Key Points

- Led by Tesla, a new generation of electric vehicle brands is transforming Chinese consumers’ idea of what cars should be

- Electrification allows suppliers from the consumer electronic and home appliance industries to compete in the global auto sector

- Chinese semiconductor and software providers have a chance to grow their international market share

All investment strategies have the potential for profit and loss, capital is at risk. Past performance is not a guide to future returns.

Being a leading global car manufacturer demands the kind of knowledge that takes years to build and prove. China has been striving towards this for decades.

The country’s automotive industry is much younger than those of more developed countries in Europe, the US and Japan. Significant car production here dates back only to the reformist 1980s and the landmark joint venture agreements between state-owned automotive groups and giant global brands.

In 1984 the establishment of Shanghai Volkswagen marked the beginning of the Chinese government’s effort to 'exchange market for technologies' – opening the domestic market to foreign players in the hope they would share production knowhow.

But it didn’t work as planned. The following decades saw only the manufacture and assembly of low value-add parts being outsourced to Chinese companies.

Meanwhile, Beijing imposed strict policies to protect these local companies. State-owned enterprises may have held majority ownership, but they developed only limited technological capabilities and remained heavily reliant on their foreign partners’ supply chains.

Despite these limitations, by 2008 China had emerged as the largest car market in the world, accounting for about a third of the global passenger car sales thanks to rising disposable income.

China’s new rich loved flashing their wealth behind the wheel of the latest luxury model, making the country one of the most profitable markets for global brands.

State support – breaking into the supply chain

The introduction of state subsidies for electric vehicles (EVs) in 2009 hoped to reposition China’s auto industry and strategically reduce the nation’s long-term carbon emissions.

These were largely focused on incentivising EV production and reducing total cost of ownership, including purchasing, charging and maintenance costs.

Tesla was the first non-Chinese brand to be eligible after its Shanghai Gigafactory opened in 2019.

Due to its lucrative market potential and agile supplier base, China presented the perfect opportunity for Tesla. According to the carmaker, the Gigafactory was approximately 65 per cent cheaper to build than its Model 3 production system in the US. It is big enough to produce 750,000 vehicles annually, with capacity expected to increase.

The media has been keen to stress how the Chinese government gave billions of dollars’ worth of cheap land, loans, tax breaks and subsidies to Tesla. With hindsight, the impact of this was deeper than is usually assumed.

Initially, state subsidies were widely perceived as a measure designed to protect local companies’ competitiveness. But the opening of Tesla’s Shanghai factory demonstrated the government’s efforts to attract an influential foreign company to the EV sector.

This was meant to improve market openness, prompt innovation from domestic competitors and attract the interest of the global capital market. Following on from this, other global EV brands became eligible for Chinese subsidies as well.

And despite the controversy surrounding more than a decade of substantial state support, this undeniably presented an opportunity for new Chinese automotive suppliers to build their product and cost competitiveness in the industry.

Electrification of cars replaces traditional internal combustion engines with a simpler mechanism that includes batteries and electric motors. The performance of the batteries is particularly sensitive to temperature, so they require thermal management systems.

Tesla’s Shanghai Gigafactory aimed to source at least 90 per cent of these parts locally.

It was a milestone project, offering the chance of a lifetime to many providers of equipment and components in China’s established home appliance and smartphone industries. Through the Tesla relationship, many were able to prove themselves to other global automotive brands.

Thus, a generation of suppliers grew up alongside their automotive clients. And as brands often prefer to keep their supply chain simple, these relationships have tended to last.

Baillie Gifford has held thermal management component manufacturer Sanhua since the launch of its A-share portfolio, and battery maker CATL, as both had previously proved themselves in the German auto supply chain. After Tesla localised its manufacturing in China, they became its first Chinese suppliers.

The rise of CATL has nurtured China’s battery supply chain, which now includes the world’s largest EV battery equipment supplier, Wuxi Lead Intelligent, and separator maker, Yunnan New Energy.

These suppliers possess part of the technical expertise behind the car-making process, optimising cost, safety and performance with their own capabilities.

