Capital at risk

Long Term Global Growth

Long Term Global Growth is an unconstrained equity strategy focused on exceptional companies. We invest over the long term in listed firms with the scope to grow to many multiples of their current size over the next decade.

We seek out transformational growth

We manage a concentrated portfolio of innovative growth companies. We embrace the asymmetry of equity markets by staying optimistic about the future to deliver transformational returns to our clients.

Long Term Global Growth: our philosophy

Investment manager Mark Urquhart introduces Long Term Global Growth, reflecting on the exciting opportunities ahead.

A selective strategy

We take a bottom-up approach to stock selection. Portfolio construction is purely stock-driven, so no reference is made to benchmark indices in our investment process. We are genuinely active, not passive. Portfolio holding sizes are based purely on the magnitude of the potential upside and the associated level of conviction.

This investment approach is consistent with outperforming a typical global equity benchmark by about 3 per cent per annum, net of fees, over the long term.

A concentrated, resilient portfolio

At its core, LTGG’s task is future-proofing. Investing with an eye on the next 10 years instead of the next quarter necessitates adaptability, diligent capital allocation and resilience from our holdings.

This is a high bar for inclusion, resulting in a portfolio of 30-40 stocks, and because we embrace asymmetry, position sizes are often skewed – winners can reach 10 per cent of the portfolio.

We believe that the rewards to the champions of change can far outweigh the losses of incumbents: the best feature of equities is the unlimited upside.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Quarterly update

Get the latest investment commentary, portfolio overview, transactions and performance information alongside governance engagement and voting.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2024

| # | Company | Fund % |

|---|---|---|

| 1 | NVIDIA | 8.3% |

| 2 | Amazon.com | 6.7% |

| 3 | ASML | 5.1% |

| 4 | PDD Holdings Inc | 4.2% |

| 5 | Adyen NV | 4.0% |

| 6 | Dexcom Inc | 3.8% |

| 7 | Spotify Technology SA | 3.5% |

| 8 | Intuitive Surgical | 3.5% |

| 9 | Cloudflare Inc | 3.4% |

| 10 | The Trade Desk | 3.4% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: Skipping the queue with Nubank

Discover how Nubank is freeing Brazilians from endless queues and leading a financial revolution.

Transformations

The LTGG Team explore themes that will be key to the next 20 years of transformational growth.

LTGG Reflections: e.l.f Beauty

Why we believe e.l.f. Beauty's innovative approach and explosive growth make it a must-have in the LTGG portfolio.

Reflections: Risk

How we identify leading high-growth companies by blending deep fundamental analysis with strategic insights.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Reflections: A robotic reality

From surgery to warehouses, discover how robotics are redefining efficiency and innovation in 2024.

The opportunity in risk: LTGG Q1 2024

How the LTGG team searches for companies willing to take bold risks to become future leaders.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: The year of the dragon

LTGG investment manager Mark Urquhart reflects on his recent trip to China.

Long Term Global Growth Strategy

Investment manager, Mark Urquhart, discusses the Baillie Gifford Long Term Global Growth Strategy.

Reflections: Llama mile

How the ecommerce giant is slashing delivery times with innovation and an unlikely courier fleet

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

LTGG’s 2023 year-end review

Was 2023 the year that saw transformational growth stories resume their conquest?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Reflections: Illumina

Why we sold Illumina after more than a decade in the portfolio.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Reflections: Solar innovations

Enphase's role in the solar revolution and the potential for long-term growth.

A net zero initiative update

A reflection on Baillie Gifford’s commitment to the climate transition.

LTGG third quarter 2023 update

A look at portfolio performance over the recent quarter-end.

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: from biologics to branded fashion

In this monthly update, the team discusses recent research visits to WuXi, Symbotic and Moncler.

Reflections: NVIDIA - chipping away at success

Following a successful quarter, the LTGG team consider the future of NVIDIA.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Reflections: The transformative potential of AI

Artificial intelligence is not as new as you think it is, as the LTGG portfolio reveals.

Long Term Global Growth Q2 update

The Long Term Global Growth team reflects on recent performance, portfolio changes, and market developments.

