Key Points

- Loosely defined Environmental, Social and Governance (ESG) investing is in danger of undermining the very progress it purports to promote

- To be effective long-term investors we must seek out the wider implications of growth at every company we consider

- Impact takes many different forms and we, the US equities team, are defining what it means to us

All investment strategies have the potential for profit and loss, capital is at risk. Past performance is not a guide to future returns.

As an industry, it feels like we are heading down the wrong path. Loosely defined ‘ESG’ investing is in danger of undermining the very progress it purports to promote. A focus on metrics encourages the flow of investment dollars into businesses large enough to ‘afford to care’ where disclosure and Corporate Social Responsibility become tools to preserve their position in the corporate order. This is not what drives change and societal progress. Innovation drives progress. New businesses bringing paradigm-shifting technologies to market drive progress. Those businesses need investor support, especially in their earlier stages, and that support can both enable change and enhance returns for shareholders. Done well, investment strategies with explicit impact objectives have an important role to play in moving the industry forward. But by far the greater weight of equity capital resides outside of this sphere and allowing this to fall into a box-ticking trap that unwittingly serves the status quo brings with it tremendous risk.

We believe that we can do much better. Our US Equity Growth strategy is not an impact strategy in the industry sense of the word. But that doesn’t mean that we have no impact. We resist the artificial separation. We are part of the investment ecosystem, as are our clients’ capital and the companies to which we allocate that capital. To be effective long-term investors we must seek out the wider implications of growth at every company we consider. We must recognise the impact of the capital we allocate and consider the purpose of every engagement we undertake. The support of a long-term shareholder can give a business license to take risks in the pursuit of progress. Directed engagement can nudge businesses towards better long-term outcomes. Impact takes many different forms and we, the US equities team, are defining what it means to us.

Changing the narrative

The dictionary has two definitions of impact: ‘a marked effect or influence’ or ‘the action of one object coming forcibly into contact with another.’ The current industry view of impact has aligned neatly with the former, focusing primarily on companies. This makes sense. We too have previously written about our clients’ capital impact and on the role of companies which can influence, and drive change beyond their boundaries.

Less time though, has been devoted to the latter definition, ‘the action of one object coming forcibly into contact with another’, yet this is potentially the most intriguing, and if harnessed effectively, the most powerful. This definition better captures the broader investment ecosystem and the role of investors and capital itself. The impact investing trinity of (1) company impact (2) investor impact and (3) capital impact. By exploring these three components, perhaps we can reach a more holistic definition of impact.

1. Company impact

It’s abundantly clear to us that a small group of companies are going to be instrumental in driving significant and sustainable social and environmental contributions over the coming decades. On the surface, the investment industry appears to recognise this too, as seen by the growth of the impact investing ‘category’ and explosion of ‘ESG’ ratings and ‘sustainable’ versions of stock indices. Whether much of this is a genuine belief in the power of actual long-term investing to bring about change is up for debate. Tesla’s removal from the S&P 500 ‘ESG’ index, replaced by an oil refining company, while ExxonMobil remained in the top 10, suggests there is much to improve.

‘ESG’ scores for companies are of limited use. They tell us little about the impact a company may have on society over the next 10 years. The impact investing ‘category’ that is evolving, while admirable, is too limited and restrictive. The requirement to measure and report on the impact that an investment is having sounds intuitive. But it is impossible to measure all impact. There is subjectivity and nuance to the long-term impact that any company can have. Even if it is hard to measure, does that mean the company isn’t an ‘impact investment’ or won’t have an impact?

We believe that sustainability is inextricably linked to being a long-term investor. Social and environmental impact is part of the broader holistic view of company sustainability. For us, ‘long term’ means sustainability. You cannot capture more value than you create for any length of time; companies that do this will not survive. Those that thrive in the long run will deliver more value than they capture.

Here are two examples of companies we invest in that have a ‘medium ESG risk score’ (whatever that means), and where their long-term impact is hard to measure, but likely to be profound.

