May 2021

Investors should carefully consider the objectives, risks, charges and expenses of the Fund before investing. This information and other information about the Fund can be found in the prospectus and summary prospectus. For a prospectus or summary prospectus please visit our website at https://usmutualfund.bailliegifford.com. Please carefully read the Fund's prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Limited and a member of FINRA.

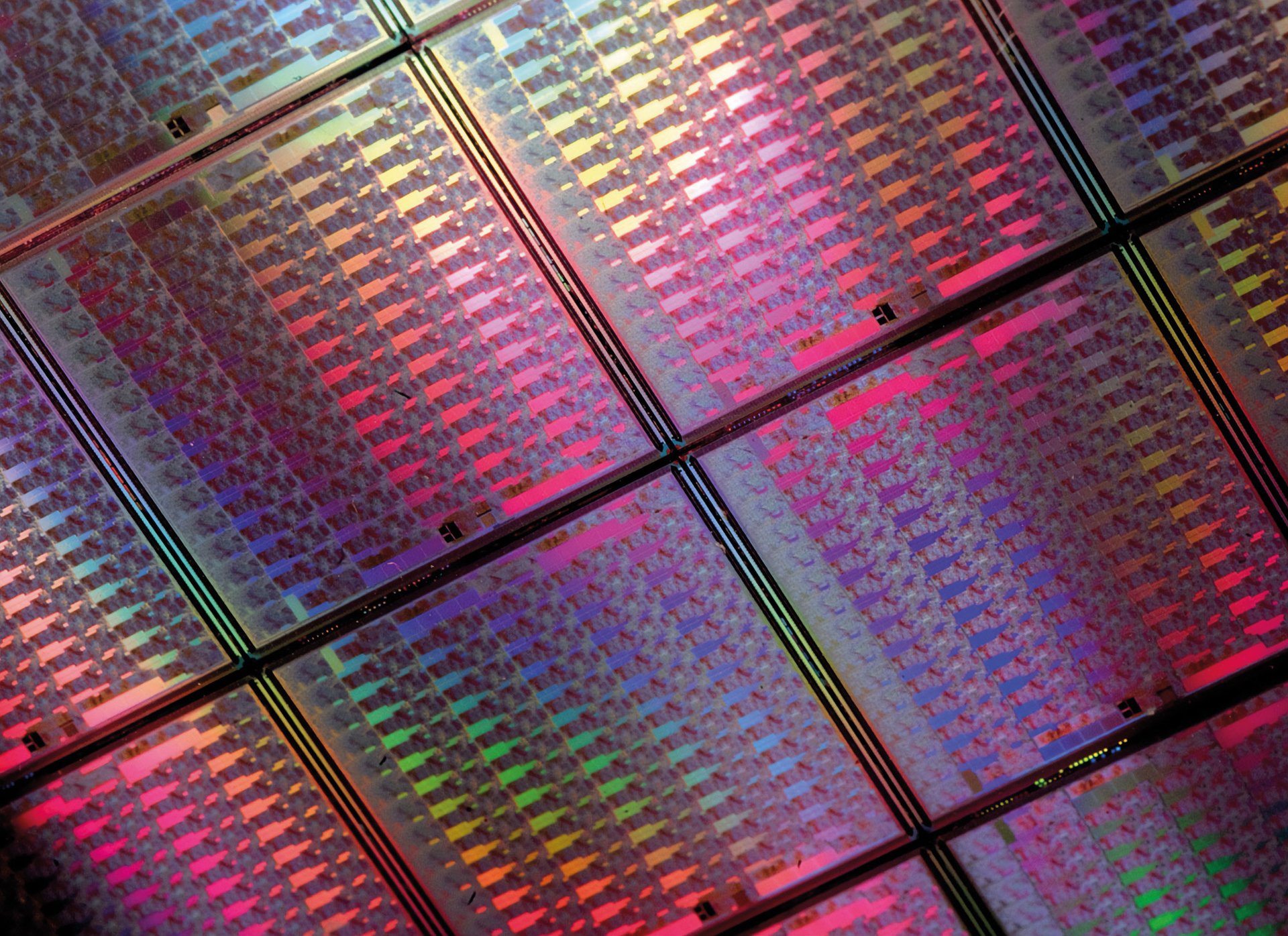

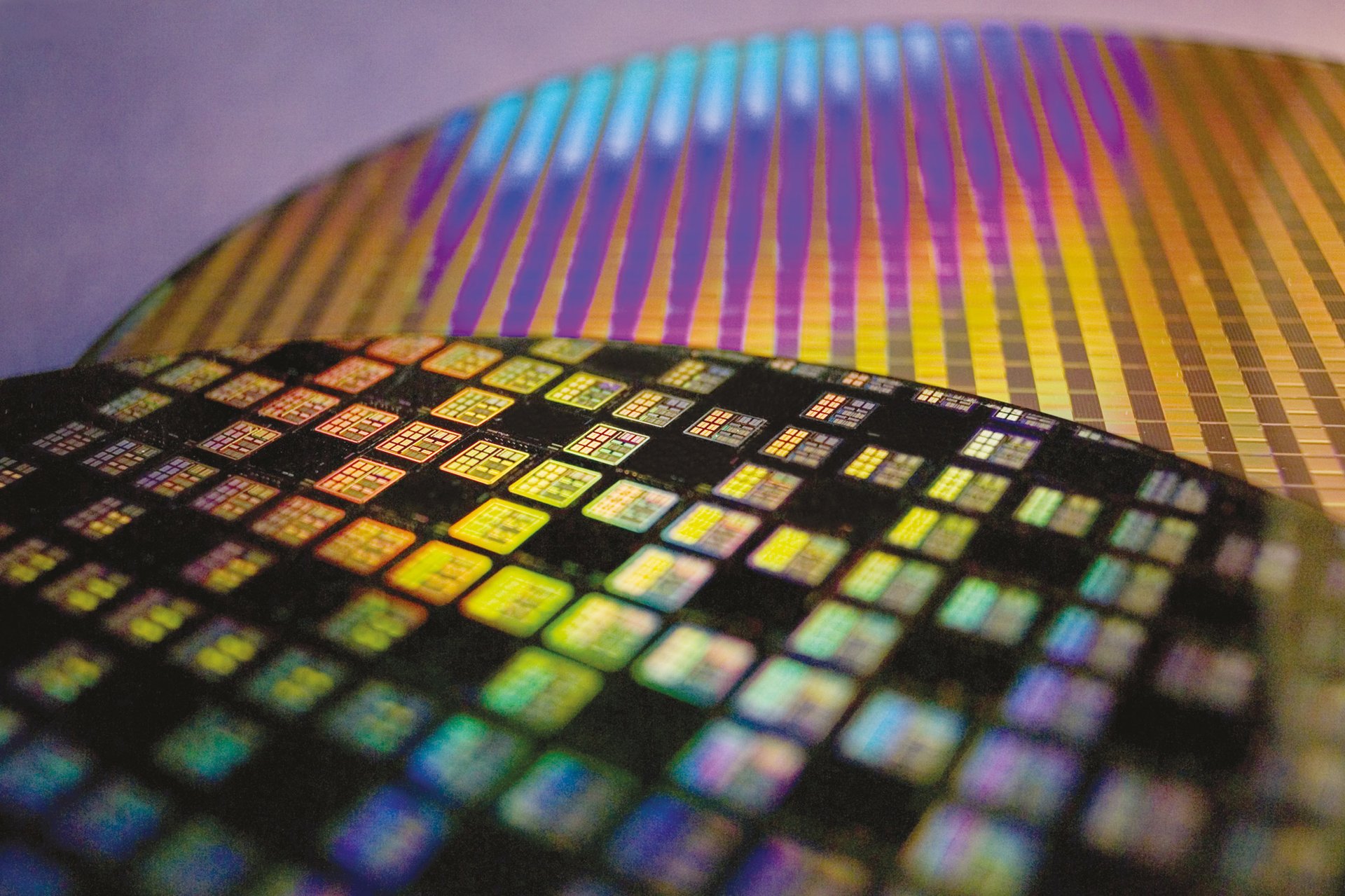

What is no bigger than your fingernail, something you use multiple times a day but can’t see?

