Insights

Filters

Insights

Yarak: culture in the age of AI

What happens to great company cultures in the age of AI, where knowledge can be compressed, and decisions are pushed toward algorithms?

Are we in an era of commercial diplomacy?

US tariffs are reshaping trade. Explore the opportunities and political risks for leading US growth companies.

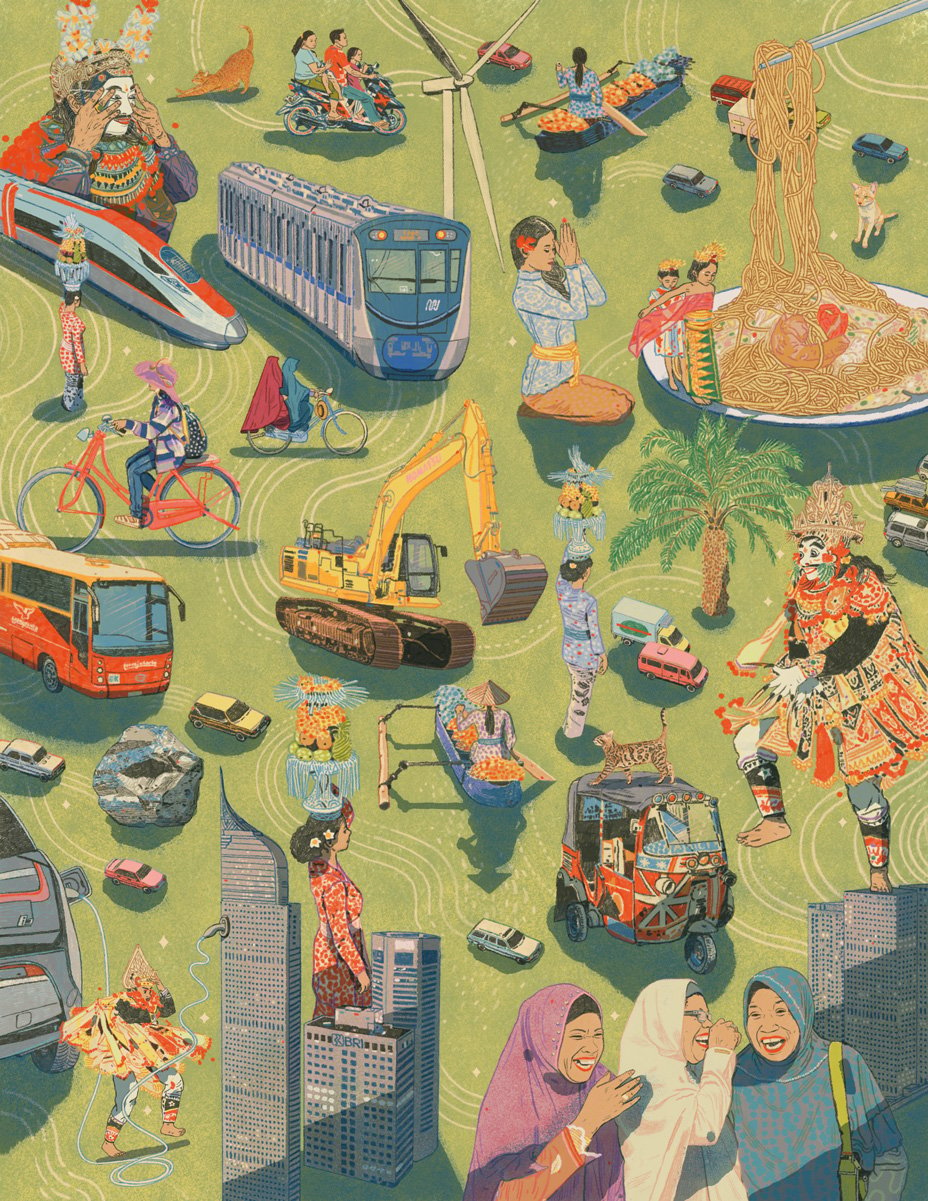

Emerging market companies leapfrogging western rivals

Investment manager Alice Stretch explores disruptive businesses in Asia and Latin America.

What’s your flavour of choice?

Three investment managers debate growth strategies from tech disruption to steady compounders

Some like it hot

Why the 'riskiest' growth companies may actually be your portfolio's best defence.

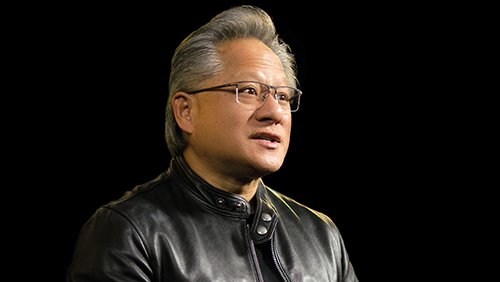

The world is about to get ‘weird’

Why avoiding US growth stocks is perilous: AI infrastructure, asymmetric returns and the paradigm shift.

Korea’s Value-Up ambition

Why South Korea’s stock market has transformed from ugly duckling to world-leading.

Private growth: the underappreciated opportunity

Why the asset class offers patient investors access to exceptional companies.

Private companies: from Anthropic to Zetwerk

Why we invested in the AI lab and supply chain specialist, among other companies operating in private markets.

Global Alpha Research Agenda 2025

From AI to emerging consumers, we focus on the growth areas and companies capitalising on opportunities.

Global Alpha insights: our reliable growth engine

Not flashy, just dependable. Why compounders remain the engine of durable long-term returns.

Synthesis in risk management

Discover how Baillie Gifford balances modern risk analytics with long-term growth investing.

Amazon: Stock Story

Jon Henry gives three key reasons why tech giant Amazon remains a special investment.

Fairytales and fundamentals revisited

Jonny Greenhill on Long Term Global Growth’s patient approach to backing transformative companies.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

When machines feel human

When machines speak, do we meet minds, or our own reflection?

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

Netflix: Stock Story

Ben James delves into Netflix's transformative journey from a DVD rental service to a global streaming giant.

Wise: Stock Story

Thomas Hodges highlights how Wise’s fast, low-cost money transfers enhance global payments.

Silicon Valley and beyond: innovation at source

Innovation thrives in the US’s tech and biotech clusters, where science and entrepreneurship meet.

US perspectives: are we in an AI bubble?

Real growth or market mania — how can we tell the difference?

