to find out whodunnit.

Paradigm shift

Companies have a sense of urgency with AI, recognising its potential for material impact. We agree. It is one of the few areas where we observe the pace of change accelerating.

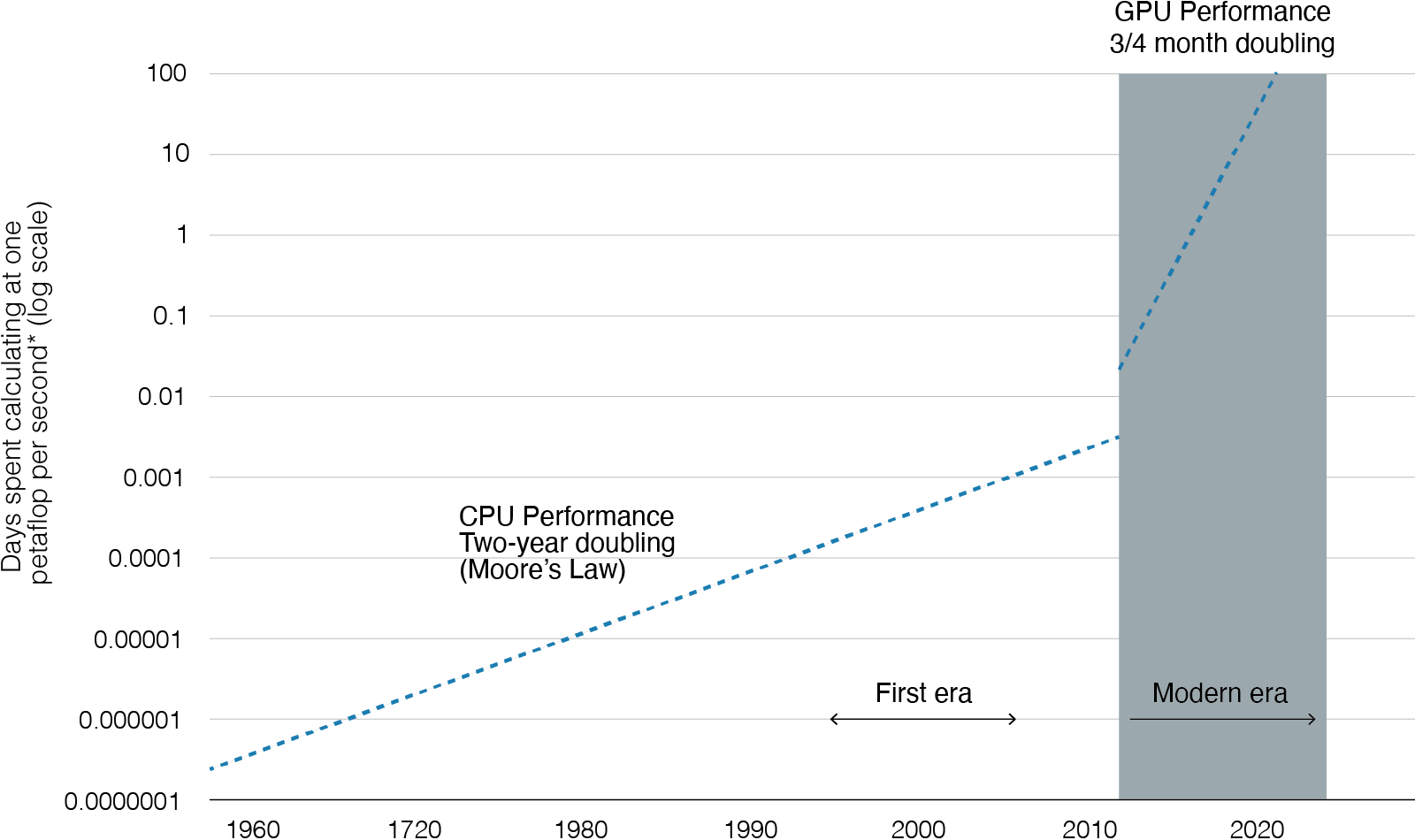

The chart below depicts the remarkable progress in computing performance seen over the last 60 years. It has driven the computing industry’s architectural evolution – from mainframes to personal computers, mobile to the cloud.