A semiconductor1.

What are the most important technology companies you haven’t heard of?

TSMC and ASML.

To say semiconductors are essential to electronic devices is arguably inane; maybe to say they are essential to everyday life is fairer, and perhaps even closer to the truth is that they are responsible for powering phenomenal technological and societal advancement.

The Positive Change portfolio seeks to invest in companies whose products and services are providing solutions to global challenges. So, it’s perhaps unsurprising that Tesla (transforming the automotive sector), Moderna (unlocking a new paradigm of medicine) and Safaricom (providing connectivity and access to financial tools in Kenya) are all holdings. But when we say that we own a semiconductor equipment manufacturer (ASML) and semiconductor manufacturer (TSMC), we’re often met with curiosity. In fact, I would argue that the change delivered by Tesla, Moderna and Safaricom would be impossible without the existence of ASML and TSMC. Semiconductors are at the heart of technology, they are the building blocks of the innovation that powers societal progress, and yet they can be overlooked for their importance in driving positive change.

1. Semiconductors are a series of electronic circuits printed onto a conducting material (usually silicon). They form the brains of devices, determining their capabilities and functionality.

In his 2010 Ted Talk, the late and great Hans Rosling recounted the arrival of his family’s first washing machine and his mother saying, “Now Hans, we have loaded the laundry. The machine will make the work. And now we can go to the library,” and went on to energetically tell his audience “Because this is the magic: you load the laundry, and what do you get out of the machine? You get books out of the machines, children’s books. And mother got time to read for me… (and) she got books for herself.” He then went on to thank industrialisation, steel mills, power stations and the chemical processing industry, all of which contributed to making washing machines possible. Semiconductors also play their role in programming washes. Laundry is mundane, but the washing machine is miraculous in saving (predominantly) women the labour of finding, transporting and heating water before the labour of washing, and for freeing up their time to spend on something more enjoyable and productive.

“The cause is hidden. The effect is visible to all”

The Cause:

