Key points

Introduction

As we write this note, our daily lives are gradually getting back toward what we thought of as normal prior to 2020. And while it is reasonable to assume that some parts of that normality will take a lot longer to return, if at all, from an economic perspective, the recovery is well underway.

Following their strong recovery after March 2020, many financial markets have continued to compound good results. This has been possible because of the swift and unprecedented fiscal and monetary policy response to offset the economic damages from the pandemic, their continuation into 2021 amid nervousness about further variant virus outbreaks and the ongoing deployment of several vaccines.

However, the horizon of this LTRE exercise extends well beyond the present recovery. And while we wholly expect other unanticipated events to occur, the central case we present in this brief document envisions a return to typical economic cycles, albeit with some longer-lasting effects of what we’ve all been through in the past 18 months.

We continue to see plenty of opportunities among the asset classes within our opportunity set, though importantly we also see even more potential within the individual asset classes. Here we focus on asset class returns, but we expect a happier hunting ground for the average active manager than in the past decade, as big trends really come to bear, such as action on climate change, the tilting of economic power to Asia, the accelerating influence of technology on the world, regulatory and investor preference developments in ESG, the tipping of ‘baby-boomer’ wealth deeper into the decumulation (spending!) phase, and the distinct possibility of easy monetary and fiscal conditions overshooting.

As an accompaniment to this work, we have recently published a piece examining the effects of several different [climate-related] scenario pathways on asset class return opportunities.

Notable Changes Since December 2020

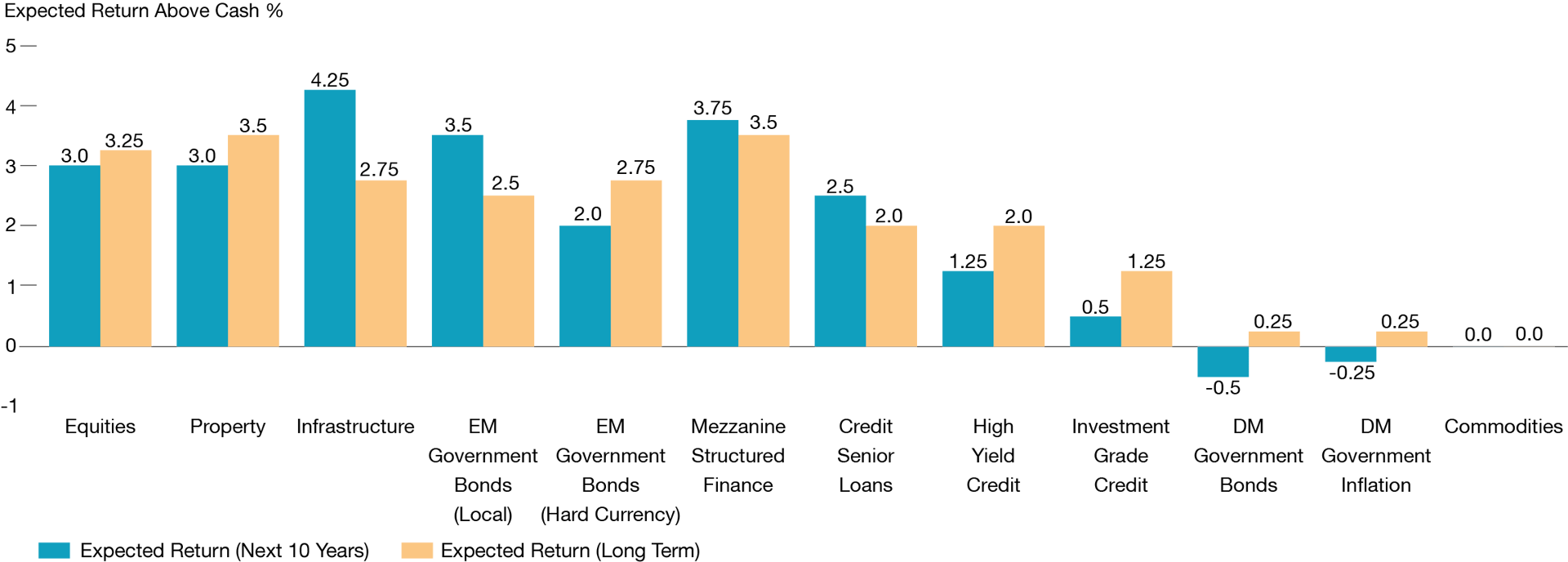

Relative to our returns expectations in December 2020 when valuations were generally more attractive, our current returns expectations are mostly lower, following the continued strong performance of asset classes over the past six months.