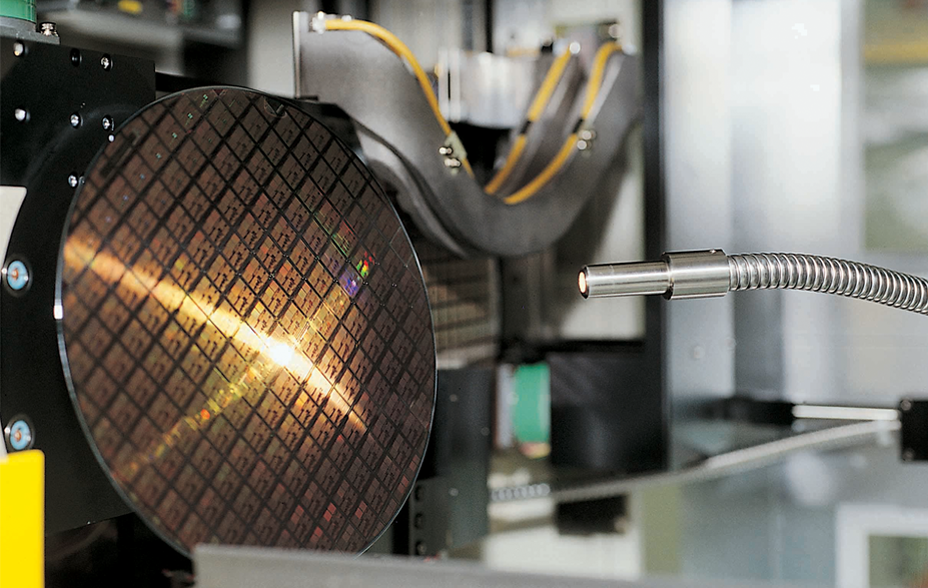

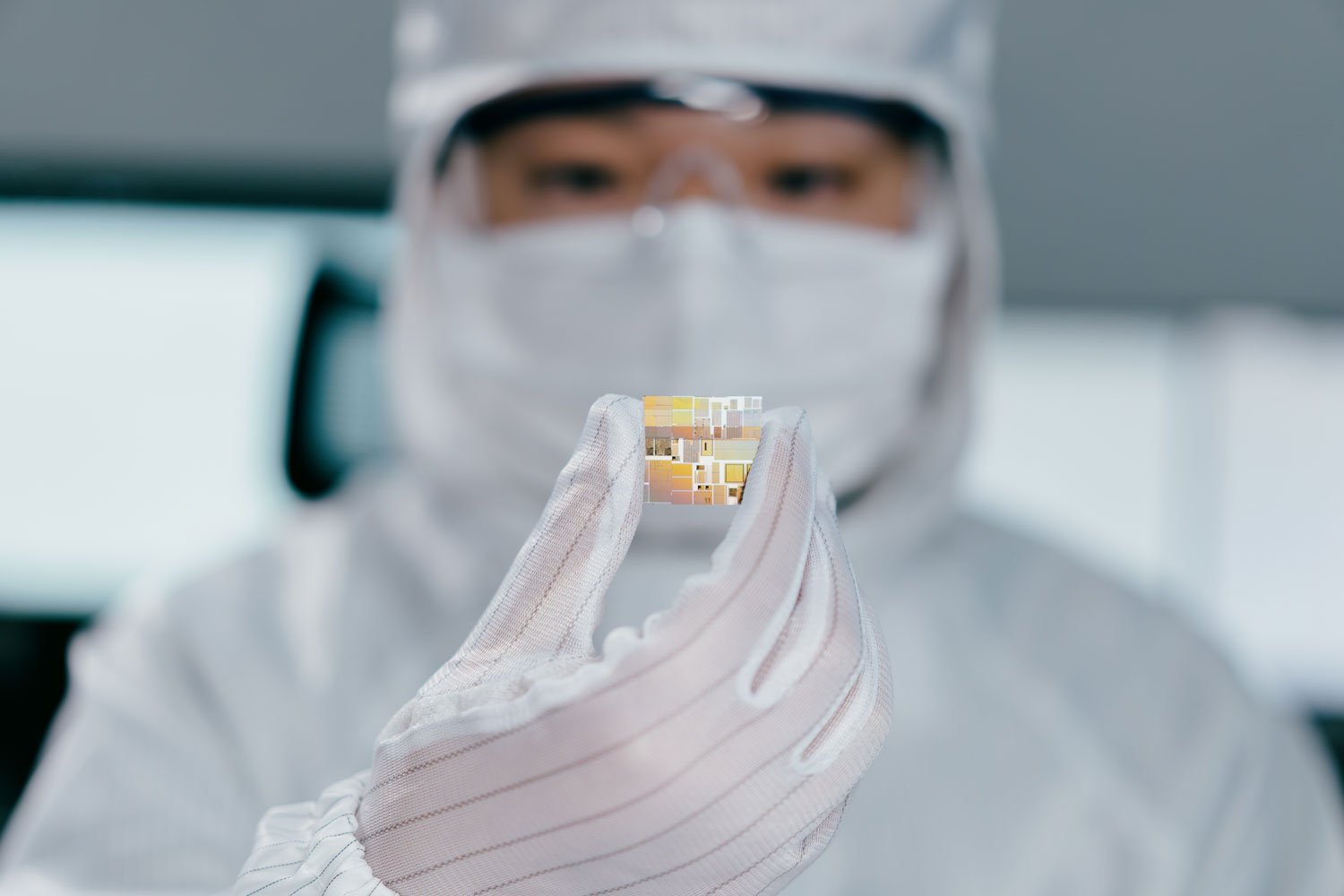

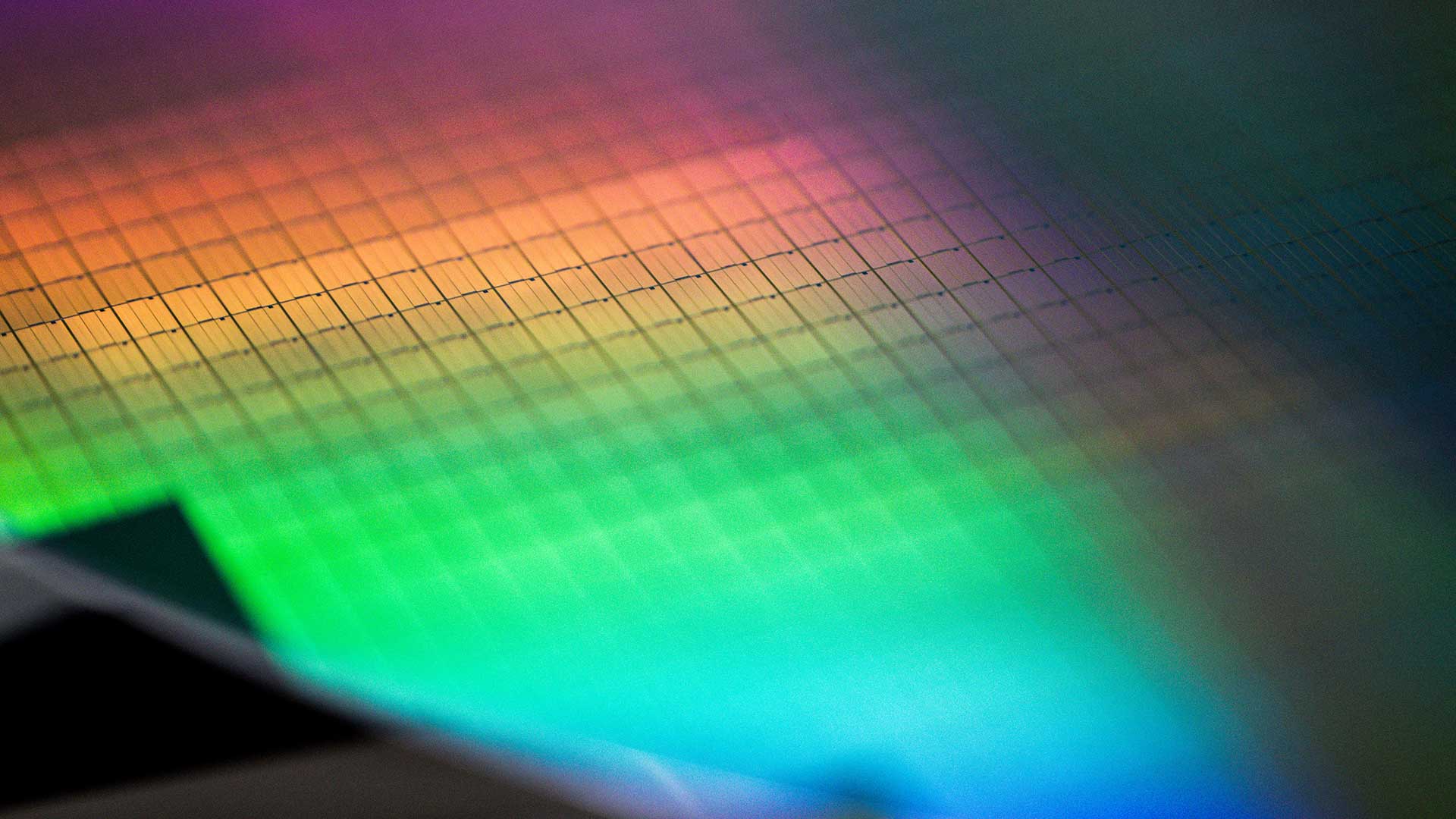

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

Tencent: Stock Story

Fernanda Lai explores how Tencent became the super-app pioneer connecting over one billion users.

