Overview

The Worldwide Pan-European Fund aims to maximise total return principally through investment in equity securities which are listed, traded or dealt on Regulated Markets across Europe.

Performance & Portfolio

Data is not currently available for this share class.Top Ten Holdings - 31/03/2024

Fund % 1 Schibsted 4.2% 2 Ryanair 3.8% 3 Prosus 3.8% 4 Topicus.com 3.7% 5 Hypoport 3.7% 6 ASML 3.6% 7 Games Workshop 3.3% 8 Atlas Copco 3.2% 9 Reply 3.0% 10 Sartorius Stedim Biotech 2.8% Total 35.2% Sector Analysis of Total Assets - 31/03/2024Fund %

- 1 Industrials 24.17

- 2 Consumer Discretionary 20.43

- 3 Information Technology 18.10

- 4 Financials 16.75

- 5 Health Care 11.60

- 6 Communication Services 8.22

- 7 Cash 0.73

- Total 100.00

As the Fund invests in overseas securities, changes in the rates of exchange may cause the value of your investment (and any income it may pay) to go down or up.

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co.

Please note that totals may not add due to rounding.Insights

Managers

Stephen Paice

Stephen is head of the European Equity Team. He joined Baillie Gifford in 2005, and became a partner of the firm in 2024. Stephen has been involved in running the European portion of the Global Core Strategy and Managed Strategy since 2019, as well as becoming a member of the International All Cap Portfolio Construction Group in 2022. Prior to joining the team he spent time in the US, UK Smaller Companies and Japanese equities teams. Stephen graduated with a BSc (Hons) in Financial Mathematics in 2005.

Chris Davies

Chris joined Baillie Gifford in 2012 and is an Investment Manager in the Europe Team. He graduated BA (Hons) in Music from the University of Oxford in 2009 and went on to gain an MMus in Music Performance from the Royal Welsh School of Music and Drama in 2010 and an MSc in Music, Mind and Brain from Goldsmiths College in 2011.

How to Invest

You can invest in a range of our funds via a number of fund platforms and supermarkets. Certain share classes are available for investment via a number of platforms. Please see the links opposite.

Baillie Gifford does not sponsor, maintain or have any control over the content of any other websites.

Therefore, we are not responsible for the adequacy or accuracy of any of the information you may view, nor do we undertake to ensure successful transmission to any linked website.

How to Invest

Documents

You can access any literature about the Fund here, either by downloading or requesting a copy by post (where available).

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.

Annual Reports

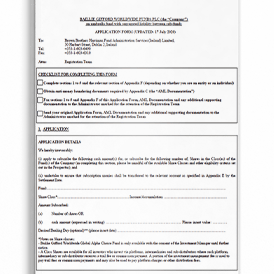

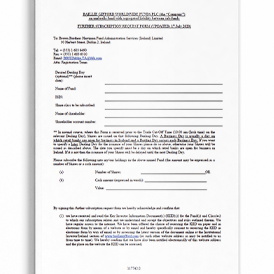

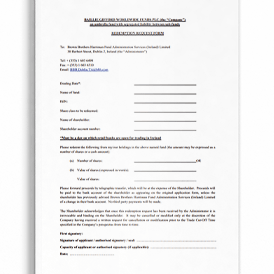

Application Forms

Corporate Governance

Fund Factsheets

Important Disclosures

Interim Reports

Investor Tax Reporting

MIFID II Ex-Ante Disclosures

Other Fund Literature

Philosophy and Process Documents

Prospectus

Quarterly Investor Updates

Sustainability-related Disclosures

Shareholders Rights Directive

PRIIPs Key Information Document

PRIIPs Performance Disclosures

Further Information

BAILLIE GIFFORD INVESTMENT MANAGEMENT (EUROPE) LIMITED: REGISTERED OFFICE

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (No. C182354). Registered office: 4/5 School House Lane East, Dublin 2, D02 N279. Registered in Ireland (No. 625892).COMPLAINTS CONTACT DETAILS

In the first instance, clients should contact their normal Client Contact with any concerns. Alternatively, or for those clients who do not have a direct client contact assigned, complaints can be emailed to Baillie Gifford’s Compliance Department at: InstitutionalComplaints@bailliegifford.com. A summary document which contains details on Baillie Gifford’s complaints management policy is available upon request. All material complaints are recorded in an in-house incident management system and are escalated to, and dealt with by, members of staff of suitable seniority, independent of the area from which the matter arose.Risks

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The specific risks associated with the Fund include:

Custody

Custody of assets involves a risk of loss if a custodian becomes insolvent or breaches duties of care.

Concentration

The Fund’s concentrated portfolio relative to similar funds may result in large movements in the share price in the short term.

Foreign Currency

The Fund has exposure to foreign currencies and changes in the rates of exchange will cause the value of any investment, and income from it, to fall as well as rise and you may not get back the amount invested.

Environmental, Social and Governance (ESG)

The Fund invests according to responsible investment criteria and with reference to the principles of the United Nations Global Compact for business. This means the Fund will not invest in certain sectors and companies and, therefore, the universe of available investments will be more limited than other funds that do not apply such criteria/ exclusions. The Fund therefore may have different returns than a fund which has no such restrictions. Data used to apply the criteria may be provided by third party sources and is based on backward-looking analysis and the subjective nature of non-financial criteria means a wide variety of outcomes are possible. There is a risk that data provided may not adequately address the underlying detail around material non-financial considerations.

Please consider all of the characteristics and objectives of the fund as described in the Key Information Document (KID) and prospectus before making a decision to invest in the Fund. For more information on how sustainability issues, such as climate change are considered, see bailliegifford.com.

Volatility

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further Details

Further details of the risks associated with investing in the Fund can be found in the Key Information Document (KID), or the Prospectus. Copies of both the KID and Prospectus are available at bailliegifford.com.

Definitions

Active Share: A measure of the Fund's overlap with the benchmark. An active share of 100 indicates no overlap with the benchmark and an active share of zero indicates a portfolio that tracks the benchmark.

Important Information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here.