Insights

Filters

Insights

Viewing 361 of 361

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

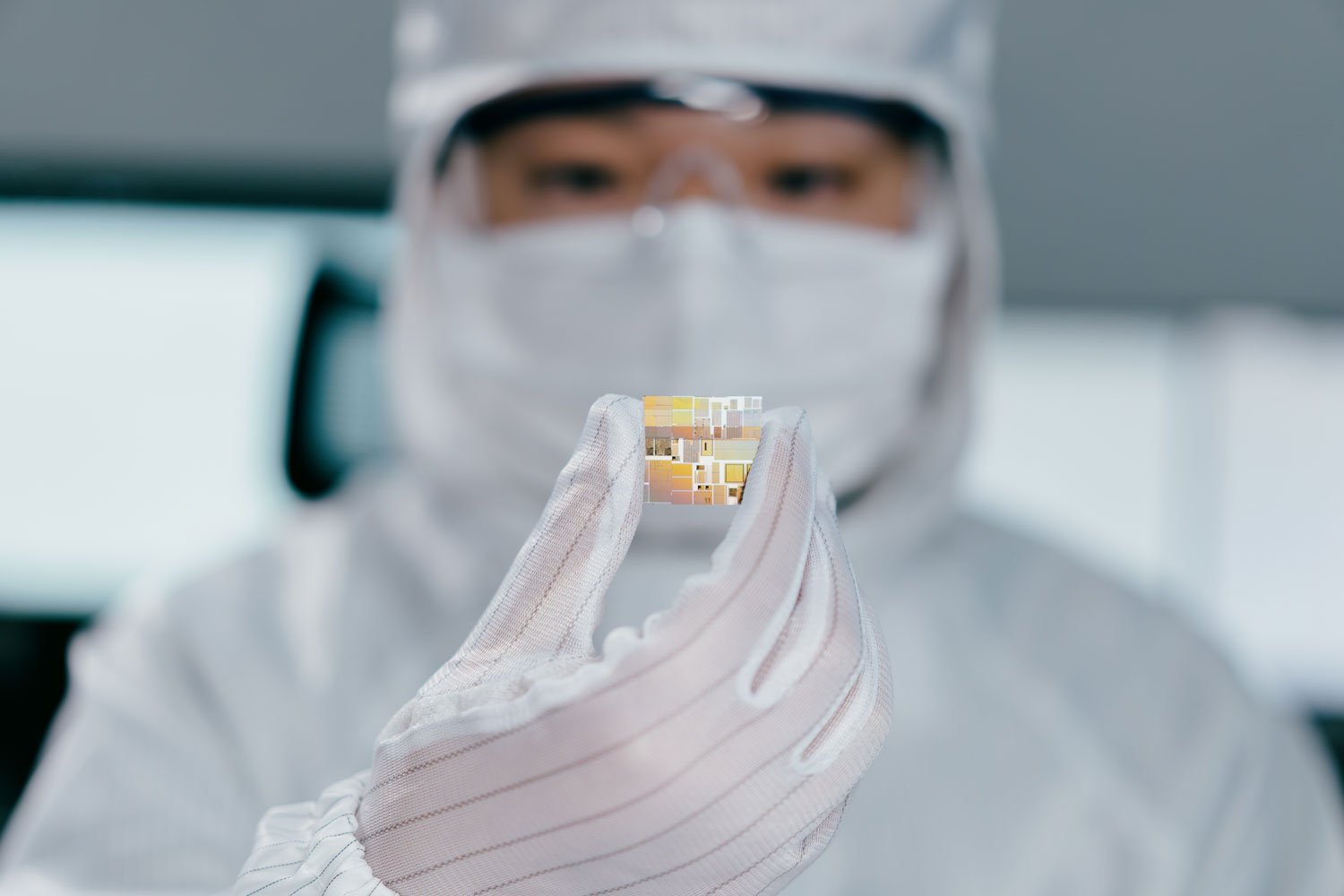

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

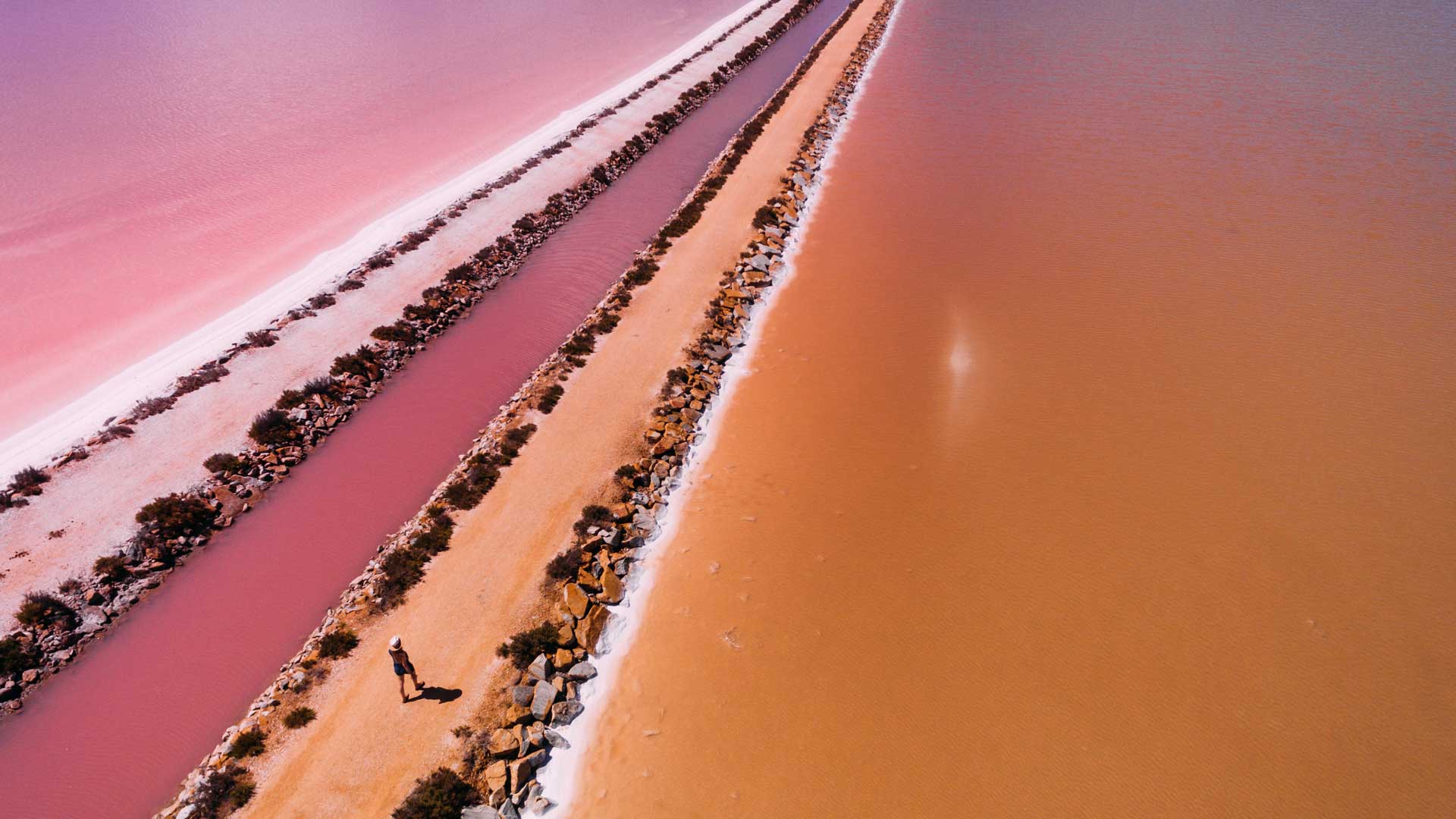

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Investing in UK water

The companies transforming the UK’s water infrastructure.