Reflections: Defying data disorder

Why Datadog's ability to master the chaos of cloud computing offers an attractive opportunity.

LTGG second quarter 2023 update

An update on portfolio performance, and the importance of adapting for the future.

Reflections: Kaizen – continuous improvement

Reflections on performance, holdings and continuous improvement.

Long Term Global Growth Q1 investment update

Long Term Global Growth Team reflects on recent performance, portfolio changes, and market developments.

Quarterly Review

LTGG review the first quarter of 2023 and the engines of change.

Reflections: Catch-22 Earnings

Does the market under-appreciate the impact of intangible investments?

Reflections: Rising from the ashes

An investment portfolio update explaining why holdings have thrived despite economic chaos.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Reflections: Shifting shades of grey

Short-term, many companies seem grey and similar. But patience will reveal colourful outliers.

LTGG quarterly commentary

A look at recent macroeconomic factors and performance and considerations for the future.

Reflections: Operational growth hurdles

Why growth is still possible in hard times.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

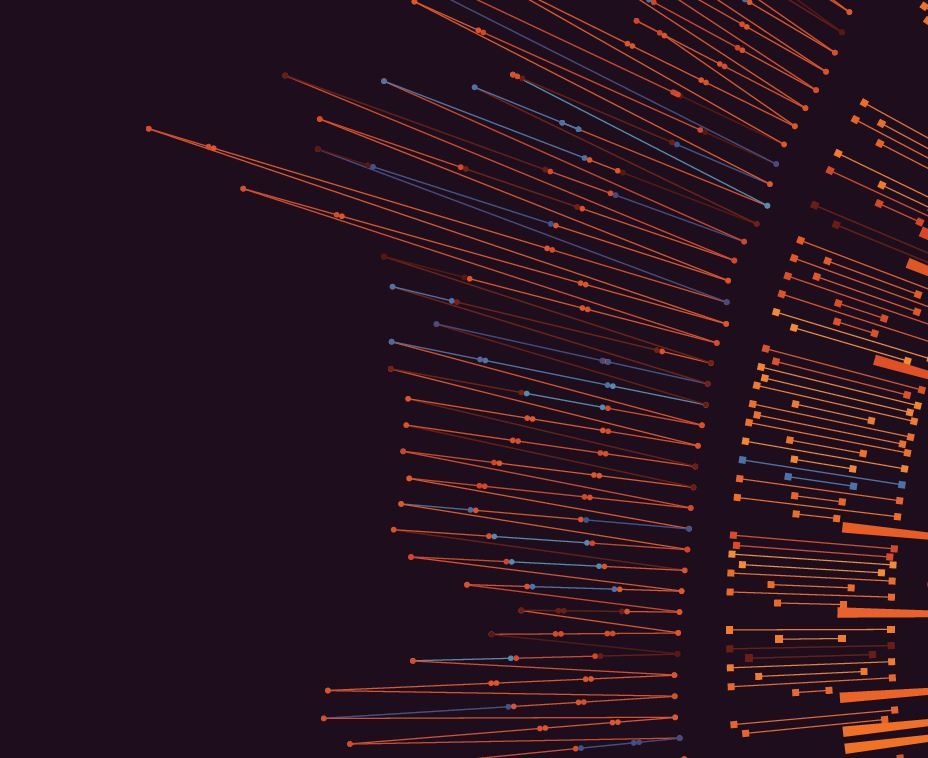

The changing face of advertising

With data at the heart of digital advertising, advertising businesses now come in many forms.

LTGG investor update

The LTGG Team share their thoughts on the portfolio, the current environment and what makes them optimistic about the future.

Reflections: Engines of growth

Understanding why certain ideas lead to growth can boost the chances of outperformance.

LTGG: climate progress update

Positive progress from a number of portfolio companies.

LTGG: our companies’ character

An LTGG ESG update.

Reflections: LTGG on tour

What do we learn from meeting management teams? That it’s good to be on the road again.

Reflections: The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Reflections: Company check in

We met holdings to track their progress as well as scouting out potential additions to the portfolio.

