Key points

This article is part of the Disruptive Innovation series.

- The future of mobility is being spurred on by a shift to electric vehicles, which themselves rely on battery technology advances

- In the near-term, the focus is on electric cars but flying taxis could also become commonplace within our lifetimes

- Investment opportunities also exist among those rolling out charging stations and offering ways to recycle lithium-ion batteries

All investment strategies have the potential for profit and loss. Your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Radical change in transport technologies can happen quickly.

In the images below, the photo on the left shows New York in 1900, when the horse and cart was the dominant mode of road-based travel.

A decade later – as can be seen in the central photo – the combustion-engine motor car ruled the road following the launch of Ford’s Model T.

Now another gear change is happening thanks to the need to cut carbon emissions, increase convenience and improve safety and affordability, said investment manager Thaiha Nguyen at a recent Baillie Gifford event themed around disruptive innovations.

By 2030, President Biden wants half of all car sales in the US to be zero-emission, the bulk of which are likely to be electric vehicles. Half a world away in China’s Shenzhen, tens of thousands of buses and taxis are already EVs. Stand by a busy road and all you may hear is a hum.

Tesla, NIO and Li Auto are three electric vehicle makers that Baillie Gifford has backed, which are already experiencing strong sales growth. But this is just the start.

“It’s highly likely that over the next few decades we’ll see even more rapid disruptions in transportation than we did over the last century,” said Nguyen.

Flying taxis, self-driving vehicles and hyperloop pods could all be on the horizon, she added. And further into the future, Baillie Gifford holding SpaceX hopes to pioneer interplanetary travel.

Second-order effects

The consequences of all this should be far-reaching.

Pre-pandemic, the average commute to work in the US was already just under one hour a day.

Free up that time, Nguyen said, and you create fresh earnings opportunities.

For example, entertainment apps such as Facebook and TikTok could show users more ads. Or real estate companies, like Zillow, could benefit from more people moving home. The US home sale and rental platform has said 30 per cent more of its own employees moved property after it offered flexible working arrangements than the previous pre-pandemic year.

This indicates that travel does indeed affect where people decide to live.

“What if we can live in the suburbs and use autonomous driving or flying cars to travel to work?” added Nguyen.

“That could reduce the pressures we have in our cities and make housing more affordable for everyone.”

Flying taxis

The idea of electric vertical take-off and landing (eVTOL) aircraft becoming a form of mass transit might sound like the stuff of science fiction.

But Nguyen said they may not be as far off as you might think.

Many of the foundational technologies already exist and will become better and cheaper over time, including:

- high-energy density batteries

- lightweight materials

- electric-powered propulsion systems

- machine learning techniques to help develop and power software to autonomously pilot the aircraft and provide air traffic control

Building the infrastructure required for eVTOLs is also much less costly than constructing a sealed-tube hyperloop for electric pods or other suggestions for next-gen land-based transport, Nguyen noted.

Baillie Gifford has invested in two companies developing eVTOLs: US-based Joby Aviation and the German firm Lilium Air Mobility.

They suit Baillie Gifford’s strategy of making long-term bets on early-stage companies offering asymmetric returns - those where the upside potential for growth is vast and the maximum loss is capped at the cost of the stake.

Nguyen said the quality of the two firms’ engineering talent and the time they had spent developing close relationships with regulators also gave the two a competitive edge over rivals.

“We look at the management team, we look at the founders – they must be committed, have vision and be motivated by more than monetary value to do good things for society,” she added.

“In Joby and Lilium’s case they want to solve the challenge of urbanisation happening so quickly. What do you do when you run out of space on the ground? Obviously you go up to the sky.”

Shared mobility

A shorter-term solution to freeing up space in our cities is to make people less dependent on their own cars.

Baillie Gifford owns a stake in the ride-hailing service Lyft. And via equity in Alphabet is involved in the robo-car project Waymo, which is testing a driverless pick-up service in Phoenix, Arizona.

WATCH: Baillie Gifford webinar on the future of mobility

But while these businesses may ease pressure on city centres by reducing the need for so many parking spaces, there's been research suggesting they increase traffic at busy times by providing an inexpensive alternative to public transport. Lyft is trying to tackle this by relaunching its shared ride option, which now provides the option to book a pick-up 30 minutes in advance. It says this should give it a better chance of matching the user to other passengers going in the same direction, and then offering them all a reduced fee.