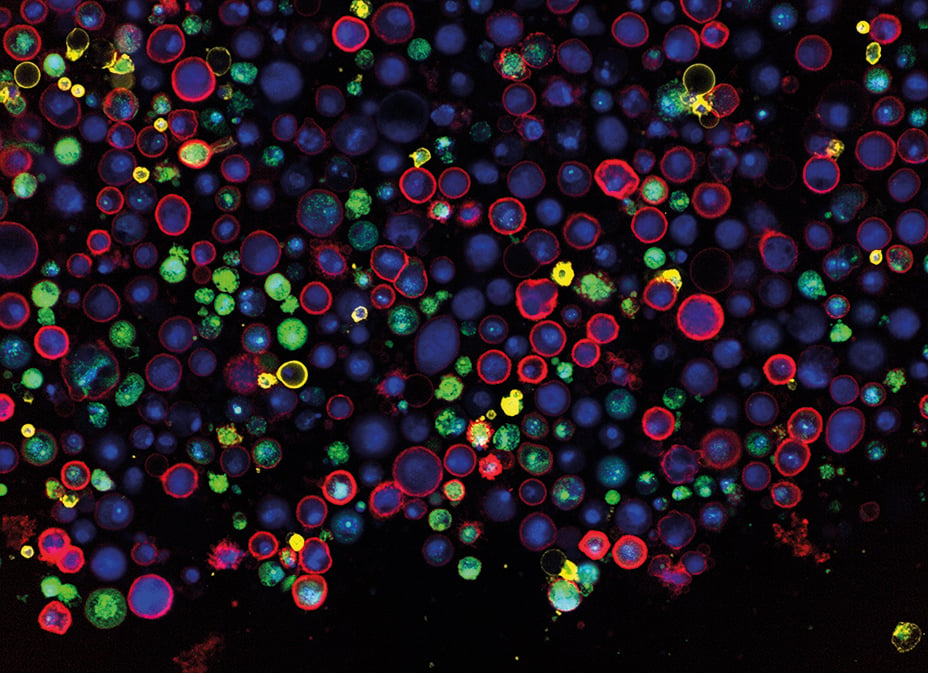

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

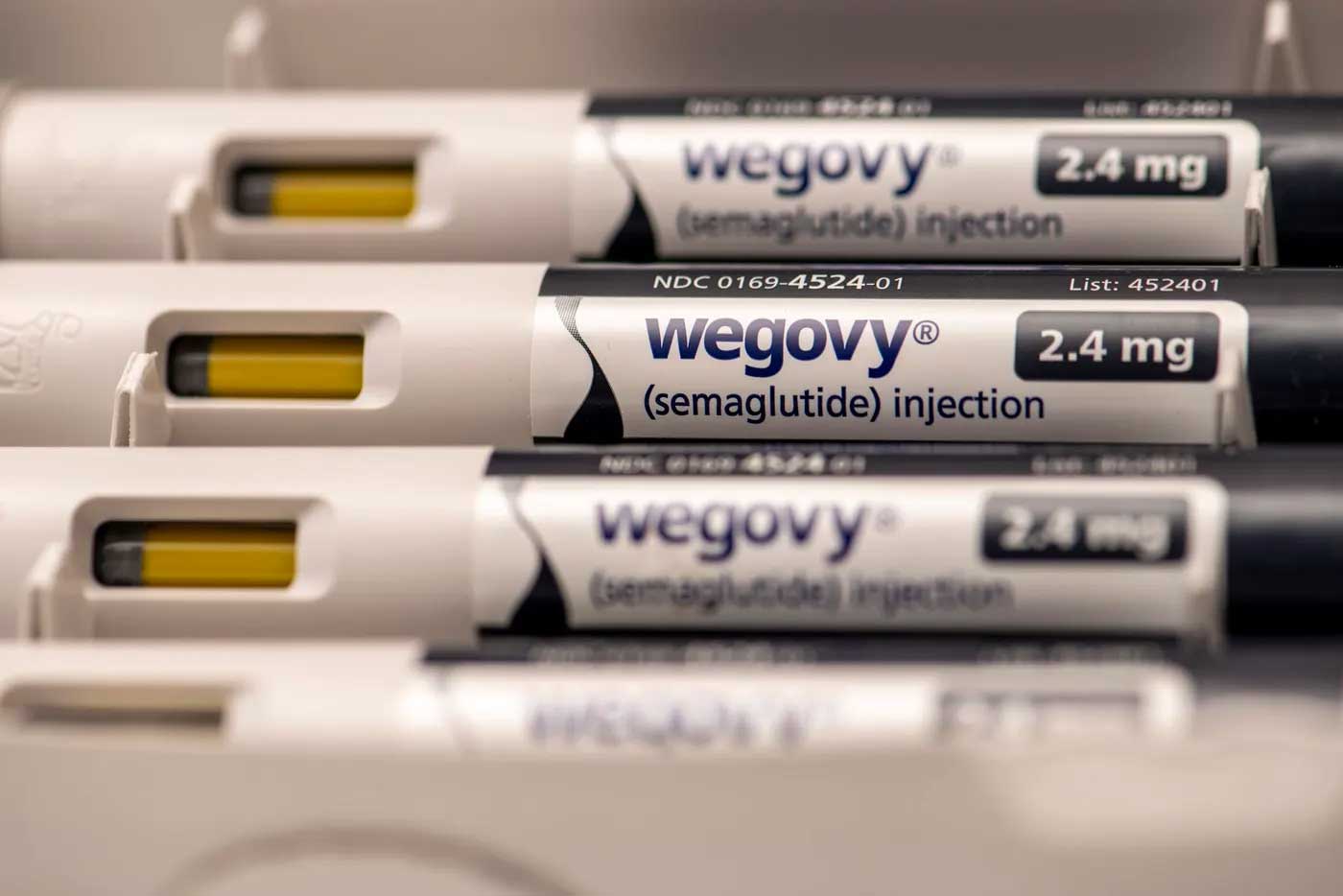

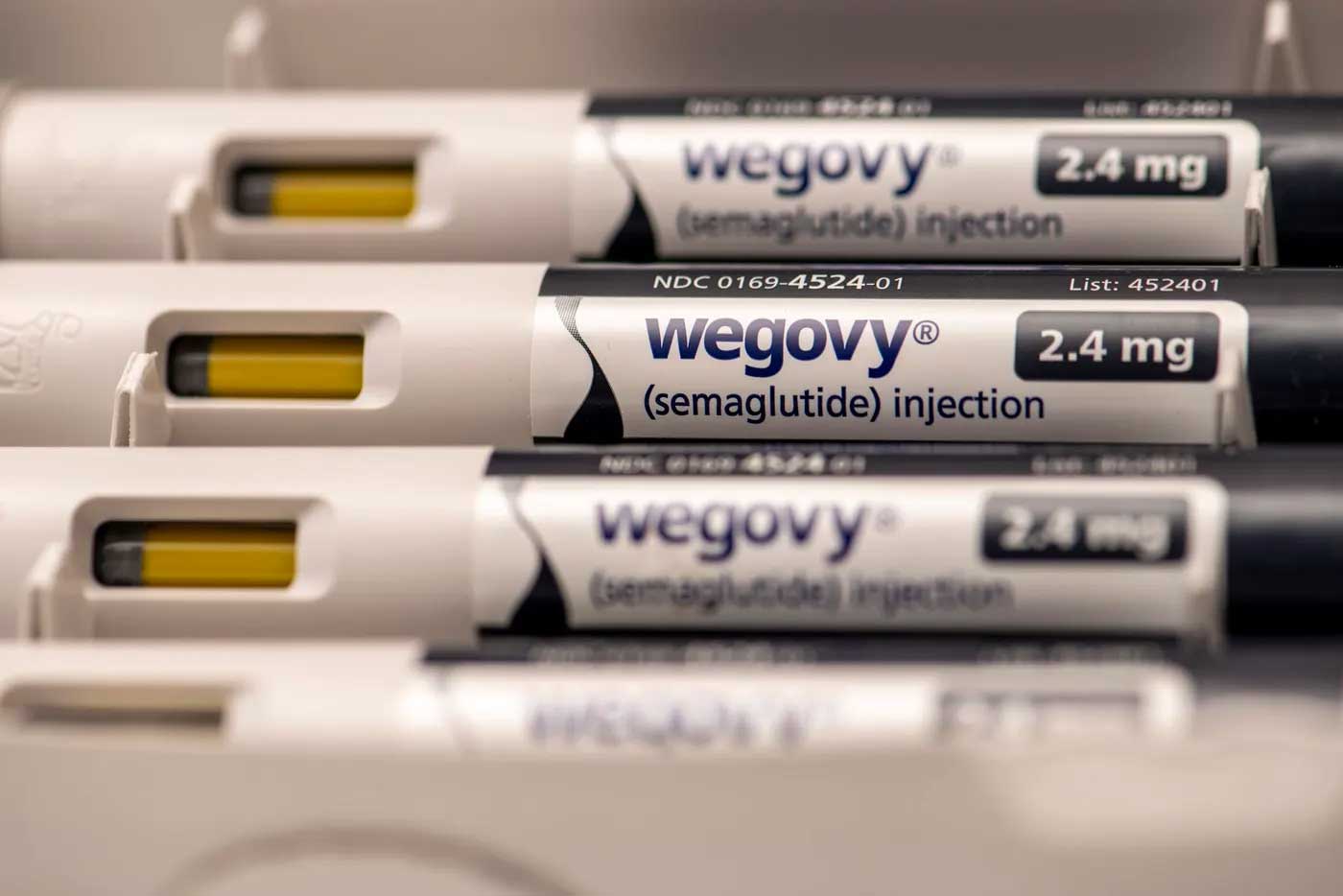

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

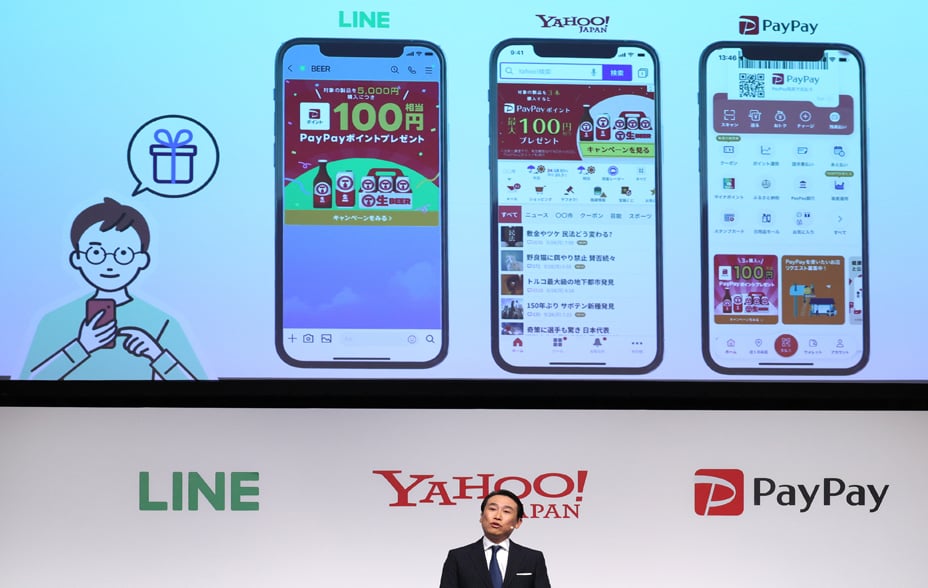

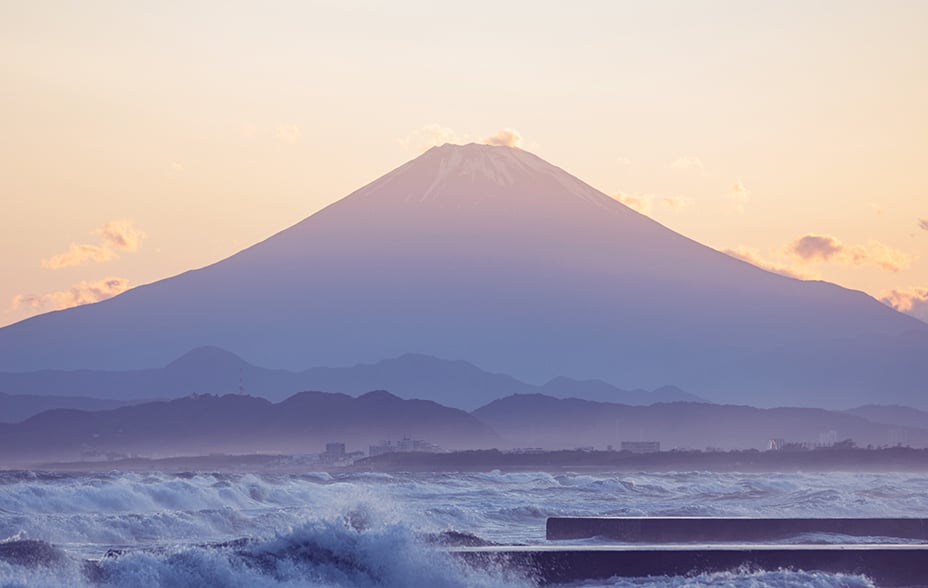

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

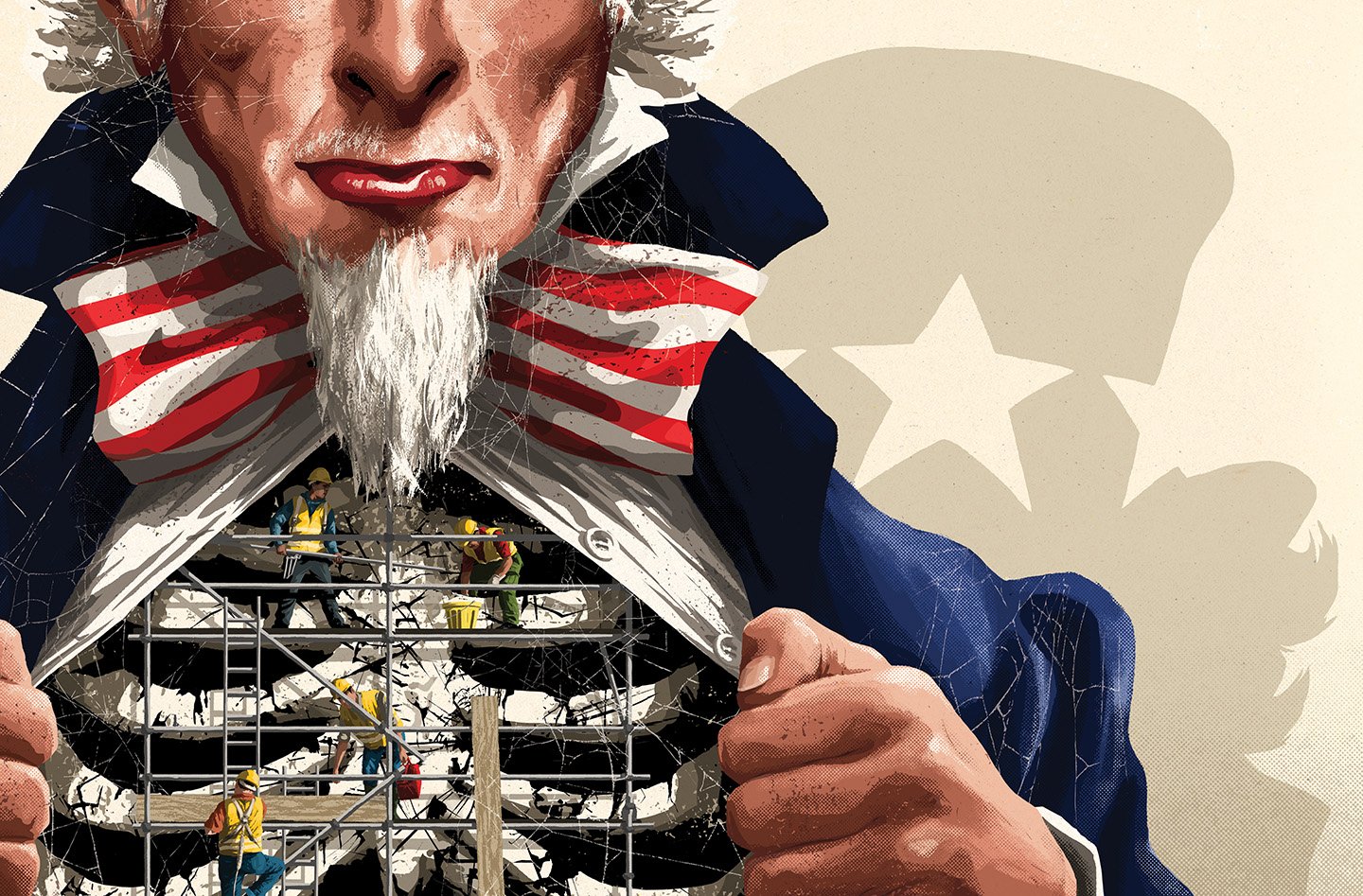

