All investments have the potential for profit and loss, your or clients’ capital may be at risk.

Dating back to 1371, the Worshipful Company of Haberdashers has few worldwide equals for business longevity. Haberdashers’ Hall, home of the ancient City of London livery company, was thus an appropriately long-termist backdrop to Baillie Gifford’s Global Alpha Investor Forum.

It was recent history that was top of mind for the Strategy’s three portfolio managers, Malcolm MacColl, Spencer Adair and Helen Xiong, who acknowledged that the last three years have been tough for clients and investors. Reflecting on this period, the managers said they have sought out situations where they could have acted differently and learned lessons from this process.

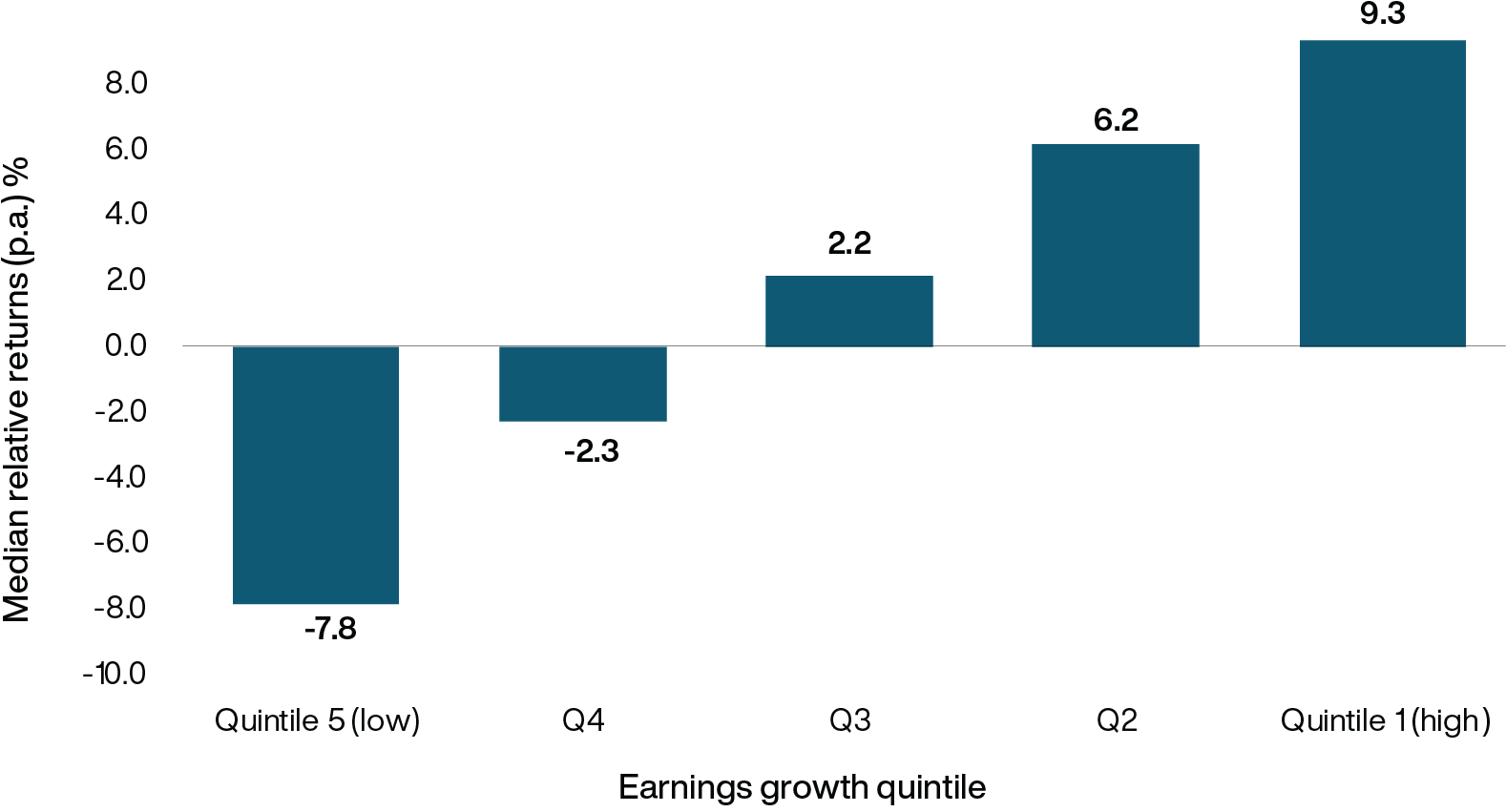

Malcolm MacColl emphasised that the team remains strongly committed to Global Alpha’s reward-seeking growth philosophy, reiterating his faith in the power of compounding as a means of generating long-term wealth. Citing independent data, he showed the correlation between higher earnings growth rates and higher excess returns for stocks. He highlighted how the rolling five-year returns of the top 20 per cent of companies in terms of earnings growth have outperformed the wider market by over 9 per cent over the last 34 years.

