Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This information and other information about the Funds can be found in the prospectus and summary prospectus. For a prospectus and summary prospectus, please visit our website at bailliegifford.com/usmutualfunds. Please carefully read the Fund's prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Ltd and a member of FINRA.

Spoiler alert! In the classic Western of the same name, four of ‘The Magnificent Seven’ died. Being magnificent or considered the best of the best was not enough to save them.

It just goes to show that you are only ever as good or bad as you perform in your current shootout. Odds are, someone is going to come along at some point who is a better or faster shot than you.

That’s part of the reason why, while the US domestic market is home to some exceptional companies and offers excellent investment opportunities, you should not overlook international markets.

US stocks currently represent approximately two-thirds of the global equity market in terms of market cap. At the same time, the S&P 500 stock market is approaching its highest concentration level in history.

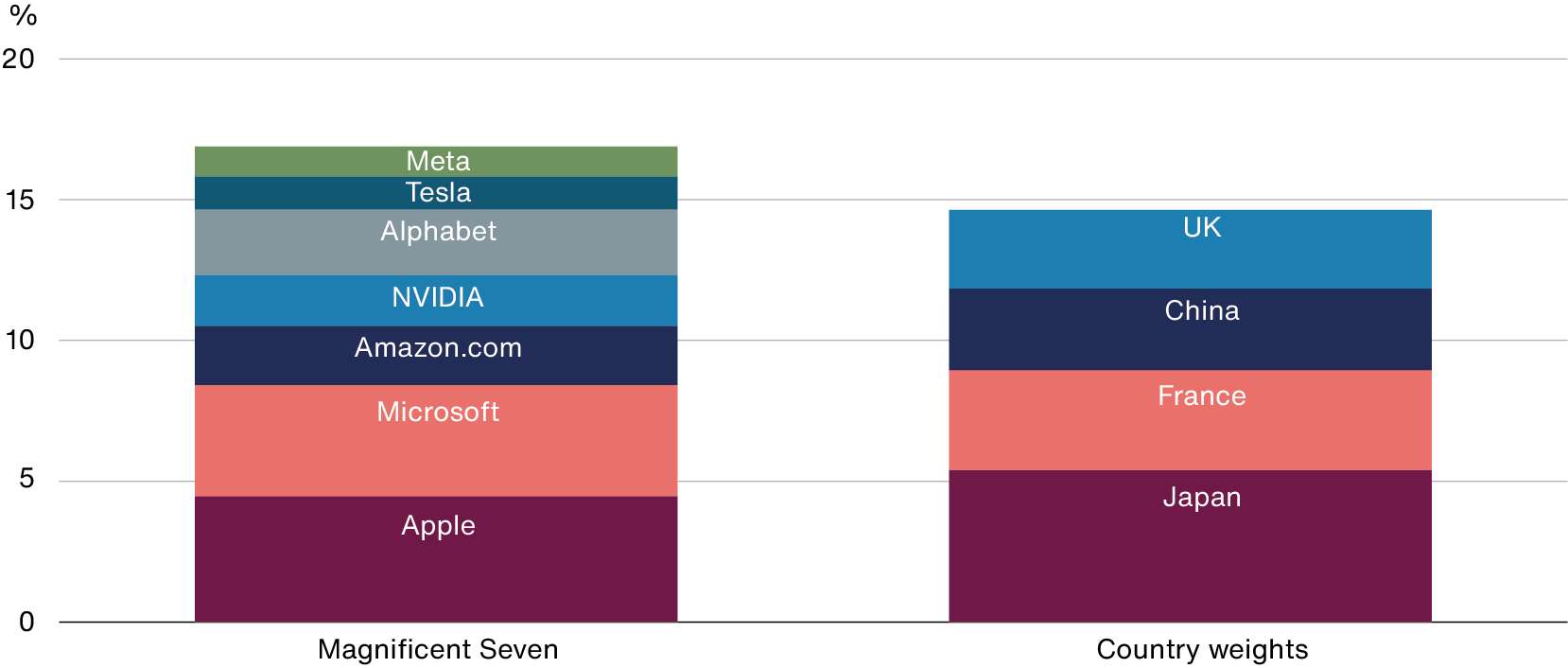

Dominating it are the ‘Magnificent Seven’ – technology companies Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta and Tesla. They account for an extraordinary 17 per cent of the MSCI All-Country World Index, more than the combined weighting of Japan, France, China and the UK.

