All investment strategies have the potential for profit and loss, capital is at risk.

In 1910, a Dutch colonial engineer discovered nickel deposits on the island of Celebes (now Sulawesi). The Imperial Japanese Army invaded in 1942, partly to lay hands on the metal to sustain its wartime industry. Now Indonesia mines more nickel than the next three biggest producing nations put together.

Our increasing conviction in Indonesian companies partly comes from how its government maximises the potential of its bountiful raw materials. These include commodities essential to the global transition to low-carbon technologies.

The world’s fourth most populous country is benefiting from a global boom in the resources it possesses in plenty. Beyond nickel, they include oil, copper, cobalt, bauxite, palm oil and rubber. The ‘green transition’ would be almost impossible without copper’s conductive properties, for example. Engineers use it to make solar, wind and hydro systems more efficient. They use cobalt to produce wind turbine magnets and to make biogas.

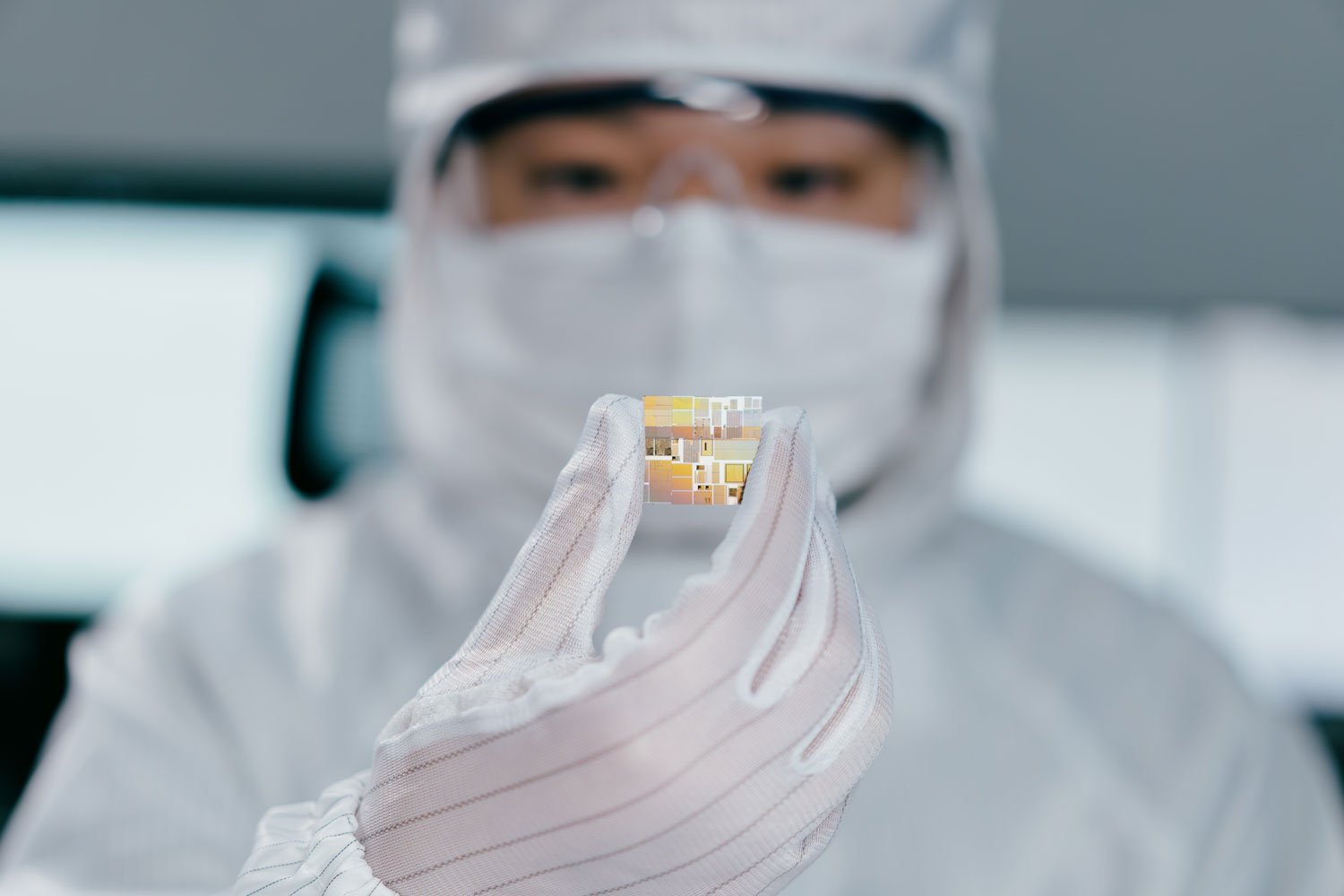

The abundance of cobalt and nickel makes Indonesia a key link in the electric vehicle (EV) battery supply chain. Its politicians have long cultivated good relations with the west and China, expanding the range of potential customers.