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

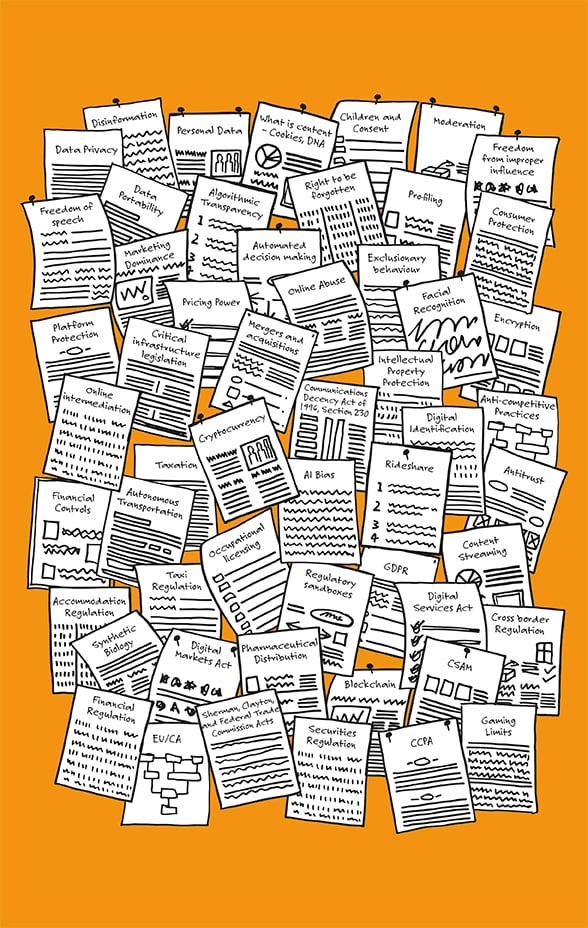

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

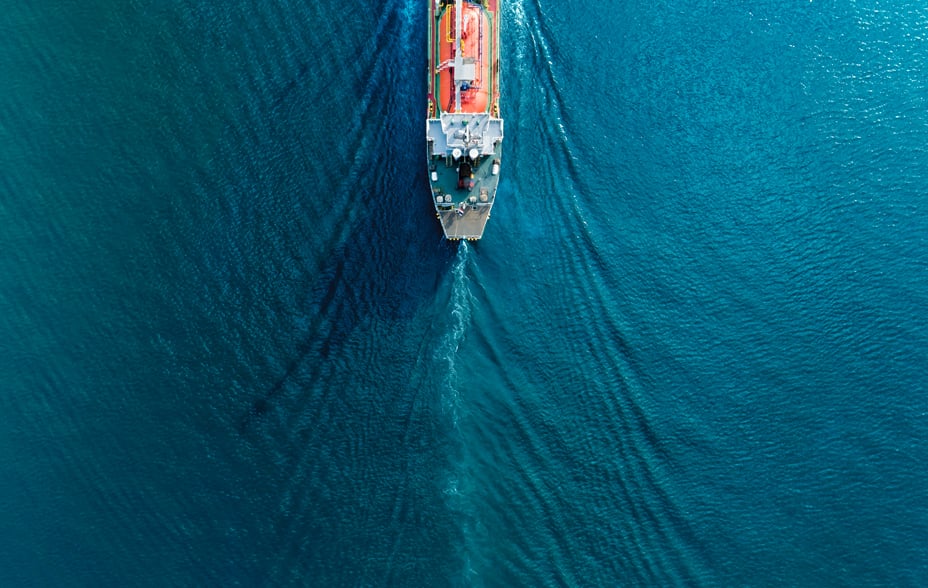

The money migrators

How cross-border payments company Remitly takes the tension out of cash transfers.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by nearly nine out of ten Scottish Mortgage companies.