This, however, is not universal and we see higher expected returns from some of the fixed income asset classes, such as emerging markets bonds and most credit markets. Yields and spreads on EM bonds have risen during the first six months of the year, leading to slightly better return prospects over the next decade for these areas. In Credit, a revision of our expected losses to default has improved the outlook, despite generally tighter spreads.

While Infrastructure and real estate continue to offer reasonably attractive returns at cash + 4.25per cent per annum (% pa) and 3.0% pa respectively over the next decade, these figures are substantially down on December’s forecasts, after both valuations have risen and premiums to NAV have appeared or increased over the period. Driving recent returns, both are benefiting from the low interest rate environment, while the growth outlook for certain sectors, such as regulated utilities, have improved markedly.

Behavioural changes and government policy actions during the pandemic have reinforced or accelerated certain structural trends; the move towards digitisation (eg more online shopping) and decarbonisation of energy demand (increasing deployment of wind and solar energy, improving growth prospects for electric vehicles). These trends are creating opportunities within certain asset classes. For example, we expect the likes of silver to do significantly better than our returns expectation for commodities as a whole. In infrastructure, power transmission networks and renewable energy companies stand to gain from the green energy revolution. In property, logistics property should outperform, as demand increases to facilitate timely deliveries of online shopping. In equities, selective growth equities should continue to dominate, benefiting from both digitisation and the green revolution.

Asset Classes

All returns are shown relative to local cash rates and net of any access costs. Importantly, they also assume that investment is on a passive basis, and so these should be regarded as minimum achievable returns. We view these estimates as broadly sensible indications1 of likely returns and as central projections from a wide range of possible outcomes. They should not be interpreted as high precision forecasts and, even if they prove accurate in the long term, it is very likely that actual returns in the short- to medium-term will be quite different.

1In this summary table, and at the end of each asset class section, we have rounded our forecasts to the nearest 0.25%. This permits sufficient distinction between asset class returns while avoiding spurious accuracy in our forecasting. Consequently, there may be some instances in which numbers quoted in the text do not exactly add up to the stated forecast.

Equities

↓ 10-Year Returns: +3.00% over cash

↑ Long-Term Returns: +3.25% over cash

Equities are one of the most attractive long-term asset classes in our investment universe. We project an expected excess return of 3.25 per cent pa over the long term, although current valuations bring the 10-year forecast down to cash + 3.0 per cent pa. That said, equities should generally do well in an improving growth environment in the medium term and a return to trend growth in the long term. While returns have been strong since March 2020, there has also been significant dispersion, ie differences between winners and losers. As economic growth recovers sustainably, cyclical equities should continue to catch up. In addition, equities, particularly selected growth equities, are beneficiaries of a lower for longer interest rate environment.

Infrastructure

↓ 10-Year Returns: +4.25% over cash

→ Long-Term Returns: +2.75% over cash

The asset class is particularly interesting just now as governments look to roll out fiscal stimulus programmes, often with a key concentration on infrastructure projects, which are generally seen as having a high economic multiplier (ie they are an effective way for governments to spend money for the biggest impact on their economies). This increased demand, in combination with a particular focus on ‘green’ projects (to the benefit of renewable energy operators, developers and those involved further along the electrification chain), is raising growth prospects at a time when valuations look unchallenging owing to lower yields in other asset classes, most notably developed market government bonds.

Property

↓ 10-Year Returns: +3.00% over cash

↓ Long-Term Returns: +3.50% over cash

In assessing prospective returns from property markets, we expect the starting yield and the net rental growth to be the primary return drivers in the long run. We estimate that growth in net rental income (from an established portfolio) will lag inflation by around 1.0 per cent, reflecting the impact of new supply and the tendency of established properties to experience erosion in their real rental value, as well as the aforementioned structural headwinds facing office and retail properties.

Our analysis shows substantial difference between individual sectors – with the prospects for physical retail and commercial office real estate heavily impacted by the crisis, while those for logistics and fulfilment property have been enhanced. Within the office sector, newer, flexible, suburban buildings are likely to benefit at the expense of older, less flexible city-centre towers as tenants consider the need for space per worker and the desirability of requiring employees to transit through major transport networks and hubs to commute to their workspace.