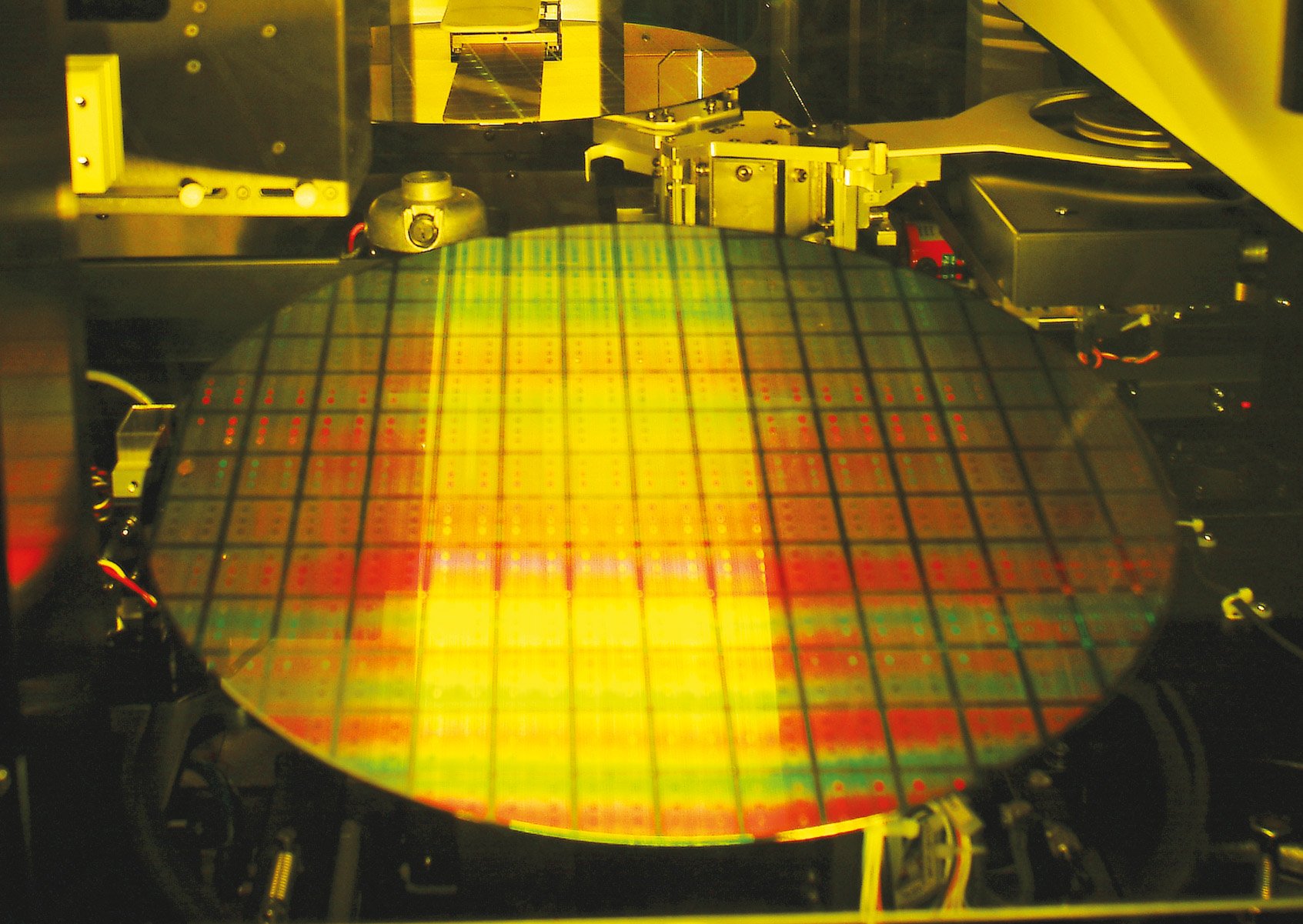

ASML’s incredibly complex lithography machines2, software and services play a critical role in the manufacturing of semiconductors, enabling its customers to increase the power of semiconductors and lower their costs, helping power what is known as Moore’s Law3. By enabling greater processing capability, ASML is contributing to technological advancement; in reducing the cost of computing power, it is helping democratise access to new and life-changing technologies, whether it be mobile computing, medical devices, electric vehicles or quantum computing.

TSMC manufactures semiconductors – using ASML’s equipment – on behalf of its customers, saving them the significant outlay ($10–15bn) of building a semiconductor factory (or ‘fab’ as they are called in the industry).When it was established in 1987, TSMC disrupted the status quo by paving a way for leading chip companies like NEC and Fujitsu to outsource production, thus saving enormous financial investment and time. Today TSMC’s services allow its customers to focus on their areas of speciality (design) and for the economies of manufacturing at scale to be shared across the industry, hence enabling faster innovation at a lower cost.

The Effect:

The effects enabled by these companies are far reaching and profound, perhaps most importantly in connectivity. ASML and TSMC have played a crucial, but seldom recognised or lauded, role in reaching the milestone of over half of the global population being connected to the internet. Semiconductors made by TSMC using ASML’s equipment have enabled the rollout of network infrastructure (2G, 3G, 4G and now 5G networks) across the globe and price deflation in mobile devices. Connectivity has many benefits. Crucially, it enables greater access to information that can expand knowledge and aid decision making; it provides access to vital tools and services such as an ability to make safe payments and means of transferring money and it brings sellers and buyers together. Connectivity can enable inclusivity and productivity, making it an incredibly powerful tool in addressing poverty.

Semiconductors are powering more than universal connectivity – they are enablers of the energy transition, electrification and monumental change in the healthcare sector where genetics, data and machine learning are helping us understand biology and develop novel diagnostic tools and new paradigms of medicine. So ASML and TSMC are powering positive change in several dimensions and across each of our four positive change themes (Social Inclusion and Education; Environment and Resource Needs; Healthcare and Quality of Life; Base of the Pyramid).