Reflections: Second quarter 2022

Sailing in the Roaring Forties.

LTGG Manager Update

The LTGG Team share their thoughts on what’s currently going on in the markets, what worries them and what they are excited about for the next 5-10 years.

Reflections: Sea Ltd

LTGG unpacks the potential of a new holding in the fintech and gaming space.

Jumpers in the hot wash

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Reflections: The future of synthetic biology

How Ginkgo Bioworks is making advances in computing and DNA engineering.

Reflections: A look back on Q1

The LTGG team consider recent performance and the long-term outlook for the fund.

Reflections: Roblox

New holding, Roblox, aims to bring the world together through play. The LTGG Team take a closer look.

Reflections: On short-term drawdowns

The LTGG team on short-term drawdowns and investing in era-defining companies.

Long Term Global Growth: Team evolution

Scott Nisbet interviews the Long Term Global Growth decision-makers discussing volatility, inflation, interest rates, China and portfolio holdings: Roblox, SEA, Moderna and Coupang.

ESG collaborations

Looking before we leap into industry initiatives.

Reflections: Affirm

The LTGG team take a closer look at how Affirm plan to transform the consumer credit industry.

ESG data: Filling in the gaps

LTGG is making efforts to improve environmental, social and governance metrics.

Reflections: The return of the tartan army

LTGG on demanding huge returns, backing companies that rip up the rule books, and looking to the future.

Reflections: Illumina

The genome sequencing specialist is playing a valuable role in the hunt for new treatments.

