Moderna's messenger RNA (mRNA) technology opens up the possibility of coding our bodies to heal themselves.

As with any investment, your capital is at risk.

Moderna gained global fame for its Covid-19 vaccine, which the biotech company hopes will be the first of many transformative applications of its messenger RNA (mRNA) technology.

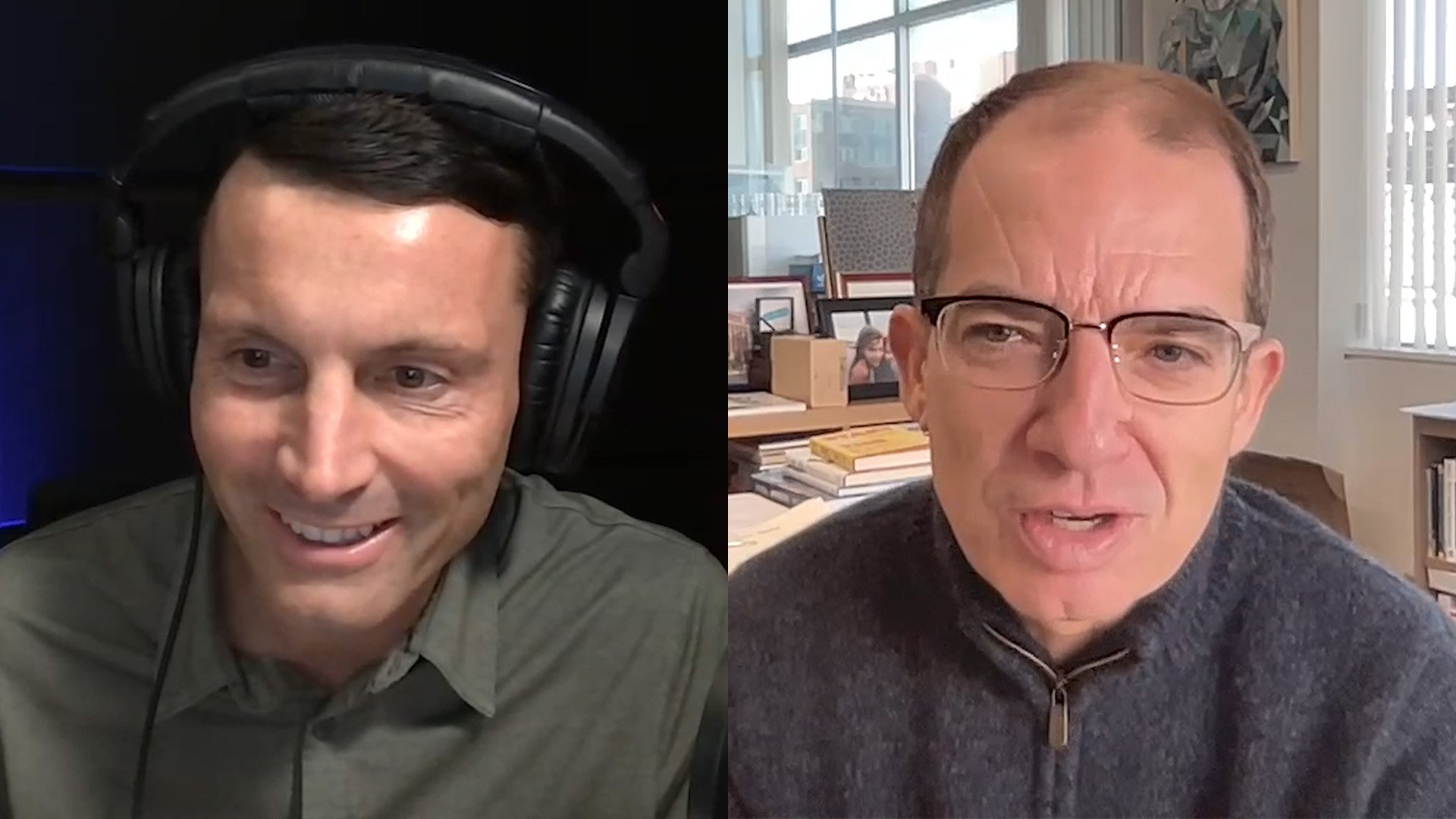

Tom Slater, investment manager at Baillie Gifford, asks Moderna’s chief executive Stéphane Bancel what’s next for its cell-coding science, and how it could solve some of humanity’s most challenging health issues, from respiratory illnesses to cancer.

Writing the code of life

It’s easy to forget that triumphantly helping to contain a global pandemic was unforeseeable when Bancel joined Moderna in 2011. He admits he was initially sceptical about mRNA technology – using code to create molecules that instruct our cells to produce the antibodies needed to fight off viruses and unwanted bacteria.