2. Using light, lithography machines print patterns onto silicon wafers to form electronic circuits on the silicon to create the chip.

3. Gordon Moore, co-founder of Intel, predicted in 1965 that the number of transistors on a chip would increase (doubling every year for the first decade and then revised to a doubling every two years) while the cost of components would fall.

Social Inclusion

and Education

MercadoLibre depends on connectivity for its ecommerce business and fintech services.

Alibaba’s ecommerce infrastructure and digital technologies depend upon semiconductors.

Environment and

Resource Needs

John Deere’s See and Spray technology uses sensors, cameras and machine learning to identify what is weed and what is crop, reducing the volume of herbicides used by nearly 80%.

Semiconductor content in EVs is estimated to be twice that of internal combustion engines today, and fully autonomous vehicles of the future could have 8–10x as much semiconductor content by value.

Healthcare and

Quality of Life

Dexcom’s continuous glucose monitors that help diabetic patients better manage their condition use semiconductors in the transmitters and receiving devices.

Patients gain access to Teladoc’s virtual healthcare over mobile devices powered by semiconductors.

Base of

the Pyramid

Safaricom, Kenya’s largest mobile phone operator, uses semiconductors in its mobile network infrastructure and its mobile payments platform, m-Pesa, depends on affordable mobile devices powered by semiconductors.

Semiconductors play a central role in the operation of Bank Rakyat’s 990 ATMs and cash deposit machines and enable its digital banking services.

Interestingly, the cause (semiconductors) of the effect (innovation across multiple industries) is growing in visibility as the confluence of rising demand to support multiple innovations, supply disruptions and escalating political tensions lead to global shortages of these tiny and unseen pieces of tech, with ramifications in a range of industries from auto manufacturing to consumer electronics. TSMC and ASML might not be the most important tech companies you have never heard of for much longer; they might become the most important companies you learn more about.

It is not only the likes of ASML and TSMC that pique the interest of those following Positive Change, but also companies like MercadoLibre and Shopify. Like ASML and TSMC, this is another cluster of companies we would describe as enablers driving positive change.

The dictionary definition of an entrepreneur is ‘a person who sets up a business or businesses, taking on financial risks in the hope of profit’. MercadoLibre, Latin America’s largest ecommerce and budding fintech company, describes the entrepreneur as ‘the vehicle to achieve an equitable, more democratic economy and to create an authentic transformation in society and on the planet’.

As a company aiding entrepreneurs through providing access to customers, the infrastructure to service customers and the financial tools to operate and grow their businesses, MercadoLibre plays an important role in facilitating job creation, rising incomes and social mobility.

Shopify, much like ASML and TSMC, is another company you are unlikely to have heard of but probably engage with regularly and plays a similar role to MercadoLibre. Shopify provides an operating system for online retailers – it works in the background when we purchase goods online, providing merchants with a means to accept and process payments, engage with customers and ship their products. Shopify wants to lower the barriers to business ownership and to make commerce better for everyone; its founder, Tobi Lütke, is passionate about democratising commerce and empowering independent businesses.

Shopify and MercadoLibre were once micro-businesses – for example, Shopify’s origins stem from the founder’s frustration at the lack of software available to help him set up an online store selling snowboards. It has since grown from a handful of people in a coffee shop to a company powering 1 million businesses which in turn supported 2.1 million full-time jobs in 2019.

By helping small or medium-sized enterprises (SMEs), these companies are helping boost economic growth and a more inclusive world. Around 90 per cent of businesses are ‘formal’ SMEs4, which provide more than 50 per cent of jobs worldwide and contribute up to 40 per cent of GDP in emerging economies; if we were to include the informal sector, the figures would be amplified.

4.There is no standard international definition of an SME. The OECD refers to them as firms employing up to 249 people with micro (1–9), small (10–49) and medium (50–249)

Shades of Grey

The impact of these companies is not always universally positive. For example, semiconductors are used to power military drones and aircraft; rapid innovation cycles create additional demand and consumption for electronic devices; not all information available is accurate or 'good' information; and we are mindful of the environmental impact of increasing consumption facilitated by ecommerce. We are open to these potential negatives but, on balance, we believe technological advancement and inclusive economic growth are inherently positive in driving social progress.