The case for long-term growth investing

Five-year returns by five-year earnings growth quintile

Rolling five-year horizons (1989-2023)

Source: FactSet, MSCI, FTSE. US dollar.

The universe consists of all stocks listed in the FTSE World and MSCI ACWI Indices at each starting point excluding repetitions.

Date range: 31 December 1989 to 31 December 2023.

MacColl explained, “The underlying philosophy of our strategy is that growth works. The question then is whether the portfolio is invested in the right growth companies for our investors?”

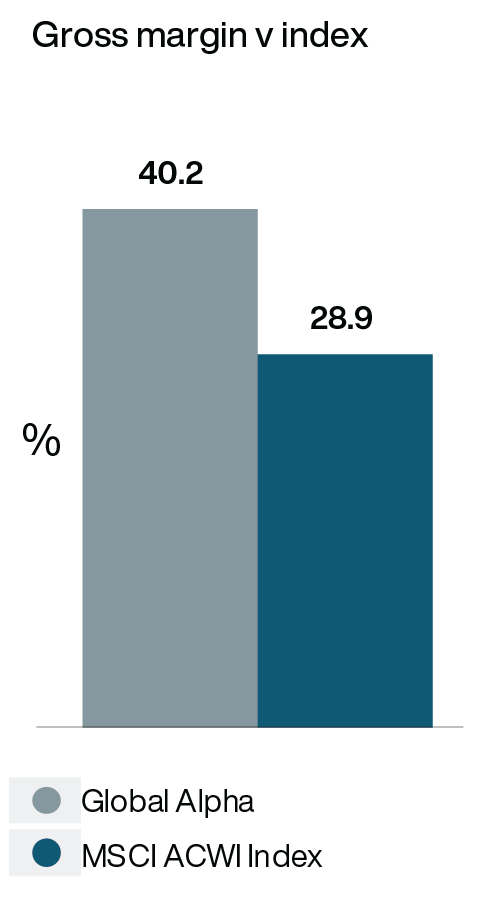

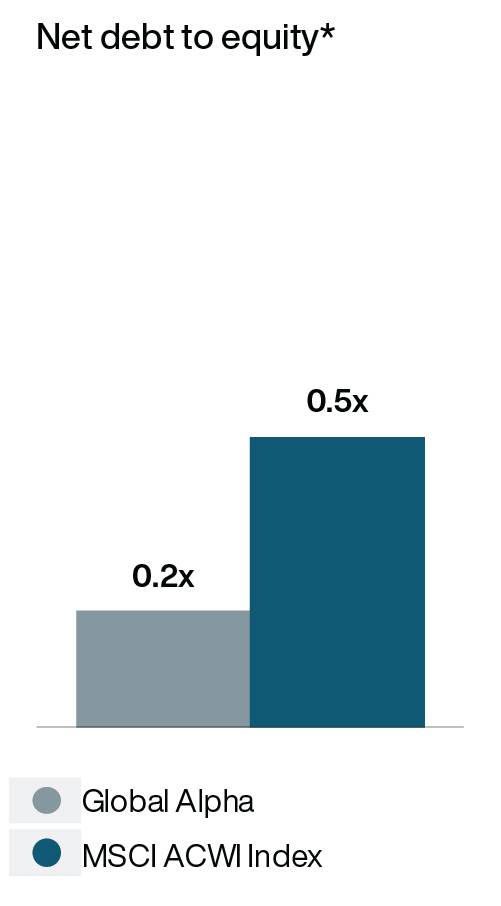

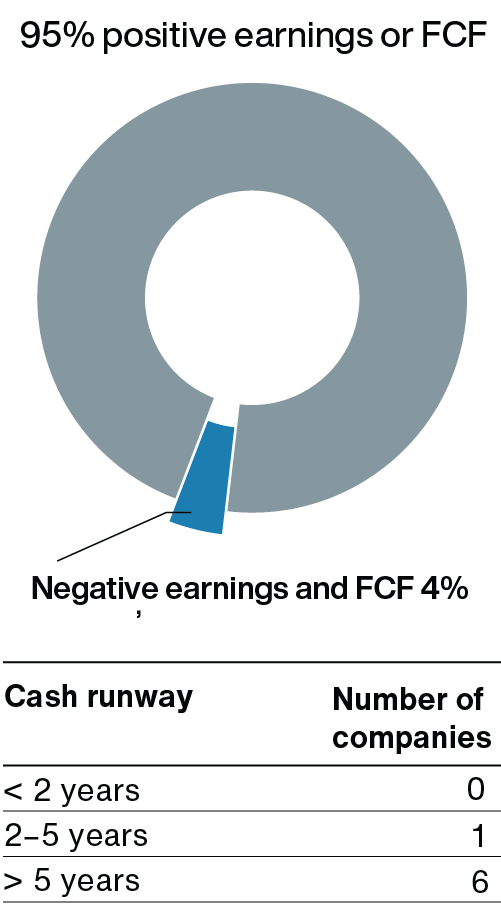

His detailed examination of the portfolio suggests that it is. For instance, the gross margins of the portfolio in aggregate are more than 10 per cent higher than the market average, while borrowings are considerably lower, and 95 per cent of portfolio companies being cash-flow-positive.

Portfolio strength

Source: Baillie Gifford & Co, FactSet, Revolution, MSCI. Richemont do not make this data available therefore are excluded from earnings data. Holding weight is 1.1%.

As at 31 December 2023, Sterling. Based on a representative Global Alpha portfolio. *Presented as a ratio. Representative portfolio and index net debt to equity figures excludes financials.

Representative portfolio and index earnings figures are calculated excluding negative earnings.

However, the level of growth from these companies is more critical. Data from FactSet shows the portfolio’s companies in aggregate are forecast to grow two and a half times faster than the market over the next three years.

Following a period of unexpected volatility, MacColl and colleagues stressed that the portfolio is well positioned for an environment where, even if interest rates or inflation stay high, the companies are likely to do well.

Enduring growth

This might seem surprising, given that the background is not particularly encouraging – decelerating global growth, the threat of a US recession and rising geopolitical tensions. In her remarks, Helen Xiong pointed out that aside from any short-term implications the correlation between adverse events and share prices over the long term is tenuous at best.

“Since the 1920s, the US has had around 17 recessions, including the Great Depression, numerous wars and now also a global pandemic. Yet over the last 100 years, the S&P has delivered around 10 per cent per annum” she said.

In any case, she added, present high interest rates matter little to companies with a low level of debt, while companies who are cash positive will be able to fund their own growth. Regardless of geopolitical and economic events, these companies are capable of delivering high earnings growth, which is what drives share prices over the long term.

