Key points

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

We all know how it feels to be packing a suitcase ahead of a well-earned holiday, trying to decide what to take within our baggage allowance. To make the most of our holiday, we must travel equipped for all weathers. If we only pack clothes for sunny weather, we risk missing out on sightseeing on cooler or rainy days - a risk we cannot afford to take given the limited timeframe of our holiday. Therefore, it is essential we prepare plenty of options ahead of time. The same holds true for a maturing pension fund. The macro economic environment, like the weather, can be volatile. Periods of strong growth can be succeeded by systematic shocks, with enormous implications for the portfolio and trustees’ well-earned funding position. Because of this, it is crucial for a maturing pension fund to be invested in a portfolio that is equipped for whatever economic weather may arise. Baillie Gifford’s multi asset funds aim to provide exactly this protection.

The de-risking journey

When pension funds are young, time horizons are long and risk tolerance is high. However, this risk tolerance is negatively correlated with time and as pension funds become older, their risk appetite starts to decrease. With time on its side, a young pension scheme can more easily absorb the ups and downs of economic cycles. This ability to ride out economic cycles means that listed equities are often the best investment option at this stage as they can offer good long-term growth, provided you are able to ride out the short-term volatility. However, as a pension fund starts to approach maturity, sensitivity to economic cycles increases. Less time to maturity means less time to recover from a market downturn. As a result, pension fund allocations often transition toward the safer haven of fixed income, an asset class which typically exhibits lower volatility than equities.

Given the inherent uncertainties about the future, timing that transition is very difficult: it is rarely clear when the right time is to begin moving from equities to fixed income. The risks are high, and the costs can be large. Switch too early and you may miss out on strong investment performance; transition too late and you may be exposed to large drawdowns with insufficient time to recover.

This can be a daunting time in a pension fund’s lifetime. But it doesn’t have to be. Instead of trying to time the market, a skill beyond even the most experienced investment manager, one could look at investment strategies with the flexibility to navigate these uncertainties and which can bridge the gap between equity portfolios and fixed income portfolios on the de-risking journey. A well-diversified multi-asset approach, which aims to deliver attractive returns with low volatility, could be the answer.