Every technology company can thank the tailwind of Moore’s Law, which predicted a regular doubling of processing power, for their prosperity.

Accelerating computing progress

Source: *Open AI. 1 petaflop = 1015 calculations

What’s next? The modern era of ‘accelerated computing’ – using specialised chips to speed up computation by processing many calculations in parallel. We can confidently predict a 1,000-fold computing performance improvement over the next decade, outpacing Moore’s Law and taking us to places we can’t fathom.

This potential for exponential growth sparked our interest in machine learning and was first mentioned in our research library of investment analysis a decade ago. Fast forward a few years and these improvements are already making their mark, spawning many commercial applications. AI progress is real, and some businesses are already thriving.

OpenAI

Run by Sam Altman, Open AI disclosed over a billion dollars in revenue run rate in 2023. It already has over two million developers using its AI platforms. No wonder ChatGPT, the company’s chatbot, became the fastest-growing consumer internet app of all time after its launch in late 2022.

Shopify

Tobi Lütke, chief executive of Shopify, is pivoting the company’s business strategy to unlock the technology’s capabilities. Merchants can now use text generation tools to create product descriptions, blog posts and marketing emails, and Shopify is providing AI-enabled commerce assistants that make it easier to start, run and grow businesses.

Duolingo

Duolingo’s chief executive Luis von Ahn thinks AI will create a material tailwind for his language-learning platform as it can now offer the kind of responsive, interactive conversations that you could previously only have with a human tutor. As a former professor of computer science at Carnegie Mellon University, he is well placed to comment.

Tesla

Tesla admitted in 2023 that autonomous driving is more likely to be achieved using AI-driven neural networks. Rather than using manual code, Tesla now trains its Full Self-Driving algorithms on billions of video frames showing how humans do it, recorded from the cameras on their vehicles.

Different perspectives

Discussions with management teams help us to assess whether companies can adapt to emerging challenges, and our reputation as long-term shareholders gains us valuable access.

A recent invite to a gathering of AI luminaries attended by leading companies, including OpenAI, Anthropic, Scale AI and Cohere, enabled us to monitor potential competitors to our existing holdings. We learn the most when we are the least informed in the room.

We also regularly draw on our links to academia. The insight we gain from our expanding network of academic partners helps us build conviction in our investment hypotheses. These include:

- IMEC, a renowned research and development centre in Belgium specialising in digital technologies, enables us to comprehend the latest semiconductor scaling and AI model developments.

- Delft University in the Netherlands has enhanced our understanding of machine learning since our relationship began in 2017.

- The University of Edinburgh’s Futures Institute has been supported by us since 2019 through a 10-year programme, including creating a post of chair in the ethics of data and AI.

- Leverhulme Centre for the Future of Intelligence at Cambridge University helps broaden our perspective on the impact of computing advancements.

We encourage inquisitive minds on our investment floor to discuss and share ideas about AI too, supporting the potential for long-term progress whether it involves the companies we invest in or projects within the firm.

Our partnership structure plays a crucial role in nurturing this mentality.

When assessing the prospects of companies or technologies driving change, we want to ensure we remain focused on the future. We think long term. We observe slow but potentially powerful transformations and think optimistically about how companies could benefit from them.

...115 years ago, we wagered on tyres taking over from horseshoes.

Identifying companies early means we don’t have to predict the precise timeframe progress catalyses. If you buy in early and remain patient, there is little need to time the market if growth is delivered. That is our advantage.

We explore future scenarios, favouring companies with upside potential, and stay more patient than most. We know the ownership journey can be treacherous at times and our resolve will be tested, but the potential rewards for our clients are worth it.

AI and enterprise

Advances in AI are helping to drive down the cost of intelligence, meaning any organisation drawing on human capital could use the predictive power of AI to influence business outcomes. Netflix uses it skilfully at scale to calculate what show its subscribers will binge on next, for instance.

Recent advances in ‘generative AI’ represent a step-up in capability. In simple terms, chatbots may merely be predicting the next word in a sequence but at the speed and scale they’re capable of they can feel like sentient beings.

In effect, the invention of ChatGPT has bolstered the workforce of every business on earth without adding a single person to the payroll.

