Key Points

- The switch from analogue to digital across sectors as diverse as education and transport is creating opportunities to invest

- Cheap renewable energy could drive wealth creation in emerging economies

- Recent market volatility has masked the underlying operational performance of strong companies

For professional audiences only. Not intended for use by retail clients.

“The past few months have not been a good time to be an optimist,” admitted Malcolm MacColl, co-manager of Baillie Gifford’s Global Alpha Strategy, during a recent client seminar. Disruption to the global economy from the pandemic, fears of a recession linked with rising inflation, and Russia’s invasion of Ukraine conspired to form a “near perfect storm”, with the market “prioritising certainty and defensiveness over longer-term potential”.

MacColl acknowledged that the Strategy had underperformed in recent months, and that short-term periods of market uncertainty were “very tough” for clients. He thanked clients for their patience and outlined why the co-managers were sticking to their reward-seeking strategy.

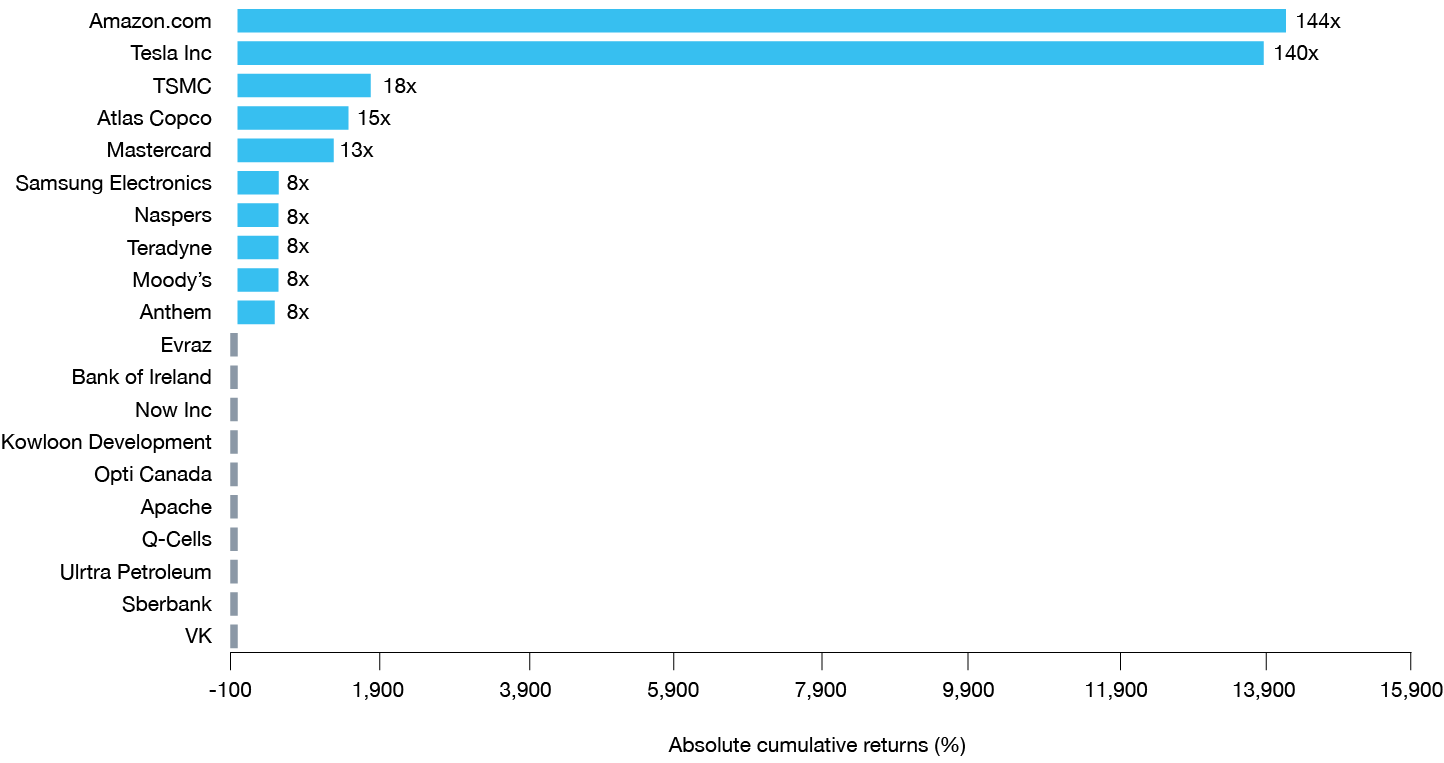

Picking the right stocks sits at the heart of that strategy. Global Alpha focuses on companies with the potential to grow their earnings. Thirty years’ worth of data supports the link between earnings growth and long-term share price performance.

MacColl gave the example of US healthcare insurer Anthem, the tenth best-performing stock in the portfolio. Its cumulative returns more than outweighed the drag from the ten worst-performing stocks since Global Alpha launched in 2005. “The large winners swamp the bottom end,” he explained.

Stock picking and asymmetries matter

Volatility is part of the journey for long-term growth investing, as demonstrated by Anthem’s overall performance. Its largest fall from peak to trough was 66 per cent, while technology giant Amazon – the best-performing stock in the Strategy – has experienced similar falls before recovering.

Despite share price falls, MacColl underlined the continued strong operational performance of stocks in each of Global Alpha’s three growth profiles – compounders, disruptors, and capital allocators. He pointed to the increasing contribution from Microsoft’s Azure cloud computing services — which is growing at a rate of 40–50 per cent compared with the tech giant’s overall 15–20 per cent growth rate — which he believes can help the company grow at four or five times faster than the wider market. At Farfetch – which provides online platforms for luxury goods retailers – he underlined its revenue growth of more than 20 per cent year-on-year, along with a doubling since 2019 of its gross merchandise value. MacColl also highlighted property manager CBRE’s advantages of scale, including its growing customer base and its expanding range of services.