Emerging Market Government Bond (Local Currency)

↑ 10-Year Returns: +3.50% over cash

↓ Long-Term Returns: +2.50% over cash

The heterogeneity of the emerging market (EM) local currency government bond universe makes the concept of a single fair value less useful than with some other asset classes. Some countries, such as Poland, are relatively developed, low inflation economies that offer low nominal and real yields, while others, such as Brazil, are less mature with higher inflation and generally weaker institutions, and so offer higher yields. Over the past six months, the local currency EM bond market yield has risen from December’s low levels, and currently stands at 5.0 per cent. This is still below our estimated long-run fair value of 5.75 per cent.

To generate our expected return for the coming decade (and the long term), we combine the duration returns from investing in the EM Local Currency index with the currency returns. Over the next decade, we project a nominal return of 4.80 per cent (the sum of 5.50 per cent duration returns less 0.7 per cent of currency losses each year), giving us an annual return of 3.50 per cent relative to developed market cash returns. Over the long term, we project an annual return of 2.5 per cent over developed market cash.

Emerging Market Government Bond (Hard Currency)

↑ 10-Year Returns: +2.00% over cash

→ Long-Term Returns: +2.75% over cash

The hard currency universe comprises an even wider range of countries than the local currency universe, with around 65 issuers across Africa, Asia, Europe, Latin America and the Middle East.

The current spread (additional yield over US Treasuries) is 3.4 per cent, which is at a similar level as our estimated long-term fair value spread of 3.5 per cent.

Our expected return from hard currency bonds (over the next 10 years) is around 3.75 per cent pa, which is 2.0 per cent pa over (USD) cash. This is below our long-term expected return of 2.75 per cent over cash.

Mezzanine Structured Finance

↑ 10-Year Returns: +3.75% over cash

↑ Long-Term Returns: +3.50% over cash

Structured finance describes a broad universe of credit-type investments that offer a tranched exposure to underlying, secured cash flows. These typically take the form of CLOs (collateralised loan obligations, where the underlying is senior loans) or MBS (mortgage backed securities, where the underlying cash flows are commercial or residential mortgages), though many other asset types can be structured in this way. These are also sometimes known collectively as asset-backed securities (ABS).

Our expected long-term return for mezzanine structured finance is 3.50% p.a. over cash, based on a fair value spread of 3.5% less an annual loss rate of 0.10%. As the current discount margin is above this fair level, we expect a higher return of 3.75% p.a. over cash over the coming decade.

Senior Loans

↑ 10-Year Returns: +2.50% over cash

↑ Long-Term Returns: +2.00% over cash

For much of the last ten years, the discount margin on loans in both the US and Europe has traded in line with, or wider than, the spread on high yield bonds. This in part reflects reduced demand for loans due to regulatory changes which has made collateralised loan obligations (CLOs) more difficult and expensive to issue and the changed risk appetite from market participants. That demand has not been fully replaced by more conventional sources, in part because of the lower liquidity of the loan market making it unsuitable for frequently-dealt vehicles (loans are not UCITS (investment funds regulated at European Union level) eligible, for example). However, more recently CLO issuance has picked up and institutional interest in the loan market has increased.

Senior loans are currently trading at discount margins of 4.1 per cent in euros and 4.4 per cent in US dollars2. Over the next ten years and beyond we assume these spreads revert to 3.75 per cent.

High Yield Credit

↑ 10-Year Returns: +1.25% over cash

↓ Long-Term Returns: +2.00% over cash

High yield bonds, also known as sub-investment grade or junk bonds, have historically returned approximately 2.5 per cent in excess of their local government bonds, albeit this is based on a relatively short, thirty-five-year history over which the market has changed substantially3. US dollar high yield bonds currently trade at a spread4of 3.0 per cent compared with our fair value estimate of 3.75 per cent.

Given the strong performance of high yield bonds over the past 12 months, with spreads tightening moderately, our forward-looking excess returns of 1.25 per cent pa over cash is meaningfully lower than our long-term excess returns of 2.0 per cent pa over cash.