Shopify: a counterexample to received wisdom

Shopify is a Canadian ecommerce company. By offering a platform that removes barriers to operating a business online, it allows businesses to quickly establish their ecommerce presence to sell, ship and process payments. This creates the potential for greater consumption, a subject of increasing concern from a sustainability standpoint. However, while considering the seemingly direct environmental impacts of a business, we believe that it is important to examine the impact companies have on achieving sustainability more deeply. In fact, Shopify has an important role to play in driving sustainable commerce globally through efforts such as:

- Shopify’s Sustainability Fund, which is investing in high-potential technologies at the frontier of the carbon removal industry

- Influencing its millions of merchants to adopt more sustainable business practices, such as the Offset App

- Developing lower carbon shipping options in its supply chain

- Its platform is carbon neutral, 100 per cent of employee home offices are powered by wind energy in North America, and every payment through Shop Pay removes carbon from the atmosphere

Yet virtually none of this influence and potential impact comes through in headline third party ‘ESG scores’ for Shopify.

Watsco: a company driving change beyond its boundaries

Heating, ventilation, air conditioning and refrigeration (HVACR) company Watsco is not a household name. Its business model doesn’t grab many headlines either: as the leading distributor of equipment and parts in the US, it focuses on acquiring other businesses to grow.

However, this overly simplistic description fails to capture Watsco’s unique long-term culture and its influence beyond ‘just growing market share’ through acquisition.

For example, five years ago Watsco created a new division, Watsco Ventures. Watsco is driving the digitisation of the HVACR industry through innovative software solutions that have helped thousands of businesses and HVACR entrepreneurs succeed and grow – while accelerating the adoption of more efficient HVACR systems that help businesses and consumers reduce their carbon footprint, improve air quality, and reduce waste.

Some Watsco Venture company examples:

- OnCall Air, a digital sales platform that helps contractors sell high efficiency products while boosting their business development.

- Credit for Comfort, a financing solution that makes payments affordable so consumers can make better choices

- Alert Labs, a 24/7 remote monitoring IoT devices for A/C, leaks and floods that helps reduce and prevent water loss.

The nuances of the potential long-term impact of Watsco and Shopify can’t be captured in a single ‘ESG score’. Therefore, we believe company impact is better defined as a combination of quantitative and qualitative elements that explore the following key factors: why a company exists (its purpose), the problem it is trying to solve (and how important that is to its purpose), and its ability to influence beyond its measurable boundaries. All this is amplified by the ‘force’ a company has, in other words its scale and its growth rate. Can it move the needle?

2. Investor impact

Impact as ‘the action of one object coming forcibly into contact with another’ is about our role as investors in helping companies to deliver on their reason for being, as well as aligning ourselves with their purpose and doing all we can to support them in achieving it. We must recognise that our engagements can be additive to their overall impact.

The ‘physics’ of investor impact

The concept of force implies magnitude, but also direction, i.e. moving something somewhere. Impact is the difference between a scalar and a vector:

| Type of motion | Scalar | Vector |

| Description | Described by magnitude only | Magnitude and direction |

| Example | Five miles | Five miles due north |

| Investing Equivalent | An ‘ESG score’ for a company based on its existing policies | Working with a company over time on its journey towards a strategically important issue |

Distance is one example of a scalar quantity. ‘A marathon is 26.2 miles’. It doesn’t matter in which direction; a marathon is defined by its magnitude. It tells us nothing about the path taken to run the distance. The New York City Marathon starts in Staten Island and finishes roughly 12.3 miles away, on a North-North East bearing which lands you in Central Park. That’s the vector sum of all that sweat and effort, a straight line drawn through hundreds of shorter vectors charting the twists and turns of the route. While the runners may feel downcast about their smaller vector total, if that evening they return to the same hotel room they started the day in then the vector sum of their movements will have dwindled to nothing at all.

The investment equivalent is shown in the table above. Engaging on a topic with companies because it is a measurable metric alone will generate work and take time (both scalar quantities) but it may not move a company towards its goal. It could be a zero-vector sum effort. Meanwhile, supporting a company on a strategically important issue which advances its long-term purpose has magnitude and direction. In other words, ESG scores are scalar. Actual investor impact is a vector. And marathons are really hard.

