Capital at risk

ACWI ex US All Cap

We have three core beliefs: superior profit growth leads to outperformance; fundamental analysis enables exploitation of market inefficiencies, and share prices reflect fundamentals in the long term.

Identifying the drivers of growth

A growth portfolio taking the best ideas from firmwide research. For over 30 years, International All Cap has had a consistent investment process, actively making long-term investments in growing companies.

International All Cap Q3 update

Investment manager Iain Campbell reflects on recent performance, portfolio changes and market developments.

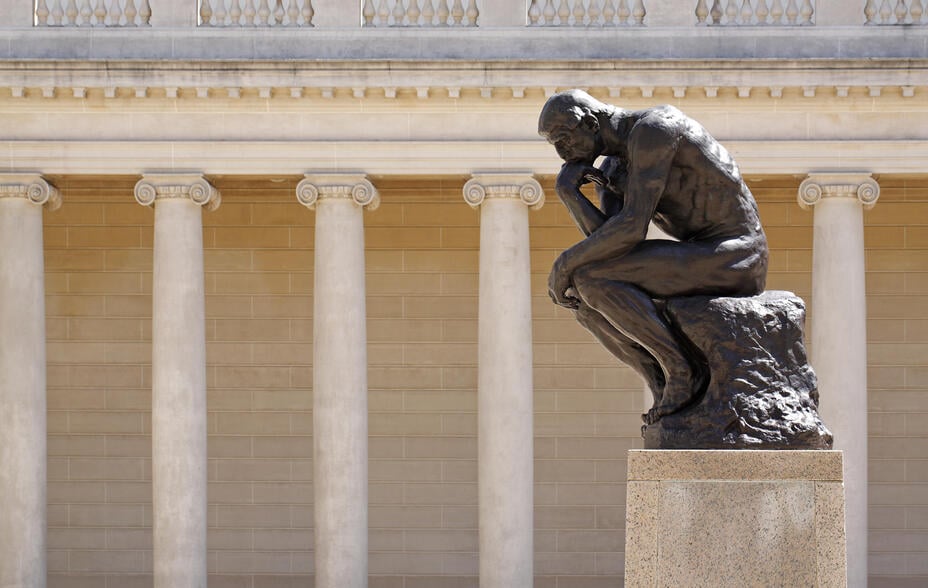

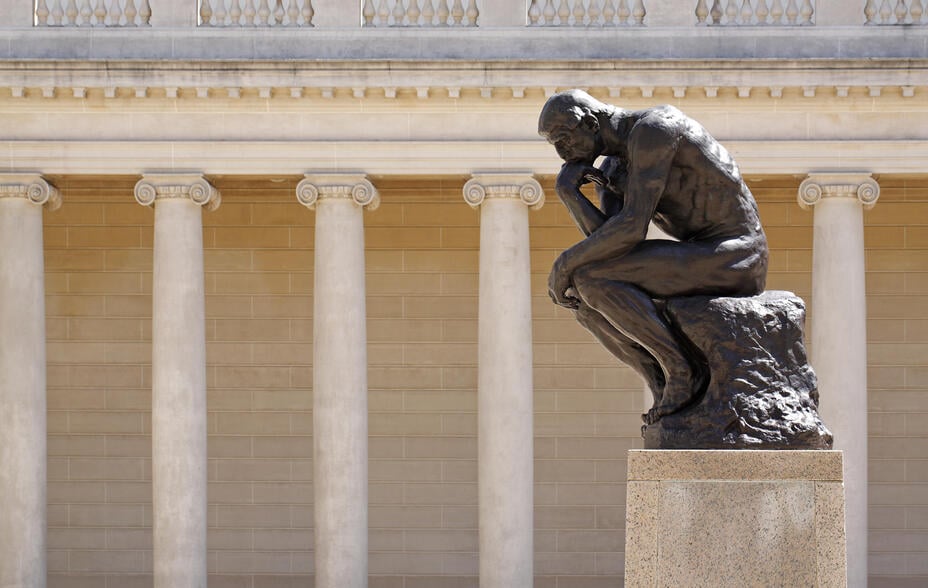

Searching for superior companies

To perform better than the market, you need to be different from it. We look to invest in businesses that exhibit some combination of sustained, above-average growth and strong competitive advantage, such as superior profit margins or returns on invested capital.

We believe that stock markets have a recurring tendency to under-appreciate the value of long-term compound growth. We aim to take advantage of this by investing with a minimum time horizon of five years in mind.

An eclectic portfolio

We take great pride in drawing from firmwide research to bring our best international ideas to the portfolio.

We search for growth across the market cap spectrum. The result is a portfolio tilted towards the lower end of the benchmark’s market cap range. We think this is a fertile hunting ground for focused, well-run growth companies.

The strategy has a long and proud history. Our track record has outlived personnel changes by following a consistent investment philosophy and process.

Human ingenuity will continue to generate opportunities for strong returns long into the future.