Conclusion

While this cluster of companies might not be immediately obvious contenders for a global impact strategy, we firmly believe they are important enablers of what Hans Rosling described as “the secret silent miracle of human progress”. They are also united by being at the forefront of their areas of expertise with a relentless desire to keep advancing their products and services for the benefit of society. That is to say they are the wave makers, not the wave riders, in their respective fields – our hurdle for inclusion is high. To find and identify them as companies powering positive change requires broad horizons – a willingness to look beyond traditional sector classifications, and an open and inclusive, rather than exclusionary, approach – and an inquisitive attitude to possibilities and controversies. It’s not easy, but then anything worthwhile is seldom easy.

Risk Factors

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned.

Any stock examples, or images, used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

As with all mutual funds, the value of an investment in the fund could decline, so you could lose money.

The most significant risks of an investment in the Baillie Gifford Positive Change Equities Fund are Investment Style Risk, Growth Stock Risk, Long-Term Investment Strategy Risk, Non-Diversification Risk and Impact Risk. The Fund is managed on a bottom up basis and stock selection is likely to be the main driver of investment returns. Returns are unlikely to track the movements of the benchmark. The prices of growth stocks can be based largely on expectations of future earnings and can decline significantly in reaction to negative news. The Fund is managed on a long-term outlook, meaning that the Fund managers look for investments that they think will make returns over a number of years, rather than over shorter time periods. The Fund may have a smaller number of holdings with larger positions in each relative to other mutual funds. The Fund may not be successful in assessing and identifying companies that have or will have a positive impact or support a given position. In some circumstances, companies could ultimately have a negative social impact, or no impact, on addressing a global challenge, or on environmental, social and/or governance impact matter. The Fund’s focus on social, environmental or governance (ESG) factors may mean it makes different investments than funds that do not focus on these issues in their investment process. The Fund may not choose to invest in potentially profitable companies or could sell investments based on ESG factors when it might be a financial disadvantage to do so. Other Fund risks include: Asia Risk, Conflicts of Interest Risk, Currency Risk, Emerging Markets Risk, Equity Securities Risk, Focused Investment Risk, Frontier Markets Risk, Government and Regulatory Risk, Information Technology Risk, IPO Risk, Japan Risk, Large-Capitalization Securities Risk, Liquidity Risk, Market Disruption and Geopolitical Risk, Market Risk, Non-U.S. Investment Risk, Service Provider Risk, Settlement Risk, Small-and Medium-Capitalization Securities Risk, Socially Responsible Investing Risk and Valuation Risk.

For more information about these and other risks of an investment in the fund, see “Principal Investment Risks” and “Additional Investment Strategies” in the prospectus. The Baillie Gifford Positive Change Equities Fund seeks capital appreciation with an emphasis on investing in businesses that deliver positive change by contributing towards a more sustainable and inclusive world. There can be no assurance, however, that the fund will achieve its investment objective.

The fund is distributed by Baillie Gifford Funds Services LLC. Baillie Gifford Funds Services LLC is registered as a broker-dealer with the SEC, a member of FINRA and is an affiliate of Baillie Gifford Overseas Limited.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

|

Holdings |

Fund % |

|

1. Moderna |

9.05 |

|

2. ASML |

7.90 |

|

3. TSMC |

6.29 |

|

4. MercadoLibre |

5.49 |

|

5. Tesla Inc |

5.30 |

|

6. Dexcom |

4.91 |

|

7. Illumina |

4.18 |

|

8. M3 |

4.00 |

|

9. Ørsted |

3.48 |

|

10. Umicore |

3.48 |

It should not be assumed that recommendations/transactions made in the future will be profitable or will equal performance of the securities mentioned. A full list of holdings is available on request. The composition of the fund's holdings is subject to change. Percentages are based on securities at market value.

52955 USM WE 0202