Capital at risk

International Growth

We aim to deliver attractive long-term returns to clients by being patient owners of exceptional growth companies. We believe disruptions are happening in many economic sectors at different speeds. We are interested in investing in two types of growth company: those able to grow very rapidly and those with durable growth prospects.

Searching for outliers

International Growth seeks to invest in outstanding growth businesses that possess a strong competitive advantage and have a culture that allows them to maintain that advantage in a sustainable way.

International Growth Q1 investment update

The International Growth Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Embracing the exceptional

Our objective is to outperform the benchmark by 3 per cent per annum (net of fees) over rolling five-year periods. To do so, we buy and hold shares in exceptional growth companies with a five-to-10-year investment horizon in mind.

Our diversified portfolio contains more than 50 holdings.

We embrace the concept of asymmetry of equity returns and adopt a thinking approach based on probability when building upside scenarios.

Patience in an impatient industry

Being long-term owners of companies on behalf of our clients is our main advantage in an impatient industry.

As active stock pickers, our edge also comes from being willing to get things wrong in our search for outliers and seeking wisdom from outside the financial system.

Our resulting portfolio usually displays a high active share and a low turnover.

Exceptional growth companies can thrive in even the most inhospitable macroeconomic environments by harnessing innovation.

Meet the managers

Documents

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2024

| # | Holding | % of portfolio |

|---|---|---|

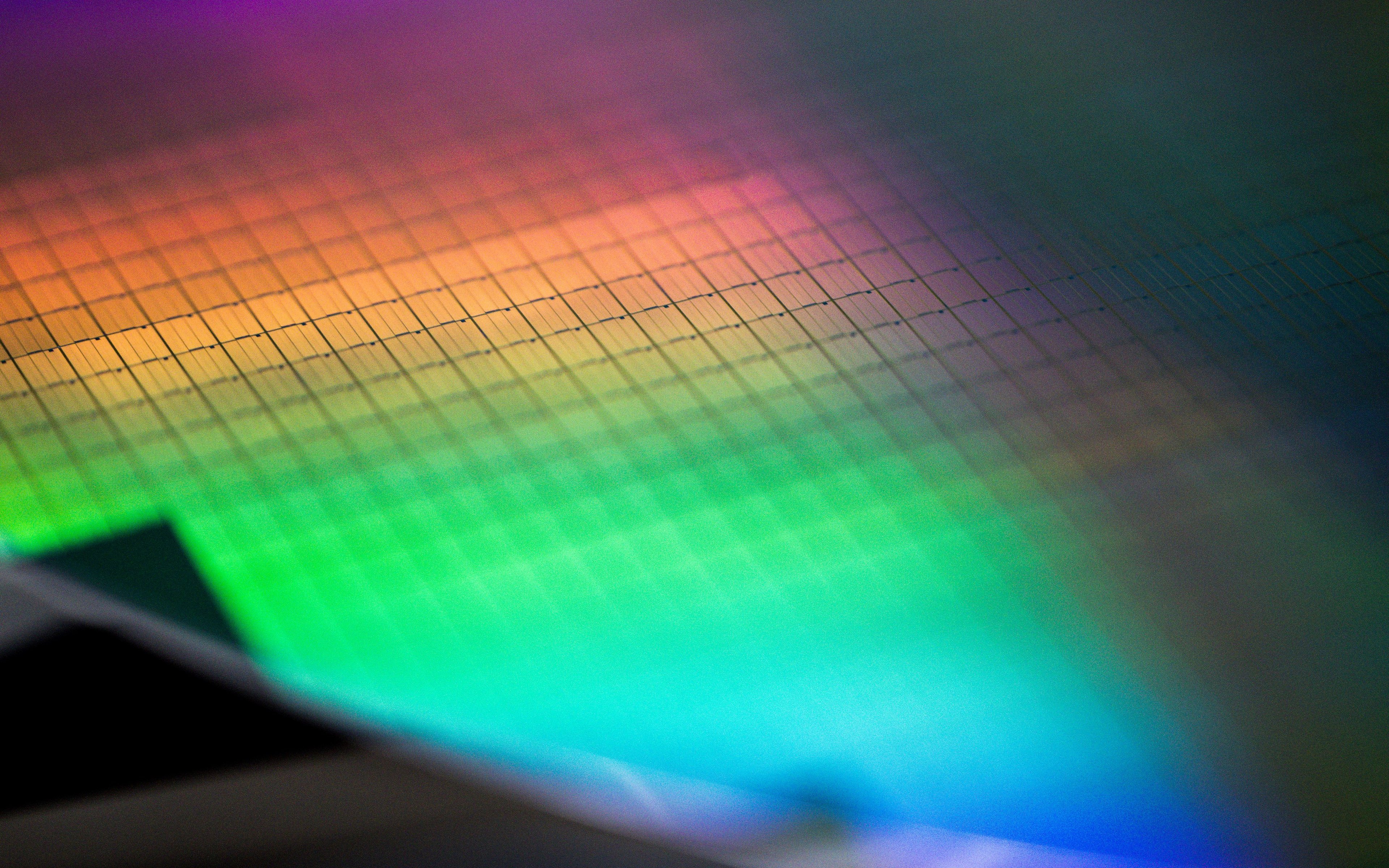

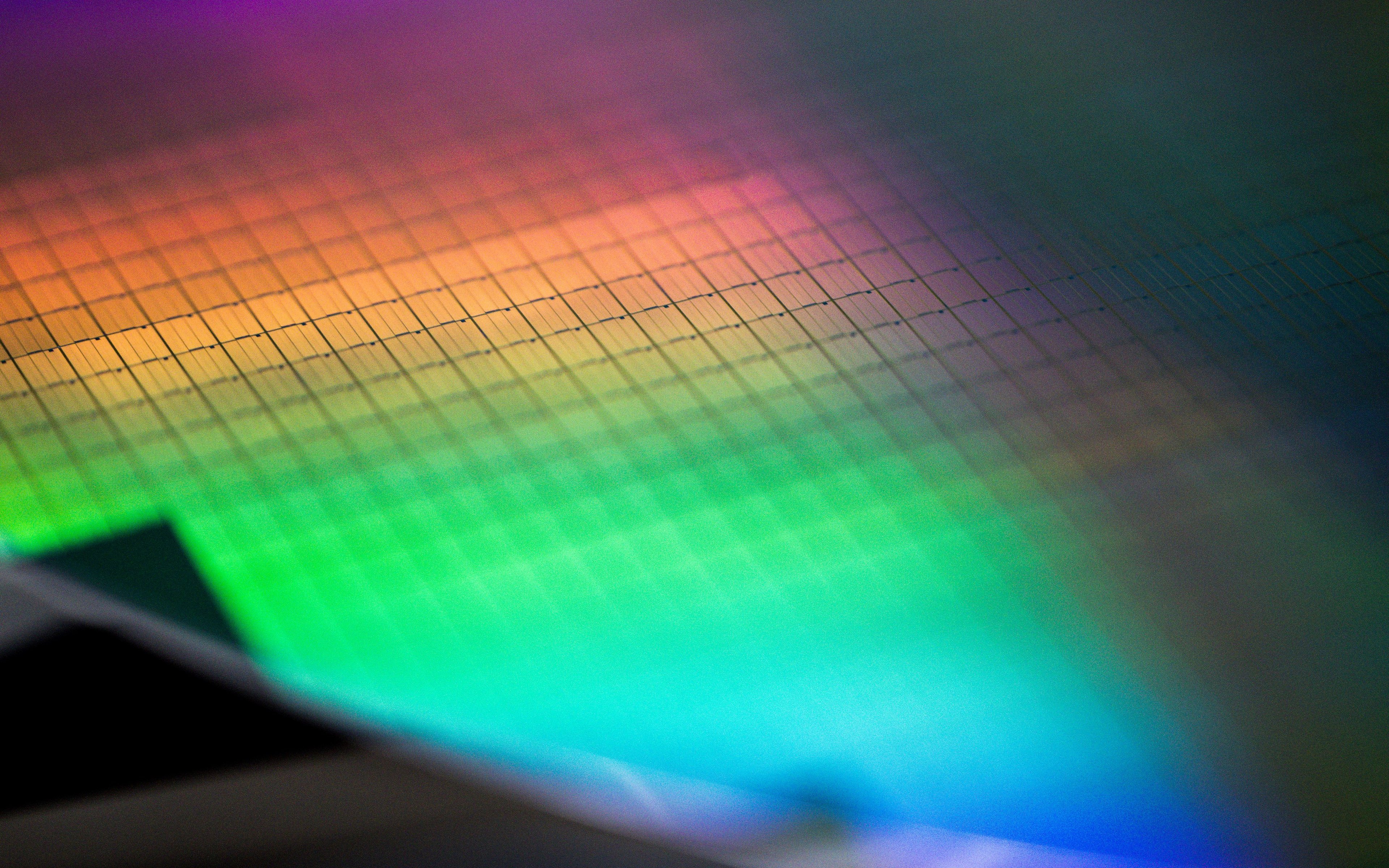

| 1 | ASML | 7.06 |

| 2 | MercadoLibre | 6.08 |

| 3 | Spotify | 5.71 |

| 4 | Adyen | 5.18 |

| 5 | Ferrari | 4.71 |

| 6 | TSMC | 4.53 |

| 7 | Atlas Copco | 3.74 |

| 8 | L'Oréal | 3.24 |

| 9 | Tencent | 2.97 |

| 10 | argenx | 2.92 |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Ferrari: racing through time

