Capital at risk

Emerging markets equities

We’ve been managing dedicated emerging markets portfolios for three decades. We are targeting a wide range of growing emerging market companies.

Why invest in emerging markets?

Emerging markets can give you access to many of the world’s most dynamic, high-growth companies. Over the past two decades, the breadth and quality of these businesses have significantly improved, and the economies themselves have become more robust. However, not all opportunities are equal. With our extensive experience and unique approach, we strive to pick only the fastest-growing businesses from a diverse range of countries and industries for you.

How do we invest in emerging markets?

We consistently find that the companies which outperform are those that grow their profits faster than the market in hard currency terms over several years.

Our goal is to discover these businesses, assess their long-term growth potential and then patiently hold them, allowing our research-driven decisions to generate returns for you.

Emerging market strategies

Emerging Markets All Cap

Our longest-standing Global Emerging Markets portfolio, targeting the world’s best Emerging Market companies with a diversified approach.

Emerging Markets Leading Companies

A more concentrated Global Emerging Markets portfolio of 35-60 stocks. Seeking strong opportunities to own for the long term.

All our investment capabilities

Core growth

Large, diverse portfolios of growth-focused holdings built with benchmarks and reduced volatility in mind.

Flexible growth

Portfolios containing a mix of firms focused on disruption, steady compounding and timely capital allocation.

High growth

Concentrated portfolios of fast-growth companies, typically holding between 25 and 50 stocks.

Insights

Key articles, videos and podcasts relating to our emerging markets equities investment capabilities:

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

Monthly insights

Related insights

Emerging Markets: are you missing the point?

Why underweighting EM is an active risk, not a cautious stance.

Emerging Markets Q3 update

Investment manager Ben Durrant reflects on recent performance, portfolio changes and market developments over the last quarter.

Emerging Markets Q2 update

Investment manager Will Sutcliffe reflects on recent performance, portfolio changes and market developments.

Emerging markets: the next engines of global growth

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

EM: how we do what we do

How do we implement our emerging markets philosophy in practice?

EM: Why we do what we do

Why do we invest in emerging markets in the way that we do?

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

A long view of the east

With 35 years of investing behind us, we look to the future with our Asia-ex-Japan Strategy.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

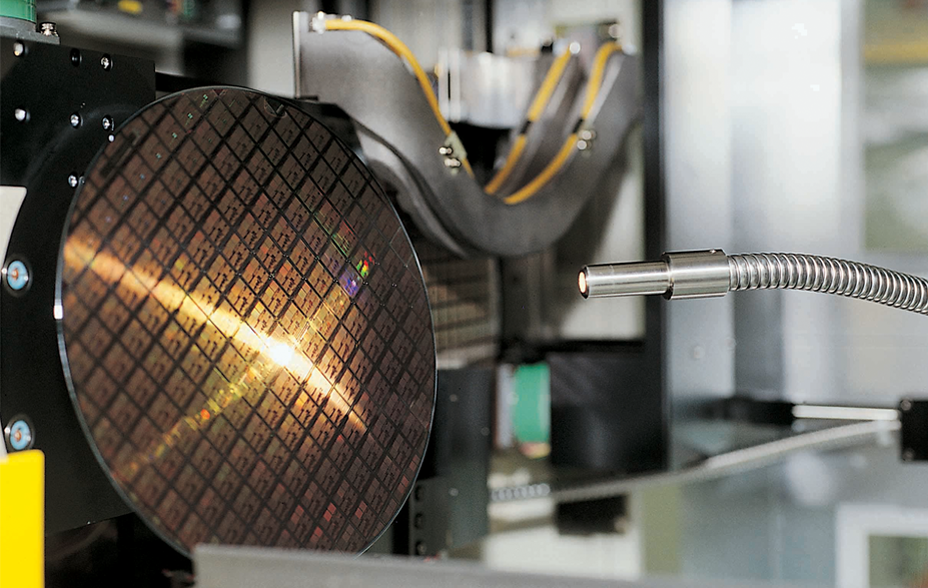

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

Important information

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients and is authorised and regulated by the UK Financial Conduct Authority. Baillie Gifford Overseas Limited is not licensed under the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law.

Baillie Gifford Overseas Limited markets and distributes Baillie Gifford’s range of collective investment schemes to Qualified Clients and Qualified Investors in Israel, as listed in the First Addendum to the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and in the First Addendum to the Israel Securities Law, 5728-1968 (the “Securities Law”). Detailed disclosure of the collective investment schemes can be found within this website and in the relevant scheme prospectus.

Baillie Gifford Overseas Limited does not provide investment advice. If you are in any doubt about whether an investment is suitable, you should seek independent advice.

No action has been or will be taken in Israel that would permit a public offering or distribution of the Funds mentioned in this website to the public in Israel. This website and the Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”). In addition, the Funds mentioned in this website are not regulated under the provisions of Israel’s Joint Investment Trusts law, 5754-1994 (the “Joint Investment Trusts Law”). This website and the Funds mentioned herein will only be distributed to Israeli residents in reliance on an exemption from any advice or marketing restrictions [in a manner that will not constitute “an offer to the public” under sections 15 and 15a of]/[in reliance on an exemption from the prospectus requirements under] the Israel Securities Law, 5728-1968 (the “Securities Law”) or the Joint Investment Trusts Law, and any guidelines, pronouncements or rulings issued from time to time by the ISA as applicable.