Therefore, investing globally results in a significant home bias and an unintended level of vulnerability. Markets are inherently cyclical. The odds are that individual companies, no matter how dominant they currently are, will ultimately lose their lustre. During the past thirteen years, high exposure to US equities has been greatly beneficial, but it was a different story in previous decades.

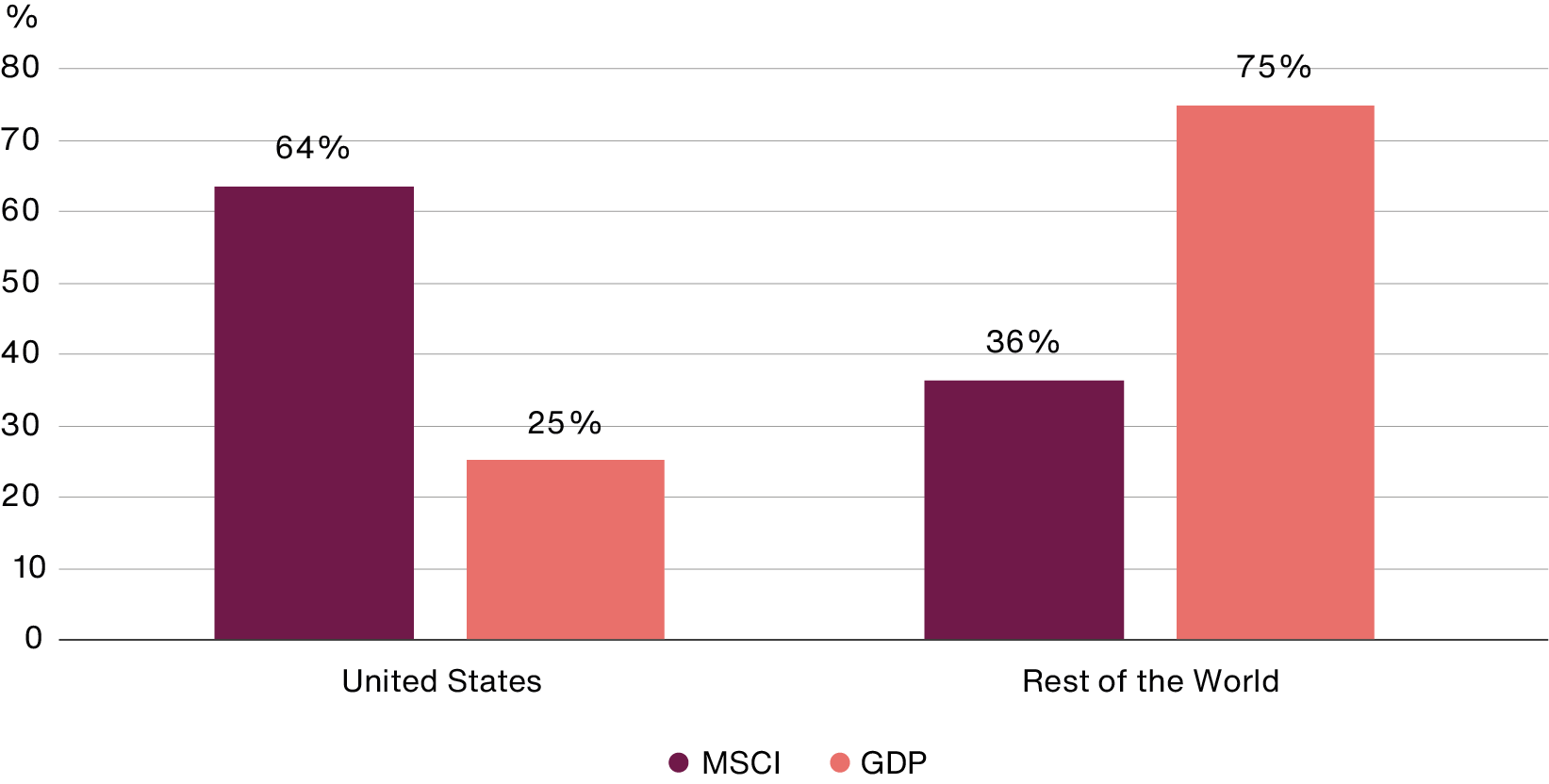

Weighting in the MSCI All Country World Index

Source: MSCI. Data as at 31 December 2023.