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

Positive Conversations 2023

The Positive Change Team’s ESG and engagement report shows the difference talking can make.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

Positive Change: a review of 2023

A performance update explaining why we back firms solving social and economic issues such as Moderna and MercadoLibre.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

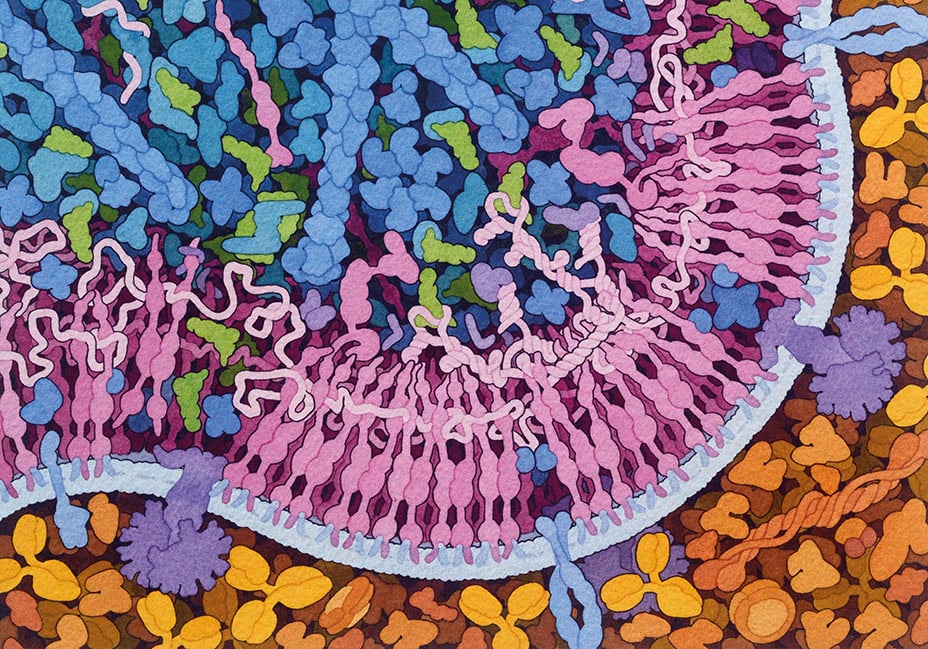

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Enduring good

What values are important to you? And are they reflected in your investments?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

How Amazon pioneered a new path

The new wave of companies blending physical and digital processes together.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

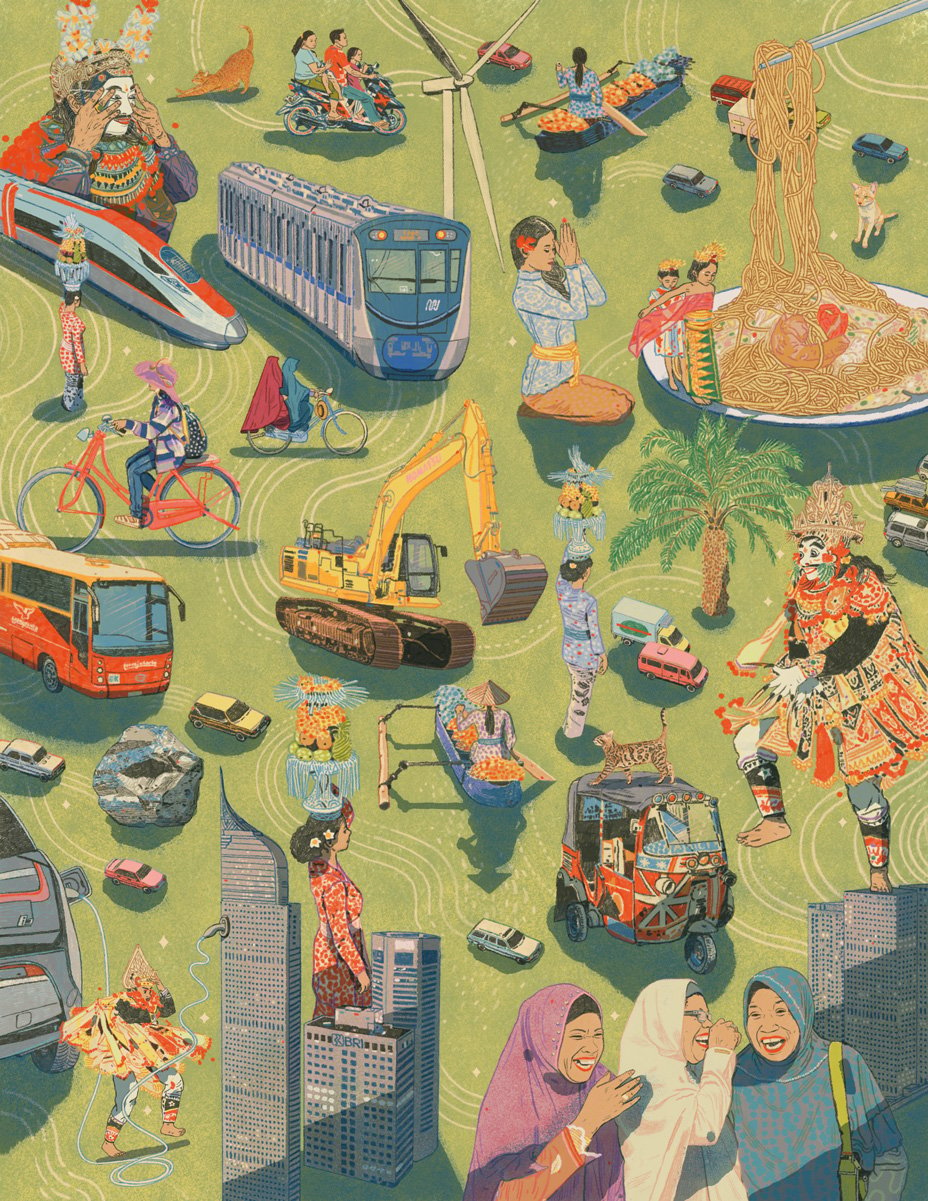

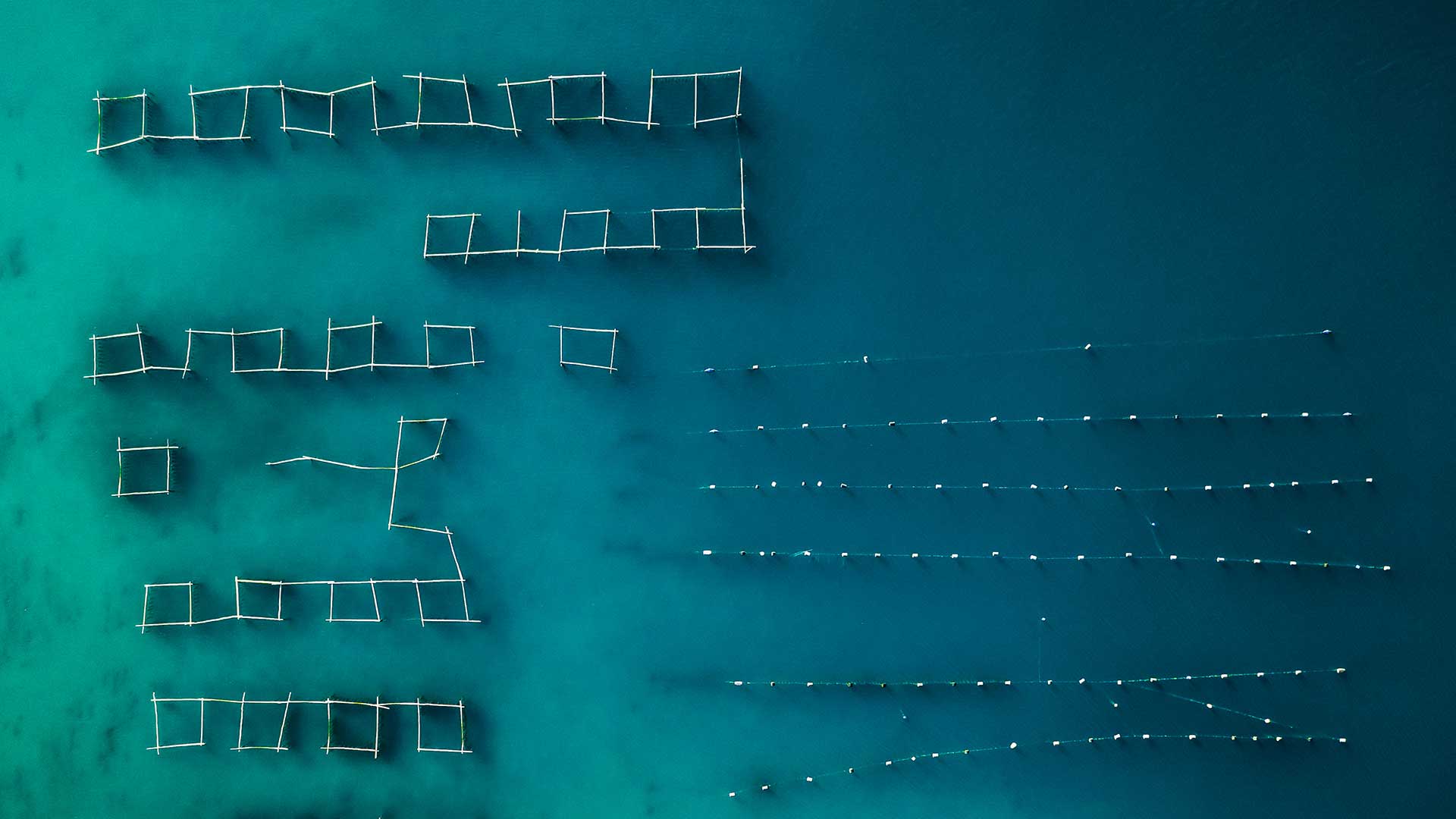

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

A net zero initiative update

A reflection on Baillie Gifford’s commitment to the climate transition.

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

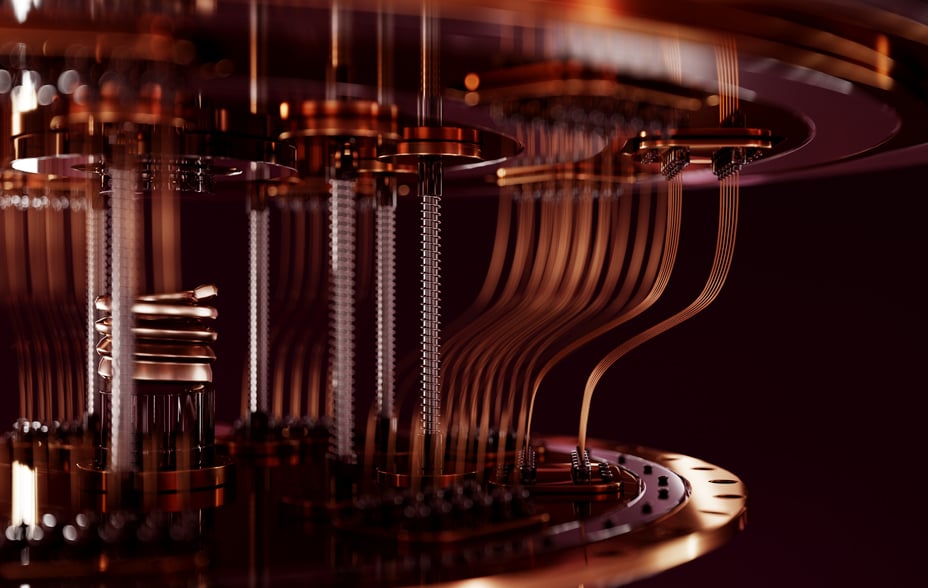

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

Legally bond: finding underestimated resilience

By keeping an open mind, we hope to find opportunities other credit investors might overlook.

