Key points

- A handful of exceptional businesses drives long-term equity returns through the power of compounding

- Even the biggest winners face sharp drawdowns, so the skill lies in discerning lasting change from short-term noise and holding on for compounding growth

- We look for companies that could be multiple times larger in five to 10 years, backing those we believe have strong cultures and financial discipline

As with any investment, your capital is at risk.

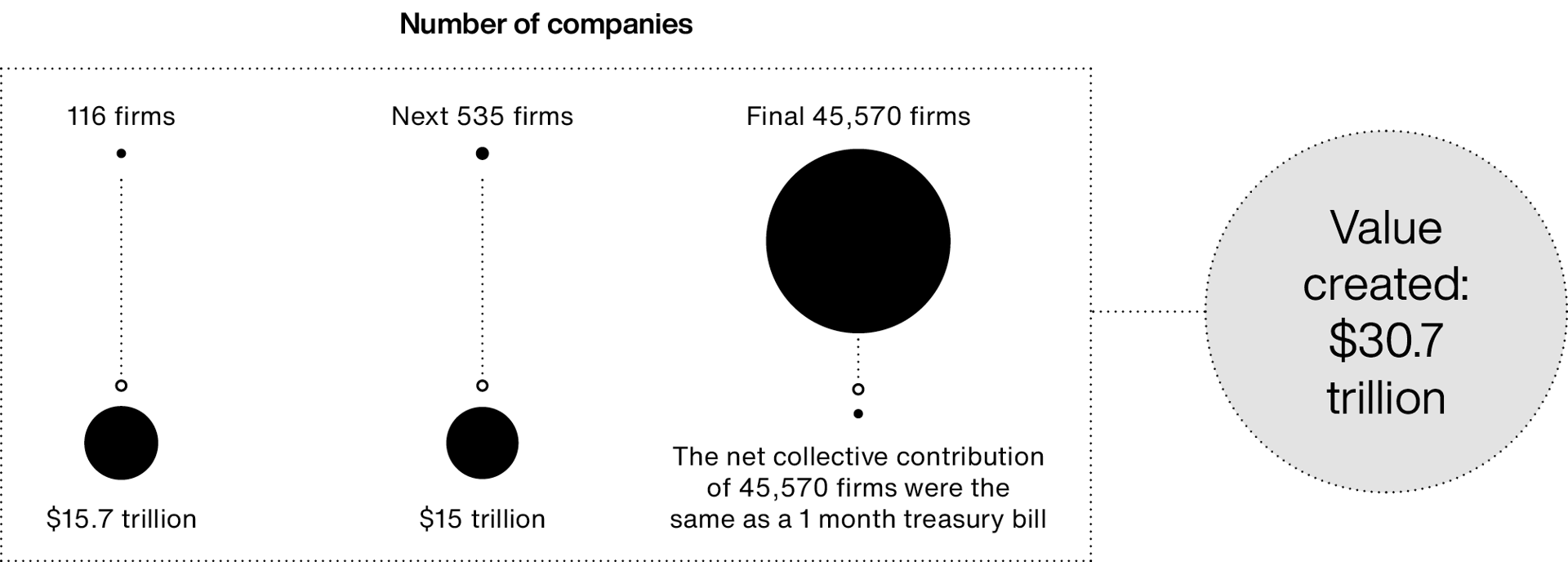

Why a tiny minority drives the majority of returns

Equity markets are not a level playing field: the lion’s share of long-term wealth creation is generated by a small number of exceptional companies. Therefore, finding and owning a handful of truly outstanding companies matters far more for long-term returns than avoiding those that don’t work out.

Equities have asymmetric payoffs. That means that the downside is mathematically bounded at 100 per cent. But, on the upside, when a company compounds its advantage over many years, it can grow by multiples of the original investment.

This has two implications for long-term growth investors. First, most companies will have little impact on portfolio results over time, meaning it is all the more important to focus on the second point. The ask being made of the investment manager is to find and patiently own the rare businesses capable of compounding value for a decade or more, even when their path is volatile and unconventional.

Reminding yourself of this helps cut through the daily noise of market swings and quarterly results, and puts headline-grabbing macro news into perspective. Instead of getting distracted, investors should focus on whether a company’s competitive advantages are widening and its opportunities are expanding. When those forces are working in tandem, the mathematics of compounding can overpower many setbacks and challenges.