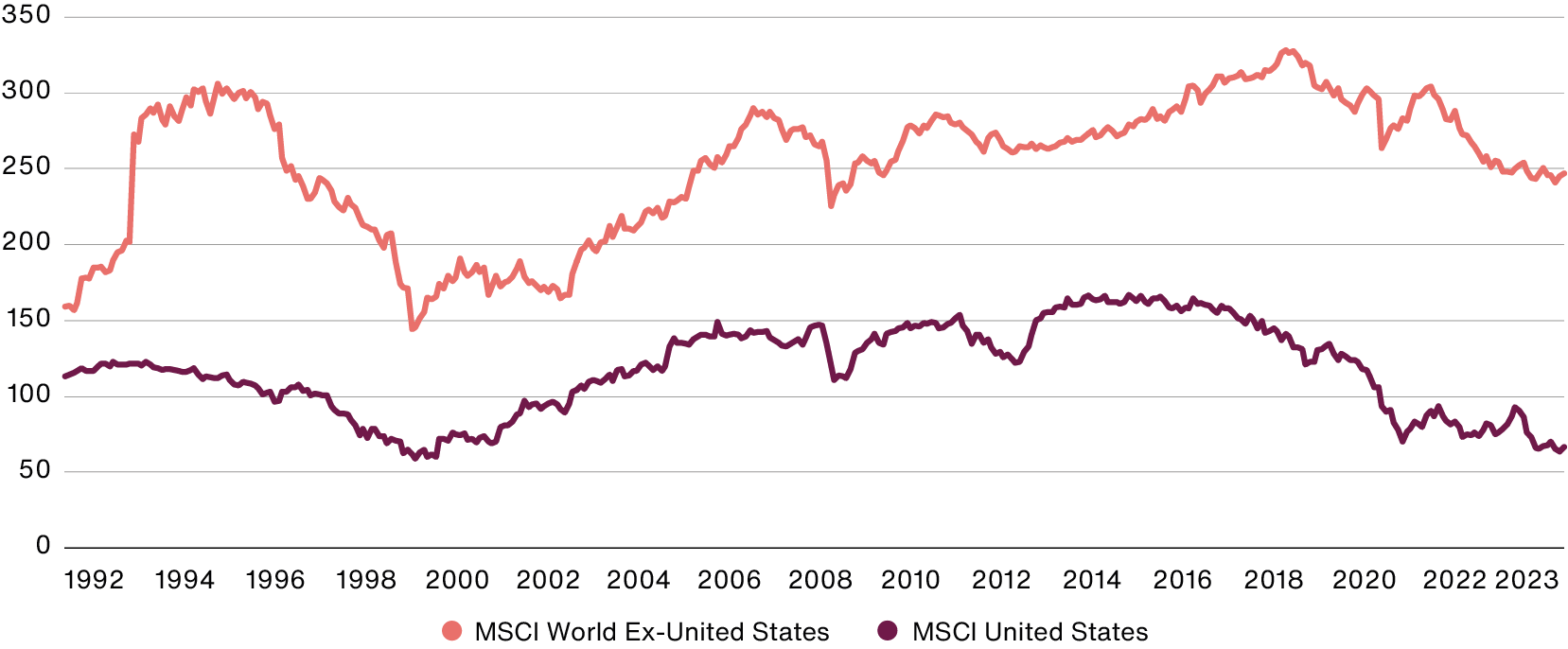

Consider, for example, the ‘lost decade’ for US stocks: between 2000 – 2009, the cumulative total return for the S&P 500 was -9.1 per cent versus +30.7 per cent for the MSCI ACWI ex US.

