Capital at risk

Global Income Growth

Long-term dividend compounding is the eighth wonder of the world.

We focus on companies that can compound earnings and dividends effectively over long periods. These are rare but can deliver attractive returns.

For a lifetime of income, choose growth

Whether you require an income today and for years to come or are simply looking for attractive capital growth and total returns over the long term, dividend growth investing might be what you’re looking for.

Global Income Growth Q3 update

Investment manager Alistair Way reflects on recent performance, portfolio changes and market developments.

A truly long-term approach

We aim to deliver a dependable income and real growth in dividends and capital over the long term.

We believe the best way to meet these objectives is to invest in companies that can pay dependable dividends across the cycle and have the prospect of real growth in profits, which will, in turn, lead to growth in dividends and capital.

Such companies are rare and highly attractive to a client who needs income today and is also seeking capital appreciation well into the future.

Resilient and dependable dividends

Our portfolio is a selection of carefully selected dividend-paying companies with attractive growth prospects and resilient businesses.

The strategy is managed with a growth mindset and a lengthy investment time horizon. We focus on dividend growth, not short-term yield.

The companies we hold support real growth in dividends, and they typically have resilient business models that provide stability at times of market volatility.

With many investors fixated on the short-term, our long-term focus gives us the opportunity to invest into mispriced dividend-growing companies.

Meet the managers

Documents

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 November 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | TSMC | 4.2% |

| 2 | Microsoft | 4.1% |

| 3 | Apple | 4.1% |

| 4 | Procter & Gamble | 3.1% |

| 5 | CME Group | 3.0% |

| 6 | Coca-Cola | 2.8% |

| 7 | Atlas Copco | 2.8% |

| 8 | Roche | 2.6% |

| 9 | Analog Devices | 2.5% |

| 10 | Deutsche Börse | 2.4% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

What’s your flavour of choice?

Three investment managers debate growth strategies from tech disruption to steady compounders

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

The science behind investing

From nanotechnology to investing, Olivia Knapp explores the chemistry of good research.

Profile of a returning industry veteran

After nearly 20 years leading global equity teams, explore why Alistair Way returns to Baillie Gifford.

Global Income Growth Q3 update

Investment manager Alistair Way reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 update

Investment manager Ross Mathison reflects on recent performance, portfolio changes and market developments.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

