Please remember that the value of an investment can fall and you may not get back the amount invested.

The problem

Investment managers at Baillie Gifford have been thinking a lot about inflation and how it affects portfolio returns in recent months.

Prices have been rising at rates not seen since the early 1990s. It’s not yet clear whether this is a temporary spike or a shift to a higher inflation world.

War in Ukraine and sanctions against Russia have cut trade routes and played havoc with global supply chains. The fact that the two countries previously supplied 30 per cent of global wheat exports gives an idea of the scale of disruption to food supplies alone.

But that invasion, and all the wider uncertainty that comes with it, are just the latest layers on top of an extraordinary accumulation of inflationary circumstances.

They follow an extended period of quantitative easing in the wake of the great financial crisis and increased geopolitical competition that has undermined old assumptions about global trade.

More recently there’s been the effect of vast amounts of money spent by governments around the world to counter the economic shock of Covid-19. That’s on top of the unbalancing of supply and demand and interruption to trade caused by a global pandemic, most disruptively in the great ports of China.

Signs of how soaring prices have affected food, labour, packaging and transport costs are everywhere. For example, in the UK, the price of chicken, a main source of protein, has increased by 15.5 per cent since the end of 2020 according to the Office for National Statistics, partly reflecting a 14 per cent rise in the price of chicken feed. These kinds of increases play out all the way up the economic food chain.

Considering what inflation might mean

Since mid-2021, because of inflation’s threat to investment returns, particularly to the growth stocks we favour as longer-term investors, Baillie Gifford’s Risk Team has been working closely with investment manager colleagues. Together we’ve tried to take a broader, more constructive approach to inflation, and how it affects companies’ fundamental functions.

A better understanding of that dynamic helps us assess the comparative resilience of our portfolios in these new inflationary circumstances.

We’ve dug into what the academic literature says about the relationship between inflation and stock price returns and found its lessons to be complex and inconclusive. As always, Baillie Gifford’s preferred approach of looking at individual companies on their own terms reveals more to us than generalisations across economic sectors or entire economies.

Baillie Gifford owns shares in many kinds of companies, so our approach is not uniform. With the companies that are more affected by macroeconomic adversity, we are looking closely at their resilience, solvency and likely future recovery. We’re also scrutinising consumer staples companies with low margins whose revenue growth rate may be stuck in single digits. Through this analysis, we’re framing new questions about these companies, questions for ourselves and their management teams.

More broadly, our research shows several ways in which inflation hits portfolios over time: mainly by increasing discount rates – the interest rate used to work out the present value of future cash flows. That’s how markets usually price in inflation expectations when valuing portfolios.

We also looked at how capital intensive the companies in our portfolios were, the relationship between their capital expenditure and their profitability, the speed of their business cycles and their ability to generate cash and reinvest it. How much did they depend on capital spending to keep growth going – or just to stay in business?

Interestingly, though academic studies disagree on the links between inflation and equity returns, they do show that a rising discount rate disproportionately hits stocks that will achieve a big fraction of their cash flows in the more distant future. These include many of the types of businesses Baillie Gifford invests in.

To be clear, there’s nothing intrinsic to the way these growth companies operate that makes them especially vulnerable to inflation, or any other macroeconomic factor for that matter. Instead, it’s their long growth timeline that affects how they are valued today.

Because inflation eats into expectations of future returns, the market likes stocks presently earning higher returns after taxes and inflation. It also likes those that can depend on cash coming in right now and which have resilient margins and proven profitability. Naturally, these stocks are being favoured at the expense of those that are longer-term, less certain, and more about future growth potential.

What we’ve learned is that, when considering what inflation might mean to future cash flows, markets can’t readily grasp how the fundamental strengths of a business might still make a positive difference.

Even if analysis by the Baillie Gifford Risk Team hasn’t given us a grand universal theory about the link between inflation and equity returns, it has helped identify and quantify the facets of a company that we think matter. They include the ratio of capital spending to performance and profitability, the size of margins, the speed of the business cycle and the ratio of revenues to working capital, among other factors.