Indonesia’s president Joko Widodo, or Jokowi as he’s known, has also encouraged a shift up the value chain via an unorthodox method. Following his election in 2014, he banned some unrefined raw material exports, starting with nickel ore. This forced foreign companies to process the resources within local industrial parks so that Indonesia could accrue more value from its natural resources.

Companies such as Merdeka Copper Gold support this shift. Merdeka is developing a nickel project in southeast Sulawesi, involving a mine and two new nickel smelters, in partnership with a Hong Kong-based battery maker. The Indonesian miner’s management has a strong track record, and it’s backed by well-connected shareholders.

Merdeka and other holdings, including Nickel Mines, showcase the country’s green commodities potential. Although Indonesia is a major greenhouse gas emitter because it burns domestic coal for energy, it is aggressively promoting its potential for investments in hydro, wind, solar and geothermal power and its commitment to net zero emissions by 2060.

So far, President Widodo’s commodities policy has attracted $25bn in overseas investment. China’s CATL and South Korea’s LG Energy are among companies building local processing plants. And the government is in negotiations with Tesla about building a car-making ‘gigafactory’, having already signed a $5bn deal to supply the electric vehicle maker with nickel products.

We see more foreign direct investment coming to places such as the industrial park at Tanah Kuning. Its construction in Borneo covers 30,000 hectares – the same area as the entire city of Edinburgh. It will be the world’s largest such site powered by renewables (hydroelectricity and solar power) and will specialise in battery production.