Japan’s new growth opportunities

Seeking the entrepreneurial firms that could sustain the country’s rally.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Can we mine sustainably?

Minerals are key to the energy transition. We believe mining responsibly will bring rewards.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

The secrets of enduring growth

Toby Ross reveals the four signs that a company’s growth might endure for decades.

Change as a growth driver

We live in changing times. And that will create opportunities for long-term growth investors.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Adapting to survive – and thrive

Using a fighter pilot’s business strategy can help a company orient itself amid change.

Positive Change Impact Report 2022

If impact and investing go together, it is important to understand the difference we make.

Stock stories: Climeworks

Climeworks, the company using innovative technology to capture and store CO2 underground safely, measurably and permanently.

Multi Asset quarterly update

James Squires reflects on the current environment influencing Multi Asset portfolios.

Navigating a turbulent Turkey

Turkey may be volatile, but there’s opportunity in currency forwards and competitive companies

The real deal in property

In a challenging environment, discover a European property sector company bucking the trend.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

International Alpha Q2 update

The International Alpha team reflects on recent performance, portfolio changes, and market developments.

Strategic Bond Q2 update

The Strategic Bond team reflects on recent performance, portfolio changes, and market developments.

International Concentrated Growth Q2 update

The International Concentrated Growth team reflects on recent performance, portfolio changes, and market developments.

Long Term Global Growth Q2 update

The Long Term Global Growth team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Q2 update

The Global Alpha team reflects on recent performance, portfolio changes, and market developments.

Health Innovation Q2 update

The Health Innovation team reflects on recent performance, portfolio changes, and market developments.

US Equity Growth Q2 update

The US Equity Growth team reflects on recent performance, portfolio changes, and market developments.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

International All Cap Q2 update

The International All Cap team reflects on recent performance, portfolio changes, and market developments.

China Q2 update

The China team reflects on recent performance, portfolio changes, and market developments.

Sustainable Growth Q2 update

The Sustainable Growth team reflects on recent performance, portfolio changes, and market developments.

Positive Change Q2 update

The Positive Change team reflects on recent performance, portfolio changes, and market developments.

UK Equity Core Q2 update

The UK Equity Core team reflects on recent performance, portfolio changes, and market developments.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Actual investing: the test of time

Stuart Dunbar reflects on the long-term case for Actual investing.

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Discovery: a view from the frontiers

Baillie Gifford’s Global Discovery Team reflects on the lessons of turbulent times.

Asia ex Japan manager update

Roderick Snell and Qian Zhang discuss current views and portfolio positioning for the Asia ex Japan Strategy.

Climate change innovators

How Positive Change targets companies at the forefront of tackling carbon emissions.

China A Shares: in conversation

Investor Sophie Earnshaw explains how we navigate China’s complexity to boost growth potential.

Why the long-term matters

There’s safety in being one of the crowd but it could stop you from seeing potential rewards.

Indonesia powers a green transition

The island nation’s natural wealth makes it crucial to a low-carbon future.

Finding Brazil’s social innovators

Ed Whitten travels to Rio de Janeiro and São Paulo to meet companies seeking social impact.

Multi Asset quarterly update

Scott Lothian explains how Multi Asset is riding out the ups and downs of market volatility.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Adyen: pioneer of payments

The Dutch firm making everyday payments fast and friction-free.

Positive Change Q1 update

Positive Change Team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Q1 update

Global Alpha Team reflects on recent performance, portfolio changes, and market developments.

Sustainable Growth Q1 update

Sustainable Growth Team reflects on recent performance, portfolio changes, and market developments.

US Equities Q1 update

US Equities Team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

International Alpha Q1 update

International Alpha Team reflects on recent performance, portfolio changes, and market developments.

International All Cap Q1 update

International All Cap Team reflects on recent performance, portfolio changes, and market developments.

International Concentrated Growth Q1 update

International Concentrated Growth Team reflects on recent performance, portfolio changes, and market developments.

Recursion Pharmaceuticals: finding new drugs using data science

How Recursion Pharmaceuticals is using AI to turn the hunt for new medicines on its head.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

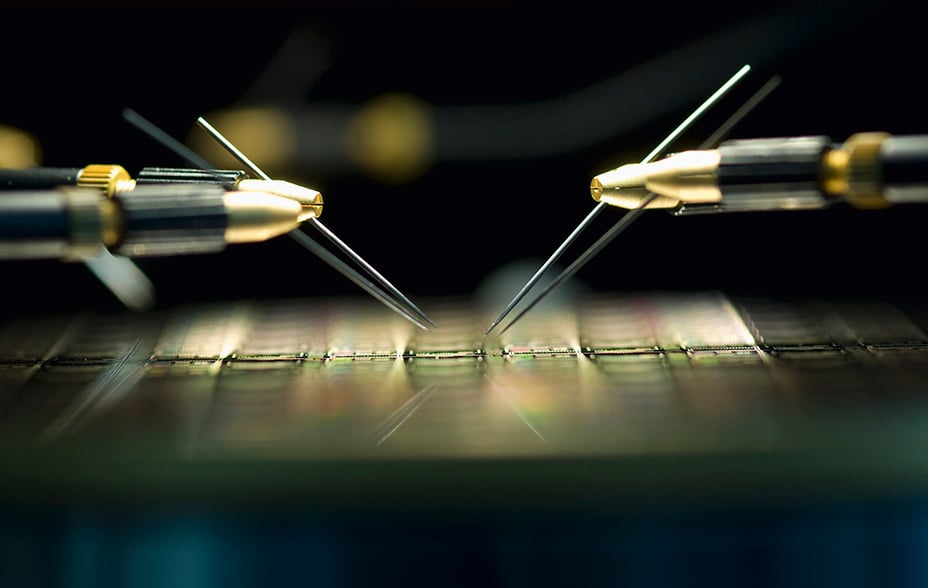

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

Climeworks: fighting global warming

Climeworks helps us remove CO₂. We invest in it because we think it can combat climate change.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Positive Conversations 2022

We don’t just talk to managements, we listen. A snapshot of Positive Change’s ESG conversations.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Sustainable growth: an introduction

ESG investing is broken. Changing our approach could open up opportunities for better returns.

Positive Conversations 2022

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

Why small is big in Japan

Praveen Kumar on the lesser-known players thriving in the shadow of the country’s big brands.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Sustainable investing in the health sector

The Health Innovation team on ESG, the future of medicine and making a positive global impact.

Making sense of the metaverse

Author Matthew Ball on the next-generation internet and the companies building its foundations.

Japan Growth: Asia’s resurgence

Despite the turbulence of last year there are reasons to be optimistic about Japanese companies.

Re-awakening utilities

Utility companies which can adapt to climate change and the shift to renewables bring the best chance of returns.

Japan: setbacks or permanent change?

Our investors’ job is to tell the difference between passing phases and deeper behavioural shifts.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Insights: investment research in Japan

Japan’s cultural landscape is changing, with implications for companies like Shiseido, CyberAgent and PayPay.

What’s next for growth stocks?

Baillie Gifford’s Dave Bujnowski explores the new engines powering progress.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

China’s changing automotive landscape

The rise of EVs spells opportunity for supply chain providers, from battery makers to semiconductor foundries

AI: Frightening or fascinating?

Investors discuss how AI software could transform healthcare, advertising, manufacturing and more.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Asia ex Japan: Portfolio manager update

Client director Andrew Keiller and investment manager Roderick Snell discuss the firm’s latest views on investing in the Asia ex Japan region.

Chip War

How semiconductors bring a competitive world together.

A dose of innovation

Your money or your health. Marina Record asks if society is ready to pay for health innovation.

UK equities: Home focus

Companies solving big problems in healthcare, fintech and AI, are proving the UK is an exciting place to invest.

The dawn of artificial intelligence

How AI is disrupting all kinds of industries, creating investment opportunities in its wake.

Disrupting heart disease

Rose Nguyen on the companies seeking to overcome the scourge of heart disease.

Japan trip reflections

Less foreign visitors, more cashless payments. Donald Farquharson reflects on post-Covid Japan

Solving the antimicrobial crisis

If we don’t tackle the AMR crisis now, it could be the world’s biggest killer by 2050.

Positive Change update

Investment manager Lee Qian and investment specialist Rosie Rankin discuss the positive change portfolio.

Investing in net zero

Detail of Baillie Gifford’s first set of NZAMi climate commitments and targets.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

A theory of radical change

Why a ‘deep transition’ may have started to deliver a more sustainable age.

Multi Asset quarterly update

Investment manager Scott Lothian reflects upon the recent drivers of performance across investment markets, how the current environment is influencing investment decisions, and the key risks and opportunities for the Multi Asset portfolio.

Rethinking where growth comes from

Partner Dave Bujnowski offers a radical new perspective on the disruptive ‘engines’ powering today’s growth.

Japanese Equities update

Fund manager Matthew Brett and investment specialist Thomas Patchett discuss growth investing in Japan.

Europe: why now?

Chris Davies is joined by Thomas Hodges to discuss why he sees reasons for optimism in European equities, and why he believes now is the time to start paying attention.

Health Innovation: an update with the managers

Join Health Innovation Portfolio Managers as they provide an update on the strategy with Investment Specialist, Jack Torrance.

Creating impact

How the Positive Change Strategy backs firms tackling social and environmental challenges.

Tapping global brainpower

How Baillie Gifford’s mutually beneficial network of academic connections makes us see the world differently.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

Small islands, lots of energy

How Orkney’s renewable energy projects can inform our investment choices.

Defining impact

The US Equities team discuss ESG and effective growth investing.

Snippets from the archives

Key insights from the International All Cap Strategy picked from the past 30 years.