How a car manufacturer turned luxury icon can continue to outpace the competition.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

International Growth Q4 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

A conversation with the International Growth Team

International Growth's investment philosophy, portfolio positioning, and outlook for 2024.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

argenx: innovative antibody therapies

The future of treating autoimmune diseases.

International Growth Q3 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Stewardship Report

Summary of stewardship activities and perspectives for 12 months to 31 March 2023.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

International Growth Q1 investment update

The International Growth Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Related insights

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Ferrari: racing through time

How a car manufacturer turned luxury icon can continue to outpace the competition.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

International Growth Q4 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

A conversation with the International Growth Team

International Growth's investment philosophy, portfolio positioning, and outlook for 2024.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

argenx: innovative antibody therapies

The future of treating autoimmune diseases.

International Growth Q3 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Stewardship Report

Summary of stewardship activities and perspectives for 12 months to 31 March 2023.

International Growth Q2 update

The International Growth team reflects on recent performance, portfolio changes, and market developments.

International Growth Q1 update

International Growth Team reflects on recent performance, portfolio changes, and market developments.

20 years of International Growth podcast

Through two decades of change, our strategy has prospered by sticking to its philosophy of patience and optimism.

What Picasso can teach us about investing

Investment Specialist Christel Brodie speaks to Tom Coutts, Investment Manager on Baillie Gifford’s International Growth Strategy, about his recent thought piece ‘What Picasso can teach us about investing’.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.