Isolating these aspects has helped provoke debate and given our investment teams a fresh perspective on the growth case for individual companies, also a means of assessing the inflation resilience of our portfolio companies.

We do this by looking at their cost pressures, growth rates, pricing power and susceptibility to rising interest rates, to name just some of the metrics that make the difference.

What does that tell us? That the kinds of disruptive and innovative companies we invest in, while not impervious, tend to have strengths that can reduce their vulnerability to inflationary forces. Their ability to adapt, disrupt and exploit opportunities can continue, regardless of an inflationary macroeconomic environment.

Even in inflationary times, holdings across all our portfolios are mostly operating well. Many are high-quality, well-positioned businesses with strong franchises, strong balance sheets and high profit margins. Many are disruptive future growth companies, which might not be profitable right now but which are growing revenues quickly or unleashing the new technologies that will spur future growth.

What they have in common is the ability to bring out innovative products that meet evolving demands while adapting to changes in the supply lifecycles. Those underlying strengths mean that, inflation or no inflation, we’re as convinced as ever about their growth potential.

Analysing portfolios

The kinds of things that make our portfolio companies resilient against inflation include a strong growth trajectory, strong profit margins and no great need for extra capital to grow.

Often the growth of these businesses isn’t geared to the economic cycle. We see cash flows stretching out into the future that denotes more resilience than that of many of the stocks they’re benchmarked against.

Then there are the businesses that are less attuned to the economic cycle. These are disruptive businesses that are grabbing market share by disrupting other established businesses. So while that discount rate might affect the current valuation, we think these businesses will keep growing.

The four most important factors determining resilience against inflation are:

- Pricing power: ability to raise prices and keep customers

- Sales growth

- Operational leverage: ability to turn extra sales into extra profits

- Sensitivity to interest rate rises

Baillie Gifford’s investment strategies are autonomous and we don’t have a house view on inflation, so there will be differing views. However, here are some examples of companies from our global strategies’ portfolios that illustrate these four factors:

Case studies

Pricing power

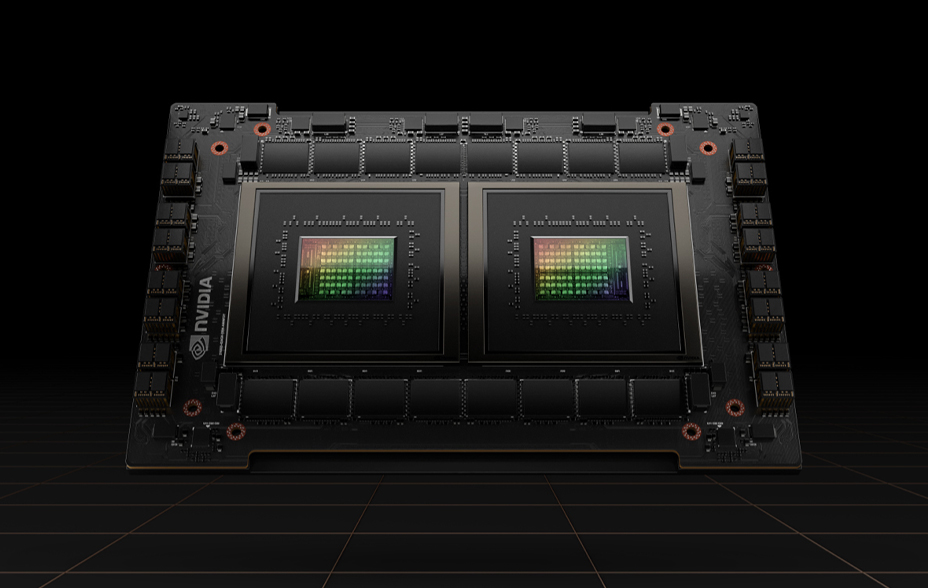

Nvidia

San Jose, California, USA

By Ben James, Director, US Equities Team

Graphic processing units (GPUs) are essential to many technologies now part of everyday life. These include augmented and virtual reality, artificial intelligence and gaming, as well as emerging areas such as cryptocurrency mining. Nvidia’s position as the leading designer of GPUs puts the company in a prime position to take advantage of demand. The need for these units is unlikely to dry up, even in inflationary times. Despite logistics disruptions and chip shortages, Nvidia has been able to increase profit margins in recent years and has a proven ability to pass extra input costs on to customers.

