All investment strategies have the potential for profit and loss, capital is at risk. Past performance is not a guide to future returns.

One of Elon Musk’s favourite Twitter topics over the past year has been long-term population collapse. He’s described this as the most significant danger faced by civilisation. In a few decades, it may well be the case that this is a more commonly aired issue than today, but in 2023 we’d suggest that you’re probably more likely to come across views from the UN that the world’s population is set to continue growing until 2100. Over the last quarter century, the run rate has been 12 years per extra billion people. Resource strains come quickly to mind as we live in an era of heightened climate awareness.

Interestingly, as the world’s population tips over eight billion, India is very soon set to overtake China as the most populous country in the world. Asia poses a conundrum. As the middle class grows, especially in less developed countries, so does energy intensity. More than one billion Asians will likely join the global middle class by 2030. We all know about China’s rising coal use or the fact that India can’t pledge to net zero until 2070. And as such, certain Western ivory towers have clearly been guilty of pointing the finger of blame towards Asia for climate change. While I won’t get into development economics or morality arguments here, I do find the reverse of these assessments very interesting. That is to say that without Asia we have little to no chance of meeting any long-term impactful climate goals. For capital allocators, this is an underappreciated opportunity.

To illustrate, let’s consider some examples.

China (and solar)

In 1956, the cost of one watt of solar capacity was $1,825. Now it can often be less than $1. In the last decade alone, solar energy has become 90 per cent cheaper. The cost has fallen below fossil fuel in most major countries. China has had a considerable part to play in this advancement. Manufacturing requires fundamental components: modules, cells, polysilicon, and wafers. China’s capacity share is 75 per cent, 85 per cent, 79 per cent and 97 per cent, respectively. Interestingly, only around one-third of demand comes from China, which is of growing export importance to the country.

Why is China so dominant? The short answer is that it’s due to technology and investment. The country makes up almost two-thirds of large-scale global investment in solar. In the first half of 2022, they invested over $40bn, a 173 per cent increase year-over-year. Significant capital investment in capital-intensive industries can be a self-fulfilling prophecy (the semiconductor foundry industry is a case in point). Solar is not just an industry where manufacturing expertise is essential; new technologies can also be used to drive efficiency. To give just one example, LONGi Green Energy, the world’s largest solar manufacturer, spoke to us recently about using sophisticated software and drones to place electric substations in distributed solar generation.

Taiwan (and chips)

The reference to the semiconductor industry above takes me next to Taiwan. Last year, our head of Emerging Markets wrote an article entitled, The Possibilist, about the chances of the 2020s being a much better decade for Emerging Market investors than the 2010s.

Within this article, there was one point that stuck with me more than most:

“To be clear, this is not a narrow call for EM investors to buy energy and commodities at the expense of technology. The energy transition may be as important an investment theme in the coming decades as Moore’s law has been in previous decades, but they will continue to feed off each other as chips and software are added to renewable supply chains or EV platforms while robotics, quantum computing and other as-yet unimagined industries demand more power.”

As a result of both supply chain vulnerabilities and geopolitical tensions, it’s become more widely understood just how important Taiwan is to the global semiconductor supply chain in recent years. As technology is used to manage climate change better, the importance of high-end microchips is likely to increase further. Currently, one company does around two-thirds of the global manufacturing of such chips. This is a clear instance of over-reliance, but one that is unlikely to change any time soon.

The number of power semiconductors used in global renewable energy is expected to grow with a compound annual growth rate (CAGR) of 8 per cent to 10 per cent from now to 2027. End applications range from electric vehicles (needing circa 2,000 chips on average) to efficient grid power management. As Caterina Favino, a journalist at earth.org, puts it, “chips harness, convert, transfer and store renewable energy as electricity and subsequently move it onto the electric grid with minimal loss of power.”

Indonesia (and materials)

Coal generation accounts for about 60 per cent of Indonesia’s electricity today. The government has publicly stated its aim to lower this reliance. However, this is a complex transition and is a good microcosm for the broader conundrum referred to in the introduction. We’ve been encouraged that the Asian Development Bank has recently issued an important Energy Transition Mechanism (ETM) for Indonesia, which supports the early retirement of coal plants to derisk any losses (both monetary and energy). Divestment is unlikely to be the answer. Instead, the mechanisms require a well-thought-through early retirement strategy. In the very long term, however, coal may not be the most important resource in Indonesia.