Emerging markets, from imitators to innovators

From driverless taxis to digital banking, emerging markets are leading a new wave of innovation that’s reshaping industries worldwide.

Any other business: your Disruption Week 2025 questions answered

Baillie Gifford's strategy specialists address your remaining queries from Disruption Week 2025.

Private companies shaping the modern world

Private innovators are reshaping how we code, build and connect – long before they reach public markets.

Discovering Europe’s winners

Amid uncertainty, Europe’s most dynamic companies are proving that innovation can flourish where few expect it.

The science behind investing

From nanotechnology to investing, Olivia Knapp explores the chemistry of good research.

Profile of a returning industry veteran

After nearly 20 years leading global equity teams, explore why Alistair Way returns to Baillie Gifford.

LTGG Reflections: Duolingo

Why Duolingo is a beneficiary of AI, not a victim – and why for the long-term investor, patience is a virtue.

Why we are backing Anthropic

Our investment thesis for the AI frontrunner.

Positive Sparks: rare diseases

Discover the companies transforming global health with rare disease innovations.

From Pac-Man to AI agents

How Tencent is evolving beyond gaming.

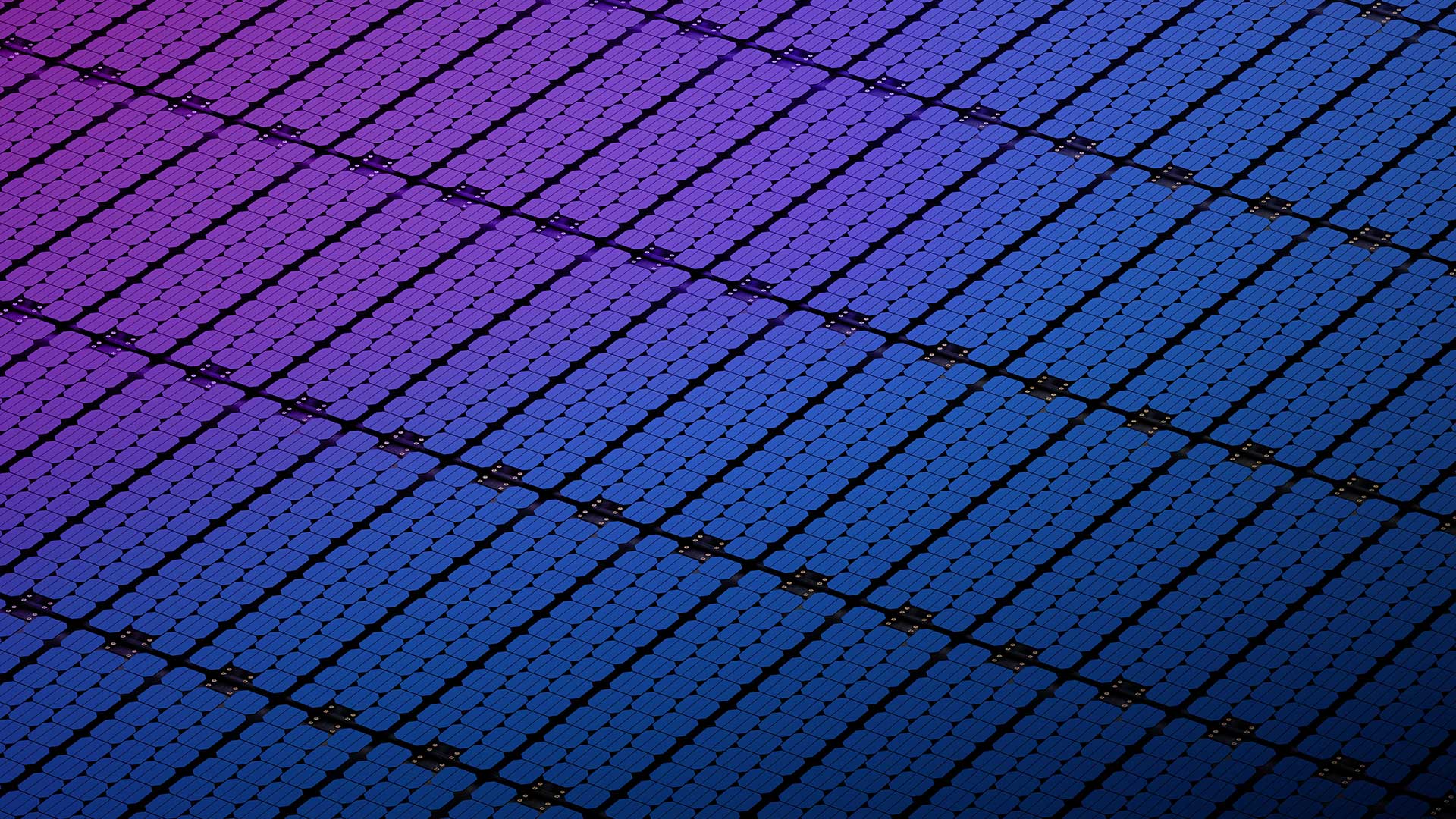

Global Alpha insights: the grid for growth

AI’s massive electricity needs create compelling investment opportunities.

Navigating the $14tr private market

Peter Singlehurst, Robert Natzler and Brian Kelly explore the exciting opportunities within the private market.

Humanoid: Japan and the rise of the machine

Humanoids have been a long time coming, allowing Japan to build a world-class edge in robotic components.

Fragmenting systems, cultural change

US culture is becoming chaotic, wreaking havoc for many but creating opportunities for certain types of businesses.

The 'aha!' moment

Inside our insight engine: how cognitive diversity and curiosity help us find standout growth companies.

Japan small caps: obsession meets opportunity

From AI-augmented weather forecasts to helping people with disabilities get hired, meet some of Japan’s most innovative growth companies.

Bridging the gap between private and public

We explore how our private and public teams collaborate to identify exceptional growth companies.

LTGG Reflections: Cloudflare

How Cloudflare evolved from internet security to AI gatekeeper, controlling content access and reshaping digital economics.

US perspectives: AI breaks the internet

AI shifts search to instant answers. Explore pay-per-crawl, provenance and guardrails reshaping the internet.

Global Alpha Q3 update

Investment manager Michael Taylor reflects on recent performance, portfolio changes and market developments.

Positive Change Q3 update

Investment specialist Catherine Flockhart reflects on recent performance, portfolio changes and market developments.

China Q3 investment update

Investment manager Linda Lin reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q3 update

Investment specialist Alison Henry reflects on recent performance, portfolio changes and market developments.

Discovery Q3 update

Investment specialist Bill Chater reflects on recent performance, portfolio changes and market developments.

European Equities Q3 update

Investment specialist Thomas Hodges reflects on recent performance, portfolio changes and market developments.

Emerging Markets: are you missing the point?

Why underweighting EM is an active risk, not a cautious stance.

US Equity Growth Q3 update

Investment specialist Ben James reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q3 update

Investment specialist Jonny Greenhill reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q3 update

Investment manager Toby Ross reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

Investment manager Alistair Way reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q3 update

Investment manager Ben Durrant reflects on recent performance, portfolio changes and market developments over the last quarter.

UK Core Q3 update

Investment manager James Smith reflects on recent performance, portfolio changes and market developments.

UK Alpha Q3 update

Investment manager Milena Mileva reflects on recent performance, portfolio changes and market developments.

Fairytales and fundamentals

Finding investment clarity when markets speak nonsense and valuations tell curious tales.

Pioneering Positive Change

In changed times, can bold investing in breakthrough innovation shape a brighter, more sustainable world?

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q3 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q3 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: the future of finance

Coinbase is reshaping finance by uniting digital assets, stablecoins and trust.

Our best ideas in China

Ben Buckler highlights Meituan (autonomous delivery), Midea (smart homes) and CATL (EV batteries).

Our best UK ideas

Chloe Darling-Stewart on why the UK’s Autotrader, Moonpig and Genus are hidden treasures.