Meet the managers

Documents

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Baillie Gifford International All Cap Collective Investment Trust (CIT)

- Separate account

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 November 2025

| # | Holding | % of total assets |

|---|---|---|

| 1 | TSMC | 6.73 |

| 2 | United Overseas Bank | 2.86 |

| 3 | Tencent | 2.74 |

| 4 | Samsung Electronics | 2.36 |

| 5 | ASML | 2.23 |

| 6 | Roche | 2.18 |

| 7 | TotalEnergies | 2.01 |

| 8 | Investor | 1.97 |

| 9 | Shopify | 1.83 |

| 10 | Assa Abloy | 1.79 |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Baillie Gifford International All Cap Collective Investment Trust (CIT)

- Separate account

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

International viewpoints: the quality derating

Why overlooked quality businesses with competitive moats compound returns through any cycle.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

International viewpoints: bubble or boom, trouble is brewing

Is AI in a bubble or a boom? Explore how market concentration, leverage, and global strategies shape the next phase of artificial intelligence.

International viewpoints: the Asian century

The Asian century is now a structural reality. Explore manufacturing dominance, innovation in chips/EVs/ecommerce, key companies, and risks.

International All Cap Q3 update

Investment manager Iain Campbell reflects on recent performance, portfolio changes and market developments.

International All Cap Q3 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

The power of exceptional companies

Lawrence Burns and Paul Taylor reveal how they identify exceptional companies that drive market returns.

International viewpoints: the case for global supply chain champions

Learn about companies like ASML, TSMC, Adyen and SAP and their irreplaceable positions in enabling digital innovation.

International viewpoints: enduring value – investing in brands built to last

Can businesses that blend heritage, stewardship and steady reinvention outperform their flashier, short-term-focused rivals?

International viewpoints: digital disruptors

MercadoLibre and Sea Ltd are examples of underappreciated digital disruptors driving global growth.

International All Cap Q2 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q2 update

Investment manager Joe Faraday reflects on recent performance, portfolio changes and market developments.

Beyond the familiar: the case for international

Discover how venturing into unexplored investment territory is yielding hidden gems.

A new age of discovery: the case for international

Explore how international equities offer unique opportunities in transformative markets.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

International viewpoints: the end of the road for range anxiety

Explore how electric vehicle innovations are ending range anxiety with faster charging and longer battery life.

International viewpoints: US vs international debate

Signs are pointing to a shift from US to international markets. When has this happened before, and what’s ahead?

International All Cap Q1 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q1 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

International viewpoints: Shifting tides toward international markets

The US stock market has outperformed international markets in recent years, but signs suggest a change in this trend.

A long-term manifesto, revisited

Why exceptional growth companies must be brave enough to ignore short-term market pressures.

International viewpoints: Europe's tech tailwinds

The European technology sector excels in niche markets, creating growth opportunities in global value chains.

International All Cap Q4 update

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q4 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: demographic crisis

Meet the problem-solvers already active in healthcare, retirement funding and workforce productivity.

International viewpoints: power players

Companies rising to new energy challenges in diverse ways, and the economies driving demand.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

Luxury brands show promise amid slump

How brands like Hermès, Gucci and Ferrari defy downturns with heritage and innovation.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

Wise: Growing global money transfers

Charting rising cross-border money payments and the opportunity for remittance service Wise.

International viewpoints: semi-cap resilience

Why our long-term conviction in ASML, Tokyo Electron and TSMC stands up to recent sector volatility.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

International All Cap: inflection points

Investment specialists give updates on performance, portfolio activity and the grounds long-term optimism.

Ashtead: hiding in plain sight

This little-known equipment rental company is one of the UK’s most exciting growth stories.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

International All Cap: committing to growth

Investors give updates on performance, portfolio activity and the merits of long-term thinking.

Near-term headwinds, long-term optimism

Investors provide an update on International All Cap performance and portfolio activity.

How to surf the waves of growth

Good investing takes quick reactions as well as a long-term vision.

International All Cap Q3 update

Investment manager Iain Campbell reflects on recent performance, portfolio changes and market developments.

International viewpoints: the quality derating

Why overlooked quality businesses with competitive moats compound returns through any cycle.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

International viewpoints: bubble or boom, trouble is brewing

Is AI in a bubble or a boom? Explore how market concentration, leverage, and global strategies shape the next phase of artificial intelligence.

International viewpoints: the Asian century

The Asian century is now a structural reality. Explore manufacturing dominance, innovation in chips/EVs/ecommerce, key companies, and risks.

International All Cap Q3 update

Investment manager Iain Campbell reflects on recent performance, portfolio changes and market developments.

International All Cap Q3 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

The power of exceptional companies

Lawrence Burns and Paul Taylor reveal how they identify exceptional companies that drive market returns.

International viewpoints: the case for global supply chain champions

Learn about companies like ASML, TSMC, Adyen and SAP and their irreplaceable positions in enabling digital innovation.

International viewpoints: enduring value – investing in brands built to last

Can businesses that blend heritage, stewardship and steady reinvention outperform their flashier, short-term-focused rivals?

International viewpoints: digital disruptors

MercadoLibre and Sea Ltd are examples of underappreciated digital disruptors driving global growth.

International All Cap Q2 investor letter

The International All Cap Team reflects on recent performance, portfolio changes and market developments.

International All Cap Q2 update

Investment manager Joe Faraday reflects on recent performance, portfolio changes and market developments.

Beyond the familiar: the case for international

Discover how venturing into unexplored investment territory is yielding hidden gems.

A new age of discovery: the case for international

Explore how international equities offer unique opportunities in transformative markets.

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Baillie Gifford International All Cap Collective Investment Trust (CIT)

- Separate account

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Baillie Gifford International All Cap Collective Investment Trust (CIT)

- Separate account