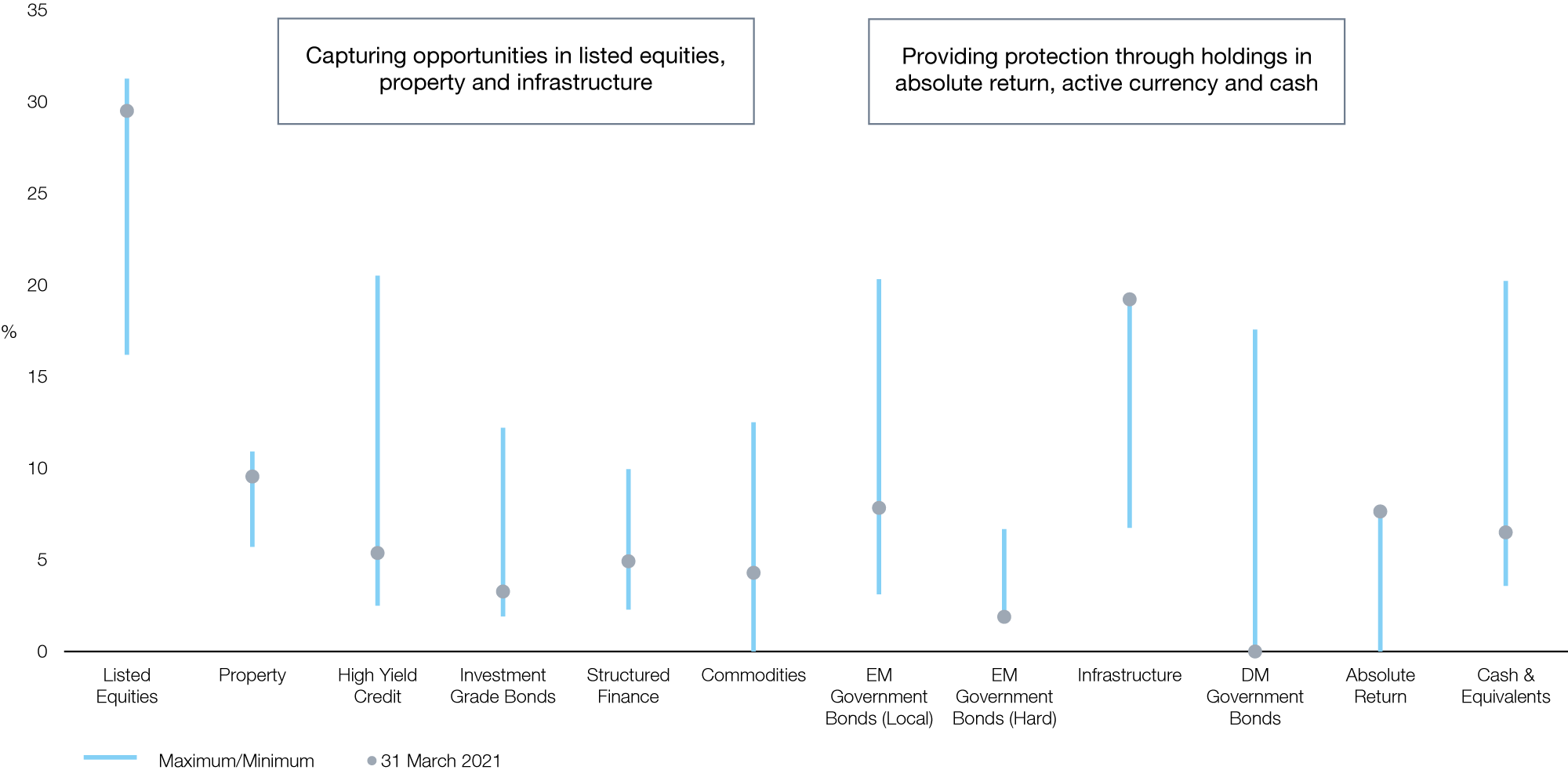

Our multi asset funds offer flexibility in the form of a wide opportunity set across many different asset classes. They can invest in both equities and fixed income, as well as other asset classes such as infrastructure, property and commodities, in pursuit of the best possible investment opportunities. In doing so, they benefit from one of the key concepts of low volatility investing: diversification.

Multi asset funds are a great option for pension funds looking to de-risk but not at the expense of good returns. They provide a smooth transition because they can deliver returns with lower volatility than pure equity strategies and higher returns than fixed income funds. Through diversification, a multi asset fund can reduce overall portfolio volatility while maintaining an attractive return.

Change is coming

The world we live in today is very different from that of ten, five or even two years ago, and the same can be said of the future. The pandemic has been an inflection point for economic, social and political factors. Although we cannot exactly predict what the future will look like, we do know that the pandemic has accelerated several long-term trends which change the way humans interact, behave and consume. One such example is retail consumption. During the pandemic, digitalisation and e-commerce have become increasingly important. We have adapted quickly to shopping online, working out from home or even communicating virtually. These trends will only continue and develop.

We believe these structural changes to the way we live will provide great investment opportunities across a range of asset classes. Therefore, it is important to be flexible and able to explore such opportunities. The Baillie Gifford multi asset funds invest across many asset classes and so can take advantage of opportunities in several different ways.

Our view is that investing in multiple asset classes can be very rewarding for long-term investors. As part of our investment process, every six months we consider the long-term return expectations for a wide range of asset classes. Attractive long-term returns are not limited to equities alone. Asset classes such as property and infrastructure, could provide long-term returns that exceed those of equities. By being flexible within asset classes we are also confident we can add additional value by investing in the most attractive sectors, geographies, or even specific investment opportunities.

However, change not only brings very exciting investment opportunities, it also gives rise to risks that may create challenges for maturing pension funds. Two examples which may be of concern at the current time are inflation risk and volatility risk.

Inflation risk

Public and private debt levels globally have increased over the past decade. This is driven by the low cost of debt on the back of low interest rates and quantitative easing by central banks in response to the global financial crisis. These debt levels further increased as a result of fiscal stimulus during the Covid-19 pandemic. Debt levels will likely rise even further as governments increase their infrastructure spending to meet their net zero carbon emission targets. The most obvious solution to manage this debt burden is for central banks to continue being accommodative by allowing inflation to move higher than the levels we are used to seeing.

Higher inflation will have an impact on both the asset side and the liability side of a pension scheme. On the asset side, financial assets are expected to experience price changes on the back of the repricing of inflation premiums. Assets which do not provide inflation protection will be negatively impacted, especially fixed income assets whose future coupon and principal payments will be worth less if they are not linked to the inflation index. One solution for pension schemes would be to invest in inflation linked bonds, but the present level of negative real yields means that this investment would in effect be loss-making. Meanwhile, on the liability side, higher inflation leads to higher future payments, which could impact the funding profile of a scheme. Multi asset funds can invest in a combination of assets offering protection against inflation risk. For example, our multi asset funds currently hold specific hedges that benefit from increased volatility driven by inflation fears (i.e. interest rate volatility strategies), real assets where income is linked to inflation rates (i.e. infrastructure and property) and commodities.

Volatility risk

Investors have become accustomed to the low volatility of returns which has prevailed for the past decade. However, this is anticipated to change going forward. Concerns around geopolitical risks (especially rising tensions between China and the US), inflationary risk and increased social challenges (such as inequality) may lead to higher volatility.