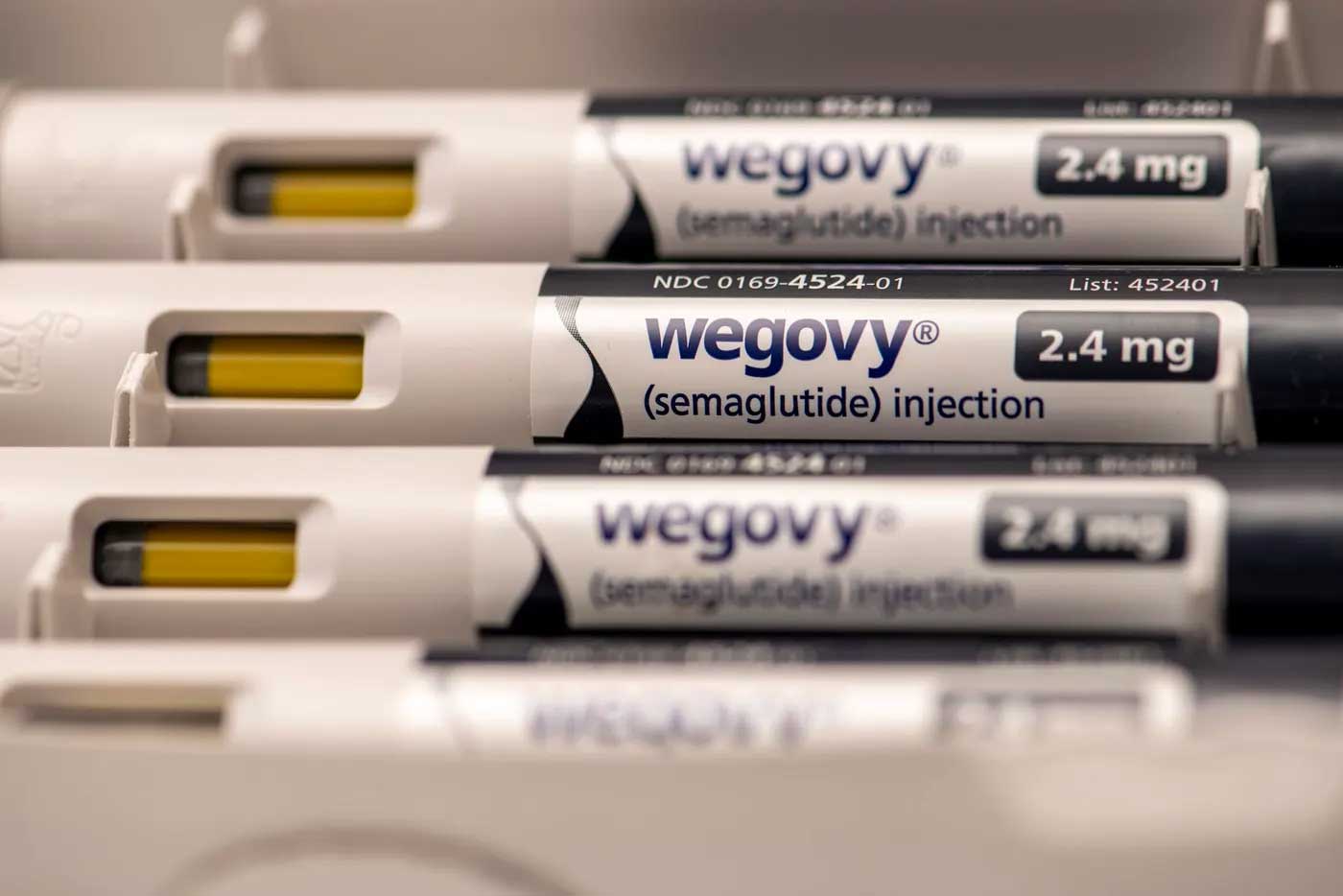

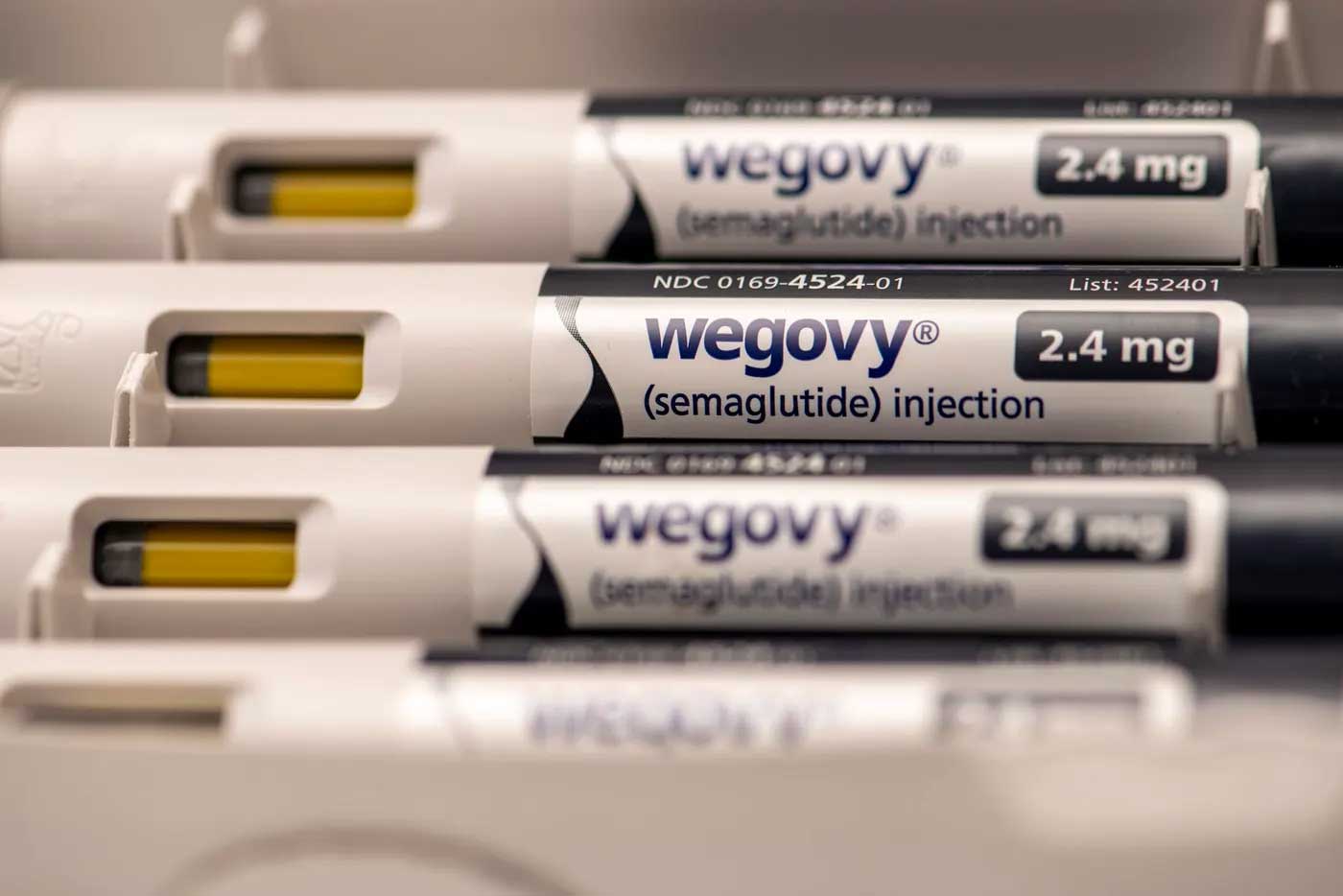

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Global Income Growth Q3 update

Investment manager Alistair Way reflects on recent performance, portfolio changes and market developments.

What’s your flavour of choice?

Three investment managers debate growth strategies from tech disruption to steady compounders

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

The science behind investing

From nanotechnology to investing, Olivia Knapp explores the chemistry of good research.

Profile of a returning industry veteran

After nearly 20 years leading global equity teams, explore why Alistair Way returns to Baillie Gifford.

Global Income Growth Q3 update

Investment manager Alistair Way reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q2 update

Investment manager Ross Mathison reflects on recent performance, portfolio changes and market developments.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients and is authorised and regulated by the UK Financial Conduct Authority. Baillie Gifford Overseas Limited is not licensed under the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law.

Baillie Gifford Overseas Limited markets and distributes Baillie Gifford’s range of collective investment schemes to Qualified Clients and Qualified Investors in Israel, as listed in the First Addendum to the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and in the First Addendum to the Israel Securities Law, 5728-1968 (the “Securities Law”). Detailed disclosure of the collective investment schemes can be found within this website and in the relevant scheme prospectus.

Baillie Gifford Overseas Limited does not provide investment advice. If you are in any doubt about whether an investment is suitable, you should seek independent advice.

No action has been or will be taken in Israel that would permit a public offering or distribution of the Funds mentioned in this website to the public in Israel. This website and the Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”). In addition, the Funds mentioned in this website are not regulated under the provisions of Israel’s Joint Investment Trusts law, 5754-1994 (the “Joint Investment Trusts Law”). This website and the Funds mentioned herein will only be distributed to Israeli residents in reliance on an exemption from any advice or marketing restrictions [in a manner that will not constitute “an offer to the public” under sections 15 and 15a of]/[in reliance on an exemption from the prospectus requirements under] the Israel Securities Law, 5728-1968 (the “Securities Law”) or the Joint Investment Trusts Law, and any guidelines, pronouncements or rulings issued from time to time by the ISA as applicable.