Shimano: our strategy in one stock

How the cycle parts maker symbolises the kind of firms International All Cap is looking for.

Growth flows

Tracking our pursuit of growth companies over time.

Investing in ingenuity

Milena Mileva on picking International All Cap’s future winners.

Forging a fund

How relationship building, performance and tales of Scotland helped establish our international funds.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

Transforming the future of healthcare

Supporting companies with the potential to transform the field of healthcare and generate attractive returns.

Sustainable Growth Sustainability Report

The Sustainable Growth team on climate change, carbon emissions and sustainable growth companies.

Cultivating change in the meat industry

Demand for meat is growing, but traditional production is costly. Could in vitro agriculture be our panacea?

Positive Change Impact Report: 5th Year 2021/22

The Positive Change Team’s latest impact report, covering our activity over the last five years and plans for the future.

Responsible Global Equity Income webinar

In the context of high inflation and market volatility, portfolio managers James Dow and Toby Ross discuss current views and explain how focusing on long-term income growth remains critical to facing these challenges.

Why are Swedish companies world leaders?

Sweden tops the charts for original thinking, from family businesses to founder-run companies.

Digital Disruption and the future

Online infrastructures and digital developments in the education, energy, and transport sectors make for an exciting future.

The search for ‘jumper-stretching’ stocks

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Why patience matters

Endurance and imagination are key ingredients for quality growth investing.

Investing in decarbonisation

Spotting companies with potential in the renewables, energy storage and carbon reduction sectors.

China’s leapfrog shopping apps

Smartphone-centric retailers drive innovation.

Study guides

Academic partnerships that generate new ideas

What makes companies resilient to inflation?

Baillie Gifford’s Risk Team has been considering how firms can reduce their vulnerability to rising prices.

The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Why it’s not over for growth stocks

Growth stocks have crashed down to earth. Has growth had its day or will it come back stronger?

Investment Stewardship

It’s not that we do ESG, but how we do it. The ESG Team list 2021’s key stewardship activities.

International Smaller Companies: Under the Radar

Part 6 - Alignment.

International Smaller Companies: Under the Radar

Part 5 - Insight.

International Smaller Companies: Under the Radar

Part 4 - Scalability.

International Smaller Companies: Under the Radar

Part 3 – Sustainability

International Smaller Companies: Under the Radar

Part 2 – Competitive Edge.

International Smaller Companies: Under the Radar

Part 1 - Opportunity

International Smaller Companies: Under the Radar

Introducing the Radar

Asia ex Japan: Portfolio Manager Update

Join Roddy Snell and Ben Durrant to discuss current views and portfolio positioning for the Asia ex Japan strategy and learn why we continue to believe this is the most attractive region globally for growth investors.

ESG v sustainability

The questions we should consider to avoid being led astray by ESG risk scores.

International Concentrated Growth: manager introductions

Radical companies may seem risky, but they’re building the future. Paulina McPadden, Spencer Adair and Lawrence Burns discuss how investing in firms with extraordinary potential is a simple approach to long-term wealth creation.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

Resurgence of European ambition – Europe’s outliers

Join Stephen Paice, head of the Baillie Gifford European Equities team, as he discusses his research on the European companies that have increased in value 10x or more, delving into their history, common characteristics, and where they are likely to occur in the future.

How education escaped from the classroom

Online courses have upended the economics of education, Thaiha Nguyen explains.

US Equity Growth: webinar highlights

Investment Managers Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski share their thoughts on the investment environment, explain why they believe there is scope for upside from here, and discuss their search for transformational growth companies.

The long view

The enduring power of Moore’s Law and other factors that might matter in the next decade of investing.

Emerging Markets: the possibilist

Understanding the difference between pessimism and possibility in Emerging Markets.

US Equity Growth Webinar: The Long View

Join Investment Managers Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski as they share their thoughts on the investment environment, explain why they believe there is scope for upside from here, and discuss their search for transformational growth companies.

Smaller companies, big disruption.

How Baillie Gifford’s Smaller Companies Fund’s ‘radar’ picks up tomorrow’s game-changing growth businesses.

The case for small caps.

Academia has taught us that size matters – provided you can effectively control for quality. Fortunately, as Steve Vaughan explains, that is the fundamental role of active stock pickers.

International All Cap – Consistency in uncertain times

Join Portfolio Construction Group Member, Joe Faraday and Client Service Manager, Andrew Daynes, as they discuss the importance of maintaining consistency in uncertain times.

India’s data-driven growth stocks

Baillie Gifford spots investment opportunities in a smartphone-transformed nation.

Reflections: A look back on Q1

The LTGG team consider recent performance and the long-term outlook for the fund.

China’s move to renewable energy

Solar power and cheap green energy makes for a promising future.

Positive Conversations 2021

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

Why private companies matter more

SpaceX, Epic Games and Stripe: the list of the unlisted continues to grow. How can investors benefit?

Global Alpha 2022 Research Agenda

In their Research Agenda for 2022, the investment managers consider the benefits of deep work in helping them find growth opportunities.

European Equities Manager Update.

When the going gets tough, exceptional companies keep going. Stephen Paice on Europe’s best.

International Smaller Companies is growing up - a three-year anniversary.

Join Brian Lum, Charlie Broughton & Richard Gall as they reflect on the first three years of the Smaller Companies strategy.

International Growth Webinar Summary.

In this webinar summary, Nick Thomas and Christel Brodie, investment specialists, cover growth investing during difficult periods and highlight the long-term growth drivers in the International Growth portfolio.

A dream within reach

New technologies, plummeting costs and our own changing behaviours all promise progress in the energy transition– just don’t expect it to come in a straight line.

International Growth: A conversation with the portfolio management team.

Nick Thomas hosts a discussion of the investment landscape with his Portfolio Construction Group colleagues, Tom Coutts and Julia Angeles.

Actual ESG

Investing in great growth companies to make a big difference.

Long-term investing and market volatility.

James Budden on holding your nerve through short-term setbacks and supporting exceptional growth companies.

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

US Equities: manager insights

Gary Robinson, investment manager at Baillie Gifford, responds to questions on inflation and valuation.

Long Term Global Growth: Team evolution

Scott Nisbet interviews the Long Term Global Growth decision-makers discussing volatility, inflation, interest rates, China and portfolio holdings: Roblox, SEA, Moderna and Coupang.

Growth or value: it’s not a black or white choice

Operational performance is a better indicator of growth than inflation. Malcolm MacColl shares why.

ESG collaborations

Looking before we leap into industry initiatives.

Sustainable companies, global challenges.

Learn about the up-and-coming sustainable companies radically shaping a more prosperous future.

Riding Growth Waves Webinar.

Good investing takes quick reactions as well as a long-term vision.

The university shaping global tech

Why so many tech founders and CEOs have emerged from the Indian Institutes of Technology.

Responsible Global Equity Income.

Toby Ross and Diane Esson reflect on the past three years of the Responsible Global Equity Income Strategy.

ESG data: Filling in the gaps

LTGG is making efforts to improve environmental, social and governance metrics.

Global Income Growth

Some people look at life as sustaining the now, while sowing the seeds for a better tomorrow. Global Income Growth think the same way. In this film we explore their philosophy and how when searching for a lifetime of income, they choose growth.

Glasgow Climate Pact

For Global Stewardship, climate opportunities go hand in hand with climate challenges

Rules of the game

Regulation and what we look for in companies’ responses.

The ‘S’ of ESG: intangible value

ESG experts Marianne Harper Gow, Ed Whitten and Abhi Parajuli talk about the Social aspect of ESG in the context of investing.

We need to talk about inflation.

Central banks may find it hard to tackle price rises, requiring fine-tuning to fund strategies.

China: Missing a Paradigm Shift.

Investment manager Sophie Earnshaw shares her latest thoughts on investing in China.

Four decades of lessons.

Japan’s ability to anticipate technological change should see it through the ups and downs to come.

What’s a business for?

Today’s investment managers should support companies doing the most to benefit society.

Resilient income, time after time

Planning for future income demands preparation for an unknown tomorrow. In this film we explore the philosophy of Sustainable Income and how they are seeking real income, time after time.

Towards Net Zero: Reflections on COP26

Tim Garratt, Michael Pye and Caroline Cook reflect on the investment implications of arguably the most significant meeting of world leaders this millennium, COP 26.

Investing in Japan: What’s changed and what’s next?

Over four decades Japan has seen 21 prime ministers come and go. Exporters such as Toyota and Toshiba have flourished but the country has also struggled with debt and deflation. Matthew Brett, investment manager, discusses what’s next.

Tomorrow’s world, here today

Investing in private companies applying today’s early-stage tech to create tomorrow’s world.

The Biological Revolution

The use of information science to unlock biology is revolutionising our health and wellbeing.

The real case for China

Willingness to change gives Chinese firms an innovation advantage.

How to surf the waves of growth

Good investing takes quick reactions as well as a long-term vision.

Joining forces to achieve net zero.

Baillie Gifford signs up to an asset managers initiative as COP26 begins.

Mapping Veganville

Can plant-based foods save the planet? Investment manager Brian Lum explores changing attitudes.

Healthcare’s biotech revolution

A convergence of technologies is paving the way for advances in our understanding of biology.

The future of transport

Electric cars on the road and flying taxis in the air will change the way people commute and live.

The switch to sustainable food

Plant-based proteins, hi-tech tractors and vertical farms are set to disrupt agriculture.

Digital payments in a cashless future

Disruptive fintechs are paving the way to a world without physical money.

Inside and out

A focus on diversity and inclusion can result in competitive advantage.

Harnessing growth for the next decade

Investment manager Malcolm MacColl and Senior Governance and Sustainability Analyst Kieran Murray outline believed growth drivers and the development of Global Alpha’s ESG process.

Highlights Video: Harnessing growth for the next decade

Watch the highlights from the recent Global Alpha webinar: Harnessing growth for the next decade.

IDEAS Conference 2021.

With a focus on the future of mobility, the speakers discuss the ideas that will shape the way we live and work, and the companies that will drive disruption and innovation.

A conversation about sustainability

Our long-term investors know that investing sustainably is a plus for value creation.