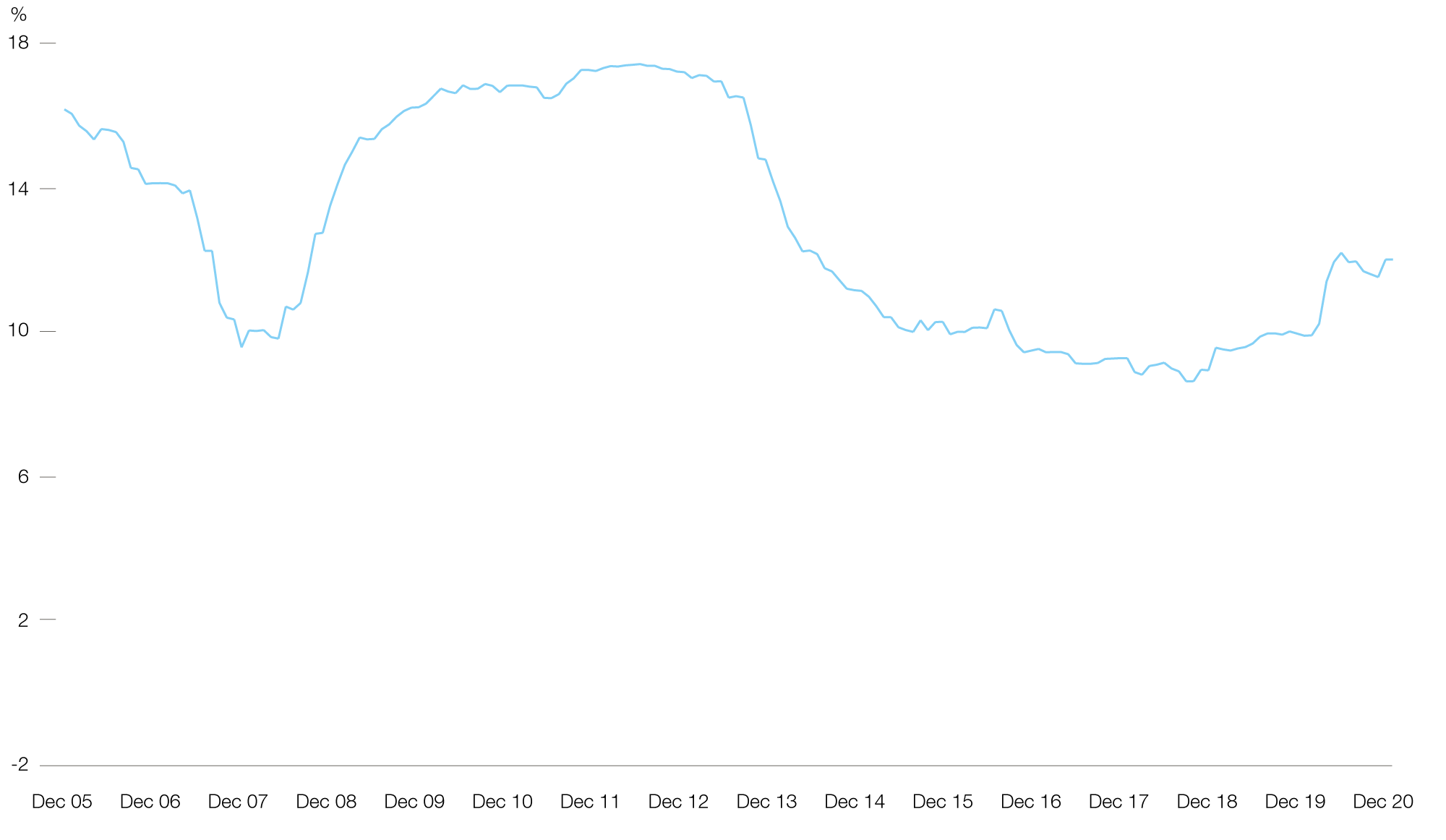

MSCI ACWI Since Inception Five Year Volatility

5-year rolling volatility of MSCI ACWI since inception. We are likely leaving the low volatility period experienced in the mid-2010s

Source: MSCI.

A multi-asset portfolio investing in a wide range of asset classes will be exposed to many different return drivers - for example, credit spreads from corporate bonds or rental income from property. Similarly, investing in different asset classes also means exposure to different risk factors. Default risk, duration risk and liquidity risk are factors which impact corporate credit positions. Meanwhile, property investment risks are related to property price changes and rental demand. Investing across asset classes enables access to different return drivers and risk factors, creating a more robust portfolio. This diversification means that a multi-asset portfolio is not exposed to a single risk factor. As a result, the portfolio has less concentration risk and so less exposure to a single event or scenario impacting performance.