He changed his mind when he saw the data and recognised how repeatable the process could be. He believed if the company could find a way to make mRNA technology work, “it would have a profound impact on humanity, on society, by developing many medicines that just aren’t doable using old analogue technologies.”

“So, that’s what we set out to do,” he explains, “to build a company that would be a platform that would have many verticals [drug categories].”

Bancel explains, “With mRNA, it’s four letters, like zeros and ones with software. You code everything.” These provide a blueprint for arranging A, T, C and G – the building blocks of DNA. The only difference with most vaccines is the order of those letters. Because this platform has digital characteristics, the more it is used, the more data it collects, and thus, the more accurate and powerful its future results become.

Compare this to traditional pharma, where production starts from scratch each time, the success of one drug telling you nothing about the success of the next, and you can see why Moderna may be onto something big.

If you would like to hear the full conversation between Tom Slater and Stéphane Bancel, please click the link below. We’re providing this link as this company is held in a number of Baillie Gifford portfolios globally so could be of interest to you.

He likens the different verticals of Moderna’s platform to the varying services of Amazon. “Vaccines are just our first vertical getting to market, and Covid-19 is just the first vaccine of that vertical.”

From Covid to cancer

But Covid-19 was never in the business plan. Bancel recalls that initially he thought it would be an outbreak like SARS or MERS. It was in January 2020 that he realised “this is going to be like the 1918 flu pandemic. It’s going to be everywhere and it’s going to kill a lot of people.”

Once the Chinese government released the code of the virus, the team at Moderna immediately inputted the protein instruction to their software, dissected the technical specifications and had a proposed code for a vaccine in just 10 minutes.

The next challenge was conducting testing and approval to get the vaccine to market as quickly as possible. But what is seldom highlighted is “[the] massive, almost miraculous scaling up of manufacturing”. To put this in context, Moderna delivered 100,000 doses in clinical trials in 2019, and in 2020 delivered 10,000 times that – 100 million doses of the approved Covid-19 vaccine.

It’s a challenge that will keep evolving as Moderna continues to develop a wide range of treatments for various clinical needs.

One way to address this in the vaccination space is combining vaccines for Covid-19 with the most common respiratory diseases causing flu-like symptoms. A single effective vaccine given once a year could reduce hospitalisations, reduce strain on healthcare systems, and promote consistency of vaccine take-up, securing revenues for Moderna.

The advent of Moderna’s personalised cancer vaccines will also change the manufacturing dynamic from Covid’s one-vaccine-a-billion-doses to one-vaccine-one-dose.

Bancel explains that, in simple terms, Moderna’s technology reads the DNA of a patient’s healthy cells compared with their cancerous cells to identify where the mutations are occurring. The scientists then write a code that instructs the immune system to ’reboot’ to enable it to detect the mutations that it wasn’t seeing before.

Investment manager Tom Slater chats with Stéphane Bancel, chief executive of Moderna.

To achieve this level of individualisation, the company is focused on innovation, developing robotics and digital tools to shrink the time it takes to tailor these products for one human at a time.

Bancel thinks if current safety trials go as the company hopes, “A 2025 launch for melanoma [a type of skin cancer] is doable.”

Another area of significant progress is in latent viruses. These are viruses that once contracted, never leave your system – human immunodeficiency virus (HIV) and herpes viruses such as Epstein-Barr virus (EBV) and congenital cytomegalovirus (CMV), for example. These viruses are extremely complex and cause all kinds of health issues. But many of them don’t yet have a clinical solution because of their complexity.

Bancel explains that Moderna has been working on solutions – with some, including a first-in-class vaccine against CMV, currently in phase 3 trials (the final stage before a treatment receives US regulatory approval). If successful, they could deliver significant benefits for public health.

Decoding the future

We are often asked about the investment case for Moderna due to the challenging period the company has experienced following the pandemic.

Slater believes the reason for this is, quite simply, the market’s primary focus on Covid. The vaccine was the immediate cash generator and the demand for it post-pandemic has been lower than expected. The company has a rich pipeline of products that have not yet been approved and the market has attached a higher risk weighting to that than we have.

In short, we believe Moderna's established success increases the likelihood of further breakthroughs. With its focus on innovation and potential to address unmet clinical needs, Moderna offers hope for a brighter and healthier future for millions.

Slater concludes, “There are huge areas of unmet clinical need that cause untold human suffering, that [Moderna’s] technology will be able to address. And it will create a huge amount of value for society in doing that. And even if it takes a small fraction of that value… that will translate into an enormous business opportunity.”

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲香港有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law

Ref: 88528 10044167