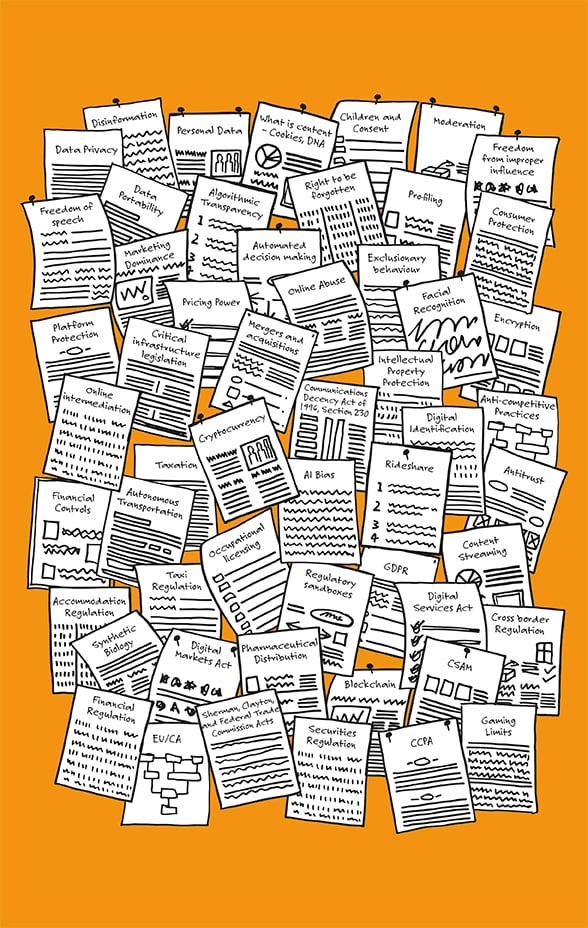

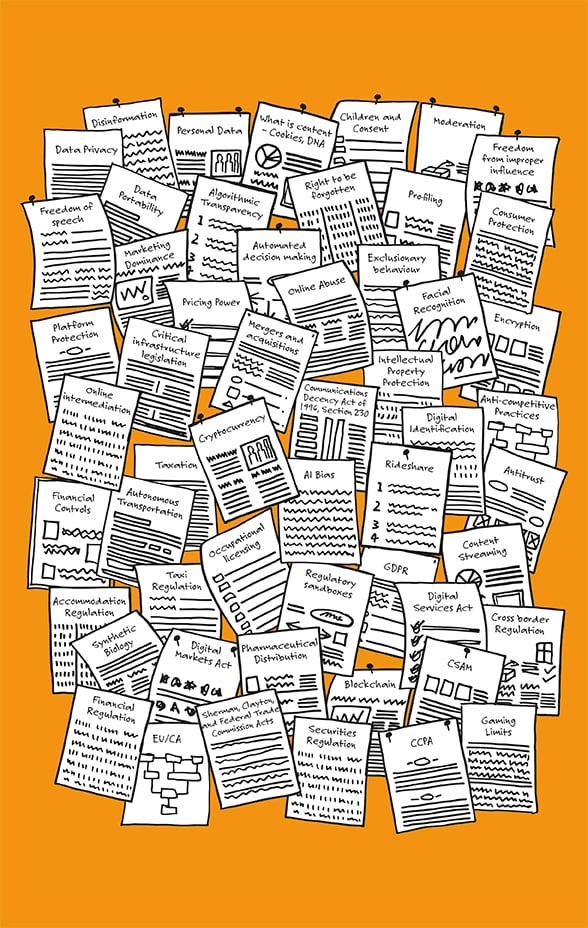

Rules of the game

Regulation and what we look for in companies’ responses.

Working it out

Adapting to the changing expectations of staff and society.

Inside and out

A focus on diversity and inclusion can result in competitive advantage.

Reflections: Looking for a contribution

The companies that LTGG invest in can turn their ability to improve society into a source of competitive advantage.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Staying engaged

What company engagement means to us.

A question of character

How we integrate environmental, social and governance factors into our investment approach.

Disruption week webinar: Digital payments platforms

New types of transactions and ecommerce services are being enabled by innovative fintechs.

Looking back going forward

In this edition of Looking Back Going Forward we explain how environmental, social and governance (ESG) considerations have been deeply embedded in our Long Term Global Growth strategy.

Reflections: Carvana

Carvana, the US online car dealership, has a lofty but straightforward mission to change the way in which people buy cars.

Reflections: China

The LTGG Team reason that where there’s transformational growth, the regulatory backdrop will evolve to keep up. That’s as true of China as it is elsewhere.

Reflections: LTGG and the elixir of youth

LTGG’s Tim Garratt explains how the team have endeavoured to keep the portfolio youthful and forward looking.

Reflections: Alphabet

The LTGG team explain why they decided to sell their clients’ holding in Google parent company, Alphabet.

Reflections: Beike

The LTGG team reflect on how Beike, China’s largest online house-buying platform, is disrupting the property market.

The anatomy of outliers

What characteristics do outperforming stocks have in common and how does the LTGG portfolio stack up?

Leading the charge

We reveal the research behind one of the highest-profile investments in Baillie Gifford’s 113-year history.

Reflections: The trade desk

The Trade Desk, a recent LTGG investment, is disrupting a $350bn market and challenging Facebook and Google’s control of online advertising. The LTGG Team discuss the opportunities ahead.

Highlights video: Long Term Global Growth webinar

Client Director Tatjana Evans-MacLeod highlights the most notable discussion points from the recent LTGG webinar, in which investment managers Mark Urquhart, Gemma Barkhuizen and Linda Lin discussed turnover, valuation, China, ESG, and capacity.

Reflections: The roaring twenties

When we are caught up in the drama of the present, it can be hard to see the accelerated progress that accompanies it. With technology firmly in the driving seat, Scott Nisbet explains why he sees a decade of growth ahead.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2020 issue

A gallery for growth

Much like an art curator, the role of the investment manager involves carefully selecting investments that will make a mark and grow in value over time.

Sensible nonsense

To stand the best chance of owning the winning companies of the 2030s, we should imagine how bizarre today’s ‘normal’ will seem when the next generation looks back.

Navigating noise

Navigating Noise, a video series brought to you by the Long Term Global Growth team, seeks to gather and share some of the thinking we find so valuable when investing for the long term.

A View from the Midst of the Pandemic

Technological developments over recent decades mean reality has outpaced the science fiction of his youth since Mark Urquhart joined Baillie Gifford almost 25 years ago.

AI: Learning on the job

Dubbed the new electricity, artificial intelligence is intrinsic to the strategy and operations of many companies in the Long Term Global Growth portfolio.