Two factors account for this impressive pricing power: First, Nvidia controls more than three-quarters of the market and its GPUs are considered the best in the business. Secondly, graphic cards have a limited shelf life. Users need to update their units regularly to benefit from constant performance improvements. With improved performance also comes a higher price. These factors have contributed to success that looks set to continue as the company keeps on innovating and expanding into new markets.

Operational leverage

Mettler Toledo

Zürich, Switzerland

By Andrew Daynes, Client Service Manager, Clients Department

Operational leverage means high fixed production costs but low costs for additional units of production. In other words, a company can sell more units without markedly increasing production costs. The more they sell, the more profitable they become. Swiss company Mettler Toledo makes weighing and measuring equipment for industrial and laboratory use. The company has consistently grown earnings per share at around 15 per cent a year: 5 per cent revenue growth, 5 per cent margin increases, and 5 per cent share buybacks. This impressive display of high operational leverage and pricing power, underpinning a strong return on invested capital, is rooted in product quality. It operates in a niche where customers’ priority is accuracy of measurement, price is secondary.

Mettler Toledo also has an excellent sales force and has become extremely efficient at selling products containing only incremental innovations. This all means that in inflationary times the company has options: It’s in a strong position to pass on extra costs, but it also has headroom to cut margins, take market share and steal a march on its rivals that will benefit it in the long term.

Interest rate sensitivity

HDFC

Mumbai, India

Joe Faraday, Director, International Equities Team

Indian financial services giant HDFC benefits from positive interest rate sensitivity. This means that when rates go up, which tends to happen in response to high inflation, it directly benefits the company. HDFC is the largest mortgage provider in India, with businesses in life insurance, asset management and banking. It’s a trusted brand in a fast-growing market, with an extensive network of branches as well as good digital platforms. As interest rates rise, HDFC’s net interest rate – the difference between what the company pays in interest on deposits and what it charges on loans – increases, so it becomes more profitable.

What matters more, however, is how the company uses these extra profits and how it copes when interest rates are low. HDFC takes a conservative, long-term view. The company is very good at reinvesting profits to drive long-term growth. This cautious approach means that when rates do drop, the company can still build for its future and cushion itself further against the threat of future failure.

Sales growth

SEA Ltd

Singapore

By Tim Erskine-Murray, Director, Emerging Markets Team

Selling new kinds of products and services whose disruptive appeal defies short-term trends and cycles is good protection against inflation. Take Singapore’s SEA Ltd: From success with the video game Free Fire (300 million players per month), it has aggressively expanded into ecommerce with its Shopee brand, and then digital payments and financial services arm SeaMoney. The group, which operates in Southeast Asia and Taiwan, generated $3.2bn of revenue in the fourth quarter of 2021, up over 100 per cent from the previous year. The long-term picture is encouraging: Gaming is predicted to grow from a $175bn market to a $300bn market by 2025, and SEA has 1.8 per cent of the global market.

More than $60bn of sales are currently made on Shopee’s site, up 75 per cent in 2021, largely due to Covid-19. But ecommerce penetration is still only 12 per cent in Southeast Asia and is expected to grow to over 20 per cent in the next few years. SeaMoney could be an even larger opportunity than ecommerce with 74 per cent of its addressable markets either unbanked or underbanked. Rival fintech companies don't have the ecommerce data on which a lending and payments business is best built.

Risk Factors and Important Information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in June 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

겝샘尻栗밗잿(베)唐掘무鱇(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

겝샘베棍尻栗샘쏜밗잿(베)唐掘무鱇(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref 23122 10011971