Both inflation risk and volatility risk could have a significant impact for pension funds de-risking. It is important to manage such risks in order not to incur losses and risk being unable to meet future liabilities. Our multi asset funds are very well-equipped for these scenarios. The ability of these funds to invest in a broad range of asset class and allocate between investments should be appealing to a maturing pension scheme. A diversified, robust portfolio could be the best option to overcome these risks, more so than a single asset class portfolio.

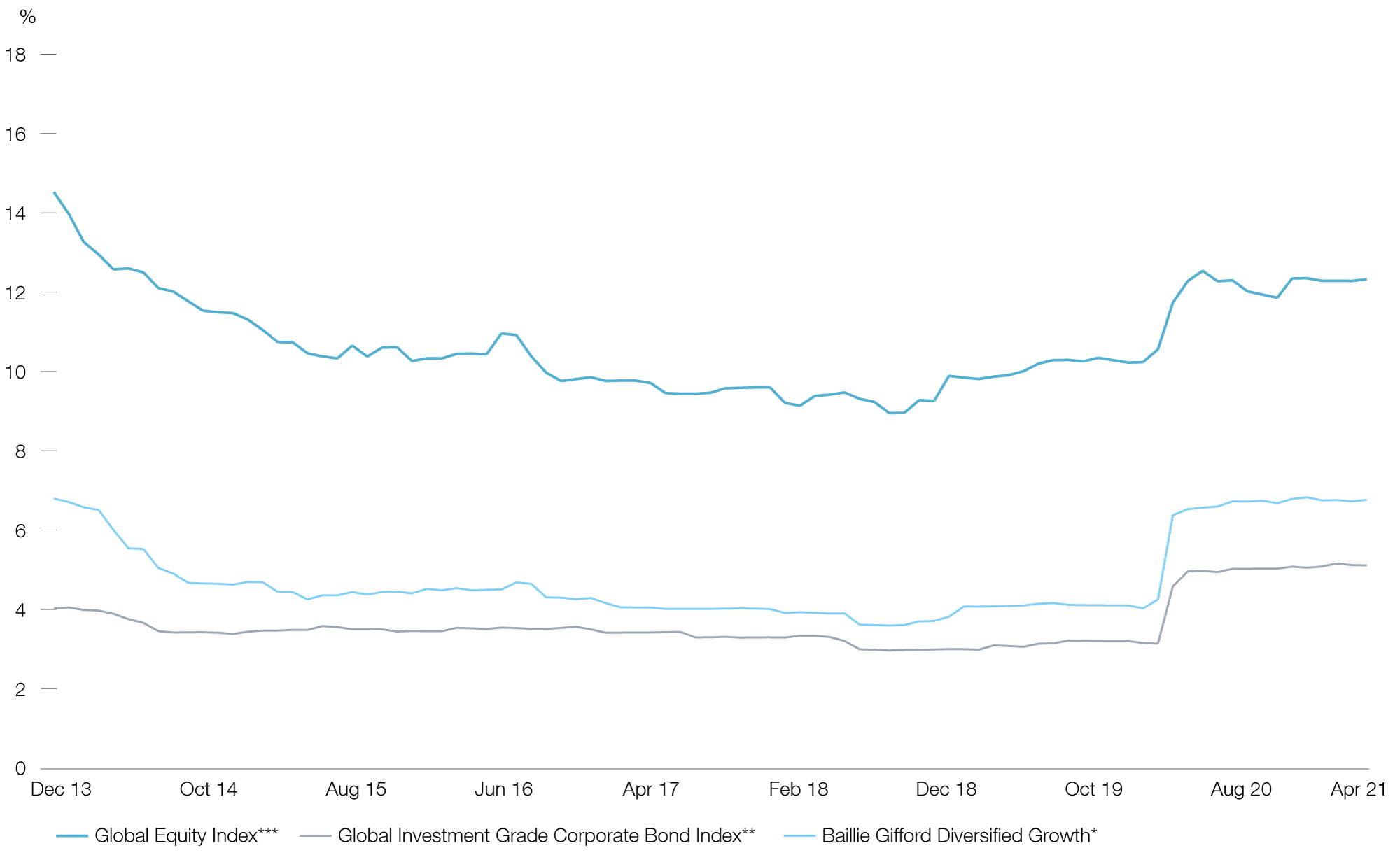

Five Year Rolling Volatility

5-year rolling volatility of Diversified Growth has proven to be consistently below 5-year rolling equity volatility, and not far above 5-year rolling volatility of corporate bonds

Source: Baillie Gifford, ICE BofA, MSCI. Net of fees. GBP. *Based on a representative portfolio, **ICE BofA Glob Corp GBP Hdg, ***MSCI ACWI.