Calm reflection during the amygdala hijack

In times of stress stock markets, like people, often revert to act now, think later. Tim Garratt advocates doing the opposite.

Footprints and first steps

Mike Berners-Lee helps us to reassess how we calculate the environmental impact of the holdings within the LTGG portfolio.

Lessons from the Sonoran Desert

‘Lessons from the Sonoran Desert’ explores further the pioneering work of Professor Hendrik Bessembinder at Arizona State University, whose heroic feat of global number-crunching revealed extraordinary things about the nature of company returns.

Long-term talent

Gemma Barkhuizen and Robert Wilson recently joined the LTGG team as part of Baillie Gifford’s graduate training programme. Here they share their experiences, talk about what’s important to them, and give their view of LTGG’s way of looking at the world.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2020 issue.

When Milton met Billy

Shareholders seem to be obsessed with short-term profits. We aren’t. Scott Nisbet proposes an alternative path, where patience with the right companies is rewarded, and a less direct route to profitability can lead eventually to a more valuable outcome.

LTGG XV

The evolution of LTGG over the first 15 years.

Looking back going forward

In the latest edition of Looking Back Going Forward, John MacDougall looks back over the 15 years of Long Term Global Growth's history, reflecting on some of the holdings that have performed best, and the varied paths their share prices have followed.

Graham or growth?

In his latest paper, James Anderson discusses Ben Graham’s book The Intelligent Investor, the seminal work on Value investing that remains as valid today as it did when he wrote it seven decades ago. James considers the author’s views and their implications for Growth investing in the current environment.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2018 issue,

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2018 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2017 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2017 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2016 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2016 issue.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: Skipping the queue with Nubank

Discover how Nubank is freeing Brazilians from endless queues and leading a financial revolution.

Transformations

The LTGG Team explore themes that will be key to the next 20 years of transformational growth.

LTGG Reflections: e.l.f Beauty

Why we believe e.l.f. Beauty's innovative approach and explosive growth make it a must-have in the LTGG portfolio.

Reflections: Risk

How we identify leading high-growth companies by blending deep fundamental analysis with strategic insights.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Reflections: A robotic reality

From surgery to warehouses, discover how robotics are redefining efficiency and innovation in 2024.

The opportunity in risk: LTGG Q1 2024

How the LTGG team searches for companies willing to take bold risks to become future leaders.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: The year of the dragon

LTGG investment manager Mark Urquhart reflects on his recent trip to China.

Long Term Global Growth Strategy

Investment manager, Mark Urquhart, discusses the Baillie Gifford Long Term Global Growth Strategy.

Reflections: Llama mile

How the ecommerce giant is slashing delivery times with innovation and an unlikely courier fleet

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

LTGG’s 2023 year-end review

Was 2023 the year that saw transformational growth stories resume their conquest?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Reflections: Illumina

Why we sold Illumina after more than a decade in the portfolio.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Reflections: Solar innovations

Enphase's role in the solar revolution and the potential for long-term growth.

A net zero initiative update

A reflection on Baillie Gifford’s commitment to the climate transition.

LTGG third quarter 2023 update

A look at portfolio performance over the recent quarter-end.

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Reflections: from biologics to branded fashion

In this monthly update, the team discusses recent research visits to WuXi, Symbotic and Moncler.

Reflections: NVIDIA - chipping away at success

Following a successful quarter, the LTGG team consider the future of NVIDIA.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Reflections: The transformative potential of AI

Artificial intelligence is not as new as you think it is, as the LTGG portfolio reveals.

Long Term Global Growth Q2 update

The Long Term Global Growth team reflects on recent performance, portfolio changes, and market developments.

Reflections: Defying data disorder

Why Datadog's ability to master the chaos of cloud computing offers an attractive opportunity.

LTGG second quarter 2023 update

An update on portfolio performance, and the importance of adapting for the future.

Reflections: Kaizen – continuous improvement

Reflections on performance, holdings and continuous improvement.

Long Term Global Growth Q1 investment update

Long Term Global Growth Team reflects on recent performance, portfolio changes, and market developments.