Our best private growth ideas

Rachael Callaghan introduces us to growth-focused private companies BillionToOne, Stripe and Vinted.

Beyond the benchmark: why being different pays off

Our chief executive on the importance of long-termism, optimism and conviction – and what comes next.

Salesforce: putting AI agents to work

Agentforce’s promise of handling customer service 24/7, faster and at a lower cost.

Lights, camera, AI

From storyboard to final cut, Runway is changing how films get made.

BYD’s right to win

The electric carmaker’s drive to follow success in China with global expansion.

The age of resilience

Why companies must be built to survive before they can thrive.

US perspectives: things are getting weird, quickly

An oar in one hand, a global studio in the other – that’s today’s frontier. What if the weirdness is the signal, and the opportunity?

The opportunity gap in Asia

Why exposure to Asia ex Japan matters for portfolios now.

Engagement and activism in Japan

Japan’s governance has had its ups and downs, but accelerating corporate reform is unlocking real investor value.

LTGG Reflections: Netflix

Lessons in disruption, adaptability and the conviction required to invest in outliers.

Three ways we think about AI in Emerging Markets

Why hardware producers, platforms and quiet compounders give our portfolios exposure to AI.

Tour de France: the Japanese connection

Bicycle parts maker Shimano is primed for a gear shift in performance.

Pushing rocks uphill: the case for European equities

Is this the turning point European investors have been waiting for?

Global Alpha insights: onsemi

How the chip maker reinvented itself from ugly duckling to industry leader.

Cultural architects

How great founders shape exceptional companies in changing times.

Skin in the game: the power of persistence

Why ‘inside ownership’ makes companies more likely to focus on efforts that will pay off in the future.

Healthcare: fear and opportunity

Fear dominates healthcare stocks, but patient investors see opportunity unfolding in the next wave of innovation.

LTGG Reflections: Rocket Lab

From a New Zealand shed to challenging SpaceX: why Rocket Lab's remarkable journey captivates LTGG.

Altruist: rebuilding infrastructure for investment advisors

How a private company is reshaping the $86tn advisory market.

Global Alpha insights: power-up mode

Turning a potential AI threat into a strategic advantage, what is software company EPAM Systems' game plan?

Positive Sparks: financial inclusion

Explore how digital innovation is revolutionising financial access for the world's unbanked.

The ‘invisible’ millions: banking’s new frontier

From microloans for farmers to insurance for gig workers – high-impact financial firms with great growth potential.

US perspectives: stablecoin summer

Discover how stablecoins, boosted by new US legislation, could transform global finance and unlock long-term growth.

Sustainable Growth Q2 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q2 update

Investment manager Katherine Davidson reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q2 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q2 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Brittle botany

How LTGG cultivates resilience in a fractious world.

UK Alpha Q2 update

Investment manager Milena Mileva reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q2 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q2 update

Investment manager Gary Robinson reflects on recent performance, portfolio changes and market developments.

UK Core Q2 update

Investment manager Iain McCombie reflects on recent performance, portfolio changes and market developments.

US Alpha Q2 update

Investment manager Sacha Meyers reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q2 update

Investment manager Donald Farquharson reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q2 update

Investment manager Mark Urquhart reflects on recent performance, portfolio changes and market developments.

Positive Change Q2 update

Investment manager Lee Qian reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

Investment manager Helen Xiong reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q2 update

Investment manager Will Sutcliffe reflects on recent performance, portfolio changes and market developments.

Private Companies Q2 update

Investment manager Tara Sallis reflects on recent portfolio changes and market developments.

Japan All Cap Q2 update

Investment manager Jared Anderson reflects on recent performance, portfolio changes and market developments.

Discovery Q2 update

Investment manager Douglas Brodie reflects on recent performance, portfolio changes and market developments.

European Equities Q2 update

Investment manager Chris Davies reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 update

Investment manager Ross Mathison reflects on recent performance, portfolio changes and market developments.

China Q2 investment update

Investment manager Sophie Earnshaw reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Listening beats forecasting

Why we value curiosity over certainty: recent lessons from the road

Positive Change Impact Report 2024

What difference did companies make in the real world during 2024? Our breakdown of progress on global challenges.

Uncommon understanding

Global Alpha’s investment managers reveal how they spot what others don’t see.

Global Alpha: an enduring focus in a changing world

Explore 20 years of Global Alpha in our anthology of articles covering the past, present and future.

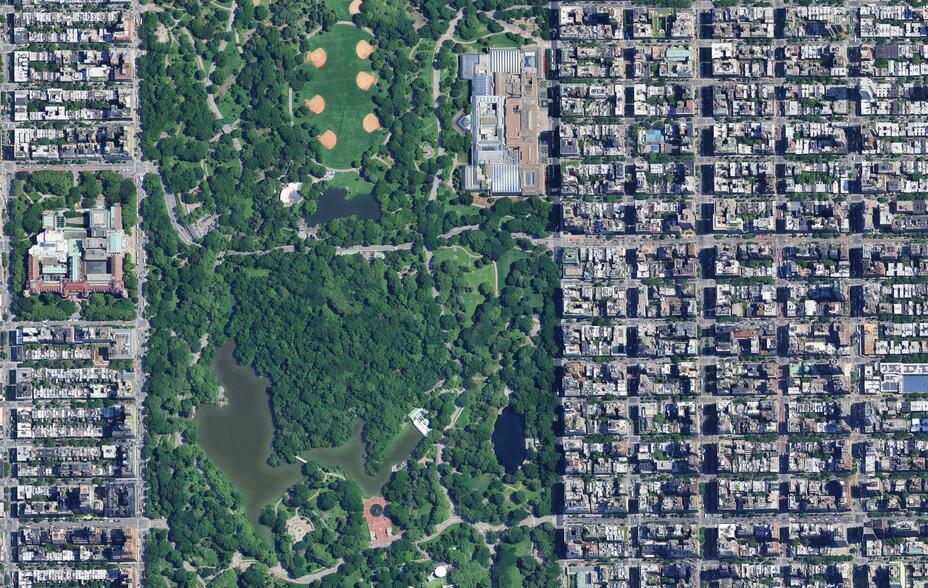

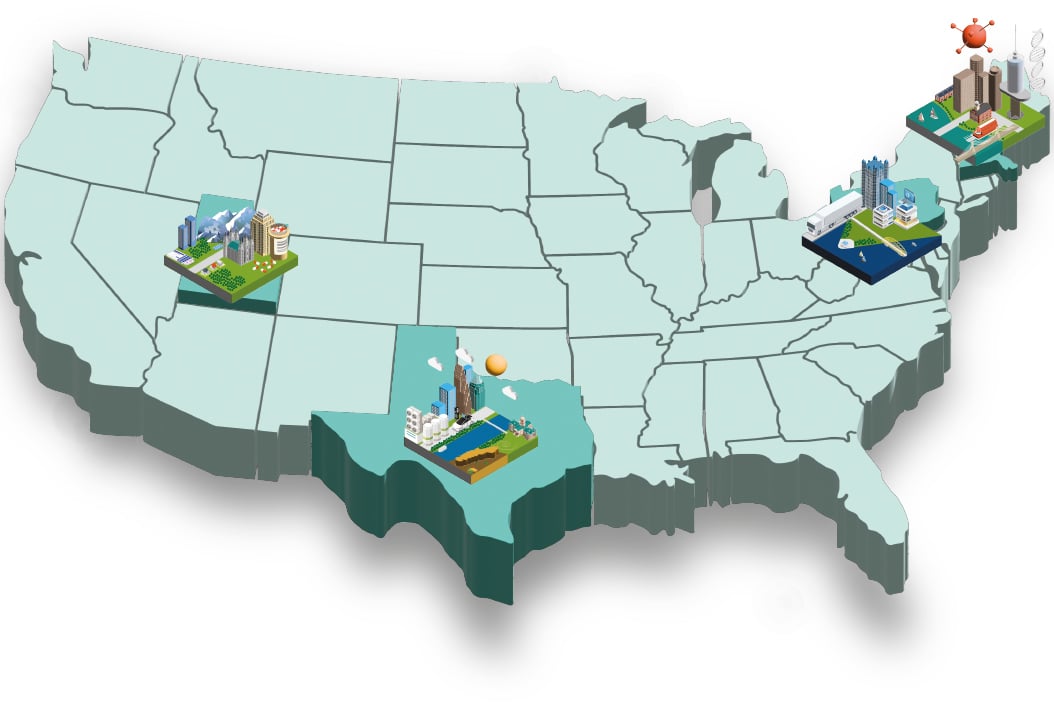

US perspectives: infrastructure, the invisible opportunity

A look at the long-term shifts in US infrastructure and the businesses poised to benefit from its rebuild.