We believe there are several reasons why this is the right time for pension schemes to consider investing in a multi asset approach:

- The pandemic has led to the acceleration of several long-term trends. The investment opportunities arising from these developments are very attractive. These opportunities span across geographies, industries and asset classes. The fact that multi asset funds have the flexibility to invest across asset classes gives them a greater advantage in benefitting from these opportunities.

- Equity markets have delivered strong returns over recent years. However, we believe that infrastructure and property should also deliver very attractive returns over the next ten years and beyond. Investing in a multi asset fund that can explore opportunities in these asset classes is a great way to benefit from these growth areas.

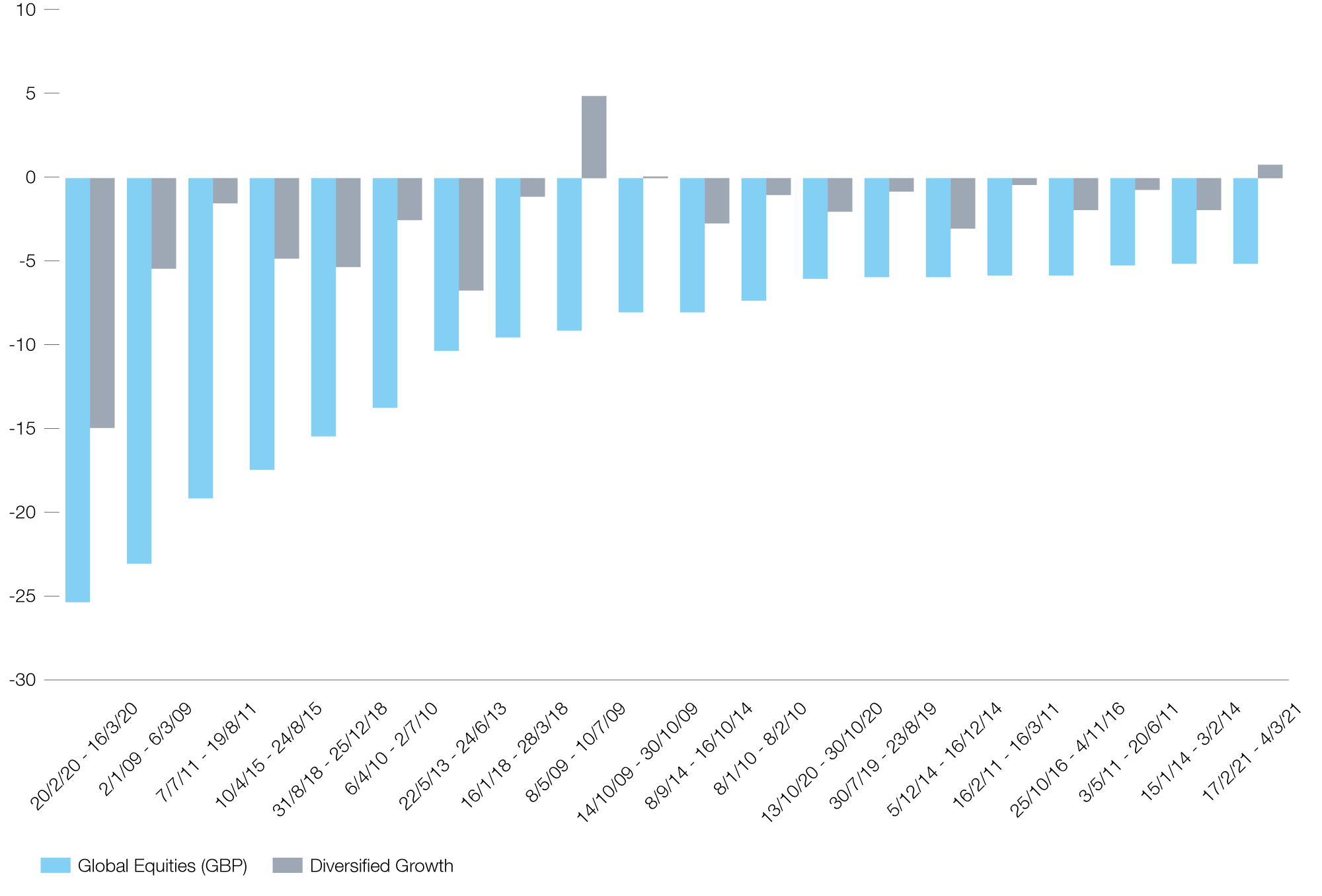

- An investment strategy with lower drawdowns and lower volatility will allow for a smoother transition for maturing pension funds. Multi asset funds are invested in a range of asset classes. This diversification reduces both overall volatility and maximum drawdowns. In addition, unlike other lower volatility strategies good returns will not be sacrificed. Therefore, they make for a very attractive option for de-risking pension funds.

