As innovation accelerates, technology is being applied more widely and to greater effect. Whether you measure it by increases in computing speed, the adoption of industrial robots, global research inputs or the scale and accuracy of artificial intelligence applications, there is abundant evidence that we are experiencing transformative change.

Elsewhere, I have considered what this means for the future of productivity. Here, I want to address another aspect: how does automation impact inflation prospects over the next decade and beyond?

How automation and inflation might be linked

Sustained wage increases are a core part of the textbook inflationary model. However, I will focus on the interaction between technology, labour markets and inflation to suggest that we can no longer assume such an outcome as a result of automation.

Wages and inflation can be linked in different ways.

On the demand side, when there are low levels of unemployment the labour market has stronger bargaining power. Therefore, higher employment levels in a booming economy can lead to rising wages, leading to higher prices, prompting further wage rises. Or inflation can result from a supply shock: soaring input costs lead to rising prices, causing higher wage demands and setting off an inflationary spiral.

As such, the relationship of automation to inflation depends critically on its impact on labour markets. Traditional theories of economic growth do not typically allow for the possibility that technology can have any detrimental, long-term impact on labour markets.

They argue that new technologies may substitute for labour in the short term. In doing so, they increase productivity, leading to more aggregate demand and hence more employment in fields in which workers retain a comparative advantage. As a result, real wages and productivity should broadly rise in tandem over time, producing a stable labour share of total output.

Traditional inflationary models no longer hold true

Economic theory is wrong to assume that technology should always enhance real wages and maintain the labour share of output. In this regard, Daron Acemoglu and Pascual Restrepo have spearheaded an evolution in economic thought. With some simplification, their framework distinguishes between technologies that are:

- Labour-augmenting

A technology that generally boosts productivity without leading to job losses, often increasing workers’ value.

An often-cited example is the introduction of automated teller machines (ATMs) in the 1960s. Many presumed the cashpoints would lead to fewer bank tellers. However, the number of bank tellers in the United States doubled in the 40 years from 1970 as the machines freed them from the routine task of dispensing cash. Tellers focused on higher-value-added activities, such as selling products. That boosted profitability and led to an expanded branch network.

- Labour-displacing technology

A technology that involves the direct substitution of capital for workers.

One example is spinning machines replacing skilled artisans during the Industrial Revolution. They spun far more cotton mechanically than human workers could by hand. That made skilled artisans less, not more, valuable.

One of the critical insights of Acemoglu and Restrepo (2018) is that while job displacing technology always, by definition, leads to job losses in the short term, it may or may not lead to an improvement in employment and wages in the long term.

For the impact to be positive overall, at least one of two things must hold:

1. The new technology increases productivity

Higher productivity increases aggregate demand. That leads to more output and, therefore, more employment in non-automated tasks. That may be at firms that are automating or in other firms whose input costs have gone down.

2. The new technology creates new tasks in sectors where labour has a comparative advantage

The spinning machines of the early Industrial Revolution displaced artisans. That ultimately led to the creation of factories and supervisory and administrative roles that had not existed before.

If either of these holds, adopting technology should have no long-term detrimental impact on employment and wages. But it is not inevitable they will hold. Indeed, there are several circumstances in which they might not. For example:

- New technology might not increase productivity very much, or indeed at all, if it is not very good or is introduced for reasons other than its impact on output.

- The productivity gains from automation might not be reinvested in expanding output. That may be because the firms to which those gains accrue are unable or unwilling to invest the proceeds in expanding overall production.

- New tasks might not be created. Or, if they are, the constant expansion of the technological frontier means they might not be tasks that humans are better at, particularly if they require advanced skills that the existing labour force has not acquired.

This framework helps to explain changes over time in the labour share of income, which traditional growth theories do not adequately capture. While real wages and productivity have broadly been stable over the very long term, there have been long periods when that has not been so.

Technology’s impact on labour

During the first several decades of the Industrial Revolution, the growth of productivity that accompanied a wave of innovation saw a pronounced decline in the labour share of income.

As Frey (2019) points out, between 1780 and 1840, output per worker in the UK grew by 46 per cent, but real weekly wages rose by about 12 per cent. Given that hours worked went up, wages almost certainly declined. It was only from the mid-19th century that the pattern reversed, and wages began to catch up again.

Frey explains this using Acemoglu and Restrepo’s framework. With some simplification, the early Industrial Revolution was a period in which technology was heavily labour-displacing as mechanisation replaced skilled artisans.