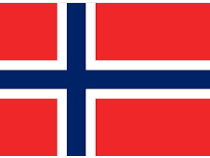

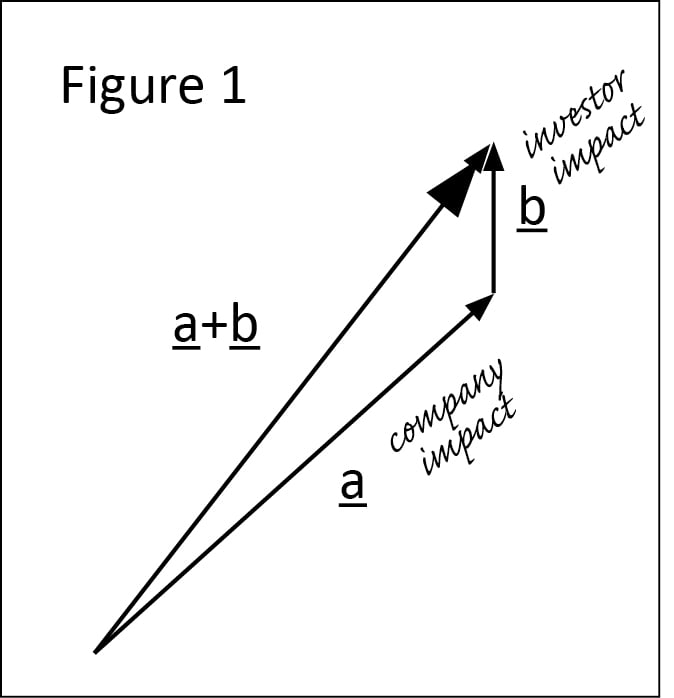

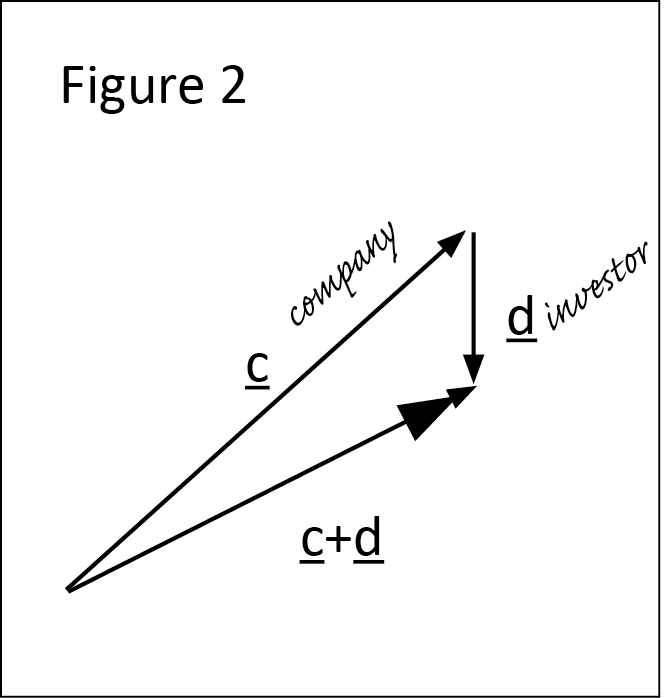

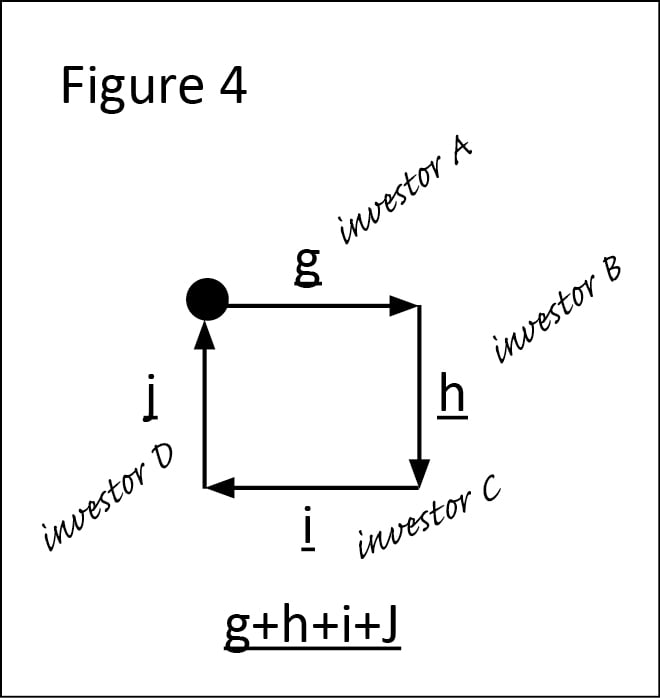

Exploring this analogy further through pictures, vectors can be represented graphically as arrows. Here, the arrow length shows the speed of change a company is driving (the magnitude), and the direction of the arrow shows the direction the company must travel to fulfil its purpose.

These diagrams below illustrate how investor interactions with companies can impact them in broadly three different ways:

1. Accelerate the change a company is driving

2. Negatively contribute/detract from the change

3. Potentially cause a stall in progress towards its goal or stop it altogether

Figure 1 shows how engagement with a company (a) in a way that is directionally aligned (b), can result in an acceleration toward the desired goal.

e.g. a company with beneficial technology, the provision of capital and considered engagement enhances the company’s success.

Figure 2 illustrates the opposite. Investor engagement (d) is not directionally aligned and reduces the speed and impact a company (c) can achieve.

e.g. a company which has been actively hindered by the requirements of the ‘ESG industry’, detracting from its long-term impact.

Figure 3 shows how forces (e and f) working in opposing directions, can significantly reduce the speed at which a company can deliver on its purpose and deliver its impact.

e.g. ExxonMobil. Investors can tug it in the opposite direction to its core business and purpose but do little to change the company’s direction.

Figure 4 illustrates the consequences of complete misalignment; engagement is high but directionless, the company fails to make any progress in delivering on its purpose. Impact is zero.

e.g. A biotech company with so many competing demands from the investment industry may get nowhere, particularly if it is capital constrained.

When impact is viewed as a vector, our role as investors is additive if correctly aligned; we have the potential to be an accelerating force. Thus, investor influence is important. It is not just about identifying, buying and holding companies for long periods, it is about the thoughtful consideration of where engagement is most valuable and how it can help deliver, and potentially accelerate long-term missions.