Quarterly Review

LTGG review the first quarter of 2023 and the engines of change.

Reflections: Catch-22 Earnings

Does the market under-appreciate the impact of intangible investments?

Reflections: Rising from the ashes

An investment portfolio update explaining why holdings have thrived despite economic chaos.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Reflections: Shifting shades of grey

Short-term, many companies seem grey and similar. But patience will reveal colourful outliers.

LTGG quarterly commentary

A look at recent macroeconomic factors and performance and considerations for the future.

Reflections: Operational growth hurdles

Why growth is still possible in hard times.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

The changing face of advertising

With data at the heart of digital advertising, advertising businesses now come in many forms.

LTGG investor update

The LTGG Team share their thoughts on the portfolio, the current environment and what makes them optimistic about the future.

Reflections: Engines of growth

Understanding why certain ideas lead to growth can boost the chances of outperformance.

LTGG: climate progress update

Positive progress from a number of portfolio companies.

LTGG: our companies’ character

An LTGG ESG update.

Reflections: LTGG on tour

What do we learn from meeting management teams? That it’s good to be on the road again.

Reflections: The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Reflections: Company check in

We met holdings to track their progress as well as scouting out potential additions to the portfolio.

Reflections: Second quarter 2022

Sailing in the Roaring Forties.

LTGG Manager Update

The LTGG Team share their thoughts on what’s currently going on in the markets, what worries them and what they are excited about for the next 5-10 years.

Reflections: Sea Ltd

LTGG unpacks the potential of a new holding in the fintech and gaming space.

Jumpers in the hot wash

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Reflections: The future of synthetic biology

How Ginkgo Bioworks is making advances in computing and DNA engineering.

Reflections: A look back on Q1

The LTGG team consider recent performance and the long-term outlook for the fund.

Reflections: Roblox

New holding, Roblox, aims to bring the world together through play. The LTGG Team take a closer look.

Reflections: On short-term drawdowns

The LTGG team on short-term drawdowns and investing in era-defining companies.

Long Term Global Growth: Team evolution

Scott Nisbet interviews the Long Term Global Growth decision-makers discussing volatility, inflation, interest rates, China and portfolio holdings: Roblox, SEA, Moderna and Coupang.

ESG collaborations

Looking before we leap into industry initiatives.

Reflections: Affirm

The LTGG team take a closer look at how Affirm plan to transform the consumer credit industry.

ESG data: Filling in the gaps

LTGG is making efforts to improve environmental, social and governance metrics.

Reflections: The return of the tartan army

LTGG on demanding huge returns, backing companies that rip up the rule books, and looking to the future.

Reflections: Illumina

The genome sequencing specialist is playing a valuable role in the hunt for new treatments.

Rules of the game

Regulation and what we look for in companies’ responses.

Working it out

Adapting to the changing expectations of staff and society.

Inside and out

A focus on diversity and inclusion can result in competitive advantage.

Reflections: Looking for a contribution

The companies that LTGG invest in can turn their ability to improve society into a source of competitive advantage.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Staying engaged

What company engagement means to us.

A question of character

How we integrate environmental, social and governance factors into our investment approach.

Disruption week webinar: Digital payments platforms

New types of transactions and ecommerce services are being enabled by innovative fintechs.

Looking back going forward

In this edition of Looking Back Going Forward we explain how environmental, social and governance (ESG) considerations have been deeply embedded in our Long Term Global Growth strategy.

Reflections: Carvana

Carvana, the US online car dealership, has a lofty but straightforward mission to change the way in which people buy cars.

Reflections: China

The LTGG Team reason that where there’s transformational growth, the regulatory backdrop will evolve to keep up. That’s as true of China as it is elsewhere.

Reflections: LTGG and the elixir of youth

LTGG’s Tim Garratt explains how the team have endeavoured to keep the portfolio youthful and forward looking.

Reflections: Alphabet

The LTGG team explain why they decided to sell their clients’ holding in Google parent company, Alphabet.

Reflections: Beike

The LTGG team reflect on how Beike, China’s largest online house-buying platform, is disrupting the property market.