Envisioning the future – from electrification to AI

Tesla is of course not the first company to sell electric cars in China. But it is the first brand to have changed Chinese consumers’ perceptions. Its pioneering engineering of vehicle infrastructure has also encouraged more creativity in the industry.

Chinese consumers have a reputation for adapting to new product concepts and lifestyles quickly, and EVs fit this pattern.

Tesla’s marketing appealed particularly to the younger generation, which suddenly saw EVs as a cool and practical alternative to fossil fuel vehicles. Locally-sourced parts helped to make the brand more affordable.

Several domestic car brands, including BYD, NIO and Li Auto are riding the trend and emerging as an attractive choice for local consumers, who have in the past preferred mid- to high-end German brands.

This may mark the beginning of more Chinese names establishing themselves in the top tier of the market – not just new EV companies but also domestic brands that had previously only been able to sell to the lower end of the market.

And interest in futuristic EVs is encouraging further innovation – artificial intelligence is likely to become a key element of user experience and vehicle performance.

Built on the foundation of the modern consumer electronics industry, the automotive brands, semiconductor and software industries are working more closely than ever to enable cars to become ‘computers on wheels’, with software that can upgrade continuously.

Under the influence of new brands, consumers are beginning to share this vision.

It’s no exaggeration to describe this aspect of the supply chain as a battleground for global talent. But with its huge potential market size and favourable industry environment, China stands a better chance of attracting skilled individuals to help its brands increase market influence.

As well as those who have previously worked on automotive software, engineers from the smartphone industry may be brought in to work on user interface, while experts from internet companies might work on autonomous driving.

The huge talent pool from the consumer software industry could help Chinese automotive brands to come up with globally competitive products.

Semiconductors are the basic building block of any AI application. And Chinese car chip companies have already begun to break into this sector. The primary driver of their success has been the global shortage of ‘mature-node’ semiconductors – an older generation of chips that Chinese foundries can make – which emerged in 2020.

During the shortage, a few Chinese chip companies which historically supplied other industries passed the automotive-grade certification process to win contracts from global brands.

Most of these companies, which do not have their own manufacturing capacity, are still largely reliant on TSMC, the Taiwan-headquartered foundry that’s arguably the world’s most advanced chip maker.

But state-owned producer Hua Hong has also benefited by leveraging its specialism in power semiconductors, which are used to change voltages and frequencies. The demand for such semiconductors, which improve energy efficiency, has been increasing.

A window of opportunity

It is easy to see why fossil fuel vehicle brands could face an innovator’s dilemma.

Traditional vehicles are sold like hardware. Once delivered to the customers, their parts never need to be upgraded. But the expectation of frequent software upgrades from modern drivers conflicts with the traditional layered supply chain structure of the automotive industry.

Automotive brands will likely need to build a greater level of inhouse software and service capabilities to manage the competitiveness of their products. This could damage relationships with their long-term suppliers.

Traditional brands inevitably need to consider potential cannibalisation of their existing fossil fuel businesses and whether a new investment in AI-enhanced EVs could increase returns and provide jobs for long-standing employees.

When sales are relatively small, it is easy to conclude that the amount of investment needed to build a new battery EV platform is too high to be justified. Companies must therefore be sufficiently well financed, long-term and confident to make such a decision.

Consumer vehicle market competition will be a marathon, not a sprint. Trends move quickly and every year demand for new and innovative car models will be up for grabs.

As the Chinese saying goes, opportunities favour the prepared. The window to rebuild the supply chain won’t be open for long.

This presents a challenge. It takes time for new entrants to prove their capabilities and product durability before their qualities become recognised by the wider global industry.

Part of our task at Baillie Gifford is to try to spot certainties in a sea of uncertainties.

Chinese automotive companies and suppliers are undeniably more competitive than they were in the fossil fuel era – not just domestically, but globally.

With an established base in Shanghai and knowledge of investing in technological progress, Baillie Gifford has the advantage of on-the-ground expertise.