Because the early industrial technology was relatively simple, children frequently operated it. By the 1830s, children made up about half the UK’s textile industry workforce. Skilled artisans were displaced and struggled to find alternative employment. In short, the new tasks created by technology were sufficiently low-skilled that labour did not have a meaningful comparative advantage and, therefore, found itself in a weaker position.

But a significant shift occurred between 1870 and 1980. Real wages and productivity began to move broadly in line. There are several reasons why. First, the introduction of the steam engine and latterly, electricity led to the introduction of more intricate machinery that needed skilled adults to operate it.

At the same time, factories became larger and industrial operations more complex, creating a new wave of jobs. Employers added administrative and supervisory roles, including managers, clerks, accountants, salespeople and engineers.

As the 20th century progressed, rising real wages and innovation combined to produce a benign cycle. Consumer goods, from washing machines to cars, dropped sharply in price. That boosted consumption and created new jobs in industries that had barely existed 50 years earlier.

For example, from the launch of the first modern internal combustion engine in the 1870s, the automotive industry grew to employ one million Americans directly by its peak in the late 1970s and countless more indirectly.

Technology made labour more productive by pushing workers into roles that required specific human skills. Crucially, educational attainment rose at the same time. The increased aggregate demand manifested itself in rising consumption and many new jobs.

Automation is no longer positive for (some) workers

Things have changed since the 1970s. There is a growing evidence that automation is weakening labour’s bargaining power.

Acemoglu and Restrepo (2020) studied robot adoption across a range of local US labour markets between 1990 and 2007. Even adjusting for the tendency of displaced workers to find new roles, they find that the net effects of technology on both overall employment and labour share were negative. One more robot per thousand workers:

- Reduced the aggregate employment-to-population ratio by about 0.2 percentage points

- Led to a fall in wages of about 0.4 per cent

- Reduced employment by approximately 3.3 workers.

Such falls did not occur in the century after 1870, when rapid innovation went hand in hand with rising wages and a stable labour share.

What was different this time? I think there are at least two things at play:

1. There has been a structural shift in the types of technology adopted, from labour-augmenting to labour-displacing.

2. As technology can do more, and is becoming significantly cheaper, its use is widening out across a broader set of industries.

The structural shift to labour-displacing technology

There has been a shift towards adopting technology that automates existing tasks rather than merely enhancing them, ie a shift from labour-augmenting to labour-displacing technology.

One way to make this point is to observe the significantly increased penetration of technology explicitly intended to automate human activities – especially robotics.

As the chart below shows, the adoption of industrial robots has accelerated significantly in recent years. Immediately before the financial crisis of 2007–2009, robot adoption in developed countries was running at between one to five robots per 10,000 workers per annum. Today, the annual installation rate is about two-times higher in most countries and three-times higher in Japan.

Annual robot installations per 10,000 workers

Unlike many other forms of technology, robots are labour-displacing. That is both intuitive – robots are intended autonomously to carry out functions performed by workers – and empirically demonstrable.

In their study of the impact of robots on US employment levels, Acemoglu and Restrepo (2018) compared the impact of robotics to the wider information technology category. They found a notable difference: robots were persistently and significantly labour-displacing in a way that IT is not.

In addition, as automation technology is capable of more and its cost declines, it is used across a broader base of industries. Today, robots are predominantly used in manufacturing applications. The vast majority are installed in the automotive and electronics industries. But robot penetration of services is growing rapidly from a small base.

That is particularly true in logistics, where robot installations have grown at a 45 per cent compound annual growth rate (CAGR) in the past three years. Boston Consulting Group has forecast that the global robotics market will grow between 22 and 31 per cent each year until 2030.

And robot adoption is expanding to a much broader range of service industries – from food service to nursing homes.

The workforce has not adapted to new tasks

In theory, the fact that new technology is more labour-displacing than in the past should not matter to overall labour market prospects. After all, if a new technology boosts productivity, it should lead to increased employment. And new technology should, as it always has, create new tasks in which humans have a comparative advantage, which in turn ought to support rising wages.

In the early years of industrialisation, new technology was so basic that children could operate it – and often did. But as technology has progressed, the degree of skill required to benefit from the new roles it created has gone up: either directly in operating it, or indirectly, in the new jobs it has catalysed. We can show that by looking at changing educational requirements in the job market.

As late as 1870, only 10 per cent of Americans worked in jobs that required education beyond elementary school (Frey, 2019). With more complex machinery, manual work became more skilled and the newly-created administrative and other functions typically required at least some formal education or on-the-job training.

