Key points

- AI is shifting from novelty to infrastructure, but we believe returns will still be anchored in the physical world

- Automation’s next wave is less about cost and more about resilience

- Sensing and inspection compound as factories become more autonomous

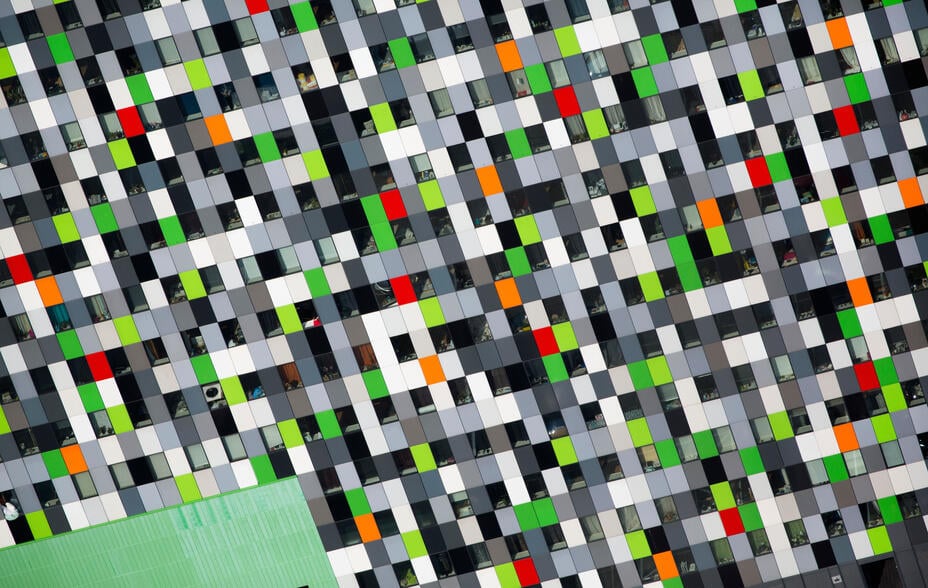

Casa Confetti student housing in Utrecht. An image that resembles pixels but exists as a structure.

As with any investment, your capital is at risk.

2025 was the year AI stopped being a theme and started to become infrastructure.

As large language models became increasingly capable, whole categories of work moved from “can this be done?” to “how quickly can it be rolled out?”

In moments like this, it’s tempting to believe the world itself is becoming weightless. That value will accrue primarily to companies that sit closest to the digital frontier.

However, investment returns often tend to be grounded in reality. Progress must still be delivered in the physical world.

Products must be manufactured, moved, and serviced. Energy must be generated and distributed. Factories must operate reliably, and supply chains must be resilient to shocks.

Intelligence is powerful, yet it still needs to manifest in the physical world to turn insight into outcomes.

The digital-physical divide

At the least disruptive end sit enduring brands like Ferrari and Hermès, businesses where scarcity and heritage create a moat that is not easily replicated. If anything, a world of abundant digital content can make the rare and tangible feel more valuable.

At the other end of the spectrum are businesses whose product is delivered almost entirely as bits. Platforms that package and distribute content digitally at near-zero incremental cost. Spotify is a good example. It doesn’t ship boxes or run factories, but it does operate something just as consequential in a digital economy.

In the middle is the interface between the digital and the physical. As compute gets smarter, the constraint shifts. Not “what can we imagine?” but “what can we reliably produce?”

This is why we have been exploring the automation of manufacturing. The tools that translate digital intelligence into physical execution.

The compounding case for sensing

Robotics, sensing, quality inspection, simulation and the orchestration layers that connect them are all moving from incremental efficiency to strategic necessity.

Keyence sits at this interface. It sells the eyes and nerves that enable a modern factory to see and sense. Vision systems that spot defects before they escape, sensors that detect position and presence, and safety systems that allow humans and machines to coexist on the same line.

What makes that position especially interesting in an increasingly digital world is that manufacturing is becoming more information-dense. If intelligence is increasingly ubiquitous, then the scarce input is high-quality, real-world data, and the ability to act on it reliably.

The more you automate, the more you need trustworthy signals. The higher the cost of downtime, the more you need early warning. In other words, as factories move toward more autonomous operation, the demand for sensing and inspection compounds. And Keyence has spent decades building an organisation optimised for exactly that compounding.

Robot density and the long runway ahead

A useful way to frame this opportunity is robot density: the number of operational industrial robots per 10,000 manufacturing employees.

The latest global reading is 177 (2024). Asia sits meaningfully above that global baseline, Europe a bit below it, and the Americas further behind. Useful context because it shows the story isn’t just more robots, but likely catch-up across regions.

At the country level, the gap is even clearer. South Korea operates at roughly six times the global average, China is about three times, and the United States is closer to two times.

Highly automated by most standards, but still far from the frontier. That matters because it suggests a long runway. The global number can keep rising without heroic assumptions, but simply through the diffusion of proven automation into the broad middle of manufacturing.

We expect robot density to keep rising because the incentives are broadening from lower cost to higher reliability and resilience.

Tight labour markets, tougher quality requirements, and the need to absorb supply-chain shocks all reward factories that can run with fewer surprises. All that pulls through more automation and, crucially, more instrumentation.

Adoption also becomes self-reinforcing. Once a plant is designed around automated flow, adding the next robot, inspection point, or monitoring layer is often a cleaner decision than rebuilding the process from scratch. And that compounding dynamic is exactly why sensing and inspection matter so much.

Automation doesn’t just add machines; it raises the premium on trustworthy signals that keep the system running.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2026 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

185401 10059872