MacColl pointed out that the market sell-off had ignored the value of many stronger businesses. He said his team had examined the underpinnings of the companies in the portfolio, including their inflation resilience. “Our businesses have very, very strong pricing power, by and large, and they also have very, very supportive margin structures,” he said. “While people are worried about growth stocks and fragility, I would argue that a lot of our businesses are actually almost anti-fragile, and that the market is getting this somewhat back to front.”

Spotting the winners for the decade ahead

Co-Manager Helen Xiong highlighted key themes from the 2022 research agenda. While the winners during the past decade were stocks such as Amazon and Facebook, which created business-to-consumer “online destinations”, she said the winners in the decade ahead would be business-to-business “online infrastructure” companies.

She pointed to businesses such as communications tool designer Twilio (which uses software to send and receive text messages – think about the automatic message you receive when you book your Uber car), payments platform Adyen, online food ordering and delivery firm DoorDash, and ecommerce platform Shopify. While digital disruption over the past decade has focused on the advertising, entertainment, and retail sectors, Xiong emphasised how that disruption was now spreading much wider, into sectors as diverse as education, energy, and transport, which account for much larger proportions of the global economy.

“Twilio, Adyen, DoorDash, and Shopify are enablers of commerce and entrepreneurship, powering what we can think of as the analogue to digital transformation,” she added. “My best guess is that only 10 per cent of the global economy has gone through that analogue to digital transformation.”

When Xiong joined Baillie Gifford in 2008, a colleague said the stock market falls that followed the global banking crisis were a “once in a lifetime buying opportunity” and that she should “have her shopping list ready”. Now, as a second similar buying opportunity arrives, she has her hitlist to hand, and highlighted the attraction of Nvidia, which has transformed itself from a computer graphics card developer into a maker of hardware and software platform to power artificial intelligence.

"It’s not just digital infrastructure that needs to be built – it is also physical infrastructure,” Xiong added. She pointed out that, while 2020 would be remembered as the year of Covid-19, it also marked the turning point at which it became cheaper to generate electricity from renewable energy than fossil fuels in many parts of the world. Having access to cheap, clean energy could mean the energy transition’s impact on the economy may match that of the internet. “We know that wealth leads to higher energy use, but can higher energy use also drive wealth creation in the emerging economies?” Xiong pondered.

Why Netflix is a ‘climate solutions provider’

Her thoughts on how cheap energy could change the economy were developed by Caroline Cook, Baillie Gifford’s head of climate, and Kieran Murray, an environmental, social, and governance (ESG) analyst embedded within the Global Alpha Team, during a breakout session entitled “The Future of Energy”.

Cook outlined the firm’s developing thoughts on how to identify climate solution providers (CSPs). “We should care about CSPs because they are fundamentally at the root of the growth we can get in the transition as investors,” she explained.

“We are talking about something that affects the whole economy – it’s not just about a wind turbine or a battery or other narrow, physical elements. We mustn’t make the definition of CSPs too narrow too early because we need to be able to deploy capital across the economy to get the transition going.”

She said the hard science surrounding climate change was driving regulators and consumers to demand change, while technology was enabling the economy to become less carbon intensive. For investors, those drivers create two opportunities: on the supply side, capital expenditure on infrastructure to generate renewable power and adapt to climate change; and, on the demand side, innovations to reduce or avoid carbon use and emissions as carbon prices affect business models.

On the demand side, CSPs could include nudging consumer behaviour towards lower-carbon options. “For us, climate solutions can be as much around a Netflix or an Amazon as a Tesla – the tangible and the intangible working together,” she added.

Murray highlighted the role streaming service Netflix can play in educating and informing consumers about climate change, with examples including the 170 documentaries, dramas, and other programmes within its “Sustainability Collection” and the success of its recent comedy, “Don’t Look Up”, about climate change denial.

He also pointed to lithium miner Albemarle as an example of a supply-side stock within Global Alpha’s portfolio. Lithium is a key component in the batteries used by electric vehicles.

How Global Discovery feeds into Global Alpha

Albemarle and electric car maker Tesla are among 10 stocks introduced to Global Alpha by the Global Discovery Strategy, which identifies small and mid-cap stocks with the potential to have a global impact. Douglas Brodie, co-manager of the Global Discovery Strategy and one of Global Alpha’s scouts, led the second breakout session, covering innovative small companies.

Global Alpha has seven idea-generating ‘scouts’, mostly sitting in regional investment teams. These scouts are senior members of the investment department. Their qualities include experience, judgement, temperament, freedom of thought, imagination and insight.

“We’re instinctively drawn to businesses that have very dynamic routes to evolve,” Brodie explained. “We need to dream a little, be creative, ask where this business could get to? We love it when we find a business that almost sounds outlandish.”

The Strategy looks for businesses that can deliver a step-change by bringing together technologies, teams, or business models. Brodie pointed to examples including Novocure, which is using electric fields to disrupt cancer cells in brain tumours, and Illumina, which makes technology to analyse gene functions and variations.

“Global Discovery isn’t about us going to the edge of the Earth to find the tiny, undiscovered idea – it’s about us finding small businesses that have global relevance,” Brodie added. “That’s the cheat sheet for blue-sky investing.”

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Global Alpha Composite | 12.6 | 8.8 | -1.6 | 55.5 | -7.1 |

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| Global Alpha Composite | -7.1 | 11.7 | 13.8 |

Past performance is not a guide to future returns.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in July 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

23549 10012313