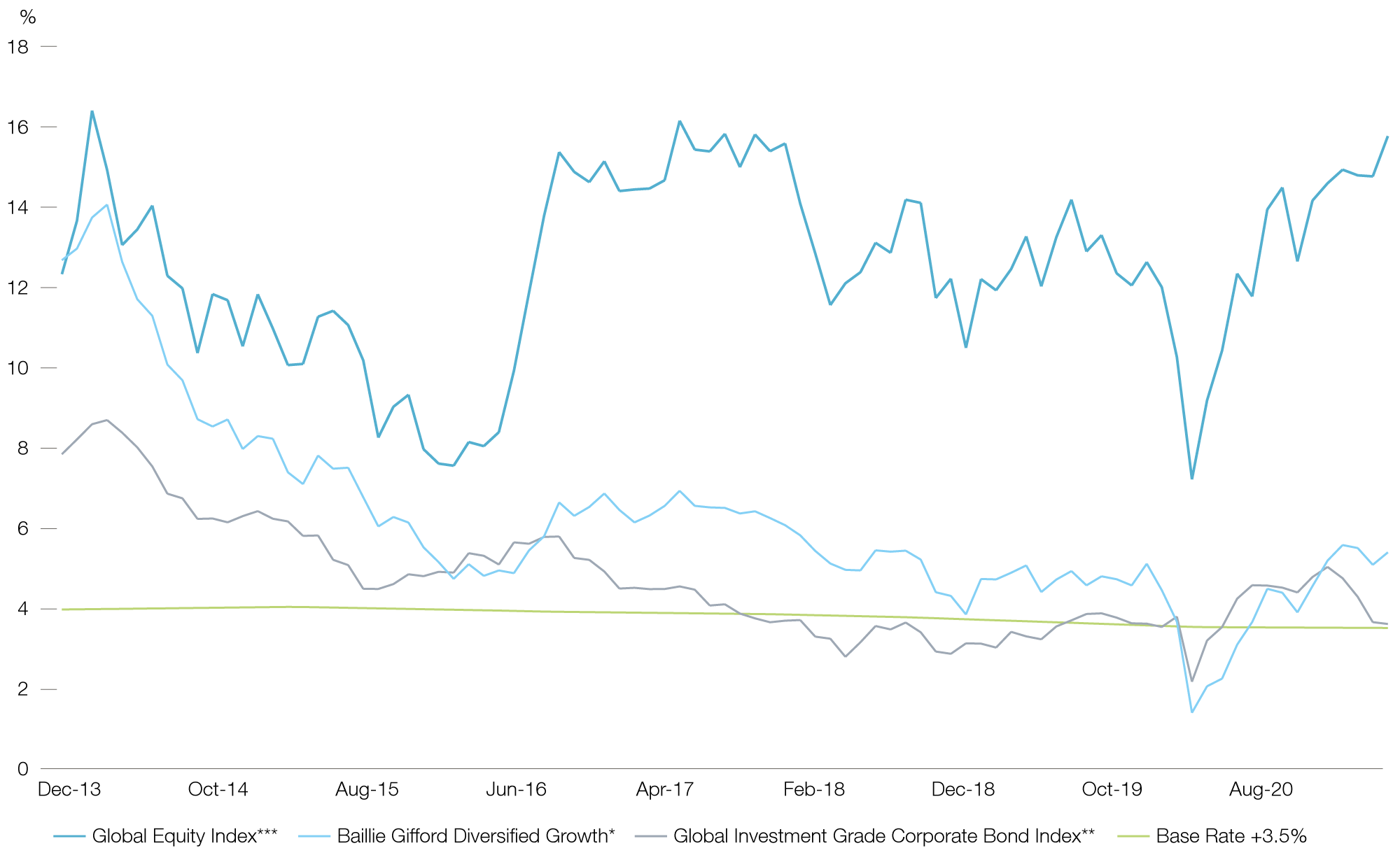

Annual Five Year Rolling Return

5-year rolling return of Diversified Growth compared to global equities, corporate bonds and base rate +3.5%

Source: Baillie Gifford, ICE BofA, MSCI. Net of fees. GBP. *Based on a representative portfolio, **ICE BofA Glob Corp GBP Hdg, ***MSCI ACWI. Past performance is not a guide to future returns.

