Key points

- Emerging markets play a crucial role in AI, providing essential hardware infrastructure and innovative software platforms used globally

- Our AI investment approach spans three categories: hardware enablers like TSMC, software platforms such as Tencent, and operational innovators including MercadoLibre

- Our balanced approach to AI investing focuses on companies with structural advantages that can compound value over multiple industry cycles

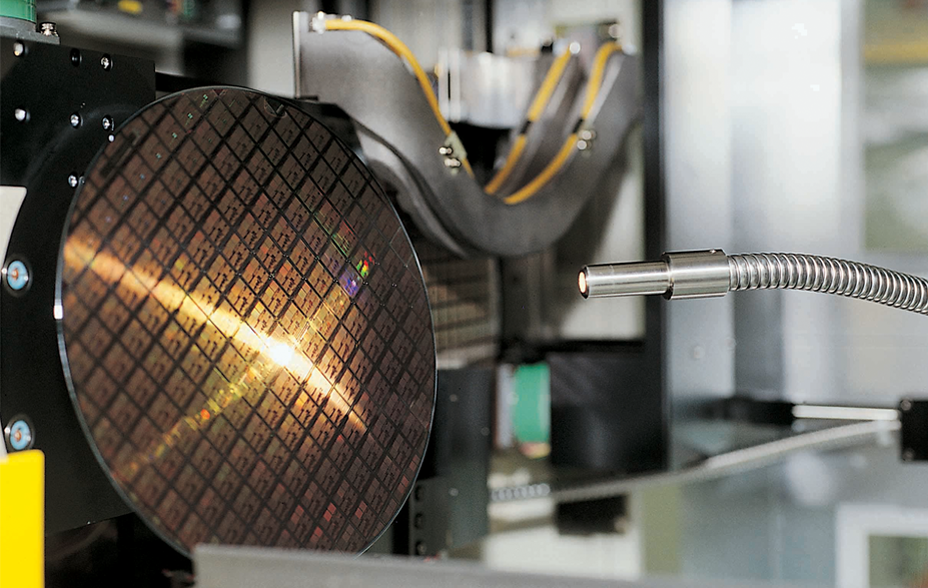

TSMC manufactures semiconductors widely used in AI datacentres. © Taiwan Semiconductor Manufacturing Co., Ltd.

As with any investment, your capital is at risk.

As Mark Zuckerberg put it to the head of our US equities team, being late to the AI party risks missing the most important technological development of the next 15-20 years. As investors, we’d add two qualifiers. First, be thoughtful about where value gathers, and second, be patient about when it appears.

On the first point, you can’t tell the story of AI without emerging markets. Many of AI’s key building blocks are being developed in our universe, from physical infrastructure, with few developed market alternatives, to software platforms applying it in novel ways.

There is a temptation to treat AI as a single theme in the portfolio. However, we have been thinking about our AI exposure in three parts, largely because each answers a different question:

- What makes AI possible? (hardware and other enablers)

- Who shapes and applies AI to real-world problems? (software platforms)

- And who is already improving their business operations with AI? (operational innovators)

Starting with the hardware – training and running large language models (LLMs) are demanding industrial processes, enabled by Asian technology. Advanced AI chip manufacturing in Taiwan, memory chips from South Korea, and the high-speed components that keep datacentres breathing are overwhelmingly emerging markets businesses.

Moreover, copper from Chile, platinum from South Africa, and rare earth elements sourced in China supply the metal and magnetics that keep hyperscale datacentres powered and cooled. That is why a little over a quarter of the portfolio is tied to AI hardware and its immediate enablers.

We have held some of these firms for years with TSMC being the prime example. A continuous holding in client portfolios since 2005, it has since compounded into one of the strategy’s defining successes. This wasn’t because we anticipated AI’s vogue nearly a quarter of a century ago. Rather, it was because we backed the company’s customer-centric culture, strong process discipline, and sensible (often counter cyclical) capital allocation: all of which gave it room to take market share as complexity rose over time.

The result has been outstanding long-term growth over multiple industry cycles, from the smartphone boom to the present wave of AI compute. A helpful reminder that, in semiconductors, structural advantages rarely move on quarterly schedules.