Our job is to make use of this position and identify the long-term winners arising from China’s changing supplier status quo.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in December 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

The allocations of investment securities set forth herein are hypothetical. There is no assurance that any specific security will be allocated to you. Allocations may ultimately change for various reasons, including among others the need to comply with applicable legal and regulatory requirements in certain jurisdictions, such as US Executive Order 13959 of November 12, 2020 (EO 13959), which prohibits US Persons from engaging in any 'transaction in publicly traded securities, or any securities that are derivative of, or are designed to provide investment exposure to such securities, of any Communist Chinese military company' as defined by EO 13959.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

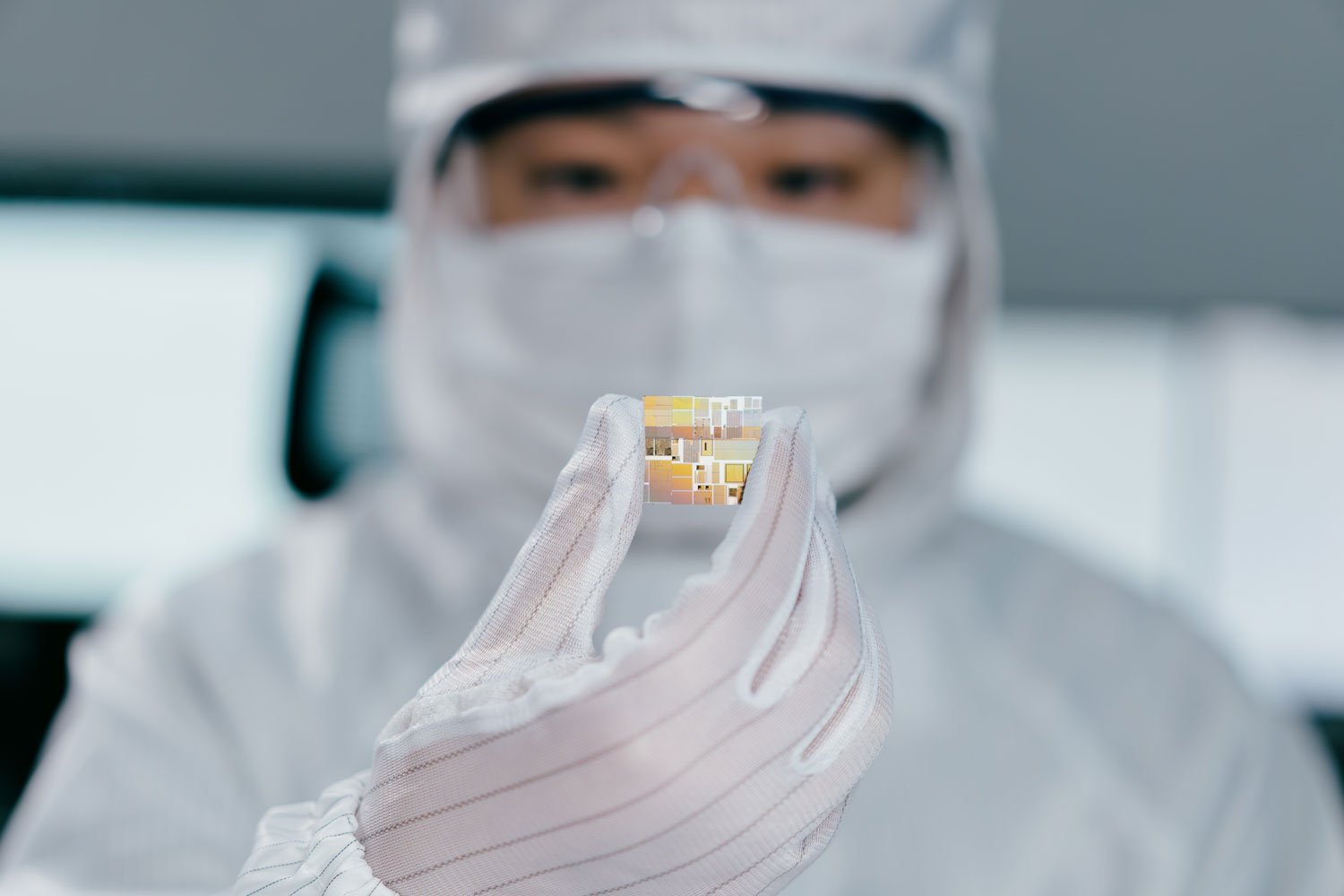

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ('FinIA'). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

27958 10016982