Capital at risk

Imagine the future

To find you great growth opportunities, we seek the innovations and individuals that will drive change. Then we take a long-term approach, investing with conviction on your behalf.

About us

We are research-driven, patient and prepared to stand apart from the crowd. And because we’re an independent partnership without outside shareholders, you are our priority.

Long-term vision

It takes time to achieve transformational change. So we invest in companies for years, even decades. And we support their leaders in making decisions that can deliver strong, sustainable returns to you.

Continuity and heritage

Since its inception, Baillie Gifford has dedicated itself to discovering global growth opportunities. Today, we leverage the stability and expertise honed over many decades to serve you.

Curious, patient, brave

We are inquisitive, act with a long-term mindset and are prepared to stand

apart from the noisy crowd. These characteristics guide all the decisions

we take on your behalf.

Empowered perspectives

We thrive on the richness of our diverse backgrounds, academic studies and experience. This unique blend enables us to make well-rounded investment decisions and cater to your varied needs.

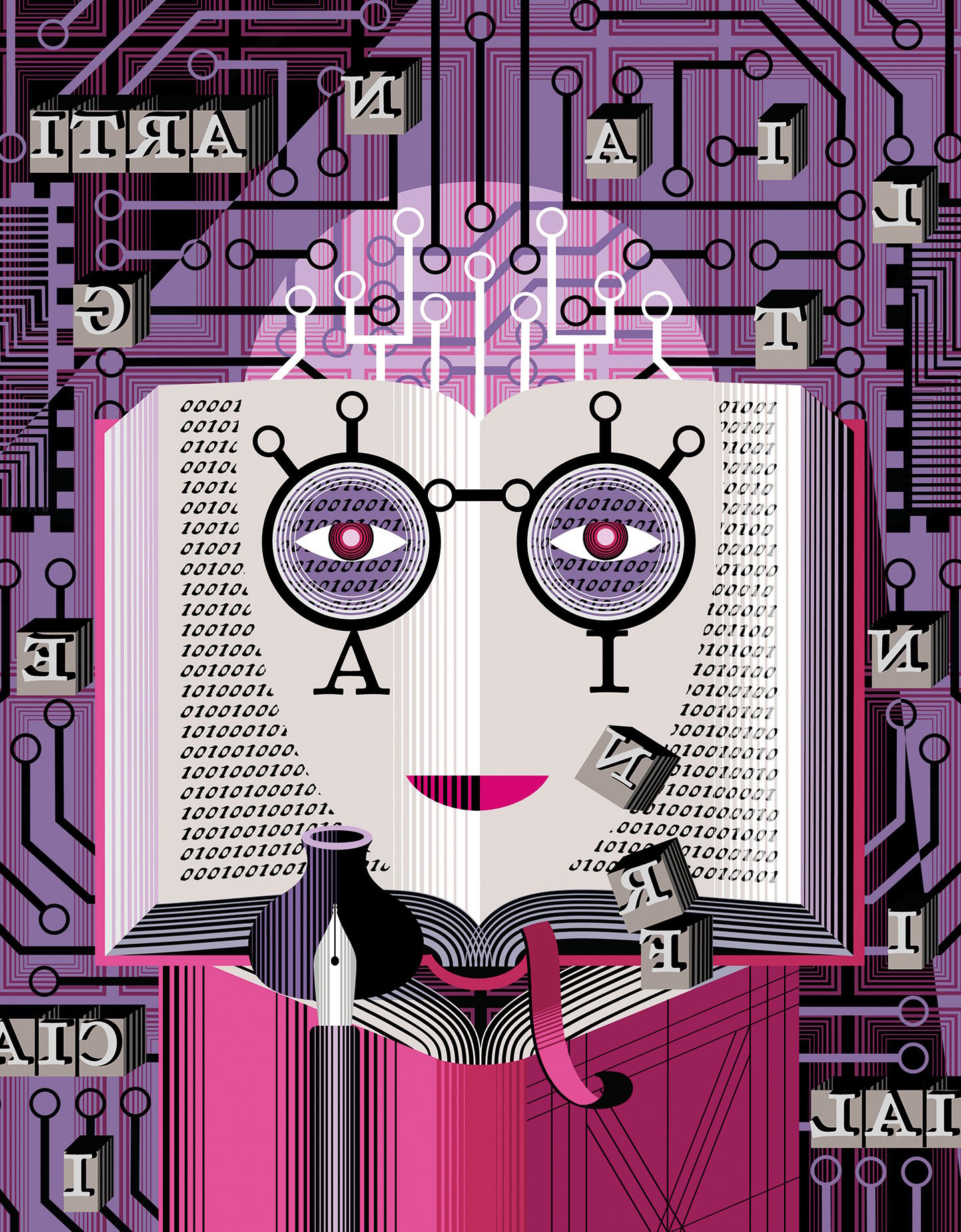

Disruption Week

Our Disruption Week investment webinar series took place in November 2023, focusing on important innovation trends and disruptive technologies.

Sessions covered disruption’s next wave, AI, nuclear innovation, and the energy transition.

Insights

Our investment managers and specialists tell you about groundbreaking companies and other forces influencing their pursuit of growth.

In the spotlight

Why growth, why now?

Shaking up the status quo

Discover the companies, products and processes transforming the world and creating new long-term growth opportunities. From apps and AI to decarbonisation and the healthcare revolution.

Sign up to emails

Get thought-provoking articles and films, updates about our range of mutual funds and information about investor events delivered directly to your inbox.