In 1992, 48 per cent of the US labour force worked in roles requiring no more than a high school diploma. Nearly two decades later, that figure had fallen to 33 per cent. Those with Bachelor or advanced degrees has risen from 26 per cent to 39 per cent (Bureau of Labour Studies, 2017).

Technology and its associated tasks’ rising complexity is not a problem for labour so long as the educational attainment of workers rises at a pace commensurate with the increase in required skill levels. And for much of the 20th century that is precisely what happened.

Recently, however, educational attainment has been slowing. Goldin and Katz (2021) note that the supply of college workers increased at about half the pace post-1980 compared to the preceding two decades. Still, new roles created by technology continued to increase at a similar rate. As a result, the level of skills fell short of what was needed, and the premium to highly qualified workers increased markedly.

As the skill content of new jobs continues to rise, the supply of workers able to fill them is not keeping pace. The benign relationship between technology, skills and new jobs seen in the century after 1870 has broken down. Instead of a constant rise in skill requirements, skill levels, productivity and wages, labour markets have become bifurcated.

The schism in the labour markets

Technology is increasingly hollowing out middle-skilled manual jobs. It is creating productive new roles, but those are increasingly reserved for a class of highly-educated workers with the necessary skills.

So, what happens to displaced workers? The evidence suggests two outcomes:

1. they are pushed increasingly into the (ever-shrinking) number of lower-skilled roles that cannot be automated and are paid lower wages

2. they drop out of the workforce entirely.

There is an increasing tendency for labour markets to resemble a skills ‘barbell’.

Highly-skilled roles are growing. The same is true for many lower-skilled roles. These involve tasks that, to date, have proven less susceptible to automation, from cleaning to call centres.

However, it is the middle section of the labour market that is suffering. It covers moderately-skilled, mainly manual jobs, which are highly susceptible to automation.

Autor (2015) analyses the changing occupational structure of the US labour market since 1940. He shows that since 1980, there has been clear bifurcation with professional and managerial roles growing significantly while skilled blue collar and operative/labour roles have declined.

Growth rates of higher-skilled roles have accelerated as, to a lesser degree, have lower-skilled service jobs. However, there have been sharp declines in middle-skilled roles that are inherently more capable of being automated, ie blue-collar and clerical work.

There are significant consequences. The hollowing out of the middle of the skill distribution, and the narrowness and inaccessibility of the opening at the top, are pushing increasing numbers of workers into lower-skilled roles. So low and middle-skilled workers increasingly compete for the same pool of occupations more immune to technology.

That suppresses wages at the lower end of the distribution, producing increased labour market polarisation as skilled wages continue to soar. As the chart below shows, this premium has become increasingly concentrated among those possessing advanced degrees rather than just college degrees (Congressional Research Service, 2020).

Per cent difference in average wage relative to education

Source: Congressional Research Service, 2020.

Before the Covid outbreak, unemployment rates in many countries were approaching all-time lows. But the figure hides those frustrated workers who cannot find jobs that meet their skills and fall into part-time work or out of the workforce entirely. Their plight explains why headline unemployment rates can sometimes portray an inaccurate picture of the actual state of labour markets.

What, practically, has this meant for wage inflation? After all, skills have not kept up with demand, which should push wage inflation up rather than down. And, indeed, that has happened – but only for the small segment of the workforce whose skills are in relatively higher demand. In the US, over the 35 years to end-2019 nominal wages increased on a per annum basis by:

- 9 per cent for the top quintile of income

- 4 per cent for the third quintile

- and 2.7 per cent for the bottom quintile

Only the top quintile saw wage growth keep pace with output. These distributions are highly skill-based: college graduates make up approximately 80 per cent of the top quintile, but only about 15 per cent of the bottom.

What does that mean for inflation?

Unlike many commentators, I am not forecasting a future of sharply rising unemployment. Changes in working-age populations in the developed world mean that labour forces are set to shrink, meaning automation will replace workers where free hands are scarce.

However, the conclusions of this paper are significant for the future evolution of employment and wages. The core thesis is as follows:

1. As technology improves and its adoption becomes more widespread, the bifurcation of the labour force will continue

2. High-skilled roles will attract an increasing premium

3. However, there will be hollowing-out of more easily automated, middle-skilled jobs

4. Increasing numbers of workers will compete for roles that are less susceptible to automation

5. The competition will hold down salary growth in many segments

6. Depressed wages will weigh on overall inflation.

What impact might this have? For the sake of illustration, let us say that Acemoglu and Restrepo (2018) are correct that adding one robot per 1,000 workers leads to a decline in wages of 0.4 per cent. The US (pre-pandemic) was installing about 0.3 robots per 1,000 workers, which implies a relatively small additional impact from robots of about 0.06 per cent per annum on employment/population and 0.12 per cent per annum on wages.