Asia's multi-faceted growth story

China's innovation and Vietnam's reforms create a compelling investment case in Asia.

Emerging markets: the next engines of global growth

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

LTGG Stewardship Report

For the year ended December 2024.

LTGG Reflections: materiality

Why focusing on long-term business fundamentals, not headlines, drives LTGG's investment success.

Beyond the familiar: the case for international

Discover how venturing into unexplored investment territory is yielding hidden gems.

A new age of discovery: the case for international

Explore how international equities offer unique opportunities in transformative markets.

Global Alpha insights: infrastructure

Why companies like Martin Marietta are set to benefit from increased spending on infrastructure.

China: a tale of two stories

Why China is experiencing an industrial boom despite slower growth in traditional sectors.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Global Alpha: introducing Michael Taylor

Investment manager Michael Taylor joins Global Alpha as a decision-maker. We explore his background, strengths, and vision for the portfolio’s future opportunities.

Has ‘ESG’ reached its expiry date?

Our new head of ESG explains why she thinks the term needs a rethink.

US perspectives: comfortable in discomfort

Explore how embracing uncertainty and discomfort can lead to exceptional investment opportunities and long-term success.

LTGG Reflections: Know where your towel is

Why investors should avoid the temptation to throw in the towel during market turmoil.

Global Alpha insights: turbulent times

How can we participate in long-term progress without it being undone by every policy turn?

Positive Sparks: fast fashion

Shifting consumer attitudes are driving innovative solutions to make fashion more sustainable.

UK growth: opportunities amid tariff turbulence

How adaptable firms in growth-driving sectors can prosper over the long term despite trade restrictions.

The case for private growth equity

How companies like Stripe, Databricks and SpaceX are shaking up growth trends typically dominated by public markets.

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

US perspectives: the retail ecosystem

Explore the evolution of retail, where cutting-edge technology and shifting consumer trends drive innovation.

With the benefit of foresight

Investors must navigate uncertainty to create long-term value in a rapidly changing world.

US Alpha Q1 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q1 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Japan All Cap Q1 update

The Japan All Cap Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q1 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Alpha Q1 update

The UK Alpha Team reflects on recent performance, portfolio changes and market developments.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q1 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

China Q1 investment update

The China Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: a time to trade?

Explore how we're evolving the portfolio as the investment environment enters a period of rapid change.

Cloudflare: Stock Story

Ben James highlights how one cybersecurity approach is redefining digital infrastructure.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

In conversation with our Islamic scholars

Join our Islamic Scholars as they discuss the importance of aligning investments with Islamic principles.

In conversation with our investment managers

Join co-managers Kave Sigaroudinia and Tolibjon Tursunov as they discuss the Baillie Gifford Islamic Global Equity Strategy.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

Why ants, scaffolding and long jumps matter to growth investors

Kirsty Gibson shares frameworks to analyse the cultures of exceptional growth businesses.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Trip notes: Kazakhstan

Sizing up super-app Kaspi.kz in Almaty.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

Watch this space: Tim Marshall on the future of ‘astropolitics’

Author Tim Marshall explains how space is set to become the new arena for rival powers.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Nubank: Latin America’s digital disrupter

Charting the app-based lenders’ long-term growth.

Joby Aviation readies for take-off

How a flying taxi firm could launch a transport revolution.

US perspectives: AI evolves again

Explore how the rapid market shift in AI and computer processing is transforming industries.

Positive Change: a review of 2024

A detailed overview of 2024 covering performance, portfolio and investment approach.

A new quest: Shariah-compliant investing

Discover how the Islamic Global Equities Strategy is blending finance and faith for global impact.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

Climate scenarios: preparing for uncertainty

How scenario analysis and climate adaptation can unlock exciting investment opportunities in resilient companies.

Private growth: Looking over the overlooked

Learn more about the key features and attributes of the growth equity asset class.

Positive Conversations 2024

Discover the difference made by dialogue in Positive Change’s latest ESG and engagement report.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Discovery: our philosophy

Investment manager, Douglas Brodie, discusses the Baillie Gifford Discovery Strategies.

Climate and energy scenarios

Explore four climate transition scenarios, their economic impacts and investment strategies for a low-carbon future.

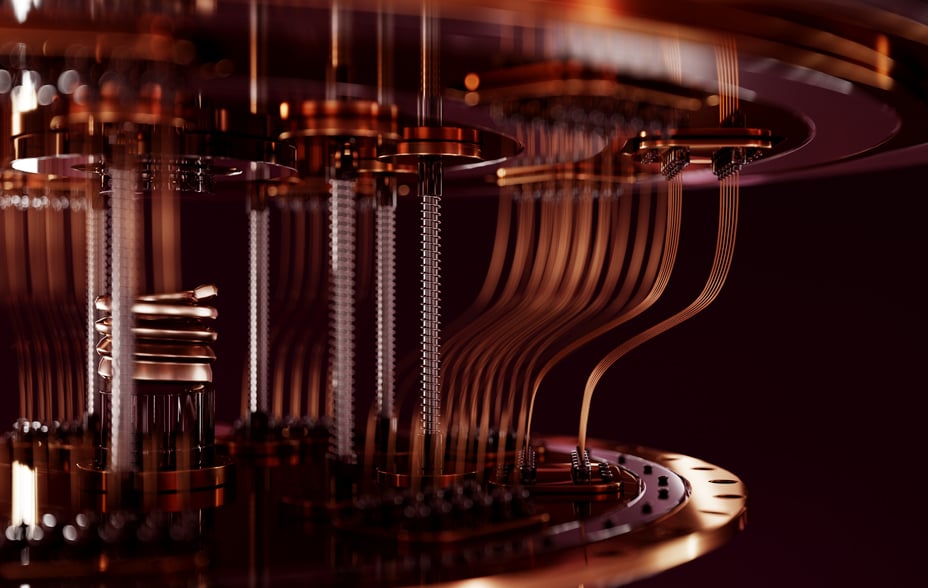

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

AI revolution: behind the 'overnight' success

AI is revolutionising industries globally. Stewart Hogg explores how AI is reshaping companies and driving long-term growth.