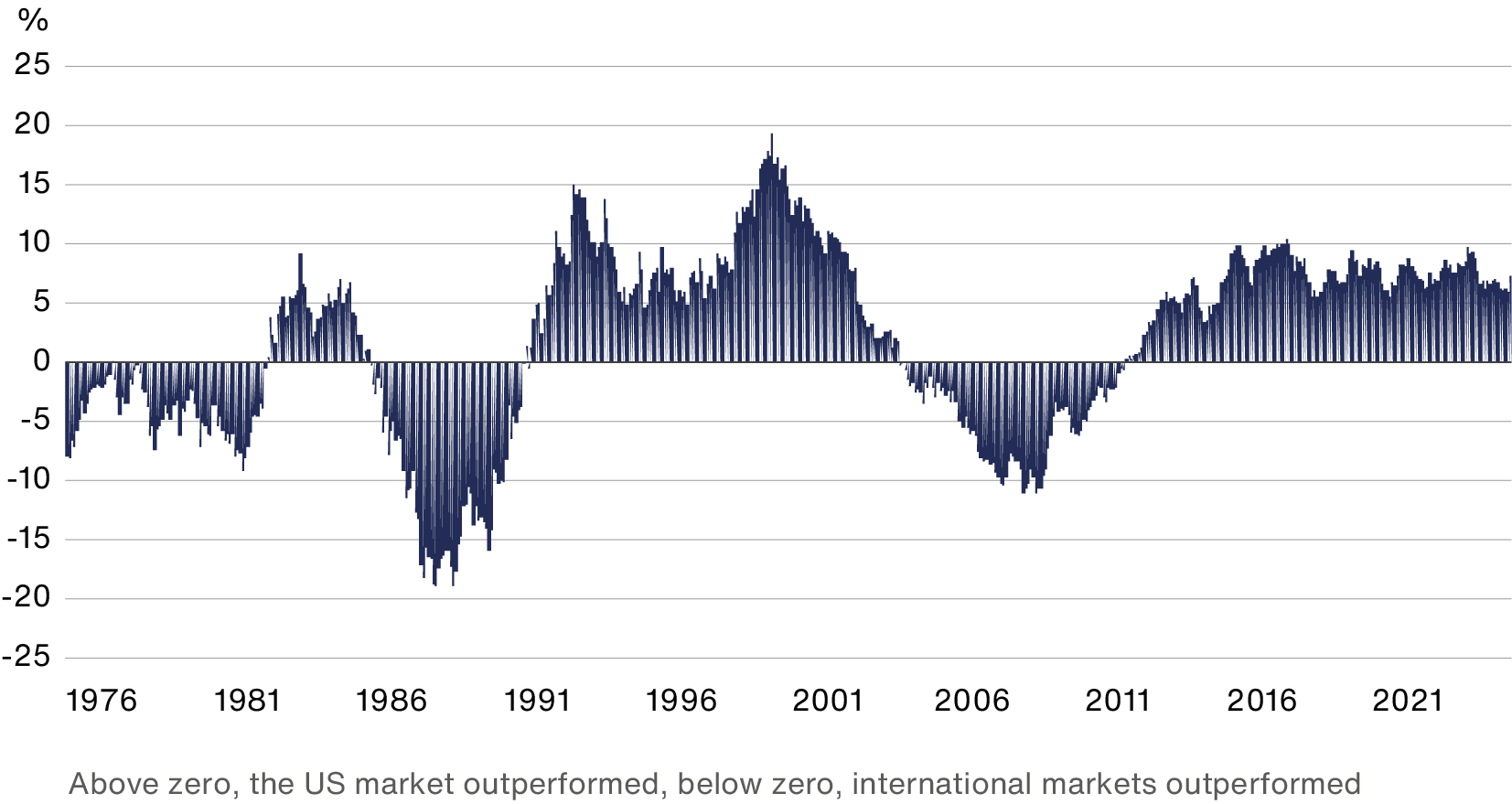

There’s a long history of throne-swapping between US and International stocks (see chart below). This is one of the most prolonged periods of relative strength in the past 20 years, and after such a lengthy period of outperformance for US stocks, history suggests this will change.

Therefore, investors should think twice before giving ex-US assets the cold shoulder. Trying to time regime changes is very difficult, and without the benefit of hindsight, it might be wise to consider both US and ex-US equities within your asset allocation.

The relative performance of US S&P500 versus international developed markets based on five-year rolling returns*

When the points on the graph are above the central (0%) line, the US market outperformed. If the points are below the central line, then international markets outperformed.

Source: Refinitive Eikon monthly data from 03/01/1976 to 03/01/2024

*Relative performance represents the S&P 500 Index’s returns minus international developed markets’ returns (MSCI World ex US)

Having an overweight position in US equities is also at odds with the shifting tectonics of gross domestic product (GDP) growth relative to index representation. The US represents 64 per cent of the MSCI universe yet accounts for only 25 per cent of global GDP. Would you bet against this reversing, given that previously stable beliefs regarding global supply chains, the unrestricted movement of goods, individuals, capital, trade policies, and global legislation continue to shift against greater globalisation.

Disparity between Index representation and economics

Source: World Bank and Factset. Data as at December 2022

This will increase the opportunities to invest in domestic champions on the right side of regulation, serving their local markets. New factories and manufacturing facilities also mean more equipment in more places for those companies within their supply chain.