Making waves

Another way to conceptualise this is to think of a wave. The size of waves on a given day is determined by numerous factors including wind direction and positioning of the moon. But wave sizes also vary wave by wave because of interactions. Every so often a set of larger waves occur because smaller waves travelling at slightly different speeds, but in the same direction, combine to create what is known in surfing as a ‘bomb’ set. A set of waves which, in essence, ‘cooperate’ to create an even larger wave, a wave with far greater momentum and force. All the constituent parts of the wave are pulling in the right direction. If we, as investors, would like to drive change, we should be looking to create bomb sets, rather than generating cross winds which flatten.

Moderna: support impact in action

At the Moderna AGM in April 2022, shareholders were asked to vote on a resolution to commission a third-party report analysing the feasibility of promptly transferring IP and know-how to facilitate the production of Covid-19 vaccine doses by qualified manufacturers in low- and middle-income countries. We opposed this resolution.

We did not come to this decision lightly. We care deeply about equitable access to vaccines and, as with every proposal we are asked to vote on, took this resolution extremely seriously.

Our investment managers had regular meetings with Moderna’s management and the chair of the board in the lead up to the AGM, to thoroughly explore the nuances of the situation, and to come to our decision. These meetings, built on a relationship that predates the company’s IPO in 2018, gave us comfort that Moderna’s leadership has deeply explored the feasibility of safely licensing its technology and to whom, in consultation with stakeholders, such as the World Health Organization. We also engaged with Oxfam on their proposal in March 2022 to ensure we fully understood the concerns raised, and to help guide our further engagement with Moderna’s management.