The same logic applies to the less well-known names in our AI hardware research. Some are established holdings, others we are tracking with keen interest. Accton’s high-end switch platforms and Fabrinet’s fibre optics, guided by committed management teams in Taiwan and Thailand, help prevent gridlock in clusters where tens of thousands of AI servers now need to speak simultaneously. Chroma ATE (also from Taiwan) plays a quieter but equally critical role, providing testing equipment that gives every semiconductor chip a ‘health check’ before it leaves the factory, spotting microscopic defects that could otherwise bring down an entire system.

Power management is equally non-negotiable. Here, Silergy, a Chinese chip designer, helps shepherd power efficiently so phones can use on-device AI without killing the battery by lunchtime. Its through-cycle investments in R&D engineers have kept the company innovating throughout an industry downturn.

Taken together, these companies, whether currently held in one of our EM strategies or simply on our radar, anchor us at the irreplaceable end of the AI supply chain. That being said, hardware alone won’t capture the value that AI creates.

On the software side, we invest in platforms that we believe can convert AI’s potential into real, recurring cash flow. By way of example, Tencent is threading AI through the WeChat ecosystem, laying the groundwork for a genuinely helpful AI agent inside China’s most ubiquitous app, as well as using tools to sharpen ad targeting: one reason advertising revenue has been increasing at a healthy clip.

The Chinese tech giant is also using AI to enrich its gaming franchises, making non-player characters more responsive, accelerating the rollout of new content, and deepening the social, player-driven experiences that keep daily engagement and in-game spending high.

In social media, Kuaishou’s Kling 2.0 video-generation model is attracting a vast creator base, reinforcing the engagement that powers the economics of its platform. And in Latin America, Globant (the IT services company) has quietly rewired its business toward AI-first services, with subscription ‘AI pods’ that blend AI automation with human IT expertise and now contribute to a growing portion of group revenue.

Although Globant’s shares have struggled since we initiated our position, we see this as a reminder that the most promising long-term opportunities often require patience in the early stages. For context, PwC’s estimate that AI could add $15.7tn to global GDP by 2030 (nearly half of it in China) gives a sense of the addressable runway for these software layers.

The third strand of our exposure rarely makes headlines but often matters most over the long term: companies using AI to take friction out of their businesses. Or better still, to add efficiency to their business model.

Latin American ecommerce and fintech company MercadoLibre is a prime example. Computer vision now helps catalogue products at scale, while multilingual models are localising content, fraud detection is approaching 99 per cent accuracy on flagged items, and the firm’s in-house LLM platform has begun to automate dispute resolution with promising early results.

Brazilian digital bank, Nubank, is rolling out generative tools in customer service and financial advice, building on capabilities acquired several years ago. In India, Delhivery’s AI-led ‘return-to-origin’ predictor tackles one of ecommerce’s costliest pain points by helping merchants prevent returns before they happen.

While AI-driven operational efficiencies are coming up in company calls with increasing frequency, they won’t all flow through to the bottom line immediately. That said, it’s reasonable to expect these gains to build on one another over time, delivering better service and low per-unit costs. This kind of sustained improvement can create the operational edge that steadily widens a company’s competitive moat.

We are often asked “what is the AI exposure in the portfolio?”. This is not a straight-forward question given it touches so many corners of the portfolio, but as this three-tier framework has introduced, it is certainly the case that our clients’ AI exposure is balanced by design. We invest in the parts of the system that the world cannot do without. We hold the platforms with hundreds of millions of users forging credible paths to monetisation. And we back the operators that quietly compound productivity.

Finally, a quick word on our own use of AI. Here, our stance is pragmatic. We use AI where it amplifies our edge, and we have invested heavily to ensure that we have access to the right tools. We’re testing AI tools that strip out administrative friction, improve search across internal and external sources, and translate the non-English web so our investors can surface diverse viewpoints more quickly: important when roughly 40 per cent of online content isn’t in English.

But our research culture is intentionally serendipitous, and human led. We won’t force AI into places where it would homogenise what makes us different. Instead, we will adopt it where it strengthens the long-term, active, and thoughtful investing approach that underpins everything we do.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in August 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia(Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

168708 10057184