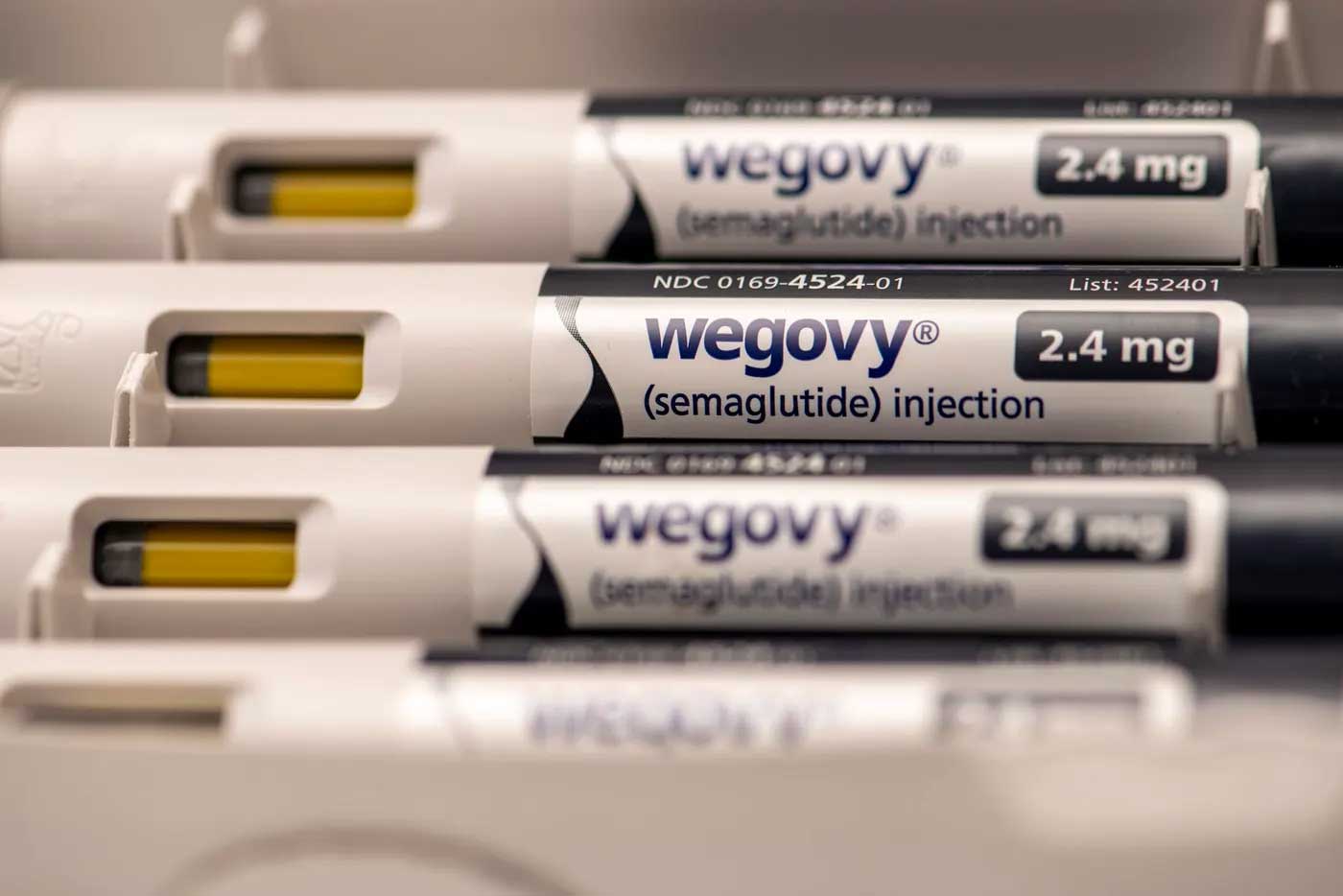

Positive Sparks: diabetes

Discover how groundbreaking diabetes solutions are driving global positive change.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

The G of ESG: governance reimagined

Why we don’t follow the crowd when assessing a company’s governance behaviours and structures.

5 inevitable and investable long-term growth drivers

Ways the world will change, from smarter robots to medical breakthroughs achieved at speed.

The concentration conundrum: challenge or opportunity?

In today’s era of US mega caps, is market concentration a challenge or an opportunity?

Finding sanity in the circus

An LTGG insight into what really matters for long term growth investing at the current juncture.

Volatility in LTGG: a feature not a bug

Why volatility is crucial to LTGG's strategy of capturing outsized returns.

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

China Q4 update

The China Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

European Equities Q4 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q4 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

US Alpha Q4 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q4 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q4 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Japan All Cap Q4 update

The Japan All Cap Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q4 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Private Companies Q4 update

The Private Companies Team reflects on recent performance, portfolio changes and market developments.

Discovery Q4 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q4 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q4 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q4 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Upfront: US equities

Gary Robinson on what a Trump presidency and AI opportunities could mean for growth investors.

Heeding nature: what’s at stake?

How we seek to understand the implications of a changing world for the companies we back.

Stock story: Ecolab

Learn how Ecolab is helping customers around the world be better stewards of water.

Investing in an ageing society

Increasingly elderly populations could transform our lives as much as climate change or AI.

Emerging markets: new opportunities

Why increased resilience and strong growth prospects merit a closer look.

Private investments: unlocking growth

The three Rs – relationship, reputation and research – are key to private company investing.

Any other business: Disruption Week questions 2024

Baillie Gifford's strategy specialists address your remaining queries from Disruption Week 2024.

The great US infrastructure rebuild

Finding gold amid the grit of the US drive to repair its essential networks.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

Why not just invest in the index?

Partner Stuart Dunbar explores why as an active manager Baillie Gifford can add value beyond investing in an index over the long term.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

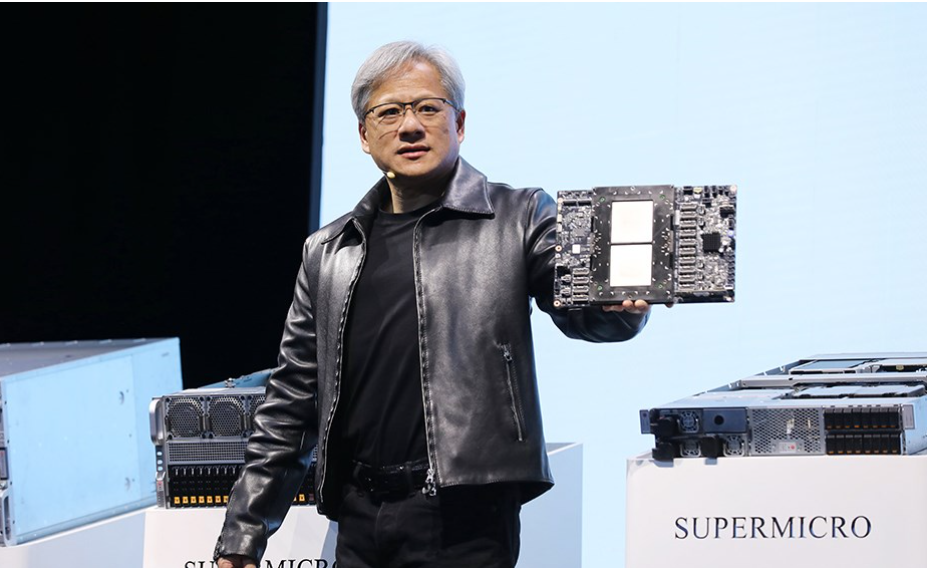

Semiconductor chips: the global tech battle

Companies and countries are vying for influence on the technology powering computation.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Do elections matter for stock returns?

What the past tells us about a new US president’s impact on growth companies.

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Our best ideas in Japan

Thomas Patchett unwraps Softbank, Rakuten and Eisai, three companies driving new opportunities in Japan.

Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks in the US.

Our best ideas in Asia

Qian Zhang covers Samsung, Delhivery and Bank Rakyat, three companies at the heart of global structural trends.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

Our best disruptive ideas

Bill Chater spotlights three companies making world-changing breakthroughs: Alnylam, Axon and SpaceX.

Future Stocks: Our best impact ideas

Rosie Rankin explains why Nubank, Xylem and Grab can both improve lives and offer investment returns.

The importance of focus

Why focus and patience are crucial elements when investing and identifying growth companies.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Ahead of the game: rethinking play’s importance

Kelly Clancy makes the case for why play is more important than you might think.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Creo Medical: at the spearhead of surgery

The Welsh company cutting surgery waiting lists – and costs.

Why technical leaders have an advantage

How the leaders of Meta, Shopify, Roblox and Spotify’s expertise helps them put AI to use.

Trip Notes: Seoul and Mumbai

Lawrence Burns sees great growth firms in action in South Korea and India.

PsiQuantum: the leap to quantum computing

PsiQuantum’s efforts could revolutionise medicine, energy use, farming and more.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

Beyond Silicon Valley

The US’s new hotbeds of innovation are increasingly based outside California.

SWCC Showa: rewiring Japan

How an ultra-traditional Japanese engineering firm became key to Japan’s power overhaul.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Japan: opportunities in automation

Japan's automation revolution and its global leadership in robotics.