We did not believe that there was a requirement for a third-party report into this issue. We trust the management’s view that further technology transfer to companies in low- and middle-income countries is not the best use of its limited resources in the immediate future, although they will continue to consider this where appropriate, and that the main bottlenecks to ending the pandemic are no longer in vaccine supply, but in last-mile distribution. We also trust the management’s decision to take a cautious approach to enabling the safe proliferation of the mRNA platform around the world to ensure that its enormous potential can be realised over the long term. The steps Moderna is taking to expand access to mRNA technologies in the future and ensure the world is better prepared for future pandemics are commendable.

Opposing this resolution allowed management to focus on these issues, as well as its extensive product pipeline. While we share the goal of ending the pandemic as soon as possible, we do not believe that passing this resolution will have led to its swifter end, nor was it in the best interest of our clients. The resolution did not pass.

Challenge as support

This is not to say that we must always agree with a company and never challenge it. We certainly do challenge our companies. It is instead, about recognising and understanding the effects of our interactions. We must ensure our impact on companies is not directionless, because while asking companies to complete ‘homework’ such as disclosing a few more metrics may seem relatively harmless, the vector illustrations above show how easily they can hamper progress. And although we believe in the long run that the needs of the entire ecosystem line up, we recognise there may need to be trade-offs that affect speed and thus velocity in the short run, but our alignment with purpose must remain constant.

Company impact plus investor impact

To summarise my argument so far, company impact is an output of its operations and behaviour. It considers a company’s reason for existence and how fundamental delivering that purpose is to its existence, multiplied by the scale of the problem, and a company’s ability to drive change through influence. The total is then multiplied by force, its scale, and its growth rate, taken to mean its ability to move the needle.

Thus:

Company Impact = (Purpose x Problem x Influence) x Force

Where Force = Mass (company scale) x Acceleration (its growth rate)

Investor impact refers to the scale of the issue being engaged upon, multiplied by how aligned that engagement is with the company’s core purpose.

Thus:

Investor Impact = Magnitude of Engagement x Alignment

But what about the money? This leads me to the third key element of impact: capital impact.

3. Capital impact

Capital is an input to impact. Its deployment can accelerate the growth of a company, which can have positive or negative results for society. We see three different types of capital impact:

- Beneficial impact

- Support impact

- Direct capital impact

Beneficial impact refers to companies which are contributing positively to society but where client capital is not playing an instrumental role. Simply buying and owning company shares that are traded in the public market is beneficial impact. Support impact refers to the fact that long-term and sizable ownership stakes can enable companies to be ambitious and take calculated risks, enabling them to deliver on their long-run potential (e.g. Amazon’s cohort of long-term and supportive institutional shareholders throughout the 2000s and 2010s). Finally, direct capital impact refers to companies where capital directly enables a company to fulfil its potential – whether that be supporting an IPO, participating in a capital raise or by investing in these businesses in private markets. These definitions are not mutually exclusive; an investment can be all three. Furthermore, beneficiary impact can be negative.

Thus:

Capital Impact = (Beneficial impact + Support Impact + Direct Capital Impact)

Zipline: Direct Capital impact

Zipline is an autonomous drone delivery company based in San Francisco. It is a private company looking to transform what is possible in logistics. Founded to ‘create the first logistics system that serves all humans equally’, it is making great progress against this goal while disrupting existing last-mile logistic solutions.

We first invested in Zipline in 2018 in our UK-listed closed ended trust. By investing via private funding rounds, our clients’ capital had a direct impact in helping the company grow its operations in Rwanda, where the forward-thinking government had hired Zipline to deliver vital blood and medical supplies to hard-to-reach rural areas. Since then, Zipline has gone from strength-to-strength, constantly iterating and improving the efficiency of its autonomous drone system, improving unit economics and branching into new countries in Africa and overseas.

Zipline’s automated delivery system is now the largest in the world. It has flown significantly more miles and made more commercial deliveries than its closest competitors to the tune of over 300,000 commercial flights, covering more than 20 million miles at the time of writing. All autonomously and with zero incidents of injury. For context, Alphabet’s drone company, Wing, has just completed its 200,000th flight, while its drones only have a six-mile range versus Zipline’s current coverage of 50 miles on a single flight.