At the G20 Summit in November 2022, Joko Widodo, Indonesia’s president, made it clear that the country is very open to foreign investment. This has been on an upward trajectory for the last decade, having nearly quadrupled since 2010. Metals processing and manufacturing are critical to this. Significantly, Indonesia is home to almost 20 per cent of the world’s nickel. It’s easy to envisage a scenario in which Indonesia becomes a more strategic partner for other countries that cannot boast this resource.

As we’ve discussed with many of you before, the importance of nickel in the electric vehicle industry is of growing significance, though only about 7 per cent of the global nickel supply currently goes into batteries. We’re at a very early stage of growth here. The Czech-Canadian scientist and author, Vaclav Smil, suggested that even if 25 per cent of the world’s EV fleet were electric in 2050, our nickel requirements could grow by a factor of 28.

For around five years, in our EM and Asian equity portfolios, and some others at Baillie Gifford with a broader remit, we have been investing in nickel producers, including those with deposits in Indonesia. Globally, in the last decade, $5.5bn has been spent on new nickel projects, with only two significant discoveries. In the 19 years before this, there were 20 significant discoveries, which equated to around 15 times the amount of material. This suggests that the low-hanging fruit has been obtained, and we need higher prices to attract more development!

South Korea (and batteries)

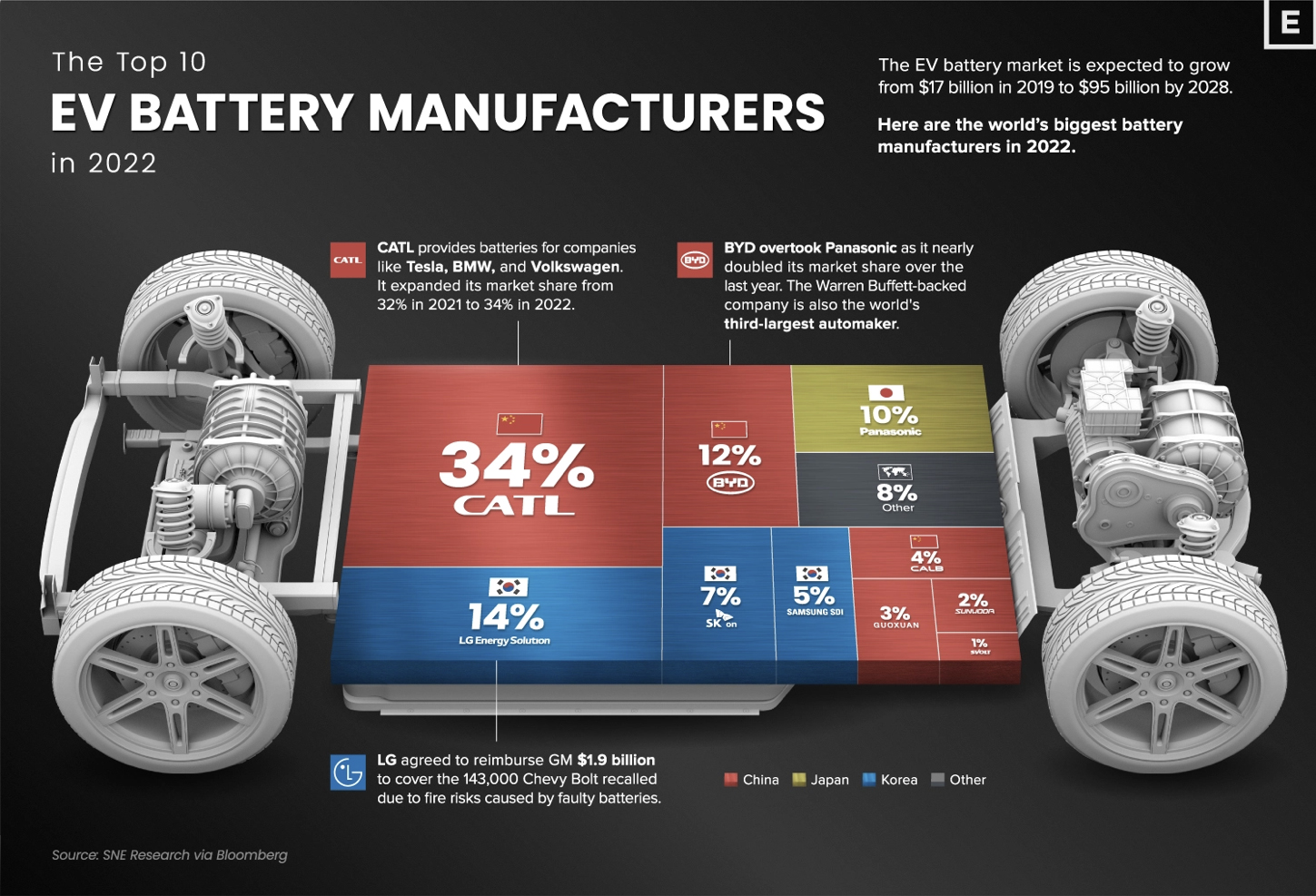

Sticking on the electrification of transport (which has the highest reliance on fossil fuels of any sector according to the IEA (using 2021 data), it is clearly not only the materials that are important in this trend but also batteries themselves. Alongside China, South Korea is home to some of the world’s most important actors in this market, including Samsung SDI, SK On, and LG Energy Solutions. Between them, they supply some of the critical global auto companies; the Korean government considers rechargeable batteries among the key industries for the country’s future economic growth. Its largest companies are investing tens of billions in research and development and benefit from significant government support through tax cuts to do so.

While China has the largest market share in electric vehicle batteries today, the last few years have made it more critical than ever for global automakers to ensure they are not overly reliant on just one country. Korea is very likely to be a real export beneficiary here. Looking at LG Energy Solutions, for instance, we can already see that its customer base already includes majors such as Tesla, VW, Renault, Audi and General Motors.

India (and hydrogen)

India’s economy is growing at such a clip that it needs to plan carefully for its future electricity demand. It is likely to need to build as much additional generating capacity by 2040 as the European Union currently possesses!