Japan: opportunities in healthcare

Japan’s innovation medical breakthroughs are combatting ageing.

Japan: opportunities in quality brands

Behind the success of Japan’s leading quality brands and what opportunities they present.

Japan: opportunities in entertainment

Japan's media giants: Sony and Nintendo's timeless influence.

MercadoLibre: Latin America’s unbanked

MercadoLibre offers hope to Latin America’s 178 million unbanked population.

The rise of cloud computing

From data lakes to Databricks, cloud storage will be key to driving progress and future innovation.

Wise: Growing global money transfers

Charting rising cross-border money payments and the opportunity for remittance service Wise.

Japanese changemakers shaping the future

The firms taking advantage of four transformational opportunities.

Starlink: internet for mobile dead zones

Low-orbit satellites could be the answer for the three billion unable to access the internet.

International viewpoints: semi-cap resilience

Why our long-term conviction in ASML, Tokyo Electron and TSMC stands up to recent sector volatility.

Extraordinary times and opportunities

James Budden explains why now is the time for growth, as markets weather exceptional volatility

Environment: making sense of the E in ESG

How companies’ relationships with climate, energy and the environment relate to long-term growth.

Academic collaborations that count

The experts helping us gain an investment edge when thinking about farming, human rights and AI.

Positive Change Impact Report 2023

Where innovation meets impact: logging portfolio companies’ progress in shaping a better future.

Lessons from a time traveller

A journey through time uncovers the deep transitions that can reshape our world.

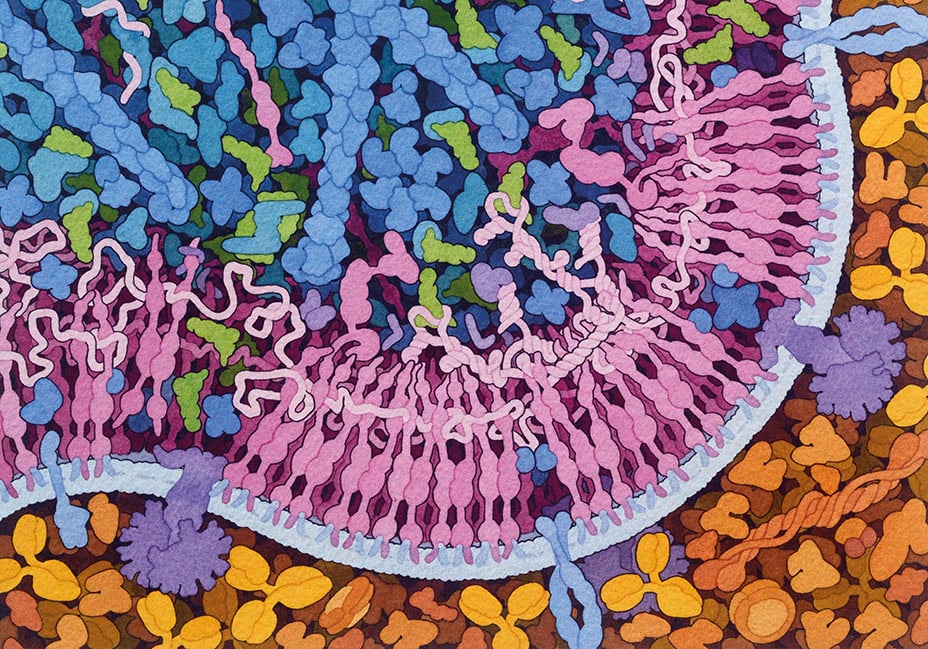

AI: driving a new healthcare paradigm

Why AI could be key to us living longer and being in better health in the future.

Streamlined for success

How efficiency drives at Meta, Shopify and Block could fuel their long-term growth.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

Private equities: time to turn to growth

Why high interest rates help rapid growth private companies with proven products stand apart.

Japan: the next opportunity

Explore Japan's market evolution, digitalization, and investment opportunities in unique growth themes.

Why small companies matter to us

Unlocking the potential of small cap investments.

A write up of Baillie Gifford’s responsible investing breakfast

An insight into the critical role of responsible investing in aligning financial success with sustainability efforts.

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Upfront: Japanese equities

Praveen Kumar shares the latest on growth equities in Japan and why now is the time for small cap investors to be bold.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Remitly: easy global remittance

The mobile app that busts stress and high charges for workers sending money back home.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by founder-led companies.

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

Upfront: Asia’s emerging markets

Roderick Snell on investing in Asia – from a strengthening dollar to the semiconductor value chain.

Positive Conversations 2023

The Positive Change Team’s ESG and engagement report shows the difference talking can make.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

Positive Change: a review of 2023

A performance update explaining why we back firms solving social and economic issues such as Moderna and MercadoLibre.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Enduring good

What values are important to you? And are they reflected in your investments?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

How Amazon pioneered a new path

The new wave of companies blending physical and digital processes together.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

Legally bond: finding underestimated resilience

By keeping an open mind, we hope to find opportunities other credit investors might overlook.

Japan’s new growth opportunities

Seeking the entrepreneurial firms that could sustain the country’s rally.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Can we mine sustainably?

Minerals are key to the energy transition. We believe mining responsibly will bring rewards.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

The secrets of enduring growth

Toby Ross reveals the four signs that a company’s growth might endure for decades.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Adapting to survive – and thrive

Using a fighter pilot’s business strategy can help a company orient itself amid change.

Positive Change Impact Report 2022

If impact and investing go together, it is important to understand the difference we make.

Stock stories: Climeworks

Climeworks, the company using innovative technology to capture and store CO2 underground safely, measurably and permanently.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Asia ex Japan manager update

Roderick Snell and Qian Zhang discuss current views and portfolio positioning for the Asia ex Japan Strategy.

Climate change innovators

How Positive Change targets companies at the forefront of tackling carbon emissions.

China A Shares: in conversation

Investor Sophie Earnshaw explains how we navigate China’s complexity to boost growth potential.

Why the long-term matters

There’s safety in being one of the crowd but it could stop you from seeing potential rewards.

Indonesia powers a green transition

The island nation’s natural wealth makes it crucial to a low-carbon future.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

The sustainability revolution

Positive Change’s Kate Fox on thinking about the world in 2050 to spot opportunities today.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Positive Conversations 2022

We don’t just talk to managements, we listen. A snapshot of Positive Change’s ESG conversations.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Positive Conversations 2022

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

Why small is big in Japan

Praveen Kumar on the lesser-known players thriving in the shadow of the country’s big brands.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Japan Growth: Asia’s resurgence

Despite the turbulence of last year there are reasons to be optimistic about Japanese companies.

Japan: setbacks or permanent change?

Our investors’ job is to tell the difference between passing phases and deeper behavioural shifts.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Insights: investment research in Japan

Japan’s cultural landscape is changing, with implications for companies like Shiseido, CyberAgent and PayPay.

What’s next for growth stocks?

Baillie Gifford’s Dave Bujnowski explores the new engines powering progress.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

AI: Frightening or fascinating?

Investors discuss how AI software could transform healthcare, advertising, manufacturing and more.

Chip War

How semiconductors bring a competitive world together.

Disrupting heart disease

Rose Nguyen on the companies seeking to overcome the scourge of heart disease.

Why are Swedish companies world leaders?

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

Why patience matters

Endurance and imagination are key ingredients for quality growth investing.

How education escaped from the classroom

Online courses have upended the economics of education, Thaiha Nguyen explains.

Why private companies matter more

SpaceX, Epic Games and Stripe: the list of the unlisted continues to grow. How can investors benefit?

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

Growth or value: it’s not a black or white choice

Operational performance is a better indicator of growth than inflation. Malcolm MacColl shares why.

Tomorrow’s world, here today

Investing in private companies applying today’s early-stage tech to create tomorrow’s world.

The responsible approach to ESG investing

Is our approach to environmental, social and governance (ESG) issues doing more harm than good? Stuart Dunbar, partner at Baillie Gifford, calls for investors to stop counting and start thinking.