However, investment managers with strong research capabilities focused on company specifics may be able to spot these opportunities in the broader opportunity set that international equities offer.

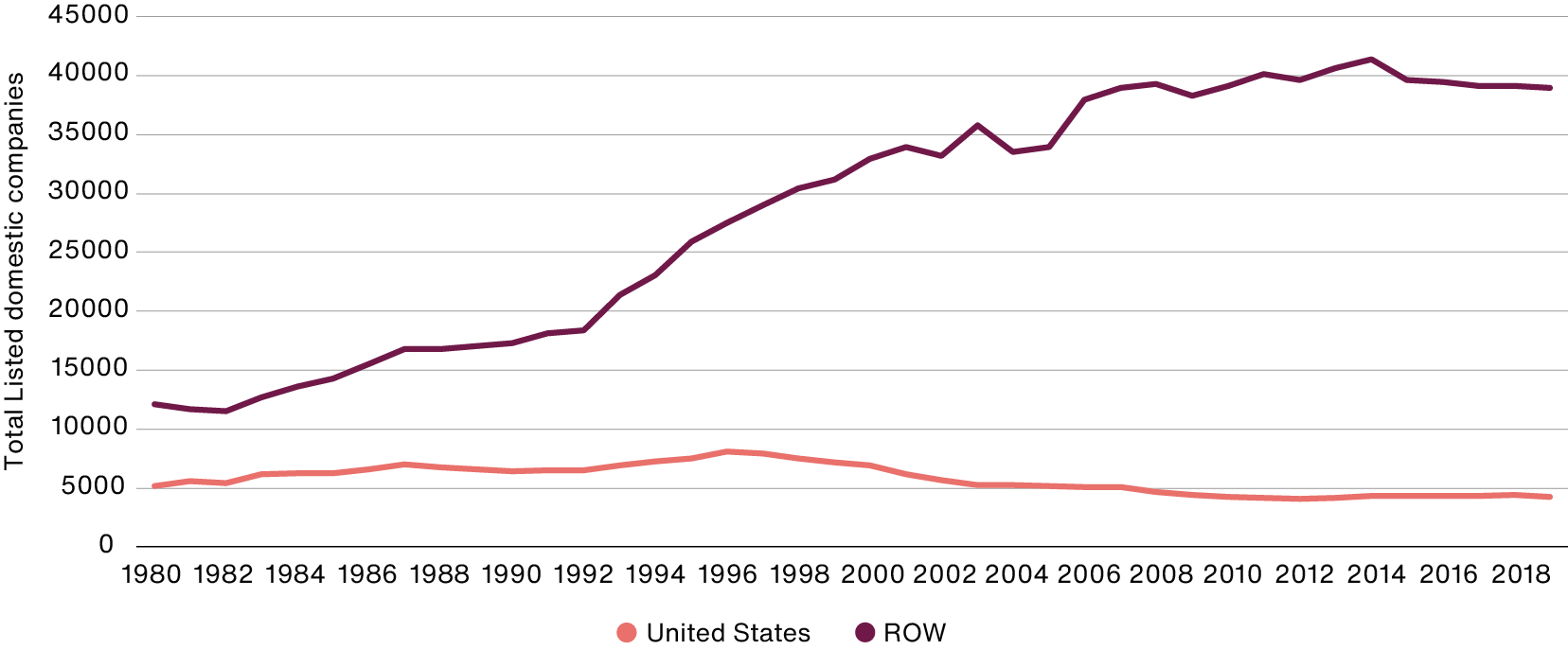

Expanding opportunity set beyond the US

Source: World Bank and Factset. Data as at 18 December 2023

Critics often argue against international diversification by pointing out that many US corporations generate significant revenue from abroad, suggesting that the international exposure of these multinationals might suffice.

We contend that relying solely on these companies does not generate the diversification benefits of investing directly in select international businesses that benefit from unique business models and growth drivers.

Moreover, these US multinationals are often concentrated in specific sectors, such as technology, and are generally larger, as evidenced by our ‘Magnificent Seven’. This concentration and preference for larger businesses might lead to an underrepresentation of smaller companies and other sectors that are less well-represented by US domestic opportunities, which could increase the risk profile unnecessarily.

Diversification

Diversification is a fundamental principle of investing.

The universe of US large and mid-cap stocks, represented by the MSCI USA Index, comprises over 600 securities. So, US investors might assume there are ample opportunities for diversification and potential risk reduction in the domestic market. But is this assumption correct?