Total wealth by all listed international stocks (1990-2020)

Source: Bessembinder H., Chen TF, Choi G., John Wei. Long-term shareholder returns: Evidence from 64,000 global stocks (August 2021).

Throughout history and across markets, the true standouts have been the businesses that have rewired how economies function. Railways collapsed distance and standardised trade, while oil powered mass mobility and fuelled the petrochemical age. Asian manufacturing excellence reshaped global supply chains, and Europe’s mobile pioneers put the internet in everyone’s pockets.

In China, digital platforms transformed payments and shopping for the entire population, while India’s low-cost data ecosystem accelerated the formalisation of the economy.

Today, semiconductors form the backbone of our digital world. This global technology stack spanning research, equipment, design, fabrication and advanced packaging, delivers the computing power behind the latest advances in everything from cloud technology to artificial intelligence (AI).

These are the kinds of companies we seek – businesses that reshape industries and everyday life, enabling compounding to do the heavy lifting over time.

History shows a clear pattern. The winners change, from rails to refineries, from routers to recommendation engines, as does the location, from London to Tokyo to Taipei to New York, but the pattern repeats. A small cohort creates outsized wealth over long horizons.

Our investment process is designed to improve the odds of identifying these outliers early. We back them with conviction and then hold for long enough for compounding growth to make a real difference to returns.

When we review a rolling 10-year analysis of our International Concentrated Growth strategy’s top 10 and bottom 10 contributors, comparing each holding’s cumulative share-price change with the maximum drawdown during our period of ownership, the results are both humbling and illuminating.

First, the winners come in all shapes and sizes. Sometimes, it’s mature brands that emerge, other times, it’s youthful platforms. This reminds us that outliers can come from many starting points, as long as the opportunity is large and the culture is restless for change.

Second, drawdowns are part of the overall growth arch. Several of our best performers – NVIDIA, MercadoLibre and Spotify – suffered material setbacks along their way; their paths were rarely smooth or predictable.

Finally, the biggest contributions often come late in the holding period, after years of reinvestment has quietly built capacity and capability, magnifying customer loyalty. Reducing positions too soon would have turned multi-baggers into average performers.

The underperformers have valuable lessons to offer too. When we have lost money, it’s often because a compelling big-picture story didn’t match up what was happening on the ground. Themes such as the energy transition or digital payments may sound promising, but lasting success depends on robust business models and leaders who can adapt when circumstances alter and continue to steer through change. When markets get tough, any weaknesses, whether in execution, business models or governance, will quickly become apparent.

This helps set expectations for clients. Owning outliers means accepting volatility, and choosing to stay the course during turbulent periods as long as the original investment thesis is intact. Selling decisions should be based on fundamentals rather than on share price movements. It also demonstrates why missing out on a few exceptional holdings can have such a large impact. Over time, the growth generated by these outlier investments can more than compensate for many shortcomings.

Needles in the haystack

At its core, our investment approach centres on a simple question: could this company reasonably be multiple times larger in five to 10 years?

That framing quickly narrows down our investable universe and points us towards businesses facing large and expanding opportunities.

Often, the most promising candidates begin by dominating a sizable market and then leveraging the capabilities they have built, from technology, distribution, brand or culture, to form a powerful second act, sometimes even a third.

Many of these companies are unconventional. Extraordinary results rarely come from playing it safe, so we are comfortable backing product-obsessed founders and owner-operators who look beyond quarterly noise in their pursuit of long-term advantage.

Above all, we favour organisations with the patience and freedom to keep reinvesting at attractive rates, always stretching their ambitions further, for years to come.