Breaking the biotech model

Could the messenger RNA vaccines deployed against Covid, help fight cancer and other diseases? After a year of crisis, Julia Angeles, co-manager of Baillie Gifford’s Health Innovation Fund, looks at the positive signs.

Looking back going forward

The LTGG Team look back on an extraordinary 12 months and discuss the growth prospects of the portfolio, the rapid development of vaccines and the importance of hold discipline.

What I've learned In four decades of investing

His career spanned big changes in investment – and in the fortunes of Baillie Gifford. Charles Plowden, joint senior partner and manager of Monks Investment Trust, looks at the opportunities ahead.

Sustainable investing: finding the innovative companies of the future

Are there limits to economic growth? Will we run out of ideas? Investment manager Lee Qian explains why he’s confident innovation will create a more prosperous, sustainable and inclusive world.

How Covid is changing the way we shop

The digital disruption of the high street accelerated during the pandemic. Baillie Gifford’s Moritz Sitte explores the innovative ways in which European retailers are reshaping the future of shopping.

The great divergence between east and west

China has defied recession in 2020, but where to now? Investment manager Roderick Snell anticipates big things ahead.

Living longer: can we afford it

More of us are living longer, staying healthier for longer and working for longer. What are the implications for investing and financing this longer life? Listen to Baillie Gifford’s Steven Hay to find out.

Tomorrow’s income aristocrats

Income investing has been shaken by the coronavirus, but how will this affect the dividend payers of the future? Baillie Gifford investment manager James Dow gives us a glimpse of the potential star performers of tomorrow.

What’s the purpose of investing

In our Short Briefings on Long Term Thinking podcast, Baillie Gifford partner Stuart Dunbar backs a return to the basics of investment.

Why this crisis favours growth stocks

Growth stocks have generally fared better than value stocks during the coronavirus pandemic, helping Scottish Mortgage Investment Trust during the worst of the stock market falls. In our podcast series, Short Briefings on Long Term Thinking Baillie Gifford partner Tom Slater explains why.

Navigating a stock market crisis

Scott Nisbet tells Malcolm Borthwick what he’s learnt from previous crises, why he’s staying calm and why now’s the time to read Albert Camus.

The Second Space Age

Fifty years after Apollo 11, can a fresh wave of innovation in space technology open new frontiers and promising investment opportunities? Investment manager, Luke Ward looks across the gulf of space and gives us his views.

Reasons to be optimistic about emerging markets

Investing in emerging markets is like Marmite. It divides opinion. Charles Plowden explains why he’s a fan in Baillie Gifford’s podcast Short Briefings on Long Term Thinking.

The beauty of Japanese cosmetics

Investment manager, Praveen Kumar explains why the Japanese cosmetics industry is in a period of rapid growth and how it could be set to continue for the long term.

Learning from Academia

Our support of inquisitive people plays a crucial role in our investment research. Discover more in our academia anthology.

Finding Europe's hidden champions

There are lots of reasons not to invest in Europe. Its economic growth is uninspiring and much of its stock index is made up of bureaucratic corporate dinosaurs. But beyond the negative headlines, there are still exciting investment opportunities to be found. They include potential tenbaggers – companies whose share price could increase ten-fold.

Space: the final investment frontier

Fifty years on from the first moon landing, entrepreneurs on the west coast of America are stepping up spending on space. To discuss how this new space race might impact investment, Malcolm Borthwick is joined by Luke Ward – space enthusiast and deputy manager of Edinburgh Worldwide Investment Trust and the Global Discovery Fund.

Will industrial biotech be the next manufacturing revolution

Industrial biotech companies can already produce synthetic spider silk and plant-based burgers that taste like meat. Future possibilities include timber produced from yeast. In the latest episode of Short Briefings on Long Term Thinking, Kirsty Gibson tells Malcolm Borthwick why she's fascinated by the opportunities of industrial biotech and its enormous investment potential.

Fashion retailers: the impact of online shopping

In the fourth episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by Milena Mileva to discuss how profound changes in consumer behaviour are changing the retail landscape both online and in bricks-and-mortar stores.

The differences between bond and equity investing

In the third episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by Lucy Isles, joint manager of Baillie Gifford's High Yield Bond Fund. Listen to the podcast to find out the three key deciding factors when choosing resilient high yield bonds and how engagement with companies can differ for bond and equity investors.

Should income investors go global

What are “the good, the bad and the unbelievably great” of global investing? In the second episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by James Dow to challenge the conventional wisdom that if you’re investing for a regular income you should stick with blue chip UK companies.

Why China?

Investment Manager Roddy Snell, in conversation with Malcolm Borthwick, goes behind some recent lurid headlines to find out what's really happening with the Chinese economy.

Beyond the benchmark: why being different pays off

Quarterly investment updates

Keep up to date with the latest views of our investment teams in these recent webinars.

Long-term vision

We understand that the proper aim of the investment business is to direct capital to creating the goods and services that improve everyone’s lives.

Recent insights

Yarak: culture in the age of AI

What happens to great company cultures in the age of AI, where knowledge can be compressed, and decisions are pushed toward algorithms?

Are we in an era of commercial diplomacy?

US tariffs are reshaping trade. Explore the opportunities and political risks for leading US growth companies.

Emerging market companies leapfrogging western rivals

Investment manager Alice Stretch explores disruptive businesses in Asia and Latin America.

What’s your flavour of choice?

Three investment managers debate growth strategies from tech disruption to steady compounders

Some like it hot

Why the 'riskiest' growth companies may actually be your portfolio's best defence.

The world is about to get ‘weird’

Why avoiding US growth stocks is perilous: AI infrastructure, asymmetric returns and the paradigm shift.

Korea’s Value-Up ambition

Why South Korea’s stock market has transformed from ugly duckling to world-leading.

Private growth: the underappreciated opportunity

Why the asset class offers patient investors access to exceptional companies.

Private companies: from Anthropic to Zetwerk

Why we invested in the AI lab and supply chain specialist, among other companies operating in private markets.

Global Alpha Research Agenda 2025

From AI to emerging consumers, we focus on the growth areas and companies capitalising on opportunities.

Global Alpha insights: our reliable growth engine

Not flashy, just dependable. Why compounders remain the engine of durable long-term returns.

Synthesis in risk management

Discover how Baillie Gifford balances modern risk analytics with long-term growth investing.

Amazon: Stock Story

Jon Henry gives three key reasons why tech giant Amazon remains a special investment.

Fairytales and fundamentals revisited

Jonny Greenhill on Long Term Global Growth’s patient approach to backing transformative companies.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

Important information

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients and is authorised and regulated by the UK Financial Conduct Authority. Baillie Gifford Overseas Limited is not licensed under the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law.

Baillie Gifford Overseas Limited markets and distributes Baillie Gifford’s range of collective investment schemes to Qualified Clients and Qualified Investors in Israel, as listed in the First Addendum to the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and in the First Addendum to the Israel Securities Law, 5728-1968 (the “Securities Law”). Detailed disclosure of the collective investment schemes can be found within this website and in the relevant scheme prospectus.

Baillie Gifford Overseas Limited does not provide investment advice. If you are in any doubt about whether an investment is suitable, you should seek independent advice.

No action has been or will be taken in Israel that would permit a public offering or distribution of the Funds mentioned in this website to the public in Israel. This website and the Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”). In addition, the Funds mentioned in this website are not regulated under the provisions of Israel’s Joint Investment Trusts law, 5754-1994 (the “Joint Investment Trusts Law”). This website and the Funds mentioned herein will only be distributed to Israeli residents in reliance on an exemption from any advice or marketing restrictions [in a manner that will not constitute “an offer to the public” under sections 15 and 15a of]/[in reliance on an exemption from the prospectus requirements under] the Israel Securities Law, 5728-1968 (the “Securities Law”) or the Joint Investment Trusts Law, and any guidelines, pronouncements or rulings issued from time to time by the ISA as applicable.