The anatomy of outliers

What characteristics do outperforming stocks have in common and how does the LTGG portfolio stack up?

Leading the charge

We reveal the research behind one of the highest-profile investments in Baillie Gifford’s 113-year history.

Reflections: The trade desk

The Trade Desk, a recent LTGG investment, is disrupting a $350bn market and challenging Facebook and Google’s control of online advertising. The LTGG Team discuss the opportunities ahead.

Highlights video: Long Term Global Growth webinar

Client Director Tatjana Evans-MacLeod highlights the most notable discussion points from the recent LTGG webinar, in which investment managers Mark Urquhart, Gemma Barkhuizen and Linda Lin discussed turnover, valuation, China, ESG, and capacity.

Reflections: The roaring twenties

When we are caught up in the drama of the present, it can be hard to see the accelerated progress that accompanies it. With technology firmly in the driving seat, Scott Nisbet explains why he sees a decade of growth ahead.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2020 issue

A gallery for growth

Much like an art curator, the role of the investment manager involves carefully selecting investments that will make a mark and grow in value over time.

Sensible nonsense

To stand the best chance of owning the winning companies of the 2030s, we should imagine how bizarre today’s ‘normal’ will seem when the next generation looks back.

Navigating noise

Navigating Noise, a video series brought to you by the Long Term Global Growth team, seeks to gather and share some of the thinking we find so valuable when investing for the long term.

A View from the Midst of the Pandemic

Technological developments over recent decades mean reality has outpaced the science fiction of his youth since Mark Urquhart joined Baillie Gifford almost 25 years ago.

AI: Learning on the job

Dubbed the new electricity, artificial intelligence is intrinsic to the strategy and operations of many companies in the Long Term Global Growth portfolio.

Calm reflection during the amygdala hijack

In times of stress stock markets, like people, often revert to act now, think later. Tim Garratt advocates doing the opposite.

Footprints and first steps

Mike Berners-Lee helps us to reassess how we calculate the environmental impact of the holdings within the LTGG portfolio.

Lessons from the Sonoran Desert

‘Lessons from the Sonoran Desert’ explores further the pioneering work of Professor Hendrik Bessembinder at Arizona State University, whose heroic feat of global number-crunching revealed extraordinary things about the nature of company returns.

Long-term talent

Gemma Barkhuizen and Robert Wilson recently joined the LTGG team as part of Baillie Gifford’s graduate training programme. Here they share their experiences, talk about what’s important to them, and give their view of LTGG’s way of looking at the world.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2020 issue.

When Milton met Billy

Shareholders seem to be obsessed with short-term profits. We aren’t. Scott Nisbet proposes an alternative path, where patience with the right companies is rewarded, and a less direct route to profitability can lead eventually to a more valuable outcome.

LTGG XV

The evolution of LTGG over the first 15 years.

Looking back going forward

In the latest edition of Looking Back Going Forward, John MacDougall looks back over the 15 years of Long Term Global Growth's history, reflecting on some of the holdings that have performed best, and the varied paths their share prices have followed.

Graham or growth?

In his latest paper, James Anderson discusses Ben Graham’s book The Intelligent Investor, the seminal work on Value investing that remains as valid today as it did when he wrote it seven decades ago. James considers the author’s views and their implications for Growth investing in the current environment.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2018 issue,

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2018 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2017 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2017 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2016 issue.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2016 issue.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

The information on this website is intended for institutional investors (as defined in the Securities and Futures Act, Chapter 289 of Singapore, as amended) and consultants in Singapore only. It is not intended for use by any other persons including members of the general public or investors from other jurisdictions.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with. These Terms and any non-contractual obligations arising from or connected with them shall be governed by, and these Terms shall be construed in accordance with, the laws of Singapore.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation or offer to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here.

This website does not collect personal information. "Cookies" may be stored on your computer for easy navigation. A "cookie" does not allow us to identify you, but stores information about navigation through our website (such as pages already visited, time and date of visit) which we can remember during the user's next visit to our website in order to improve your browsing experience. If you have any enquiries in relation to our data protection policies and procedures, this Website or the information on it, please click here to contact Baillie Gifford.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.