The exhibit below shows two concentration measures for US and global developed-market (DM) equities: the weight of the top-10 constituents and the number of effective constituents in the MSCI USA and MSCI World ex USA Indexes.

Top 10 constituents by weight (%)

Source: MSCI. Data as at 30 December 2023

Effective number of constituents*

Source: MSCI. Data as at 30 December 2023

*This is the inverse of the Herfindahl-Hirschman index – a common measure of market concentration.

By both measures, US market concentration was the highest it has been for over two decades and is approaching the dotcom bubble levels of the late 1990s.

As of December 2023, the top 10 assets accounted for 29 per cent of the weight of the MSCI USA Index. By contrast, measures of concentration in DMs outside the US have been stable and lower in recent years: the top 10 assets accounted for 13 per cent of the index weight.

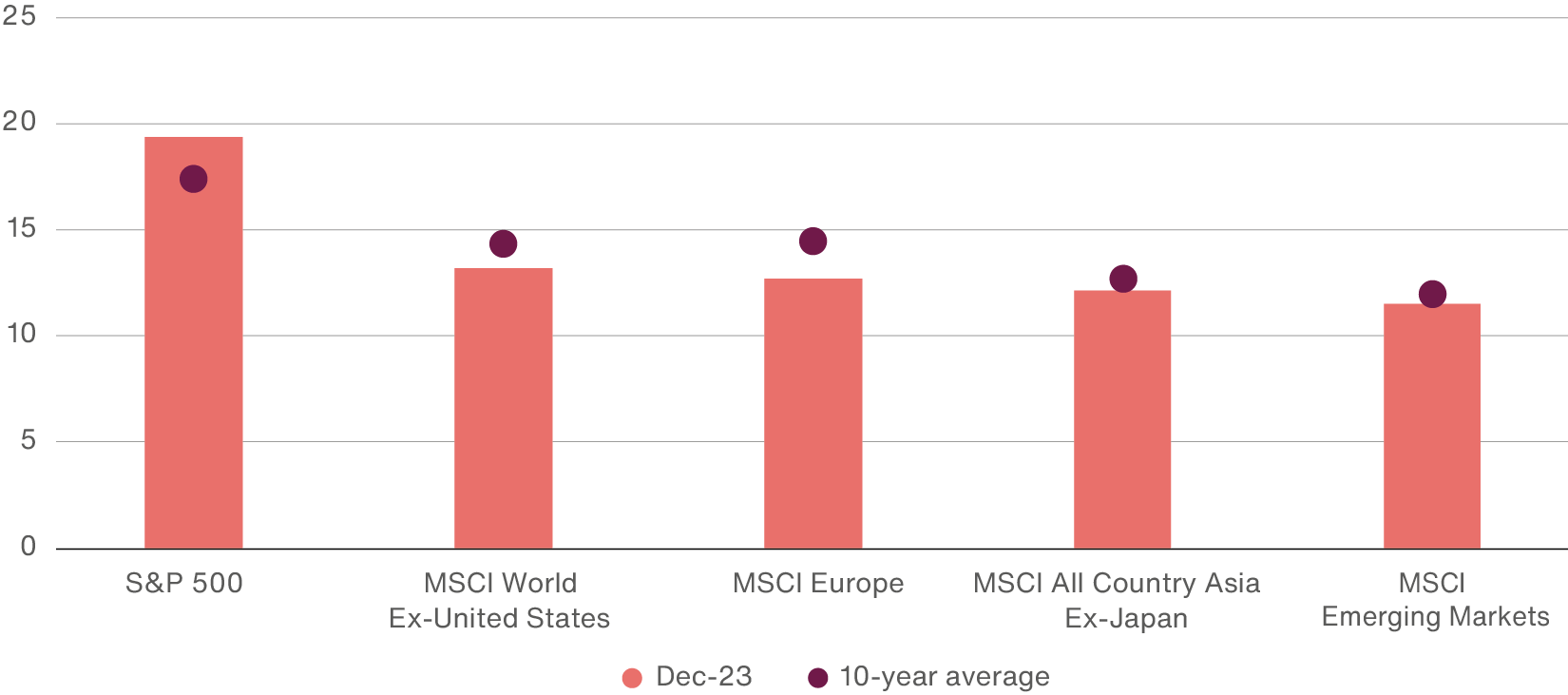

Valuation

US equity markets have historically been valued at a premium to other markets based on their underlying characteristics and growth expectations. However, the current valuation disparity between US and international equities is much wider than usual.