A shot in the arm.

Moderna’s mRNA vaccines are all set to become the cornerstone of an efficient health system.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Lessons from Bessembinder

What a US academic taught us about the companies that outperform.

India’s ‘missing’ female workers

Women dropping out of employment should weigh on investors’ minds.

Supporting ESG improvers

Investors can have the most impact by focusing on sustainability laggards, not leaders.

Misguided metrics

Why emerging markets firms struggle to get high ESG scores

Time travel investing

Evaluating emerging market stocks by taking a mental leap into the future.

Disruptive Innovation.

Watch the recordings from our week-long 'Disruption Week' event, during which we covered the exciting topics of healthcare, transport, digital payment platforms and sustainable agriculture.

Looking back going forward

In this edition of Looking Back Going Forward we explain how environmental, social and governance (ESG) considerations have been deeply embedded in our Long Term Global Growth strategy.

ESG metrics can be ‘dangerous rubbish’.

Baillie Gifford’s James Anderson warns of the risks of ill-defined sustainability metrics.

Long-Term Return Expectations update.

Decarbonisation and baby boomer spending are set to drive asset prices over the years ahead.

An appetite for ordered chaos.

Why loosening control can help companies become more innovative.

Constructive Dissatisfaction: A conversation with the International Growth Team.

Nick Thomas is joined by James Anderson and Tom Coutts to discuss the current investment landscape and the evolving situation in China.

US Discovery: an American voyage into the future

Baillie Gifford launches a new offering seeking out America’s most entrepreneurial new companies.

Climate Change: Risk or Opportunity?

Alicia Cowley, member of the Asia Client Service Team, is joined by ESG specialists Marianne Harper Gow and Michelle O’Keefe to discuss the burning question: Does climate change pose a risk to investment returns or are we able to identify investment opportunities in this area?

Modern-day Explorers.

Our international investors are explorers: which of the disruptors and innovators will deliver? How do we save a planet? Paulina Sliwinska invests in the companies tackling climate change.

How do we save a planet? Paulina Sliwinska invests in the companies tackling climate change.

Disruption Week: Investing in Firms Shaping the World of Tomorrow

From futuristic wireless technology to healthcare innovation and new forms of food production, the Long Term Global Growth Team’s investment manager Michael Pye considers the advances that may define life in 2040. Will the climate crisis response alter asset class returns? The Multi Asset Team investigates.

Will the climate crisis response alter asset class returns? The Multi Asset Team investigates.

Clusters, Computers and Classic Rock

Find out why small companies are one of the richest hunting grounds for long-term growth investors. Economist John Kay and investment manager James Anderson discuss how changing attitudes to known unknowns could make us better investors.

Economist John Kay and investment manager James Anderson discuss how changing attitudes to known unknowns could make us better investors.

Hyper-connected Networks

What’s left of exception growth companies? With the internet and the cloud, the sky’s the limit.

How harnessing chaos can make companies more nimble

Chaos is often associated with a failure of leadership. Gary Robinson, partner in the US Equities Team, argues that the best bosses don’t resist disorder but channel it to create ‘chaordic organisations’ in which innovation thrives.

Mind the Gap: Going on a De-risking Journey

Baillie Gifford’s multi asset funds aim to provide maturing pension schemes protection from whatever economic weather may arise.

Strategy Overview.

A brief summary of Baillie Gifford’s beliefs, purpose and strategy.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

Actual Income

Client Director Jan Oliver hosts a webinar on Baillie Gifford’s Income solutions. She is joined by James Dow, Torcail Stewart and Steven Hay, investment managers on our Global Income Growth Strategy, our Strategic Bond Strategy and our Multi Asset Income Strategy respectively.

High Yield Bond

In a world full of noise and excessive choice, it helps to see things from a different perspective. In this film we explore the philosophy behind High Yield Bond and how seeking resilience is time well spent.

Highlights Video - The Small-Cap Effect: An Existential Debate.

This short video summaries the highlights from a recent webinar in which Richard Gall, Steve Vaughan and Brian Lum, members of the International Smaller Companies Portfolio Construction Group, discusses the small-cap effect, the team structure, and the investment approach to finding exceptional smaller companies.

Japan's digital transformation

Unique to itself and often surprising, the digital transformation of the world’s third largest economy offers exciting new openings for investors, writes Donald Farquharson, head of Baillie Gifford’s Japanese equities team and Thomas Patchett, Japanese Equity Specialist.

The Small-Cap Effect: An Existential Debate.

Richard Gall, Steve Vaughan and Brian Lum, members of the International Smaller Companies Portfolio Construction Group, discuss the small-cap effect, the team structure, and the investment approach to finding exceptional smaller companies.

Exploring Sustainable Growth: A New Approach to ESG.

Are your investments as good for the environment and society as you think they are? Stuart Dunbar, partner at Baillie Gifford, explains why too many people have been lulled into a false sense of security by metrics-based approaches to ESG that don’t support the transition to a more sustainable society.

Strategic Bond.

Thinking about long-term income means thinking about what ‘can be’, not what ‘is’. In this film we explore the philosophy behind Strategic Bond and how, when it comes to income, there’s no time like the future.

Positive Change - It's Not Obvious

Positive Change invests in businesses that can help solve global challenges. But, as Kate Fox explains, the impact that some of the most influential companies have on daily lives is hidden from view.

The Responsible Approach to ESG Investing

Is our approach to environmental, social and governance (ESG) issues doing more harm than good? Stuart Dunbar, partner at Baillie Gifford, calls for investors to stop counting and start thinking.

Active Investment: Fuelling the Energy Transition

In this webinar, Product Specialist Alasdair McHugh talks to Caroline Cook, Senior Analyst in the Governance & Sustainability Team, about active investment, the energy transition, where we are now and how far we need to go.

Breaking the Biotech Model

Could the messenger RNA vaccines deployed against Covid, help fight cancer and other diseases? After a year of crisis, Julia Angeles, co-manager of Baillie Gifford’s Health Innovation Fund, looks at the positive signs.

Breaking the biotech model

Could the messenger RNA vaccines deployed against Covid, help fight cancer and other diseases? After a year of crisis, Julia Angeles, co-manager of Baillie Gifford’s Health Innovation Fund, looks at the positive signs.

From crisis to opportunity

We call our methodology long-term income, not short-term yield. In this paper we share our experience of picking stocks using this growth-focused approach. We explain why we think the best is yet to come for this approach. And we highlight three simple questions we ask of any company when picking stocks for our income-growth portfolio.

Interview with our Japanese researchers

Donald Farquharson, head of the Japanese Equity Team at Baillie Gifford, speaks to Japan-based strategy researchers Akiko Hirai and Satoko Ishino.

What I've Learned In Four Decades Of Investing

His career spanned big changes in investment – and in the fortunes of Baillie Gifford. Charles Plowden, joint senior partner and manager of Monks Investment Trust, looks at the opportunities ahead.

Are You Investing In The Right Europe?

Client Director Stuart Dunbar is joined by Stephen Paice, Head of the European Equity Team and Moritz Sitte, portfolio manager of our European funds, to discuss the question ‘Are you investing in the right Europe?’.

Highlights video: beyond the great dividend crisis

In this recording, Investment Specialist Seb Petit highlights the main takeaways from a recent webinar with James Dow and Toby Ross, co-heads of the Global Income Growth Team. Dow and Ross outline how a long-term approach and a growth mindset helped them navigate the great dividend crisis of 2020.

Actual ESG

The logic of long-term investing means that companies harming the planet and its people will ultimately be losers.

Highlights video: Long Term Global Growth webinar

Client Director Tatjana Evans-MacLeod highlights the most notable discussion points from the recent LTGG webinar, in which investment managers Mark Urquhart, Gemma Barkhuizen and Linda Lin discussed turnover, valuation, China, ESG, and capacity.

Navigating Change in US Equities.

In this webinar recording, US Equity strategy specialist Ben James talks to all four of the key decision makers in the US Equities Team, Tom Slater, Kirsty Gibson, Gary Robinson and Dave Bujnowski. The team explore the thought processes that have helped them navigate the challenge of maintaining a 5-10 year investment horizon during what has been a year of rapid change, followed by questions from attendees.

Positive Conversations 2020

This document looks at the contribution of the Positive Change portfolio to society through its business practices and focuses on our approach to engagement with the companies owned on behalf of our clients.

Sustainable investing: Finding the innovative companies of the future.

Are there limits to economic growth? Will we run out of ideas? Investment manager Lee Qian explains why he’s confident innovation will create a more prosperous, sustainable and inclusive world.

Private companies overview

The artificial barriers between private and public companies are disappearing, but the investment world has not kept up. Investment managers Tom Slater, Chris Evdaimon, Peter Singlehurst and Rob Natzler discuss Baillie Gifford’s refreshing approach to investing in late-stage private companies.

Global Alpha – Mental Models Highlights

Client director Jon Henry talks through the highlights of the recent Global Alpha webinar on ‘Mental Models’, a concept introduced earlier this year in the Global Alpha Research Agenda.

The Great Divergence Between East and West.

China has defied recession in 2020, but where to now? Investment manager Roderick Snell anticipates big things ahead.

The Great Divergence Between East and West

China has defied recession in 2020, but where to now? Investment manager Roderick Snell anticipates big things ahead.

Emerging Markets: coming of age

It’s time to stop looking in the rear-view mirror when it comes to emerging markets.

China - adjusting the lens

The future is inherently uncertain, but the acceleration of disruption, developments in innovation and shifts in consumption patterns will create winners and losers. China will play a critical role.

Living Longer: Can We Afford It?

More of us are living longer, staying healthier for longer and working for longer. What are the implications for investing and financing this longer life? Listen to Baillie Gifford’s Steven Hay to find out.

Living Longer: Can We Afford It

More of us are living longer, staying healthier for longer and working for longer. What are the implications for investing and financing this longer life? Listen to Baillie Gifford’s Steven Hay to find out.

A gallery for growth

Much like an art curator, the role of the investment manager involves carefully selecting investments that will make a mark and grow in value over time.