Put differently, the total robot stock today is consistent with the employment/population ratio being around 0.5 per cent lower and wages 1 per cent lower than they otherwise would be.

But this almost certainly understates both current and future impacts.

To illustrate, assume robot density continues to expand at the rate of recent years (10 per cent per annum since 2015). Over the next five years, the employment effect would rise to 0.1 per cent per annum and the annual wage effect to 0.2 per cent per annum – and that assumes that the displacement effect of robots does not increase in that time, which seems implausible.

At Japanese levels of robot installation, the effect would approximately double. That alone is not transformational to the long-run inflation outcome, but it represents a meaningful and growing disinflationary influence over time.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

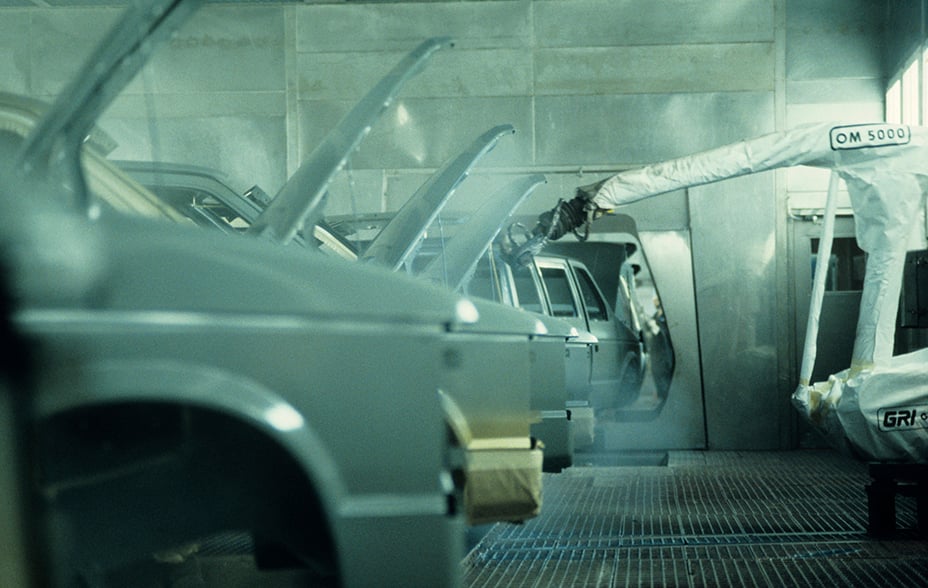

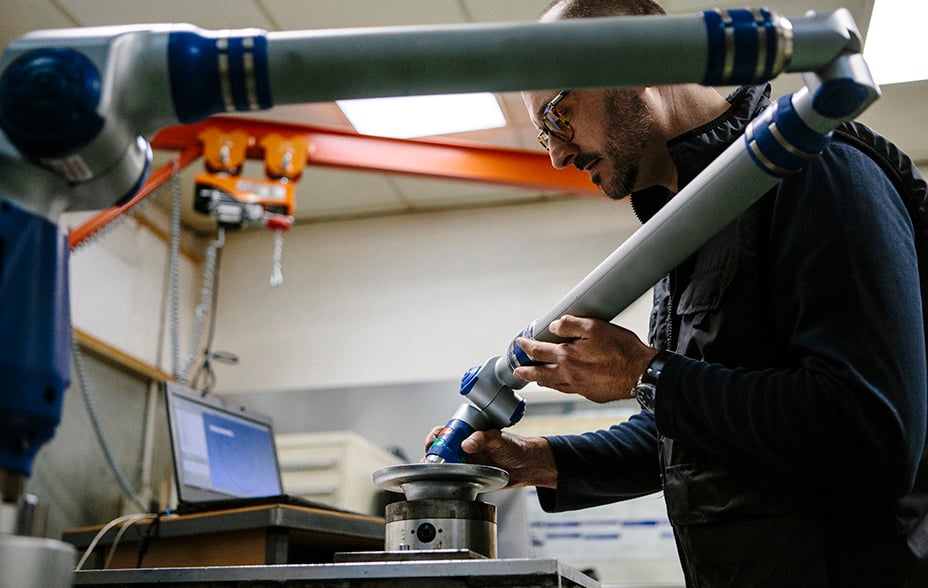

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 27483 10016242