Key points

- Tencent is transforming gaming with AI that creates smarter characters and cuts development costs

- The company’s WeChat platform could become the world’s first fully capable AI agent for daily tasks, boosting returns

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This information and other information about the Funds can be found in the prospectus and summary prospectus. For a prospectus and summary prospectus, please visit our website at bailliegifford.com/usmutualfunds Please carefully read the Fund's prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Ltd and a member of FINRA.

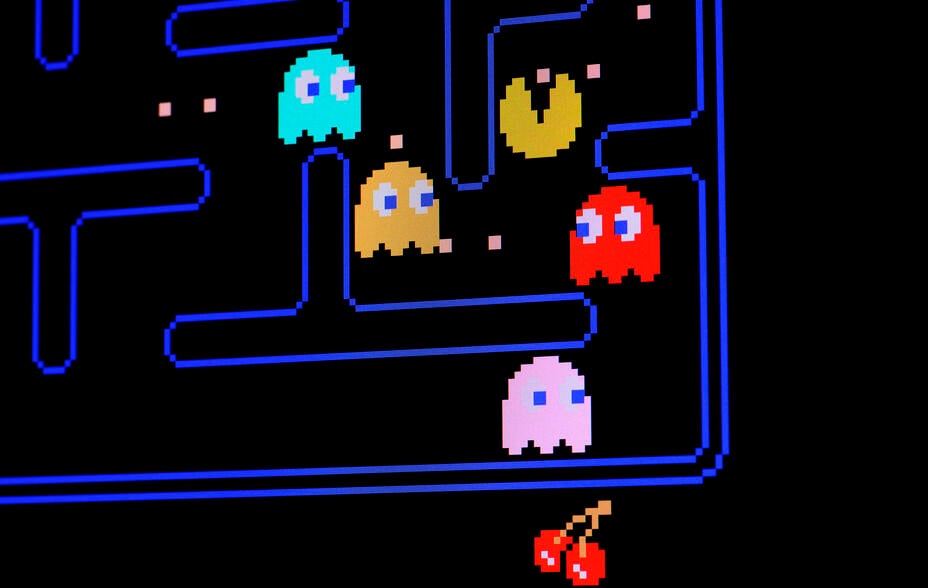

When Pac-Man first chomped its way across our screens in the 1980s, gaming was simple. Four multi-coloured ghosts chasing a yellow circle through a maze. A clever design, though predictable once you knew the routine. Blinky, Pinky, Inky and Clyde would keep you sweating for sure, but the icons hovering across the screen were never truly smart. It was a different era, one defined by linear logic with fixed inputs and fixed outcomes. You could learn the system, master it, and win. But we’re forty years on and the ghosts have evolved.

In the decades since, gaming has undergone a transformation few could have imagined. The blocky puzzles of the arcade have given way to sprawling, cinematic worlds, from Zelda’s open kingdoms to Grand Theft Auto’s chaotic cityscapes and Fortnite’s social metaverse. Players can now explore galaxies, build empires, and even live second lives online.

A key driving force behind that evolution is Tencent: the world’s second-largest gaming platform by revenue and one of the few with the scale, data, and technology to blur the line between play and intelligence. The timing is relevant. China recently outlined its next five-year plan, which made technological self-sufficiency a national priority, putting the country’s technology champions back under the spotlight.

While peers such as Alibaba have been vocal about their AI ambitions, Tencent has been more reserved. Yet, inside its studios, the company’s developers are making Pac-Man’s digital gaming descendants think for themselves. The company is increasingly treating its line-up of games as living, evolving services, rather than one-off releases.

AI can dial up the difficulty, personalise the challenges, add attitude to the characters, and even generate new content. Automated tools can now cut game production cycles by as much as 30 per cent. That means new features and updates arrive faster, keeping players engaged for longer and reducing development costs: a win for both user experience and profitability.

In one of the company’s latest games, Arena Breakout: Infinite, you no longer play alone. Drop into a mission and you’ll find a virtual squad mate moving beside you, scanning corridors, taking cover, calling out threats. When you advance, it follows; when you fall back, it holds the line. And while that might sound like a small step in a single game, it’s a profound change for the industry. AI is starting to turn these digital worlds from scripted environments into living collaborations. The effect is to extend the life of successful titles, and, in theory, make their cash flows more predictable. A game that never ends is, in financial terms, a recurring-revenue machine.

© iStockphoto.com/ilbusca

Where Pac-Man symbolised the early digital age... Tencent’s world represents what comes next.

But what begins in gaming rarely stays there. The same data, infrastructure, and algorithms that make Tencent’s games more intelligent are also being deployed across the rest of its ecosystem. Take WeChat, an all-encompassing ‘super app’ so embedded in Chinese life that it’s almost invisible. Over a billion people use it every day for around 90 minutes. Its enterprise sibling, WeCom, further links millions of merchants with their employees and customers.