Sensible nonsense

To stand the best chance of owning the winning companies of the 2030s, we should imagine how bizarre today’s ‘normal’ will seem when the next generation looks back.

Data, AI & Ethics.

Julia Angeles, investment manager on the Health Innovation Team, speaks to Claire Bell, former newspaper journalist and inquisitive researcher for Baillie Gifford. Angeles and Bell discuss the hot topics of data, artificial intelligence and ethics.

Staying Ahead of Change.

Few things matter more to an investor than understanding and anticipating change. As we celebrate 15 years of Global Alpha, we share some thoughts on how the portfolio, our process and the team have developed over time.

Global Alpha - 10 minutes with Helen Xiong

Ben Drury, client director, talks to Helen Xiong, an investor and soon-to-be key decision-maker for the Global Alpha strategy.

A shocking revelation: capitalism can power positive change

Everyone wants to make a difference, and capital thoughtfully and responsibly deployed is a powerful mechanism for change. In seeking out companies whose products and services are providing solutions to global challenges, we believe a proactive investment approach can also be the basis of attractive investment returns. Investment Managers Kate Fox and Lee Qian explain why positive change really matters.

Tomorrow’s income aristocrats

Income investing has been shaken by the coronavirus, but how will this affect the dividend payers of the future? Baillie Gifford investment manager James Dow gives us a glimpse of the potential star performers of tomorrow.

Multi Asset Investment Update.

James Squires, head of multi asset, discusses several key areas related to Baillie Gifford’s multi asset funds, namely an update on performance, our current views and outlooks and how those views and outlooks inform the positioning of the portfolios.

Health Innovation: it’s time to rethink what the word ‘healthcare’ means

We are in an era of great convergence. The Health Innovation strategy seeks to support this era of change by looking out for innovative and pioneering companies that have the potential to bring substantial improvements to human health and healthcare systems.

アフターコロナの投資戦略

三菱UFJ信託銀行と共同開催の資産運用ウェブセミナー。 アフターコロナの投資戦略をテーマに、パートナーであるマーク・アーカートをはじめとする弊社スタッフが今後の展望をご案内します。

Positive Change Impact Report

For Full Year 2019, updating on contributions towards a more sustainable and inclusive world.

Back To The Future.

This webinar has been prepared solely for the use of professional investors outside of the Unites States and is not for further distribution. Baillie Gifford takes no responsibility for the reliance on this webinar by any other person who did not receive this webinar from Baillie Gifford.

Positive Change in Challenging Times Webinar.

In this webinar, investment managers Kate Fox and Lee Qian speak to portfolio specialist Alison Cuthbert about the Positive Change strategy.

What's the Purpose of Investing?

Interview with Stuart Dunbar.

Tomorrow’s Income Aristocrats

Income investing has been shaken by the coronavirus, but how will this affect the dividend payers of the future? Baillie Gifford investment manager James Dow gives us a glimpse of the potential star performers of tomorrow.

What’s the purpose of investing

In our Short Briefings on Long Term Thinking podcast, Baillie Gifford partner Stuart Dunbar backs a return to the basics of investment.

US Equity Strategy – Manager Insights.

Ben James gives an update on the positioning and activity of the US Equity portfolio.

Taming the Wild West - Big Tech's Social Responsibility.

In the dystopian 2013 novel The Circle college graduate Mae Holland joins a fictional Silicon Valley tech giant that has emerged as ‘the winner’ of the battle for online supremacy, dominating messaging, payments, social media and ecommerce.

It’s time to rethink what the word healthcare means.

We’re living longer, but are we living better? Baillie Gifford’s Health Innovation team is searching for companies whose cutting-edge science and innovative therapies are redefining healthcare. Put simply, healthcare has never looked as good for those seeking more from their investment.

Why this crisis favours growth stocks

Growth stocks have generally fared better than value stocks during the coronavirus pandemic, helping Scottish Mortgage Investment Trust during the worst of the stock market falls. In our podcast series, Short Briefings on Long Term Thinking Baillie Gifford partner Tom Slater explains why.

The Myth of the Marlboro Man.

Quitting tobacco and fossil fuels should no longer carry a wealth warning, writes Scott Nisbet.

Navigating a Stock Market Crisis

Scott Nisbet tells Malcolm Borthwick what he’s learnt from previous crises, why he’s staying calm and why now’s the time to read Albert Camus.

Annual Business Update.

Our annual business update 2020.

The Second Space Age

Fifty years after Apollo 11, can a fresh wave of innovation in space technology open new frontiers and promising investment opportunities? Investment manager, Luke Ward looks across the gulf of space and gives us his views.

Reasons To Be Optimistic About Emerging Markets

Investing in emerging markets is like Marmite. It divides opinion. Charles Plowden explains why he’s a fan in Baillie Gifford’s podcast Short Briefings on Long Term Thinking.

Healthcare Innovation.

We’re living longer, but are we living better? Baillie Gifford’s Health Innovation team is searching for companies whose cutting-edge science and innovative therapies are redefining healthcare. Put simply, healthcare has never looked as good for those seeking more from their investment.

Income through a growth lens

Toby Ross shows how Baillie Gifford’s growth approach to income investing, starts from a very different philosophical position compared with our peers. Take a look from a different angle.

Governance in China: risk or opportunity?

Growing familiarity with China’s markets invites closer examination of governance at a country and corporate level. A company by company approach is vital to limit the risks and find the opportunities, writes Ben Lloyd.

The shape of things to come

It’s essential to be realistic and keep the risk of over-optimism in check. But there’s plenty to feel positive about in emerging markets, says Tim Erskine-Murray, who offers an insight into the reasons for his unwavering enthusiasm.

The Beauty of Japanese Cosmetics

Investment manager, Praveen Kumar explains why the Japanese cosmetics industry is in a period of rapid growth and how it could be set to continue for the long term.

Learning from Academia

Our support of inquisitive people plays a crucial role in our investment research. Discover more in our academia anthology.

Positive Conversations 2019

An accompaniment to our annual Impact Report using a different lens to look at the contribution of the Positive Change portfolio to society.

Corporate Scandals That Changed the Course of Capitalism

Civil society has increasingly questioned and challenged corporate behaviour and activity since the 1960s. This film documents a number of corporate disasters that have caught the public attention over the last 75 years, and have led to some profound changes.

The Impact of Online Shopping.

Malcolm Borthwick is joined by investment manager Milena Mileva to discuss how profound changes in consumer behaviour are changing the retail landscape both online and in bricks-and-mortar stores.

Changing China

Ben Buckler explores the A share opportunity in China.

Finding Europe's Hidden Champions

There are lots of reasons not to invest in Europe. Its economic growth is uninspiring and much of its stock index is made up of bureaucratic corporate dinosaurs. But beyond the negative headlines, there are still exciting investment opportunities to be found. They include potential tenbaggers – companies whose share price could increase ten-fold.

Space: The Final Investment Frontier

Fifty years on from the first moon landing, entrepreneurs on the west coast of America are stepping up spending on space. To discuss how this new space race might impact investment, Malcolm Borthwick is joined by Luke Ward – space enthusiast and deputy manager of Edinburgh Worldwide Investment Trust and the Global Discovery Fund.

Will Industrial Biotech Be the Next Manufacturing Revolution

Industrial biotech companies can already produce synthetic spider silk and plant-based burgers that taste like meat. Future possibilities include timber produced from yeast. In the latest episode of Short Briefings on Long Term Thinking, Kirsty Gibson tells Malcolm Borthwick why she's fascinated by the opportunities of industrial biotech and its enormous investment potential.

Fashion retailers: The impact of online shopping

In the fourth episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by Milena Mileva to discuss how profound changes in consumer behaviour are changing the retail landscape both online and in bricks-and-mortar stores.

Looking back going forward

In the latest edition of Looking Back Going Forward, John MacDougall looks back over the 15 years of Long Term Global Growth's history, reflecting on some of the holdings that have performed best, and the varied paths their share prices have followed.

The Death of Alzheimer’s

As lifespans increase, more of us will inevitably encounter Alzheimer’s. Thankfully, new advances mean that we may be approaching a breakthrough in treating the disease. The Death of Alzheimer’s asks how Baillie Gifford can support this effort.

Graham or growth?

In his latest paper, James Anderson discusses Ben Graham’s book The Intelligent Investor, the seminal work on Value investing that remains as valid today as it did when he wrote it seven decades ago. James considers the author’s views and their implications for Growth investing in the current environment.

The Differences Between Bond and Equity Investing

In the third episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by Lucy Isles, joint manager of Baillie Gifford's High Yield Bond Fund. Listen to the podcast to find out the three key deciding factors when choosing resilient high yield bonds and how engagement with companies can differ for bond and equity investors.

Should Income Investors Go Global

What are “the good, the bad and the unbelievably great” of global investing? In the second episode of Short Briefings on Long Term Thinking, Malcolm Borthwick is joined by James Dow to challenge the conventional wisdom that if you’re investing for a regular income you should stick with blue chip UK companies.

Why China?

Investment Manager Roddy Snell, in conversation with Malcolm Borthwick, goes behind some recent lurid headlines to find out what's really happening with the Chinese economy.

Let's Talk About Actual Investing

The task in hand is to remind our clients what investing actually means. Stuart Dunbar makes a passionate plea for 'actual' managers to demonstrate that we have our clients' best interests at heart.

Aberration or Premonition.

If capturing extremes is the key to investment returns, James Anderson sets out how we can improve our chances of investing well. He highlights the exponential long-term trends in energy, healthcare and technology that he believes will be at the heart of a dramatic implosion of the old order and will become the cornerstone of the new.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

December 2023

Article17 minutes

Featured webinars

Viewing 8 of 8 insights

Actual investors

Long-term vision

It takes time to achieve transformational change. So we invest in companies for years, even decades. And we support their leaders in making decisions that can deliver strong, sustainable returns to you.

Recent insights

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Investing in UK water

The companies transforming the UK’s water infrastructure.

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

The money migrators

How cross-border payments company Remitly takes the tension out of cash transfers.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases