© DIEGO AZUBEL/EPA-EFE/Shutterstock

Please remember that the value of an investment can fall and you may not get back the amount invested.

In the autumn of 2021, I had the pleasure and misfortune of presenting at a conference straight after Moderna chief executive Stéphane Bancel. It was a bit like having to go on after Freddie Mercury at Wembley. There are some acts you simply cannot follow, no matter how hard you try.

After all, Moderna’s impact on the world has been staggering. Its Covid vaccine is estimated to have saved nearly two million lives in 2021 alone, a powerful testament to the positive impact companies can have on the world.

Yet on stage Stéphane talked not of being content with having helped end a deadly global pandemic or of liberating the world from the confinement of lockdowns. Instead, he claimed that defeating Covid was merely Moderna’s opening act. This was only the start of a healthcare revolution.

The breadth of Moderna’s potential has always been clear to Stéphane. When he started his journey with Moderna in 2011, he believed there was only a 5 per cent chance the company would be successful. To many at the time, the ‘messenger’ RNA (mRNA) technology it was pioneering seemed more akin to science fiction.

Despite those long odds, he joined Moderna because he believed that if it could get the technology to work for one disease, it would be possible to make it work for many. Now, with mRNA technology proven against Covid, there’s an opportunity to apply that same technology to countless other diseases, such as flu, Zika, HIV and even cancer.

Protein blueprints

To understand why this breadth of applicability is possible, we need to think back to high school biology. Almost everything our bodies do relies on proteins.

The blueprints for those proteins are stored as information within our DNA. The role of mRNA is to copy, translate and deliver those blueprints to our cellular machinery for protein production. This means that mRNA exists naturally in our body as an information molecule instructing our cells to make the different proteins we need.

Moderna’s technology enables scientists to write their own mRNA instructions and have them delivered into cells. It’s similar to the way you might write software for a computer program. It unlocks the ability to design specific tools that our body might need and have our own body make them, whether that be a viral antigen, a cancer-blocking molecule or even a hormone to grow more heart tissue.

In the case of Covid, that specific tool was a harmless ‘spike’ protein that looked like Covid. It trained our immune system to be ready for the real thing, thereby saving millions of lives.

Faster treatments

Usually, healthcare innovation is incredibly difficult, slow and expensive. Any new molecule takes time to design and synthesise and requires a long safety approval process. However, each new mRNA medicine can use the same chemistry and manufacturing process.

The hardware stays the same, only the software code needs to change. This allows product development to occur at an unprecedented pace. There is also an unusual ability to iterate. In drug development, either a drug works or it doesn’t. For mRNA, you can tweak and improve the code.

Still, we should not underestimate how important Covid was to the development of mRNA medicine. In normal circumstances, paradigm shifts do not happen this fast. Not only did the pandemic validate the science of mRNA, but it provided the safety data from billions of shots, a global mRNA manufacturing capacity and regulatory backing.

Expanded horizons

Moderna now has masses of data, know-how, patents, scale manufacturing and $17bn (as at 30 September 2022) in cash on the balance sheet with which to invest both in its technology platform and in its many potential applications. There are now 48 programmes in development. Only nine relate purely to Covid.

Beyond Covid is therefore where the greatest value lies. We are now getting a trickle of real-world validation of that claim. In late 2021, Moderna provided data showing that its mRNA flu vaccine appeared to elicit roughly the same response as the market-leading flu vaccine.

Moderna was also quick to point out that it had achieved this in its first iteration. The company assumes it only gets better from here. That matters given that the efficacy of traditional flu vaccines usually ranges from just 40 to 70 per cent, with the virus still causing 300,000 deaths every year.

A year later it announced the successful trial results of a vaccine for RSV, another potentially deadly respiratory disease.

Combination vaccines

The real goal, though, is not to offer a new flu or even RSV vaccine. It is to leverage the abilities inherent within mRNA to combine multiple vaccines. In other words, mRNA with different bits of chemical code, all delivered within a single injection.

Moderna aims to use this to deliver a seasonal pan-respiratory shot each winter that covers Covid, flu and RSV. It would offer convenience and protection to patients alongside material cost savings to healthcare systems.

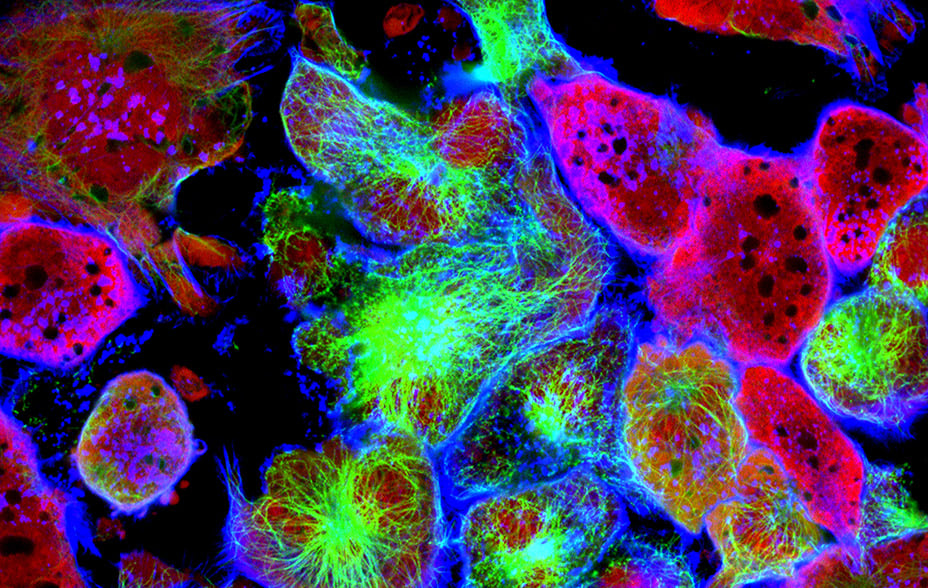

At the same time, demonstrating the breadth of possibilities, Moderna has developed a personalised vaccine for skin cancer. A biopsy sample is taken from the patient’s tumour which is then used to formulate an mRNA code for each patient.

The vaccine then trains their immune system to defend them against the specific tumour’s various mutations. Significant validation came late last year with trial results demonstrating the vaccine reduced the risk of recurrence or death by 44 per cent.

The opportunity set for Moderna’s technology platform, therefore, appears both broad and meaningful, with programmes covering everything from flu to cancer and much else in between.

Not every programme will be successful, but the firm has enough shots on goal that not all need to be. The market is focused on estimating the magnitude of the decline in Covid vaccine revenues as the world shifts from a pandemic to an endemic state. The risk, though, is that it fails to see the wood through the trees.

What Moderna offers is far more valuable than even a Covid vaccine. It offers a technology platform that can be used to create a wide range of tools, of which a Covid vaccine happens to be just one.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in April 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

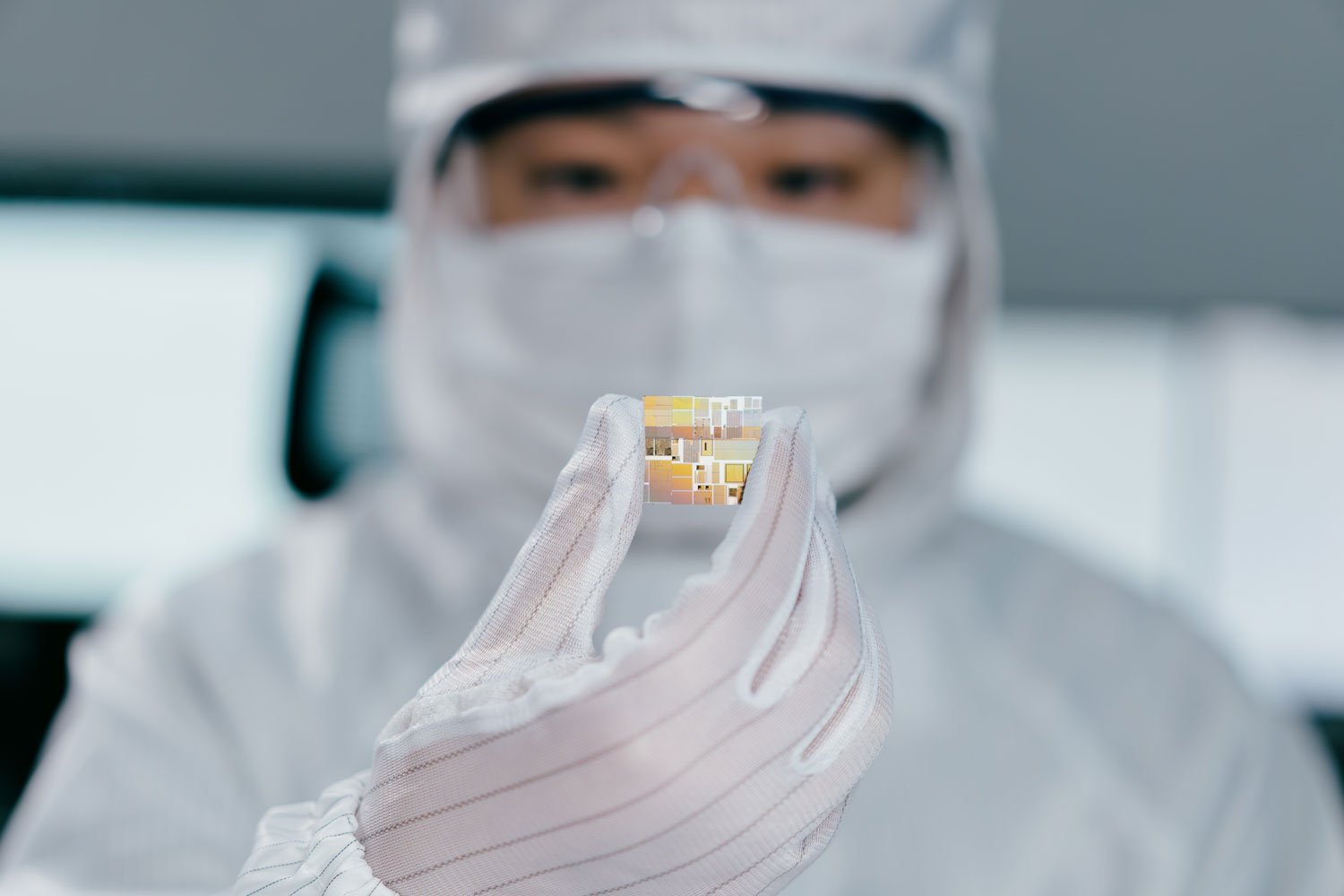

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws.

BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

407406