Investment Grade Credit

↑ 10-Year Returns: +0.50% over cash

↓ Long-Term Returns: +1.25% over cash

Over the very long term, investment grade credit has returned approximately 1 per cent pa more than government bonds5. That excess return has varied by credit rating category, with AAA bonds returning an excess of just 0.7 per cent pa and BBB bonds delivering 1.3 per cent pa. Developments in the rating composition of the index over time, and a buoyant bond market in recent years, have led to the excess return since 1970 being around 1.5 per cent pa.

Taking into account the trends in market credit rating composition, in the very long run we expect the median yield on corporate bonds to remain approximately 1.1 per cent higher than comparable maturity government bonds.

Aggregating across all markets, we expect investment grade bonds to see 0.5 per cent pa excess return over cash over the next ten years and 1.25 per cent pa excess return over the long term.

Commodities

→ 10-Year Returns: +0.00% over cash

→ Long-Term Returns: +0.00% over cash

As physical goods with real world uses (and real world storage costs), but producing no income, the factors influencing their returns are numerous: expectations for global inflation; perceived ‘safe-haven’ value; supply and demand; the enthusiasm or otherwise of financial speculators for individual commodities; and, last but not least, the investment rewards on offer elsewhere.

Our analysis indicates that the historic returns of commodities were driven by aspects of commodity futures markets that no longer exist or cannot be relied on in estimating future returns, such as the ‘roll yield’6 achieved from futures prices being typically below spot prices. Over the past 10 - 20 years, roughly since commodities became a popular alternative asset class for institutions, the roll yields have generally become more negative, in effect becoming a ‘roll cost’ for maintaining an exposure to the asset class in this manner.

Developed Market Nominal Government Bonds

↑ 10-Year Returns: -0.50% over cash

→ Long-Term Returns: 0.25% over cash

Domestic government bonds are traditionally considered to be risk-free investments and their yields are often used when pricing other instruments. Returns are influenced by underlying policy rates and local currency cash returns. Historically, government bonds in developed markets have offered a modest excess return over cash, compensating for the higher volatility, central banks’ credibility and supply and demand imbalances. Known as the term ‘premium’, this excess return has historically been significant, perhaps 0.75% pa or more. With ongoing demographic trends noted and the resulting heightened demand for long-dated government bonds, we expect a slightly lower term premium in the future of 0.25% pa This becomes our expected long-term return over cash for all developed market government bonds, while for the next 10-year period, we expect an annual return of around 0.5% below cash.

Developed Market Inflation-Linked Bonds

↑ 10-Year Returns: -0.25% over cash

↑ Long-Term Returns: +0.25% over cash

The inflation-linked bond universe is much smaller than the nominal government bond universe, with fewer countries issuing inflation-linked bonds and typically doing so in lesser size. This can mean that yields on index-linked bonds are as likely to vary in response to changes in nominal government bond yields and supply and demand factors as they are to changes in expected inflation.

Real yields across the developed world have declined meaningfully in recent years and have become substantially negative in a number of developed economies over the past 10 years.

Our expected return from the US treasury inflation-protected securities (TIPS) market got back into positive territory, with an annual excess return of 1.00 per cent over local cash. In the Euro Area and the UK, annual excess returns over cash continue to be negative (-1.25 per cent and -1.5 per cent respectively). This means that overall expected return for inflation-linked bonds has improved but still remains negative at 0.25 per cent pa below cash over the next 10 years. Over the long term, we expect to see a small positive return of 0.25 per cent over cash for the asset class.

2Discount margin data from Credit Suisse as at Dec 2020.

3This is based on USD market data covering the period 1986 to 2020, using the BAML US High Yield Index (H0A0).

4Market spread data refers to the BAML European High Yield Index (HE00) and US High Yield Master Index (H0A0).

5Source: Deutsche Bank – 100 years of corporate bond returns, based on US data since 1990. Investment grade indices have fared worse than the underlying bonds, only producing returns that are 0.3 per cent–0.4 per cent above government bonds (‘Expected Returns’, Antti Ilmanen). This is because indices are required to sell bonds which are downgraded to ‘high yield’, locking in a capital loss. As we are not bound by these requirements, we do not include this cost in our assessment of likely long-term returns.

6Commodities index futures produced annualised returns of about 10 per cent between 1959 and 2004. However, an exposure via spot commodity prices returned about 3.5 per cent during the period.

Ref: 11158 10003058.

Risk Factors

The views expressed in this article are those of the Multi Asset Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ("FinIA"). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This document is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this document be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This document contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (“BGO”) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this document represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This document is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.