In addition, Nguyen said she had recently met with Via Transportation, a New York-based unlisted company that provides technology to others to run their own on-demand shared transit systems. This paves the way for schools, businesses and local authorities to run fleets of mini-vans and shuttle buses that can be summoned via an app and then ferry groups of people travelling in the same direction.

Nguyen also highlighted the role electric bikes and scooters can play, which Baillie Gifford has exposure to via SoftBank’s investment in Tier, as well as Hyundai’s activities.

“Apart from being environmentally friendly, they are a great solution to the first- and last-mile challenges, especially for more marginalised communities in society,” she said.

Supply chains and charging

The switchover from petrol and diesel to electric power presents long-term investors further opportunities both in terms of the huge number of batteries that will be required as well as the infrastructure to charge them.

“We probably have capacity for about three million EVs a year,” said Nguyen.

“But in the future we’re going to need hundreds of millions of EVs.”

Tesla already produces some of its own battery packs at its Gigafactory in Nevada using Panasonic’s cells, but also relies on CATL for supplies. The Chinese firm is a global leader in the production of lithium-ion battery cells and packs, counting Daimler, Volkswagen, Geely, NIO and BMW among other clients.

One issue with this technology, however, is it involves cobalt and nickel. Cobalt raises ethical issues because of the use of child labour in the Democratic Republic of Congo, where much of it is mined. And environmental concerns have been raised about nickel production’s contribution to pollution and global warming.

CATL has developed lithium iron phosphate batteries as an alternative. These exclude cobalt and nickel but provide a lower energy density, meaning cars that currently use them travel less far between charges.

It is also experimenting with sodium-ion technology, which has the added benefit of removing lithium from the equation. This would cut costs, but its energy density is even lower – at least at present.

It will take time and more research for these to reach their potential, but the rewards could be great for patient investors.

Other related holdings include:

- Northvolt – the unlisted Swedish company building Europe’s largest battery facility

- LG Chem – a supplier of battery cells to Tesla, Volkswagen and General Motors

- Redwood Materials – a recycler created by Tesla’s co-founder JB Straubel, which plans to produce anode and cathode components for batteries from reclaimed materials

- Umicore – a Belgian materials technology company, which recycles electric car and e-bike batteries among other products

Charging networks

Keeping batteries charged is the other side of the equation.

And it’s unlikely that petrol stations will simply be replaced by car-charging ones.

Chargepoint has instead created the US’s biggest charging network by selling its equipment to existing companies and homes. It is now expanding quickly into Europe, where demand for EVs is even greater.

“It’s working with employers to install the charging ports at the office for staff, and is also partnering with shopping malls, hotels, restaurants and bars,” explained Nguyen, “so cars can recharge while their owners relax.”

NIO, by contrast, thinks EV drivers will prefer to exchange their car batteries for pre-charged packs instead of waiting for a top-up. It has designed its EVs with this in mind and aims to have 1,400 ‘battery swap stations’ up and running by 2025.

Climate change, battery advances and a convergence of other technologies are all set to transform our methods of travel more quickly than some people appreciate.

By being exposed to so many pioneering firms as well as drawing on other sources of expertise, Baillie Gifford is well-placed to invest its clients’ funds in those already on the road to success.

WATCH: Baillie Gifford animation on disruptive innovation

About the Investment Manager

Thaiha Nguyen

Thaiha is an Investment Manager who joined Baillie Gifford in 2014. She is an analyst in the US Equities Team and has been involved in running the North American portion of the Managed Fund since 2020. She is also a Portfolio Adviser to the Positive Change Strategy. She is a CFA Charterholder and graduated BA (Hons) in Economics from the University of Cambridge in 2014.

Words by Leo Kelion

Assistant editor, Intellectual Capital

You can read our other articles on disruptive innovation via the links below.

Important Information and Risk Factors

The views expressed in this recording are those of the speaker(s) and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Some Baillie Gifford portfolios have a significant exposure to private companies. These assets may be more difficult to buy or sell, so changes in their prices may be greater.