India is heavily reliant on traditional energy at present. Still, it often gets missed that over the last 12 years, proposals for over 600GW of coal-fired power in India have been scrapped or postponed. For context, this is about three times the current installed base of coal plants. At the state and company levels, there are clear ambitions for new energy.

The Indian Prime Minister, Narendra Modi, wants to increase non-fossil fuel power generation by three times by 2030. This would mean building the equivalent of the country’s total generation capacity again, which needs hundreds of billions of dollars in investment. Large conglomerates such as the Adani group, Reliance Industries and Tata have a massive role in these plans. Reliance Industries is likely to be especially important. This is a company that has proven it has world-class engineering expertise in building and operating one of the most complex refineries in the world. As well as this, it has shown that it can take bold and effective capital allocation decisions to build a colossal 4G network in India for over 400 million people in just a few years.

In November 2022, during COP 27, India submitted its long-term low-emission development strategy. There were six salient features, with green hydrogen production highlighted in item one. Producing green hydrogen by electrolysis from renewable sources involves breaking down water molecules into oxygen and hydrogen. Reliance Industries’ ambitions include making India the first country to produce green hydrogen for $1 a kilogram within a decade (the current cost is four times that). While it’s too early to determine with certainty whether the company will be successful, it is already one of the largest grey hydrogen producers globally. It has several key ingredients on its side: an ambitious management team, government backing and engineering expertise, to name a few.

Conclusion

There is an important point to note alongside the positive examples shared here. Under all International Energy Agency (IEA) projections for energy usage, including even the most aggressive transition scenarios, traditional energy will continue to play a vital role in both developed and emerging economies for decades. Investing in the most responsible and low-carbon fossil fuel companies remains necessary to minimise the inevitable impact of carbon emissions from these companies over the coming years.

However, the complexities of balancing the need for clean, affordable, and secure energy are likely to be particularly acute for the world’s least affluent people. Asian countries are currently responsible for a considerable portion of global emissions due to their size and stage of development. But as the continent develops further, Asia stands to play a critical role as a solutions provider for the energy transition. There is a danger that reductive scoring techniques disguised as ‘ESG integration’ miss the wood for the trees on this point.

We expect many vital technologies and resources to be developed in Asian economies, which will command more attention from capital allocators in years to come. Here I have identified just five examples. Such is the dynamism of Asia, however, that it’s almost inevitable that there will be countless more in the coming decades.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

29013 10017278