The large-cap S&P 500’s price-to-earnings ratio, which measures a company's share price relative to its earnings per share (EPS), is 19.4x, above its 10-year average of 17.4x, which could suggest that US stocks are overvalued or that investors expect high growth rates. In contrast, other markets are trading well below. Indeed, various developed and emerging international markets have been trading at their most attractive levels in decades, despite an improved opportunity set and financial characteristics.

The US market’s valuation is above its 10-year average, whereas international is below average, driven largely by Europe.

Forward price-to-earnings ratios based on 2023 consensus forecasts versus the 10-year average*

Source: Factset. Data as at 29 December 2023

*Where the diamond sits above the rectangle, the market is below its ten-year average price-to-earnings ratio.

An alternative to the ‘Magnificent Seven’

Returning to our opener, the dominant theme in equity markets over the past 12-plus months has been the rise of the ’Magnificent Seven’ US technology stocks.

Exposed to similar growth drivers of the rise of artificial intelligence and cloud computing, these tech behemoths delivered a median return of 60 per cent plus since the end of 2022 until the end of 2023. This has presented a significant portfolio challenge for US domestic and global investors. Those who didn’t own them at scale likely underperformed.

Technology consumed almost all net equity sector inflows in 2023, and ‘The Seven’ were the outstanding beneficiaries of this capital capture.

There is an equally attractive international opportunity set. Our experience managing international portfolios dates back to the 1980s, but investing overseas is more deeply embedded in our firm’s DNA. Indeed, our oldest client, which has been managed by Baillie Gifford for 115 years, has always included a global allocation.

As bottom-up equity investors, we invest in individual companies, not broad market indices. The international opportunity set is rich, diverse and home to many world-leading businesses. From quality engineering to disruptive medicine to durable luxury heritage and global leading digital payment systems.

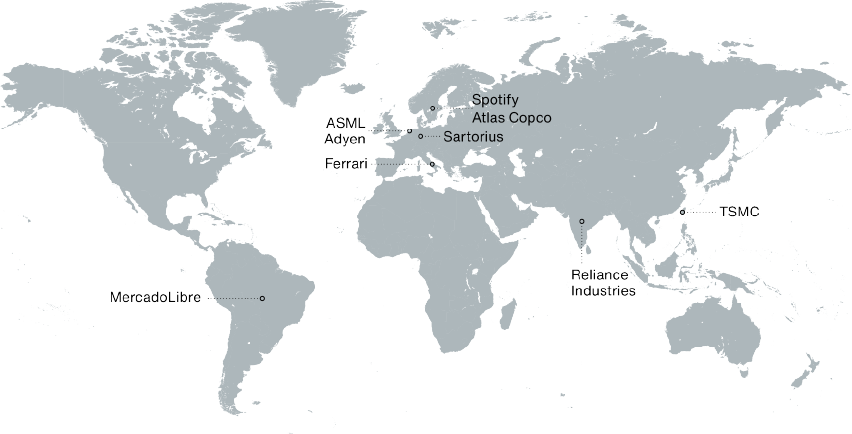

A world of opportunity

ASML

Netherlands

ASML manufactures the complex lithography systems needed to produce microchips – necessary for everything from medical equipment to cars and smartphones.

The smallest transistor ASML’s leading equipment can manufacture is 3nm in diameter, that’s 0.0000001 inches or 1/100 the diameter of a virus particle.

MercadoLibre

Latin America

In a once materially underserved region, MercadoLibre has become the leading Latin American ecommerce and finance platform.

MercadoLibre operates in a region with 650 million citizens who are increasingly using the internet. Its online marketplace receives 668 million visits per month. That’s four times Amazon’s traffic in Latin America.

TSMC

Taiwan

TSMC dominates the market for the most advanced chips for various applications including artificial intelligence, smartphones, automotive and digital consumer electronics.

In all, more than one trillion semiconductors were sold globally last year, a total so high that if you stacked them one on top of another, they would reach higher than the maximum cruising altitude for commercial aircraft.

Ferrari

Italy

Ferrari, one of the most enduring luxury brands, will release its first pure electric vehicle in 2025 to go with a growing portfolio of hybrids.

Ferrari offers a tailor-made programme allowing buyers to personalise many elements of their new car. It has however banned the colour pink for its cars, stating it does not fit its ethos.

