Greg Piefer founded SHINE Technologies in 2005. © Kat Schleicher

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

Nuclear fusion has the potential to produce vast amounts of clean energy. The aim is to replicate how the sun and other stars produce heat. And unlike today’s fission-based reactors, there isn’t the risk of a nuclear meltdown if something goes wrong.

As a long-term investor in game-changing companies, Baillie Gifford has been monitoring the fusion sector for over a decade. But it wasn’t until getting to know the private company SHINE Technologies that we first invested our clients’ capital in this field, in June 2021.

Part of SHINE’s appeal is that it’s taking a phased approach to the fusion challenge. The firm is mastering activities that advance the business towards its ultimate goal but can be profitable in their own right much earlier. There are parallels to how SpaceX has built a satellite-launching business as a financial stepping stone to sending humans to Mars.

Like SpaceX, SHINE takes a bottom-up, first principles approach to innovation rather than the top-down, rules-based one of incumbent nuclear companies. In other words, SHINE questions ‘what are the true constraints of the problem?’ and then engineers new safe, cost-effective solutions instead of seeking to follow established conventions for their own sake.

That entails risks, but as SHINE’s founder and chief executive Greg Piefer explains, his firm can be nimbler and more commercially minded than government-backed fusion labs. Moreover, unlike many of its private sector rivals, the company plans to become profitable in 2024.

The following conversation has been edited for clarity and length:

Luke Ward:

What led you to found a fusion company?

Greg Piefer:

I was a nerdy kid. I liked to watch TV shows like Star Trek that had an optimistic view of humanity’s future, with people working together to solve big problems. In them, energy abundance clearly played a huge role in elevating everybody’s standard of living. So being nerdy, I’d go to online libraries and read about particle accelerators and fusion reactors. The seed was set young.

Then I went to the University of Wisconsin, where I was taught by a guy who ran the university’s Fusion Technology Institute and an ex-astronaut who had walked on the moon. The tie-in with the moon is that it’s rich in helium-3, which is ideal for fusion reactions but doesn’t really exist on Earth in huge quantities. They told us one space shuttle cargo bay full of helium-3 would run the entire United States for a year. And I was, like: ‘Holy cow.’ So it really set in deep there.

LW:

The physics involved is highly complicated, but the engineering and business model around fusion also require huge amounts of innovation too.

GP:

I’ve never wavered in my belief that fusion is the way hi-tech societies will make energy. Eventually, fusion will be much cheaper than other forms of energy generation, but it will take a much higher level of technology than what we currently have to produce it.

So I thought it’s going to be a long game, and it’s going to take a lot of funding and practice to get good at it. That led to our approach: you can do things with fusion today that can provide important value for the world and allow us to practise, establish supply chains, start to establish economies-of-scale and build the human know-how you need to pull the larger projects off. We wanted to focus on use cases that would generate a high gross margin today because we wanted the business not only to be self-sustaining but also to reinvest in technology development.

LW:

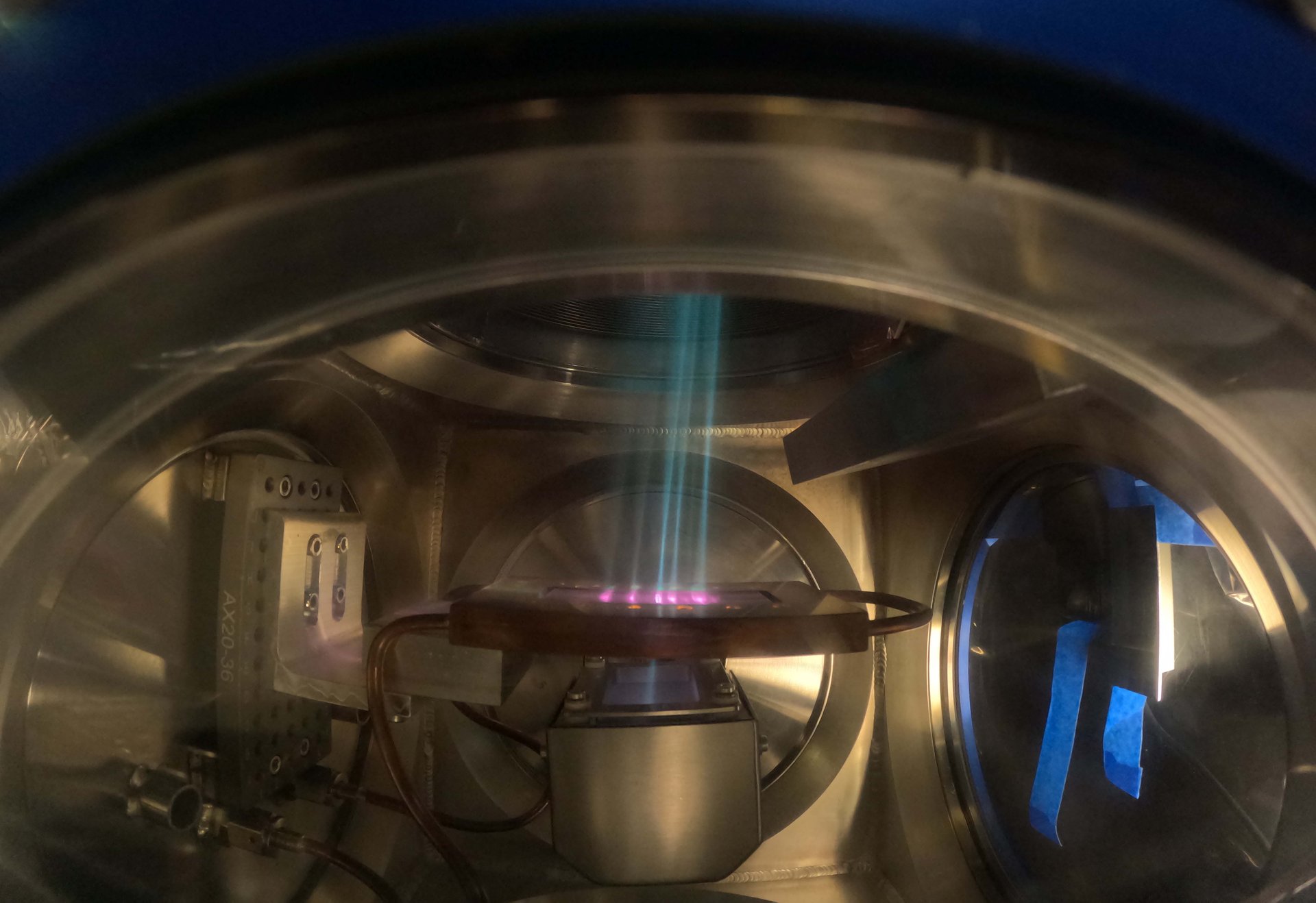

So you started by harnessing low-power fusion reactions to create neutrons – subatomic particles with a neutral electric charge – for use in advanced imaging systems. And the aerospace industry is using them to spot defects in mission-critical components.

GP:

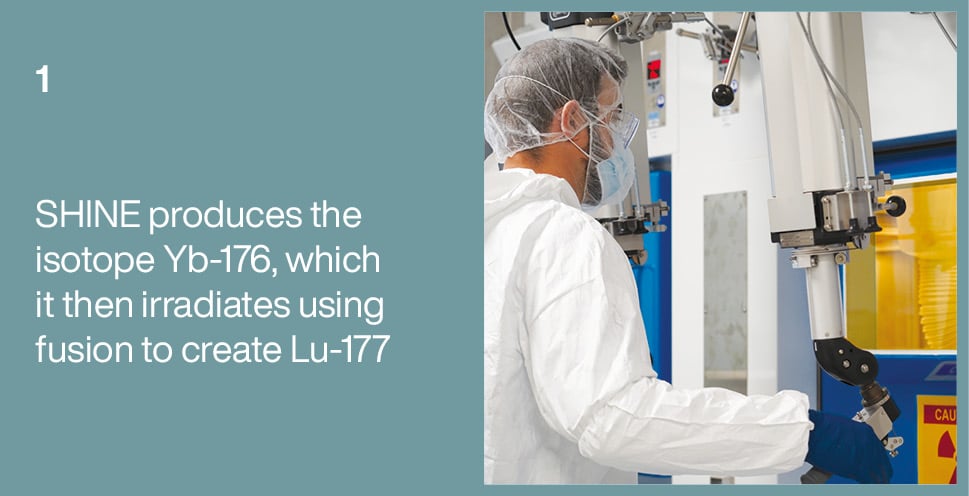

When a neutron hits a nucleus, it can change it from one element into another. So we’re able to take elements of low value as starting materials and turn them into hyper-valuable isotopes worth somewhere between hundreds of millions and billions of dollars per gram. [For context, a typical sachet of sugar that you would find in a restaurant contains about two grams.]

Diagnostic medicines need these products to look at blood flow in the body, particularly in the heart. Doctors use them to look for obstructions. We can produce the element technetium-99m to do this using our fusion process.