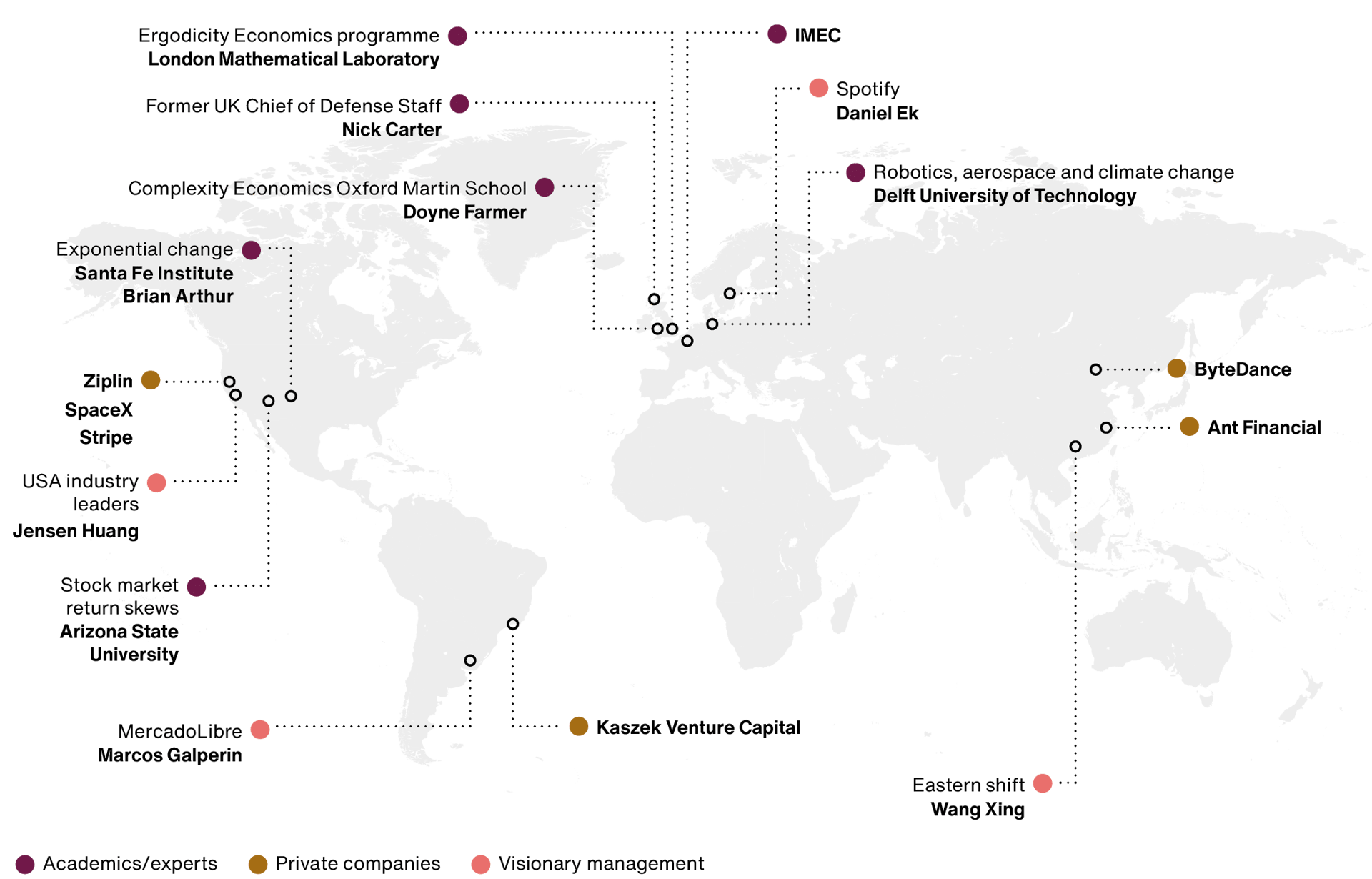

Just as important as what we invest in is how we build conviction. We draw on a wide range of networks to provide insight across public and private markets, as well as in academia. Doing so constantly challenges our thinking and helps us pinpoint the most fertile frontiers.

Extended conversations with founders give us a sense of their ambition, and the company’s culture and execution discipline. These are intangibles that you won’t find in spreadsheets. By following companies before they go public, we get an early view of business models that might one day disrupt entire industries.

And because we focus on change and not any single sector, we can spot recurring patterns. Even though each industry is distinct, customer delight, cost curves, platform effects and culture are universal.

Sources of insight

Behavioural edge: courage and patience

Finding these companies is only part of the challenge, building conviction is just as critical. The harder part is behavioural. Volatility is not a flaw to be engineered away; it is the price you pay for exceptional, enduring growth. Even the greatest winners have faced severe drawdowns, often during their most productive decades.