Any stock examples mentioned are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

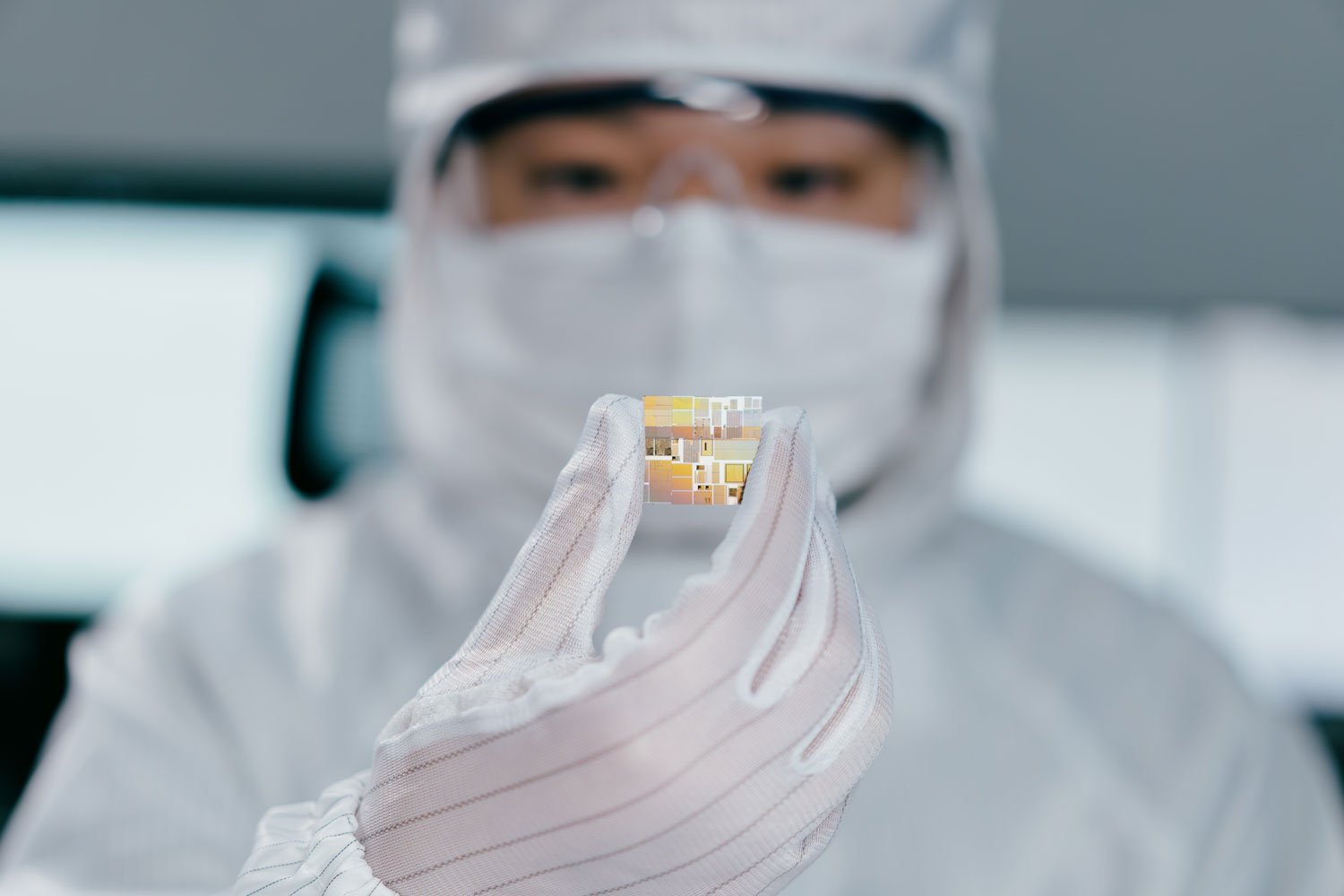

The images used in this recording are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this communication by any other person who did not receive this communication directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ('FinIA'). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China ('PRC') as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China ('AMAC') and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司('BGQS') is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited ('MUBGAM') is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a 'wholesale client' within the meaning of section 761G of the Corporations Act 2001 (Cth) ('Corporations Act'). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a 'retail client' within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited ('BGE') relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited ('BGO') neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

12346 10004127