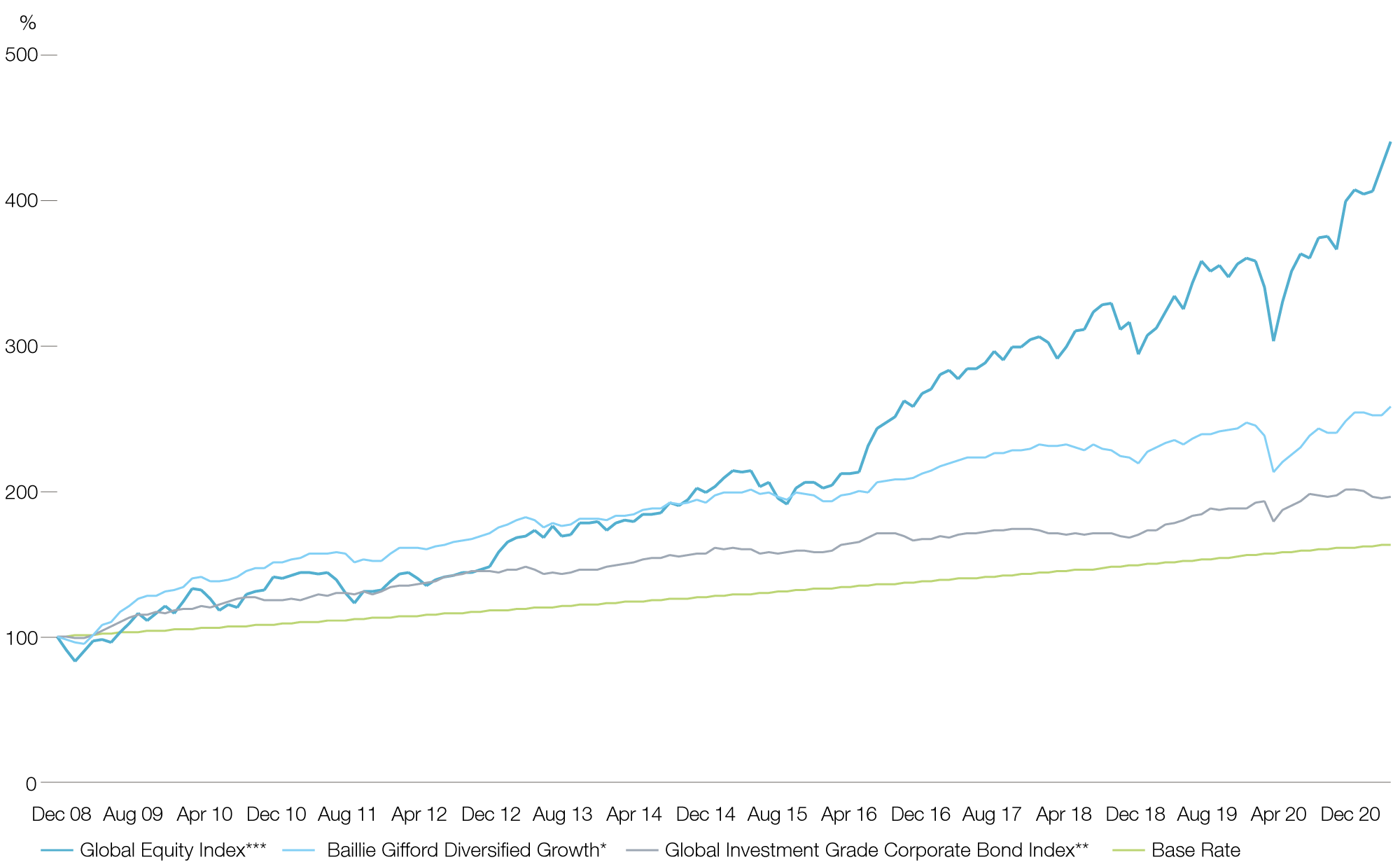

Cumulative Monthly Returns (%)

Cumulative performance of global equities, global corporate bonds, Diversified Growth and base rate +3.5%

Source: Baillie Gifford, ICE BofA, MSCI. Net of fees. GBP. *Based on a representative portfolio, **ICE BofA Glob Corp GBP Hdg, ***MSCI ACWI. Past performance is not a guide to future returns.

- Finally, we believe our multi asset funds are much better equipped to manage the very uncertain times ahead. These funds are able to invest in defensive assets and targeted hedges allowing them to better position themselves to counter specific market risks. We believe financial markets may become more volatile, impacted by uncertainty around government debt levels, climate change and geopolitical risks. Having the ability to hedge against specific risks is a huge advantage that should not be overlooked.

Multi Asset – The Baillie Gifford approach

At Baillie Gifford we started managing multi asset funds in 2008. Since inception, the Diversified Growth Fund, our longest running fund, has outperformed its dual objectives by delivering attractive returns (7 per cent per annum) with low volatility (6.5 per cent per annum to 31 March 2021 ), helping our clients achieve their financial goals. Our multi asset funds are designed to take advantage of long-term trends, while not overlooking shorter-term opportunities and risks. Our success is built around a three-pillar philosophy.

Flexibility is key

The opportunity set of the strategy is broad, with investable asset classes ranging from listed equities to emerging market local currency bonds and beyond. There are no minimum allocation constraints which allows us great flexibility. We can invest in any attractive asset class, idea or theme. We believe this is a key strength of the strategy. The team make full use of this opportunity set, having consistently held a range of asset classes since the launch of Diversified Growth in 2008.

