Key points

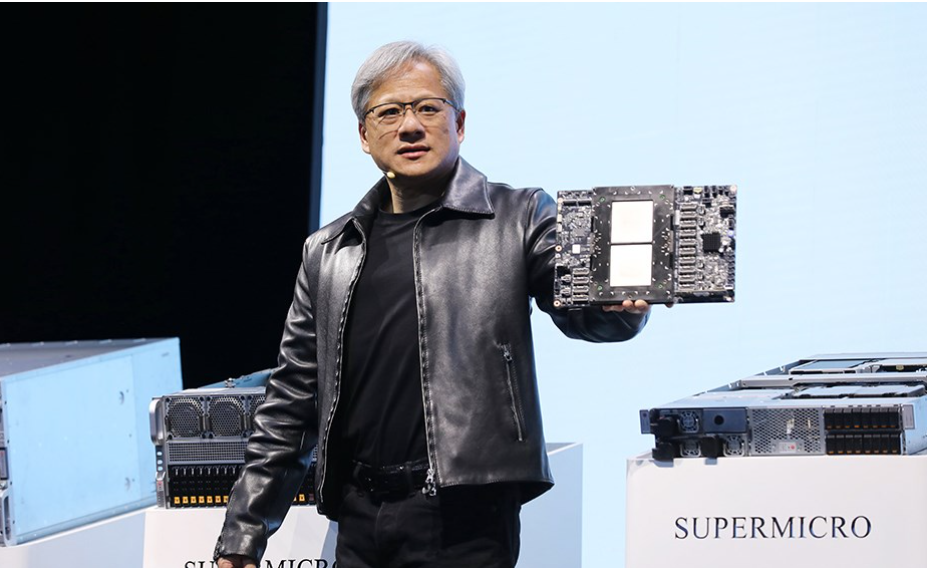

- A growing number of companies are disrupting through innovation in both the digital and physical realms

- For example, Amazon’s online store depends on its investment in its hi-tech warehouses and delivery network

- A second type of company, including DoorDash, marries the two worlds by partnering with existing physical infrastructure providers rather than trying to supplant them

All investment strategies have the potential for profit and loss, capital is at risk.

WATCH: Investment manager Kirsty Gibson discusses the power of marrying digital and physical innovation in her Disruption Week session

When you click ‘buy now’ on Amazon, your orders speed to your doorstep thanks to vast amounts of data centre circuitry, miles of automated warehouse conveyor belts and a flotilla of vans and other vehicles.

The company is known as a digital disruptor. But that’s only half the story. While its customers mainly interact with it online, much of Amazon’s competitive advantage comes from its physical operations.

In this regard, it heralded a new wave of disruption, says Kirsty Gibson, an investment manager at Baillie Gifford.

“For most of the last century, the leading companies operated almost solely in the physical world, and their competitive advantages were forged by their physical assets and access to capital to fund them,” Gibson explains. “Take, for example, the aviation, energy and newspaper industries.

“Then the proliferation of the internet gave rise to businesses with purely digital business models. They were capital-light and nimble but quite narrow in terms of the sectors they disrupted, including advertising, media and analytics.

“But Amazon was different. It wanted to sell books online but had to build physical infrastructure to do so. And it pursued a similar process when it went into cloud computing. Amazon Web Services is perceived as a digital service, but its strength depends on the firm’s huge investment in data centre hardware.”

Amazon’s effort to bolster its digital offerings with expenditure on physical operations continues to this day, from running its own cargo airline to plans to deploy thousands of satellites into low-earth orbit to provide broadband to communities below.

“Jeff Bezos talked about the idea of customers being ‘divinely discontent’ – their expectations constantly increase,” says Gibson. “So, one of the reasons Amazon has rolled out so much physical infrastructure is that it wants to get you your delivery as fast as possible at the lowest possible price. And we have confidence that the current chief executive Andy Jassy is also willing to take bold, innovative, long-term bets to improve customers’ lives.”

Chemicals and cars

Other examples of companies following Amazon’s lead in intertwining computer code with physical processes include Solugen and Rivian Automotive.

The former is attempting to disrupt the industrial chemicals industry by using artificial intelligence software to engineer enzymes, which it then uses to convert sugars into more valuable molecules. Solugen’s advantage over traditional counterparts is that it doesn’t use fossil fuels and avoids creating carbon emissions or waste.

“Solugen’s Bioforge reactor system is a fraction of the size of the colossal manufacturing plants usually required to make chemicals, which helps keep its costs down,” Gibson says. “And because it is modular, the reactors can be rolled out at many more locations.”

Rivian, by contrast, is seeking to disrupt the market for pick-up trucks and sports utility vehicles with its range of electric automobiles.

“It has to build manufacturing plants to build its cars but it’s also all about software,” says Gibson. “For example, it has provided customers with over-the-air updates to make towing trailers easier and has upgraded the suspension system to smooth rides. And it’s also investing in self-drive technologies.”

Augmenting, not displacing

Gibson also identifies a second type of company merging the physical and digital realms. “These are firms looking to build upon existing physical infrastructure rather than trying to replace it,” she explains. “They are more capital-light than the other kind but face the challenge of having to convince traditional businesses of their worth.”

DoorDash is one example. It simultaneously provides a service to three different classes of client:

- Consumers wanting meals and convenience store items delivered to their homes

- Self-employed drivers needing to be told where to pick up and drop off the orders

- Restaurants and stores supplying the food and other products

“DoorDash is a digital offering grounded in an understanding of the physical businesses it works with,” Gibson says.

“It’s all about telling drivers the optimum time to arrive, where to park and the most efficient way through a shopping mall. And it also has to know how long restaurants take to prepare a meal. You don’t want drivers waiting ages for pick-ups, but you also don’t want customers complaining that their dinner has arrived cold.”

The company also invests in physical infrastructure. Its DashMart warehouses directly employ staff to stock items and hand them off to the drivers.

“It lets DoorDash continue serving consumers at times when other retailers are closed. This also benefits its self-employed drivers, who often make deliveries to supplement a daytime job,” says Gibson.

Self driving lorries

Aurora Innovation also falls into the second bucket of physical-digital companies.

The driverless lorry pioneer has opted to avoid manufacturing vehicles of its own. Instead, it has partnered with the automotive parts specialist Continental to offer its self-driving hardware and software as a service that takes control of retrofitted rigs. Volvo Trucks and FedEx are among those to have shown an early interest.

“The truck industry faces an inadequate supply of drivers, so there’s a need for this technology. And Aurora has the clear support of industry insiders,” says Gibson.

“But the key to driving costs out of the system will be decreasing the level of remote support it needs to provide over the long-term.”

Not every business needs to merge ‘bits and atoms’ to succeed. Nor is our rationale for investing always based on the paradigm for those that try. Gibson gives Meta as an example of a holding she backed purely because of the long-term growth prospects of its digital efforts rather than its Oculus virtual reality hardware.

However, she adds that asking how companies approach the two worlds can be helpful when considering their prospects over the five-to-ten-year-plus period we aim to be a shareholder on behalf of our clients.

“The companies we invest in need to make far-sighted investments themselves, and that often involves committing capital and resources to a combination of physical and digital innovation. Doing so gives them a chance to be transformative and disruptive.”

Discover more of Kirsty Gibson’s thoughts about the digital-physical paradigm by watching the video at the top of this article of her Disruption Week webinar.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

77002 10040260