Employees now have their own personal ‘AI interns’ working for them. They won’t make your coffee or get you lunch, but their encyclopaedic knowledge and ability to serve you instantly will quickly become indispensable.

Just like human interns need support and training, so do their AI equivalents. They will get things wrong, but you remain the arbiter of their output. And they can only get smarter.

At Baillie Gifford, we view AI first and foremost as an amplifier of human capability. Academic studies already extol the benefits: how would you like your workers to complete 12 per cent more tasks, 25 per cent quicker, and at 40 per cent higher quality?

Understandably, there are concerns that AI threatens jobs due to its capacity for automation. But the opposite is equally true. More productivity creates more prosperity, generating new ideas and roles.

AI will change how we work, but this is nothing new. When Baillie Gifford made its first investment 115 years ago, we wagered on tyres taking over from horseshoes.

The more recent digital revolution has created entirely new jobs while making others redundant. AI stands to amplify what is humanly possible, even discover things that are not.

Combining a human’s strategic intuition with a machine’s computational power is likely to produce better outcomes in the long run.

This was the view of chess grandmaster Garry Kasparov, who attended our client conference in 2018 to discuss his book Deep Thinking. Kasparov doesn’t think we should be worried about computers replacing human labour – working together is best. OpenAI’s sentiment is similar.

It suggests that AI won’t take your job but a human using AI might.

Gary Kasparov vs Deep Blue computer © PENDZICH/REX/Shutterstock

For individual organisations, developing and tailoring AI’s capabilities to support their business objectives is key for ensuring successful adoption.

An AI-first mindset should graduate from being an IT strategy to a general business strategy. This requires company-wide collaboration and an admission that AI is here to help rather than hinder.

Academic Clayton Christensen mused about the threat of the ‘innovator’s dilemma’ over a quarter of a century ago, but his lessons remain prescient. The dilemma arises when traditional business practices are disrupted by technology.

Initially the technology looks inferior, so companies remain focused on existing products or revenue streams. They struggle to see the potential or threat. Then costs to access the technology fall and access quickly widens, eventually disrupting sleepy incumbents. Blockbuster and Kodak were exemplars of how not to react to creative disruption.

With AI, every company must contend with the innovator’s dilemma – it is unwise to sit idle. Aim to augment, amplify and multiply your employees' intelligence.

AI and the investment process

We are carefully assessing whether AI could improve our investment process. The administrative aspects of investing could be streamlined this way, allowing teams to focus more intently on research. We are also exploring a research aggregator that overlays internal and external content with leading search technology and AI tools.

The ease of access to information enabled by AI is helping our investors to better analyse the views of the market, enabling us to gain deeper insights into our differentiated viewpoint. And with 40 per cent of the internet’s content being non-English, there remains a vast amount of untapped information to learn from as translation tools improve.

However, we must exercise caution when considering whether AI should impact our research process.

As long-term, active growth managers we strive to beat the market, so we listen to a diverse set of inputs. This mainly comes from the people we hire. We encourage them to follow their curiosity and seek different perspectives wherever they find them. Our research is intentionally serendipitous rather than systematic, so the scope for AI to improve this organic process seems less obvious.

We think the best way to engage with the technology from a research perspective is to talk about it across the investment floor. This already happens informally in stock discussions and is communicated through our research library.

After ensuring our investors understand the technology’s capabilities and have access to the best tools, we leave them to it. Over time we can observe how research processes evolve and share any learnings. There is no set model of investment research at Baillie Gifford. Rather than bluntly integrating technology to solve a problem that may not exist, we aim to amplify our existing strengths.

Summary

We are trying to get better. Better at investing, better at client service, better at everything. We can already see how AI is helping us improve and how much further it might go.

AI can help us to deliver sharper outcomes by amplify human capabilities. We continue to be forward-thinking about using the benefits of AI in our investment process, aiming to enhance research, client service, and operational efficiency.

It’s still early days, but we look forward to sharing more of what we have learned as we go.

So, who wrote this? It was a combined effort. Like Kasparov said, working together is best.

Risk factors and important information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in April 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act. This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America. The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law,5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

93140 10046071