Xiong quoted the economist and ‘creative destruction’ theorist Joseph Schumpeter, who noted that the fundamental impulse of capitalism comes from new goods, new methods of production or transport, new markets, and different kinds of organisations. Xiong cited the success of DoorDash. Its strong balance sheet has helped to fund acquisitions, which have led to the company winning a two-thirds share of the US food delivery market.

Another illustration from the portfolio of the disruptive benefits of applying new technology to old businesses is the growth of ‘programmatic’ or tailored digital advertising service The Trade Desk, which has outstripped traditional advertisers.

A major theme of the evening was that, while volatility can be trying for investors, it can also be an opportunity. Over the last year, the Global Alpha portfolio managers have been reducing the position sizes of companies in the portfolio whose value has held up well. They are also taking advantage of the opportunity to invest in companies whose share prices appear unjustifiably low, such as Texas Instruments, one of the world’s largest semiconductor makers.

Long-term opportunity

In his remarks, Spencer Adair reminded us of how badly market sentiment, like clothing fads, can date. Who now would return to the 1980s, when shoulder pads ruled supreme? His point was that that the stock market can be as fickle as the high street. Sometimes returns outstrip fundamentals while, as in recent times, strong fundamentals have not sustained share prices. These, he said, are like coiled springs, waiting to spring back to normality.

Adair used share price data from around the Global Financial Crisis (GFC) to make his point about how quickly things can bounce back. His experience is that over time, share prices follow fundamentals, which drive long-term returns. “We think we are at a similar point to when things began to inflect upwards after the GFC. It’s not something we can prove with data, but we’re confident,” he said.

Underpinning that belief is the pace of earnings growth, which has seen a sharp acceleration. “We're seeing companies that are already growing suddenly accelerate even further,” he added. “They’ve been running at a certain pace and then the pace increases. For example, the shift to cloud and AI has meant that Microsoft grew its earnings 33 per cent last quarter. That shouldn't happen to a 48-year-old company. It shouldn't happen to a $3tn company.”

Similar success can be seen in semiconductor companies in the portfolio such as TSMC, as well as in companies that are fixing worn-out infrastructure or adapting to changing climate conditions. One example is Advanced Drainage Systems, which makes super-lightweight and durable storm drains that are easier to install than conventional ones and could last for a century. It is seeing a sharp acceleration in earnings.