Flexible Asset Allocation

Flexible asset allocation of Multi Asset Growth. Historic maximum and minimum asset allocation (weight).

A fundamental approach

At Baillie Gifford we are long-term investors. Our investments are based on thorough research, not only of the individual holdings, but also of the industry and long-term trends. We are not traders trying to time the market (often a zero-sum game). Instead, we do what we are good at, which is investing our clients’ money for the long term. We take a top-down approach looking at asset classes and economies, identifying trends and themes which offer attractive investment opportunities. Our time is spent researching long-term opportunities instead of speculating on short-term trends.

Furthermore, we think there is strong alignment between good governance and sustainability practices and achieving over the long run the best investment returns. Because governance and sustainability considerations are an important part of our role of being responsible stewards of our clients' capital, they are embedded into our research and decision-making.

Thoughtful Risk Management

Our approach to investment is one of ‘what might happen’ not ’what has happened’. Very often in investment management investors look at the past as a guide for the future. When examining expected long-term returns, we apply a forward-looking approach not only to investing, but also to risk management. Our quarterly scenario analysis is a critical component of this. In this exercise, we look at a 12 to 18-month time horizon and consider how each asset class might perform over a variety of core, specific and extreme scenarios. Core scenarios are usually centred around economic outlooks, whereas specific and extreme scenarios can vary. Previous examples have included Italexit, a pandemic and US/China tensions escalating. The scenario analysis exercise helps us ensure the portfolio remains robustly resistant to a wide range of events and conditions.

How we can make a difference

Clients should not have to miss out on returns or take excessive risks as their pension fund matures. We believe that our Baillie Gifford multi asset funds offer clients attractive long-term returns with low volatility and can play a key role in the de-risking journey.

We are extremely excited about the current investment environment. We think that several long-term themes and trends have been developing (and were further accelerated following the pandemic) which offer great investment opportunities. We are particularly excited about themes such as the green energy revolution, the rise of technology and the rise of Asia, all areas that can offer very attractive long-term returns. We have positioned the strategy to benefit from these long-term trends through exploring opportunities across asset classes, thereby avoiding sole exposure and dependence on equities. For example, we exploit the ‘green energy revolution’ theme through our allocations in equities, infrastructure and commodities.

Furthermore, the pandemic has also led to several interesting dislocations. For example, a lot of companies in industries affected by the lockdowns and restrictions experienced significant share price falls. We have identified a number of companies who are well-positioned to benefit from an easing of restriction due to their robust capital structures, strong market positions and good management. We think they will do well in the recovery and so we wish to have exposure to these names.

Given the dual objective of our strategies, we also hold several attractive hedges that should protect the portfolio in times of elevated volatility. These positions protect the portfolio against broader market selloffs and more specific scenarios, for example, higher interest rate volatility as a result of inflation concerns. The selloff in the first quarter of 2020 proved that traditional hedging positions, such as gold, do not always provide the expected hedging benefits. It is therefore vital to have the flexibility (and willingness) to add alternative hedges.

These are examples of some of the areas we are very excited about. But as the world continues to develop, economies continue to expand, and certain sectors continue to grow (i.e. technology, healthcare and renewables) more opportunities will appear. Given our broad opportunity set and flexible approach, we are positioned ideally to benefit from these. We don’t want investors to miss out on returns from new developments, technologies or economic growth while de-risking. Baillie Gifford’s multi asset funds aims to allow clients to benefit from the upside, while protecting the downside. So, let us focus on packing the suitcase for all weathers, while you look forward to enjoying your well-earned holiday.

Diversified Growth’s Downside Protection

Long-term evidence of downside protection. Performance of Diversified Growth in all global equity market peak-to-trough drawdown periods >5%

Source: Baillie Gifford and underlying index providers. Net of fees. GBP. Past performance is not a guide to future returns. Based on a representative portfolio.

Important Information and Risk Factors

The views expressed in this article are those of Philippe Jageneau and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in May 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Diversified Growth |

11.1 |

1.7 |

2.9 |

-3.1 |

13.9 |

|

Bank of England Base Rate |

0.3 |

0.4 |

0.7 |

0.6 |

0.1 |

|

MSCI ACWI |

22.9 |

9.5 |

10.3 |

5.7 |

25.1 |

|

1 Year |

5 Years |

10 Years |

|

|

Diversified Growth |

13.9 |

5.1 |

4.7 |

|

Bank of England Base Rate |

0.1 |

0.4 |

0.5 |

|

MSCI ACWI |

25.1 |

14.4 |

12.2 |

Past performance is not a guide to future results. Changes in the investment strategies, contributions or withdrawals may materially alter the performance and results of the portfolio.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ("FinIA"). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (“BGO”) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this document represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This document is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

10316 10001965