Illustration by Jack Daly

Please remember that the value of an investment can fall and you may not get back the amount invested.

This article originally featured in Baillie Gifford’s Autumn 2021 issue of Trust magazine.

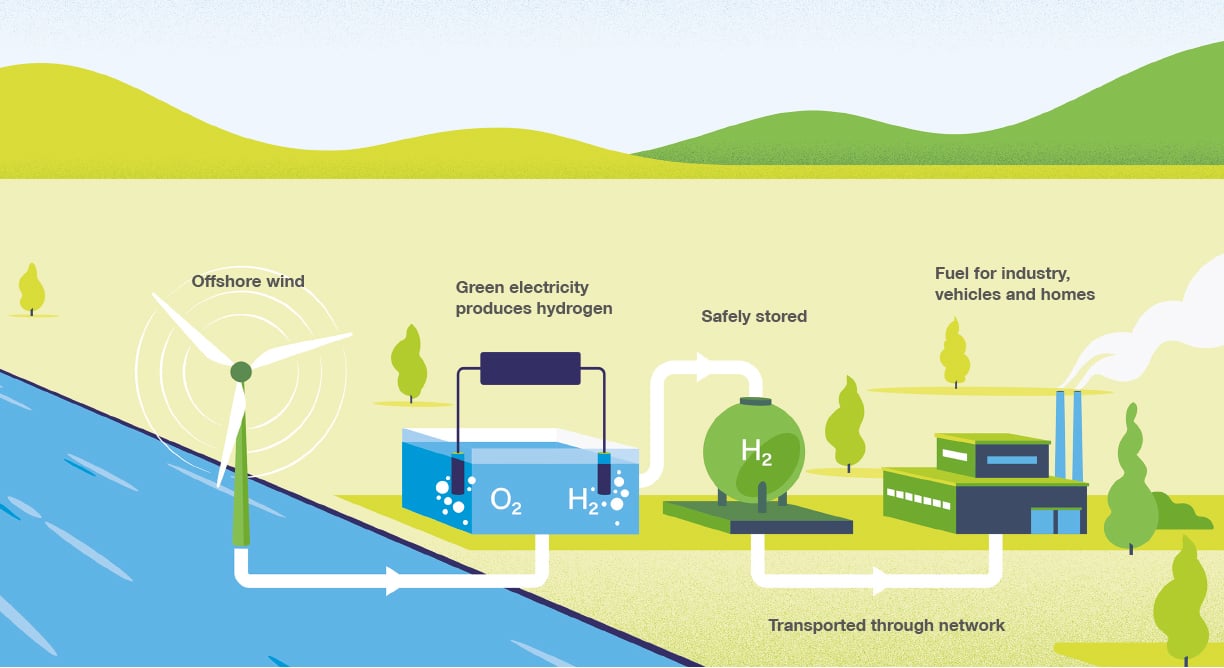

In 1874, novelist Jules Verne hailed hydrogen as an inexhaustible energy source, the answer to some of humanity’s biggest challenges.

It certainly has a lot going for it. Hydrogen is the most abundant element in the universe. It is light, packs a lot of energy into a small space and can be stored for long periods. Hydrogen can be used to fuel our cars, trucks, boats and ships, heat our homes and offices, power industry and produce low-cost fertiliser to help us feed a fast-growing population. It emits only water and can help combat atmospheric pollution, ocean acidification and climate change.

But the technological breakthrough and social alignment that would allow us to harvest this bounty have remained tantalisingly out of reach. “For decades, hydrogen has been hailed as the miracle solution, yet the date when technology can exploit its full potential has always been a moveable feast, set two or three years in the future,” according to Edinburgh Worldwide Investment Trust manager Douglas Brodie.

This time it is now in our grasp. “We see societal recognition that global warming is real and must be dealt with, there is genuine buy-in to net zero carbon commitments, as well as growing political backing for hydrogen. This is happening as renewable energy costs have fallen significantly and hydrogen-based technologies have matured. The ingredients for change are now in place as never before,” Brodie explains.

Electrification and batteries provide a path to decarbonisation in passenger transport. But in large polluting industries, such as steel and ammonia production, or in aviation and shipping, that approach is unlikely to work. For these industries, green hydrogen is the only practical route to net zero. Brodie contends that these industries will be key adopters over the coming decades, providing scale to the hydrogen economy and unlocking the economics for other uses in the future.

Edinburgh Worldwide Investment Trust has been scouting for technologies and companies with an edge in the race to make hydrogen usable, accessible and affordable.