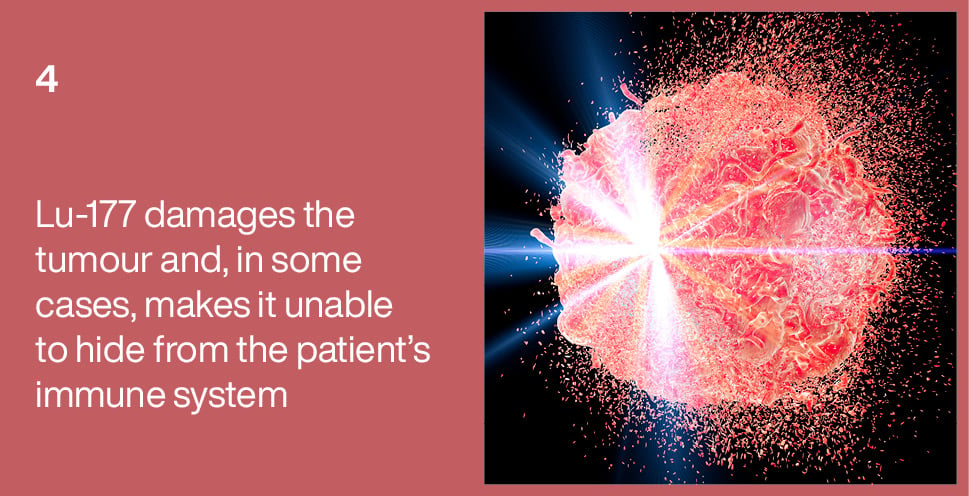

We’re also producing isotopes for therapy, including something called lutetium-177 [Lu-177], which is effectively a smart bomb for cancer.

Nuclear medicine

Images courtesy of SHINE

LW:

So over the next couple of years, you’re aiming to bring these isotope facilities fully online and significantly increase output. In the meantime, the medical industry remains reliant on older nuclear fission reactors, which have been doing this as a kind of afterthought.

GP:

Exactly. They were built for nuclear research in the 1950s and 1960s with a 30-year life in mind. They weren’t designed or optimised for isotope production, and there are now regular shortages of these products for patients because of the reactors unexpectedly going offline.

We’ve got fusion to such a level of neutron output that our Wisconsin facility can become the world’s largest producer of medical isotopes. We plan to make 20 million doses of medicine per year.

The other issue is that the raw materials lutetium-177 historically relied on solely came from Russia. Our technology has allowed us to develop a platform where we can produce our own raw materials, so we break the reliance on Russia for these cancer therapies.

LW:

And there’s an even bigger potential prize involving the transmutation conversion process. Could you talk a little bit about that?

GP:

As I mentioned, we’re going to be doing transmutation at a scale of hundreds of grams per year. As you scale that up to kilograms or tens of kilograms per year, you start to be able to solve different problems.

The most important one we see today is recycling nuclear waste. We can take waste from existing reactors, chemically separate out the isotopes and recycle most of it. The vast majority of that has huge energy content, which can go back into the reactor. It’s something we plan to do very soon, let’s say in the next five years.

But then there’s another problem. Even after you recycle all the waste, there are radioisotopes that just have very long half-lives – one thousand to one million years or even more – that aren’t useful for anything and are difficult or impossible to dispose of. This is where fusion comes in. The transmutation process can turn them into short-lived or even stable isotopes of value. So the next step for fusion is to scale it to that, by which point we’ll be getting pretty close to power generation.

LW:

And how big could these markets be?

GP:

The nuclear waste market is already worth tens of billions of dollars, and those involved can’t do the things we’re planning. So we can grow that opportunity. And then moving into energy, that’s exciting to investors as it has a multi-trillion-dollar total addressable market. It’s also exciting to me because of what it means: fusion power won’t solve all our social problems, but it’s a powerful tool that will allow humanity to do things on a massive scale. It’s going to be one of the most exciting markets to be in for centuries, in my opinion.

LW:

So the critical point is that you need lots of capital reinvestment and learnings from other activities to profitably bring nuclear fusion power to the masses.

GP:

Yes. Commercialising fusion power will require huge amounts of capital over long periods of time. In the near term, it’s got to be billions of dollars per year. And it’s probably tens of billions per year as you scale up.

It will take maybe 20-plus years until we have something that looks like a viable power plant. But SHINE will be making money in the meantime. And we won’t just be doing science for science’s sake. We’re building a truly durable and sustainable company that’s making products while we make those investments.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in August 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

The risk of investing in private companies could be greater as these assets may be more difficult to sell, so changes in their prices may be greater.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

59607 10036137