So too is Comfort Systems, which provides skilled air conditioning and electrical engineers to help fit out and upgrade large commercial buildings. Skilled construction labour is at a real shortage in the US and so business is booming. Comfort Systems grew earnings 65 per cent last quarter.

Talking of fashion, the managers noted how some of the deeper trends underpinning their investment philosophy have fallen out of favour. Healthcare is a good example. As society ages, healthcare revenues will grow, yet the industry had its worst year in two decades last year. While healthcare stocks have been trading at a 10-year low relative to the wider market, the managers have been slowly building up holdings in companies such as US health insurance provider Elevance Health, trading on just 13 times earnings in a market whose prospects are buoyed by an ageing population requiring more healthcare.

Demographics also favour emerging markets, yet, as Adair noted, these too have rarely been so unfashionable. Many technology companies in South Korea, China and Brazil are world-class, capitalising on strong business models. Several of these are, in the managers’ view, superior companies trading at very big discounts to their western peers. The companies are responding to this and taking on multinational competitors closer to home.

In the developed world, too, Global Alpha holdings such as Meta and Spotify are quietly flourishing, with strong operating momentum and improving profitability. Taken as a whole, the managers see plentiful signs of growth inflecting upwards and good reasons to believe the Global Alpha portfolio is strongly placed to deliver growing returns to investors.

Generative AI: the next frontier

What are the implications and potential for generative Artificial Intelligence (AI)? The question was explored in a breakout session with Malcolm MacColl, Helen Xiong and Global Alpha investment analyst Jacob Teal.

AI’s ability to process data and speak to humans has captured the world’s attention in just a year, but this is only the beginning of a far wider transformation. Many of the firms whose services are part of everyday life such as Spotify, Netflix or Meta are essentially software companies using algorithms. Generative AI is not a new algorithm but a new paradigm, a new way to develop software through training rather than coding.

Explained Jacob Teal: “These systems can tell patterns from information that already exists and can create new information from patterns that they've learned. That's what's new. It is even more exciting because the right hardware to enable the software is coming through at just the right time.”

Potential applications extend well beyond ChatGPT to applications including artwork, music, protein synthesis and software development. “There is no limit to where generative AI could go or to how intelligent systems can be in their ability to understand human context, which means the potential for its application is very wide,” Helen Xiong said.

In terms of what it means for companies in the portfolio, MacColl explained that the managers need to think through the implications of AI in all its different forms. “We need to understand how it can be deployed to improve efficiency or increase research and development and so on. We also need to be aware of where it can be an undermining force and perhaps change business models or disrupt incumbents.”

Repair, renew, revitalise: the infrastructure opportunity

Client Director Jon Henry introduced Spencer Adair, Mike Taylor – one of the North America scouts for Global Alpha – and Kieran Murray, Global Alpha’s environmental, social and governance (ESG) analyst, to discuss the opportunities arising from the need to urgently upgrade much of the world’s infrastructure and deal with climate change. About one-fifth of the portfolio is invested along the theme of ‘repair, renew and revitalise’.

“Most of the infrastructure in the western world was put in place in the period after World War Two in the 40s, 50s and 60s,” Adair began. “Infrastructure as a proportion of GDP peaked in the early 70s and has been declining since.

Adapting to harsher climate conditions also requires better drainage for storms, higher sea walls and breaks for forest fires. Governments and companies are increasingly aware of geopolitical tensions and threats to integrated global supply chains. Countries need to make their own vaccines, pharmaceuticals and semiconductors. The stimulus beginning to come through is unprecedented, particularly the $2.2tn committed by the US legislature to upgrade domestic infrastructure, equivalent in today’s values to about 13 post-World War Two Marshall Plans.

Increasing investment in infrastructure is beginning to come through to companies in this area. Although building materials and solutions provider CRH has enjoyed about 15 per cent growth a year for the last 50 years, it now says that it is entering a period of golden growth.

“These companies are outwardly boring, and that’s why we like them,” added Taylor. “They’re frequently well-managed, often run by families who build up their businesses in a niche area. An outwardly dull façade can mask an excellent competitive position.”

Important information and risk factors

Annual past performance to 31 December each year (net%)

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Global Alpha Composite | 32.7 | 36.4 | 7.3 | -29.1 | 19.5 |

| MSCI ACWI Index | 27.3 | 16.8 | 19.0 | -18.0 | 22.8 |

Annual past performance to 31 December (net%)

| 1 year | 5 years | 10 years | |

| Global Alpha Composite | 19.6 | 10.5 | 8.3 |

| MSCI ACWI Index | 22.8 | 12.3 | 8.5 |

Source: Baillie Gifford & Co and MSCI. USD. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite.

Past performance is not a guide to future returns.

Legal notice

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in February 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence

No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

93002 10045112