Green hydrogen

The hydrogen spectrum

Hydrogen has a big part to play in helping economies achieve their goal of net zero emissions by 2050. Many countries have already published ‘hydrogen strategies’ detailing how they intend to stimulate demand for a gas that, according to Goldman Sach’s recent report Green Hydrogen, could supply up to 25 per cent of the world’s energy needs by 2050. The report predicts a $10tn dollar market for hydrogen by that year.

The appeal of hydrogen is that, when burned, its only waste product is water. But separating it from other gasses can be a dirty, carbon-intensive business, hence the need to classify hydrogen by its method of production:

Grey hydrogen

The most common type, produced using fossil fuels such as natural gas and coal, and a massive emitter of CO2.

Blue hydrogen

Also produced using fossil fuels but carbon capture technology at hydrogen plants prevents CO2 being released, allowing it to be stored or used in other industrial processes.

Green hydrogen

Has close to zero carbon emissions as it’s created by electrolysis powered by renewable energy such as solar and wind. The production cost of these sources is steadily falling, lowering input costs to enable companies to use technologies such as those pioneered by ITM and Ceres to manufacture green hydrogen. It can also help mitigate the perennial problem of renewable ‘intermittency’ – the unreliability of the wind and the sun at times of high demand. By storing energy from times of ample renewable production for later use, hydrogen can help provide a steady supply to the grid.

“There are several green electrochemical cell technologies that either use hydrogen in a fuel cell to create electricity, or, when run in reverse in an electrolyser, to convert electricity into hydrogen,” explains Brodie. He cites the two most promising competing technologies as solid oxide cells and PEM, or polymer electrolyte membrane. Solid oxide cells run at high temperatures, can also use other fuels besides hydrogen and have a wider range of industrial applications, especially where waste heat can be used. PEM doesn’t require such high temperatures. It is less efficient but can be more responsive to sudden demand, making it suitable for pumps dispensing hydrogen on demand, or for converting and storing excess renewable energy to ‘balance the grid’ at times of plentiful electricity supply but low demand.

“Each side will argue its own technology is better, but functionally they are the same, in that they both react hydrogen with oxygen to release electrons. The only byproduct is clean water, and this equation is simply reversed in an electrolyser,” says Brodie. “We’re interested in companies with a key enabling technology that will allow them to go into lots of different areas.”

Brodie has selected two UK companies he considers “real players” in a crowded landscape of competing technologies.

ITM Power, a company held by Edinburgh Worldwide, has emerged as a leader in green hydrogen electrolysis – creating net-zero hydrogen using renewable energy (see box opposite). ITM supplies PEM systems for energy storage, hydrogen refuelling and industrial decarbonisation, a process which helps companies reduce carbon emissions in steel, glass, mining and fertiliser production.

The company has been developing strategic partnerships with firms such as industrial gas pioneer Linde, energy infrastructure company Snam, and offshore wind specialists Ørsted and Scottish Power. Its business model is highly scalable. Its one gigawatt semi-automated ‘gigafactory’ in Sheffield is an easily replicable model for building more PEM capacity as the market develops.

The trust also has a longstanding holding in Ceres Power, whose solid oxide fuel cell technology Brodie considers to be both efficient and flexible. Ceres has also established useful technology-sharing partnerships with global industrial and transportation giants such as Bosch, Doosan and Weichai.

“Ceres has found a way to run solid oxide fuel cells at a substantially lower temperature of some 550C (1,022F) as opposed to the more usual 800C (1,472F). Because they can operate at lower temperatures, they can use lower-cost materials, such as steel and ceramics, which simplifies the manufacturing process and offers scalability potential to both fuel cells and electrolysers based on this technology,” Brodie notes.

In addition, Ceres’ technology is among the most efficient ways to generate power from any fuel, whether low or zero carbon, and its method of depositing the functional aspects of the cells through ceramic ‘ink’ in its SteelCell stacks is near-impossible to reverse-engineer after manufacture. “Trying to do so would be like trying to extract flour from a loaf of bread, so Ceres has a robust intellectual property advantage,” Brodie adds.

Even if the outlines of the hydrogen economy are still unclear, Brodie expects it to be shaped by companies such as Ceres that focus on valuable knowledge-sharing partnerships and alliances, as well as by new investment and business models.

“We’re at the start of an energy transition that will last for the next 20 to 30 years,” Brodie says. “Once established, the hydrogen economy will be here to stay.” Even if there’s uncertainty about how and when the transition to hydrogen power will happen, there’s already good reason to believe that Jules Verne got it right.

If you would like to register to receive Trust magazine please visit bailliegifford.com/trust

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates. Investments in smaller, immature companies are generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller, immature companies may do less well in periods of unfavourable economic conditions.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com