Reliance Industries

India

A legendary capital allocator, Reliance has successfully shifted from oil and gas refineries to become India’s largest telecoms business, largest retailer and it is now building its presence in India’s renewable energy future.

From having no market presence in 2016, Jio (Reliance’s telecoms arm) managed to gain over 100 million users in its first year, initially offering phones for free.

Sartorius

Germany

Sartorius is a leading international partner in the biopharmaceutical sector. Its products are integral in supporting lab workers to develop and produce drugs safely, timely and economically.

Biologics research and production have surged in recent decades, with no signs of slowing down. Sales of biologics are predicted to significantly overtake innovative small molecules by $120bn by 2027, accounting for 55 per cent of all innovative drug sales.

Atlas Copco

Sweden

Atlas Copco is a technology driver, creating compressors, vacuum solutions, generators, pumps and power tools that enable everything from safe medical treatment to producing renewable energy.

Thanks to assistance and equipment from Atlas Copco, paleontologist Thomas H. Rich was able to conduct excavations for a ten-year period at Dinosaur Cove in Australia. A new species was discovered, which bears the company's name – Atlascopcosaurus.

Adyen

Netherlands

Adyen is a payment processing company that allows merchants to accept many types of payments on a single platform.

In 2023, Adyen processed an impressive €970bn in payment volume, marking a substantial 26 per cent year-on-year increase.

Spotify

Sweden

Beyond simply streaming music, Spotify is leveraging its ever-growing platform innovatively to attract and engage customers.

Today, on Spotify, listeners can discover, manage and enjoy over 100 million tracks, five million podcast titles and 350,000 audiobooks. It’s the world’s most popular audio streaming subscription service, with over 600 million users in over 180 markets.

OK Corral

The international opportunity set is a vast and exciting hunting ground for the bottom-up stock-picker.

Including ex-US equities in your asset allocation can dilute the level of stock concentration. It can also bring diversification benefits that cannot be achieved through investing in US equities alone, given the dominance of the ‘Magnificent Seven’ technology companies.

We aim to find and invest in world-leading companies that can significantly grow their businesses over the next five years and beyond. If you only invest in domestic equities, perhaps this is the time to consider saddling your horse and riding out of town.

The international companies we invest in on our client’s behalf indicate that there is a story to tell beyond the US’ Magnificent Seven.

Important information and risk factors

The Funds are distributed by Baillie Gifford Funds Services LLC. Baillie Gifford Funds Services LLC is registered as a broker-dealer with the SEC, a member of FINRA and is an affiliate of Baillie Gifford Overseas Limited. All information is sourced from Baillie Gifford & Co unless otherwise stated.

As with all mutual funds, the value of an investment in the Fund could decline, so you could lose money. International investing involves special risks, which include changes in currency rates, foreign taxation and differences in auditing standards and securities regulations, political uncertainty and greater volatility. These risks are even greater when investing in emerging markets. Security prices in emerging markets can be significantly more volatile than in the more developed nations of the world, reflecting the greater uncertainties of investing in less established markets and economies. Currency risk includes the risk that the foreign currencies in which a Fund’s investments are traded, in which a Fund receives income, or in which a Fund has taken a position, will decline in value relative to the U.S. dollar. Hedging against a decline in the value of currency does not eliminate fluctuations in the prices of portfolio securities or prevent losses if the prices of such securities decline. In addition, hedging a foreign currency can have a negative effect on performance if the U.S. dollar declines in value relative to that currency, or if the currency hedging is otherwise ineffective.

For more information about these and other risks of an investment in the Funds, see "Principal Investment Risks" and "Additional Investment Strategies" in the prospectus. There can be no assurance that the Funds will achieve their investment objectives.

| Company | Baillie Gifford Share Holding in Company (%) |

|

Alphabet |

0.05 |

|

Adyen |

11.50 |

|

Amazon |

0.38 |

|

Apple |

0.00 |

|

ASML |

2.33 |

|

Atlas Copco |

4.45 |

|

Ferrari |

2.38 |

|

Meta |

0.28 |

|

MercadoLibre |

9.94 |

|

Microsoft |

0.07 |

|

NVIDIA |

0.42 |

|

Reliance Industries |

0.96 |

|

Sartorius |

4.52 |

|

Spotify |

10.83 |

|

Tesla |

0.56 |

|

TSMC |

1.34 |

Data as at 27 March 2024