Tencent’s ecosystem is part social network, part payments system, part ecommerce hub, and now, increasingly, part intelligent assistant. Companies like Apple, Google and OpenAI are exploring the idea of an AI “agent”, a digital helper that can anticipate needs and act on your behalf. But none have what Tencent already does: a single platform that brings together social interaction, payments, and commerce in one closed loop.

That gives Tencent a structural advantage few others can match. Its ambition to make WeChat the world’s first fully capable AI agent is entirely plausible, as the foundations already exist through the company’s “Mini Programs”. These are applications that run inside WeChat, connecting more than 20 million merchants and services to its vast user base. They allow people to do almost anything without leaving the platform: order dinner, pay utilities, renew insurance, or book a holiday. Think of it as owning the iPhone’s home screen; Tencent earns a slice of value from almost everything that happens inside. So, where western AI agents will hand you options, Tencent’s could simply get things done.

In doing so, the company gathers something just as valuable as the transaction: insight. Every search, purchase and interaction within WeChat feeds into a deeper understanding of user behaviour, data that is now transforming Tencent’s advertising business through AI.

For years, Tencent’s marketing arm has been described as “under-monetised”: valuable but deliberately restrained to preserve the user experience. Most of us know the frustration of being bombarded with irrelevant ads. A pair of shoes that follows you for weeks, a product you’ve already bought, or a video that interrupts the TV show you were trying to watch. Tencent has historically taken the opposite approach, and its customers have thanked it.

However, now, with the help of AI, it can make those few ads matter more. The right message, at the right time, to the right person. And that precision is very valuable for advertisers. Early evidence suggests AI enhanced targeting can lift advertiser returns by more than 20 per cent, as campaigns reach users when they’re most likely to act. That higher return on investment, in turn, allows Tencent to charge more for ad placements, improving profitability without increasing ad volume.

Though it’s early days, the impact is already visible in the numbers. In the most recent quarter, Tencent’s Marketing Services revenue rose 20 per cent year-on-year, driven by AI enhanced ad creation and placement. Moreover, WeChat’s overall ad load remains well below that of peers such as Douyin, which means the company still has room to grow, should it so desire.

Unlike many global peers racing to build general purpose AI platforms, Tencent’s focus is deliberately narrow, applying intelligence where it drives tangible returns. Its AI capex is concentrated in gaming and advertising rather than poured into speculative ventures. That focus tells us a lot about the company’s character. It isn’t trying to reinvent itself for the age of AI, instead it’s using AI to refine what it already does best, connecting, entertaining and facilitating daily life for over a billion people.

As outlined in the most recent five-year plan, technological self-sufficiency and AI sit at the heart of China’s 2035 ambitions.

Tencent already looks like the embodiment of that vision in practice. Where Pac-Man symbolised the early digital age, one that was predictable, rule-bound, and mechanical, Tencent’s world represents what comes next. One where technology interprets, learns, and collaborates. Its games are alive, its platforms are learning, and its business model is compounding.

Here the ghosts are still chasing us. Only now, they’re starting to understand why.

Risk factors

The Funds are distributed by Baillie Gifford Funds Services LLC. Baillie Gifford Funds Services LLC is registered as a broker-dealer with the SEC, a member of FINRA and is an affiliate of Baillie Gifford Overseas Limited. All information is sourced from Baillie Gifford & Co unless otherwise stated.

As with all mutual funds, the value of an investment in the Fund could decline, so you could lose money. International investing involves special risks, which include changes in currency rates, foreign taxation and differences in auditing standards and securities regulations, political uncertainty and greater volatility. These risks are even greater when investing in emerging markets. Security prices in emerging markets can be significantly more volatile than in the more developed nations of the world, reflecting the greater uncertainties of investing in less established markets and economies. Currency risk includes the risk that the foreign currencies in which a Fund’s investments are traded, in which a Fund receives income, or in which a Fund has taken a position, will decline in value relative to the U.S. dollar. Hedging against a decline in the value of currency does not eliminate fluctuations in the prices of portfolio securities or prevent losses if the prices of such securities decline. In addition, hedging a foreign currency can have a negative effect on performance if the U.S. dollar declines in value relative to that currency, or if the currency hedging is otherwise ineffective.

For more information about these and other risks of an investment in the Funds, see "Principal Investment Risks" and "Additional Investment Strategies" in the prospectus. There can be no assurance that the Funds will achieve their investment objectives.

This communication was produced and approved in November 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned.

As at November 2025, Baillie Gifford held Tencent. A full list of holdings is available on request and is subject to change.

180802 10059092