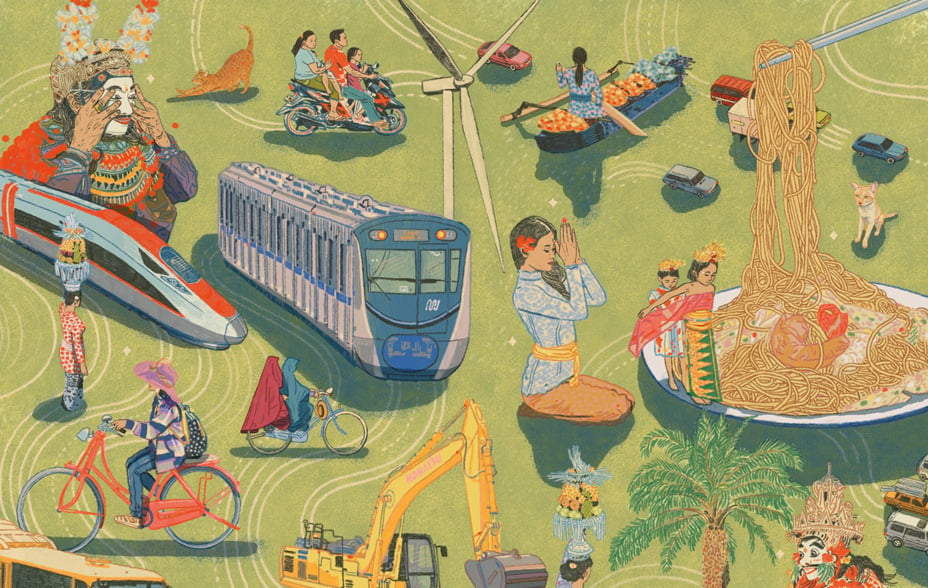

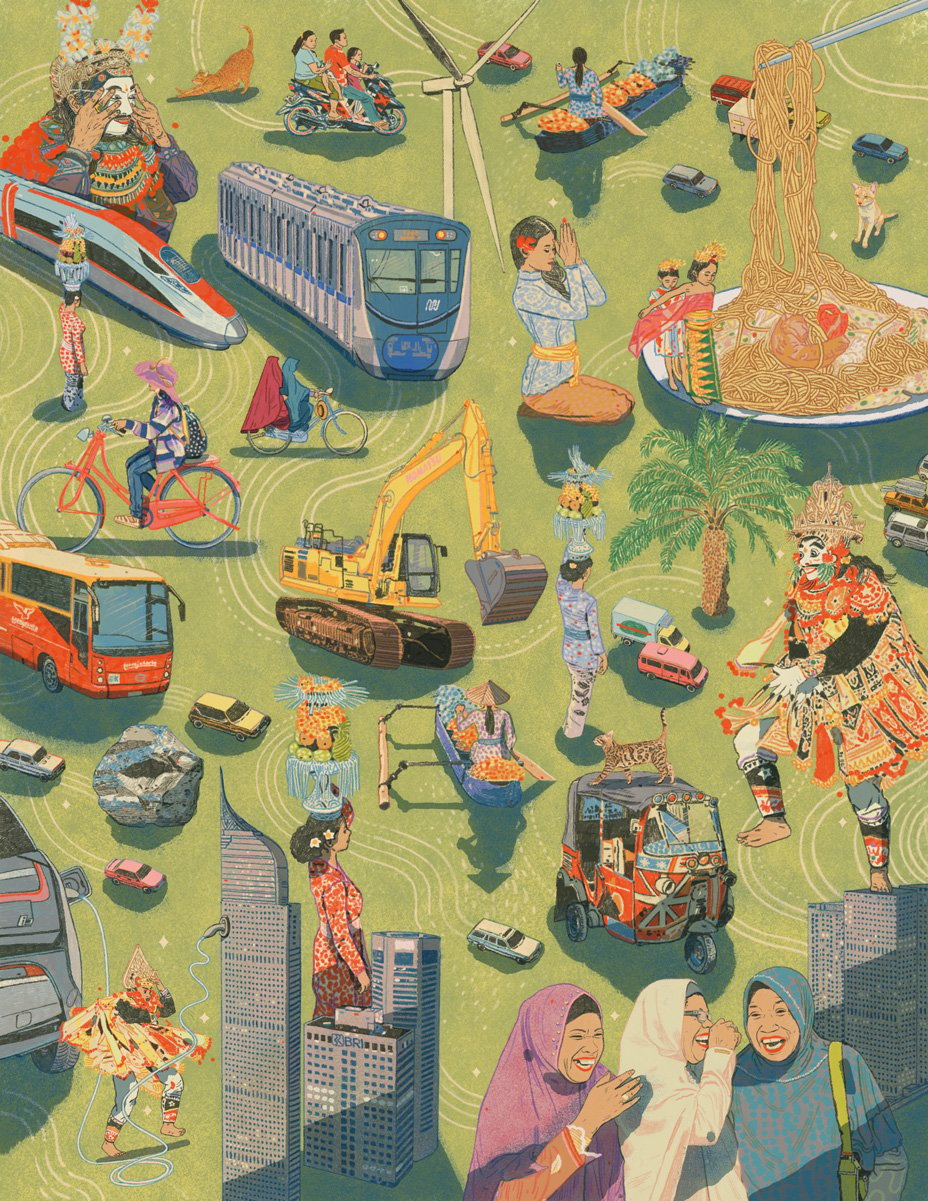

Illustration by Anna Higgie

Indonesia’s impressive GDP growth rate is buoyed not just by the success of miners and mineral processors but by companies gaining from its strengthening domestic consumption. Its quarter-billion population is youthful, and the middle class is growing.

One beneficiary is PT Bank Rakyat Indonesia, which we consider the best microlending business of any emerging market. The lender’s branch network across the nation’s many islands is nearly impossible for rivals to replicate. Decades worth of customer data and local knowledge let it price loans effectively and profitably. We see it growing strongly for decades to come.

Astra International is also enjoying the rising tide of prosperity. The well-managed conglomerate distributes cars and trucks, sells financial services and leases heavy industrial equipment. It has a sizeable market share. And it counts Toyota, BMW and Honda among its partners.

Jokowi has successfully deregulated the economy and cleaned up state-owned enterprises. Meanwhile, the internet and smartphones have mitigated the disadvantages of a country spread over 17,500 often mountainous and jungle-covered islands. Indeed, Jakarta is now a leading regional incubator of tech businesses.

Since Jokowi’s election in 2014, he has overseen the completion of 2,000km of roads. That’s more than two-and-a-half times more than his predecessors managed in the three previous decades. In addition, there are new ports, airports and hydroelectric dams. Improved mass transport systems have eased Jakarta’s notorious traffic, and Java now has the country’s first high-speed rail link. After decades when its performance struggled to match both its scale and its natural resources, Indonesia is at last going places.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 78525 10041081