Zipline now operates on three continents and is currently running a full commercial trial for retail delivery with Walmart in Pea Ridge, Arkansas, where anyone within a 50-mile radius can order a delivery from the local Walmart, and it will be delivered by parachute to their back garden in 15-30 minutes.

In terms of real impact, recent independent research ‘validated Zipline’s statistically significant impact on commodity availability, supply chain performance, and health impact’ in Ghana:

"Zipline’s service decreased the number of days that facilities were without critical medical supplies by 21 per cent. It shortened vaccine stockouts by 60 per cent and decreased people being turned down for vaccinations due to issues with inventory by 42 per cent. Zipline’s service also increased the types of medicines and supplies that were stocked at health facilities by 10 per cent.”1

"While countries across Africa have had to reject Covid-19 vaccines because they are too close to their expiration date, Ghana is taking them — saying, ‘Bring them here’ — because of Zipline."

Zipline has now delivered over a million Covid-19 vaccines in rural Rwanda and Ghana, playing an important role in the fight against the virus in poorer countries. And another report shows the impact on Rwanda’s health provision:

"Zipline’s instant delivery system is transforming the way blood products are stored and accessed on-demand across Rwanda…findings confirm reduction in time to access products among health facilities requesting them (often in cases of haemorrhage, anaemia, or trauma) by over and hour, on average, and a 67 per cent reduction in wastage of blood products through centralised storing and on-demand delivery protocol.”2

1. Drones can strengthen delivery of health supplies, a new study finds | Devex

2. Zipline transforms blood delivery in Rwanda - sUAS News - The Business of Drones

Pulling it together

Redefining impact necessitates the pulling together of ‘impact’ in all its alternative forms, broadening the definition beyond the company itself and integrating other players within the ecosystem. Therefore, we can redefine impact as follows:

Total Impact = (Company Impact + Investor Impact) x Capital Impact

This equation will never produce a nicely packaged number; it is too full of subjective analysis and nuance. For some that will make this equation useless, but others will recognise that at the heart of its complexity lies a simple message: the alignment of clients, companies and investors is essential for progress, and necessary to deliver the greatest level of impact. A focus on company impact in a purely quantitative way, and with little to no consideration of the role of capital and the investor, fails to recognise that the best of intentions can have huge opportunity costs; distractions, short-term maximisation and a reluctance to invest in an alternative future. Instead, we must recognise that impact and alignment go hand in hand, and capital and investors can both accelerate and hinder long-run impact.

Impact is not a scalar quantity, nor should we be naïve enough to attempt to boil it down to a single number. By redefining impact as a vector rather than a scalar quantity, we can begin to think of impact in a more holistic manner, recognising that there is a role for both quantitative and qualitative analysis in its consideration.

Conclusion

Driving genuine, long-term impact requires us to be completely honest with ourselves. Do we believe that if all the money in the world ended up in ESG or impact funds the world would be a fundamentally better place for all? If the answer is ‘no’, then we need to ask ourselves whether the path to an ever-narrowing definition of impact is the right one.

We must broaden our definition of impact to recognise the role of innovation and entrepreneurship in driving change in obvious, but also nonobvious ways such as influence. Alongside this, we should also recognise the role of our clients’ capital in funding innovation and our role as investors in supporting and challenging businesses. Big problems need big solutions, but it is unrealistic to assume that those solutions can succeed in isolation, or that they start big and impactful. The most promising ideas will always begin small, with an individual or group of individuals, a massive opportunity, and an audacious idea.

We must look to align ourselves with companies whose trajectories look promising and where our support, influence, and client capital, can accelerate its progress. Innovation has the potential to change the world. We, as providers of capital, can accelerate that change. The ‘impact’ of all players must be considered.

Important information

Risk Factors

The views expressed in this communication are those of the authors and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in August 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Any stock examples and images used in this communication are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(⾹港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(⾹港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act. This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America. The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 10013062 24801