Our role is to separate volatility that reflects short-lived worries and volatility that reflects structural weakening. That distinction is built into our research notes, our review cadence and the questions we ask when share prices come under pressure: what has changed in the competitive position, the customer value proposition, the unit economics and the people leading the business?

Patience goes hand-in-hand with restraint. When a company performs well, its tempting to scale back too early. But the really big returns come late and never in a straight line; the steepest part of the performance curve can arrive years after the initial thesis is proven.

That’s why we base trims and exits on how the story has evolved, rather than setting arbitrary price targets. If the opportunity set is expanding, the culture is delivering and reinvestment still looks attractive, we will often choose to sit with our discomfort. That discipline is reinforced by our partnership structure, our client base and our incentives, all designed to keep us focused on long-term outcomes.

Learning from mistakes

Some of our most valuable lessons have arisen from the times we’ve got it wrong. It can be all too easy to be seduced by the big picture themes. Grand secular themes, such as the energy transition, artificial intelligence (AI) and fintech, can seem compelling, but we should not mistake them for investment cases on their own.

When we have misstepped, it has often been because we’ve focused too much on the attractiveness of a theme, without considering the calibre of the people and the resilience of their business model. The remedy is simple. We must keep assessing leadership quality and business fundamentals with the same intensity as we do the opportunity size.

The other mistake is omission. The biggest performance detractors rarely appear in performance reports, because it turns out they are the outliers we never owned. We therefore bias our process towards owning the uncomfortable or unconventional when we believe the potential upside dwarfs the risks. We constantly challenge ourselves to make sure we are not rationalising reasons to avoid what might become the next great compounder.

Macro noise versus micro power

Macro headlines are louder and more frequent than the slow compounding of competitive advantage, which tends to matter more. We have seen exceptional businesses grow through currency depreciation, recessions and political upheaval because their customer value proposition was powerful enough to rise above the backdrop. Our analysis acknowledges unlikely but significant risks, but our edge comes from owning the companies that create the future rather than forecasting the next macro swing.

This does not mean the macro view is irrelevant. It means we treat it as context, not a signal. We size positions to withstand shocks, and we focus on qualities that matter most when conditions tighten strong balance sheets, pricing power and the ability to reinvest from their own cash flows. Companies with these strengths can continue compounding when others pull back, widening the gap that matters most over a 5-to-10-year horizon.

What lies ahead?

Looking forward, we commit to keep doing the few things that truly matter for building wealth over time. Therefore, we focus on finding the rare businesses with the business models to reshape industries, resilient companies with exceptional people and cultures. We size our holdings based on our conviction as to their potential upside, and then we hold our nerve when volatility puts it to the test and as competitive advantage deepens.

We don’t react to headlines. Instead, we measure progress in widened competitive moats and expanding opportunity sets. We will trim and sell when the investment case changes, not on the back of price movements. And we will accept being early, different and occasionally uncomfortable if it improves our chances of being right over the decade.

Time is the ally of patient, aligned ownership. With courage, discipline and curiosity, we can uncover the few exceptional companies that can create compounding that turns modest decisions into outsized results.

International Concentrated Growth

Annual past performance to 30 September each year (%)

|

|

2021 |

2022 |

2023 |

2024 |

2025 |

|

International Concentrated Growth Composite (gross) |

29.2 | -48.6 | 15.4 | 42.2 | 19.6 |

|

International Concentrated Growth Composite (net) |

28.4 | -48.9 | 14.6 | 41.2 | 18.9 |

|

MSCI ACWI ex US Index |

24.4 | -24.8 | 21.0 | 26.0 | 17.1 |

Annualised returns to 30 September 2025 (%)

|

|

1 year |

5 years |

10 years |

|

International Concentrated Growth Composite (gross) |

19.6 | 5.4 | 16.2 |

|

International Concentrated Growth Composite (net) |

18.9 | 4.8 | 15.5 |

|

MSCI ACWI ex US Index |

17.1 | 10.8 | 8.8 |

Source: Revolution, MSCI. US dollars. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite. 1 year figures are not annualised.

Past performance is not a guide to future returns.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in December 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

179411 10058720