Key Points

- Emerging markets have underperformed their developed peers since mid-2010, leaving many investors in doubt over the value of the asset class. Why might the next decade be any better?

- Many emerging markets countries show good macroeconomic health, have strong companies with low valuations and are experiencing rapid development

- We believe the prospects for improving returns here are better than they have been for some time

© Bloomberg/Getty Images.

All investment strategies have the potential for profit and loss, you or your clients capital may be at risk.

Looming over Kuala Lumpur at an imposing 1,483 feet, the Petronas Towers symbolise the energy and optimism of a nation in its stride. Once the tallest buildings in the world, they were constructed when Malaysia’s economy was booming. As wealth in the country soared, the towers rose.

This story was not uncommon in the 1980s. Economic reforms, favourable trade balances, and privatisation of sleepy state-owned enterprises in many developing economies caught investors’ attention. It was the story of emerging market investing, where earlier-stage economies promised the opportunity of greater returns. And so, in 1987, the MSCI Emerging Market Index (MSCI EM) was born.

Fast forward 35 years and many investors have started questioning whether the emerging markets story should be placed carefully back on the fiction shelf. Why? Because since June 2010, the MSCI World Index (the developed market index) has delivered five times the return of the MSCI EM Index. Investors simply haven’t been rewarded for taking the emerging market risk. So, it’s a valid question: why should you bother with emerging markets?

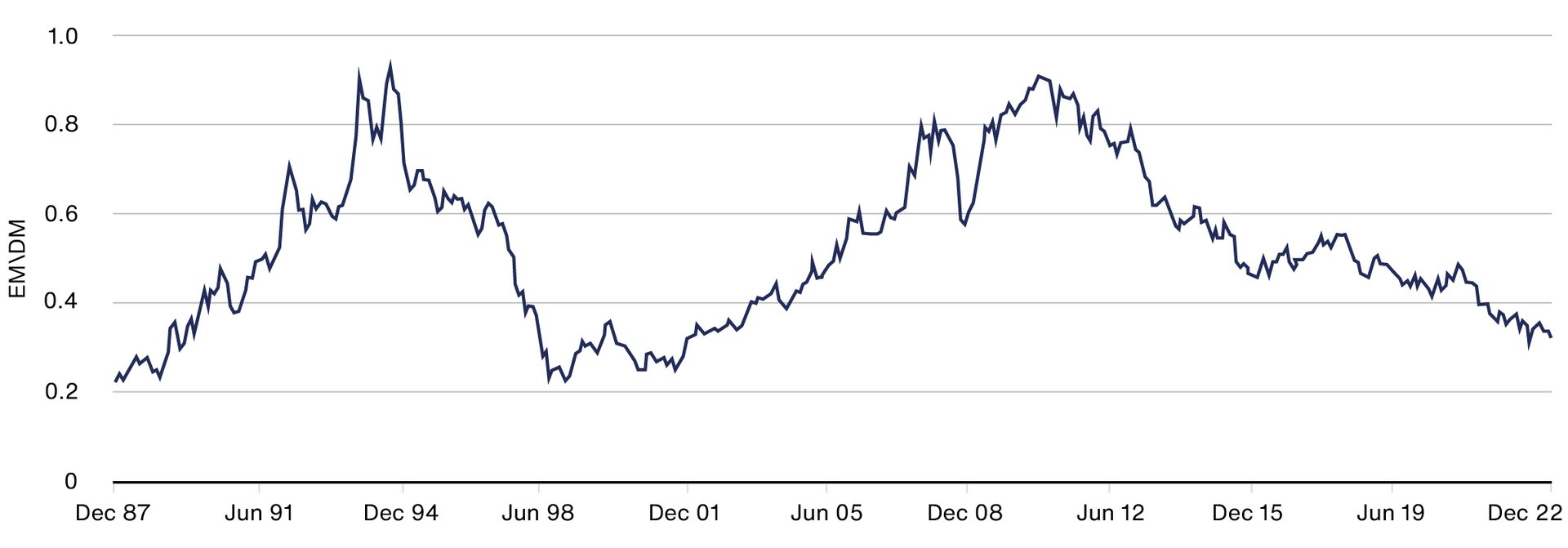

Perspective is important. Even after this lacklustre decade, emerging markets have still outperformed developed markets since the MSCI EM Index inception. However, as the chart below shows, favour has flipped between the two regions multiple times.

Emerging markets performance relative to developed markets performance

Source: Longtermtrends. MSCI, Calculated using monthly data from 31 December 1987 to 30 April 2023 in USD. Past performance is not a guide to future returns.

There are books dedicated to explaining these complex periods, but to summarise briefly:

1987–1994 Economic reforms, access to foreign capital and sweeping privatisation attracted an unprecedented level of investment to emerging markets, delivering extreme returns.

MSCI EM Index 599 per cent vs MSCI World Index 80 per cent.

1994–2001 The Tequila Crisis and the Asian Financial Crisis. These were rooted in several threads of mismanagement: excessive domestic lending, high levels of foreign debt, currency mismanagement, current account deficits and significant capital outflows.

MSCI EM Index -49 per cent vs MSCI World Index 67 per cent.

2001–2007 The rise of China: demand for emerging market products and services skyrocketed. Commodity-exporting economies such as Brazil performed very strongly.

MSCI EM Index 526 per cent vs MSCI World Index 107 per cent.

2007–2023 Free money. Following the Global Financial Crisis, developed market central banks reduced interest rates to historic lows. Individuals and companies loaded up on cheap debt, which suited equity markets. With crises in recent memory, emerging markets stayed away from the free lunch.

MSCI EM Index 11 per cent vs MSCI World Index 153 per cent.

These periods should emphasise to us that when the tables turn, it can be painful to miss out. Indeed, it has been painful for emerging market investors to witness the widening of the valuation discount between emerging markets and developed markets over the last decade or so. We should stress that there is more to the argument for emerging markets than low valuations.

Just as striking as the widening discount is the fact that we’ve seen significant capital flow from emerging markets and developed markets for the last decade, chasing better returns. According to peer group data, the weight of emerging markets equities in global portfolios is at around a 10-year low.

We don’t know precisely when the tables will turn, and it would be foolish to guess. But what we can say is that the macro health of emerging market economies looks strong not only relative to history, but also relative to developed market economies.

Poised post pandemic

Most emerging markets didn’t respond to Covid with massive monetary easing like we saw in developed markets. Support packages deployed to help major emerging markets tended to be 10–20 per cent of GDP, compared with well over 50 per cent in developed majors.

Why does this matter? The answer is that it hasn’t caused the same inflation issues in emerging markets, and it has made their readjustment much easier.

Even emerging market economies which experienced high inflation have had the flexibility to act quickly. Brazil is the best example here. It raised rates from 2 to 14 per cent in short order, and inflation is now well under control. Perhaps it has learnt harsh lessons from previous hyper-inflationary periods.

Meanwhile, many developing markets central banks are balancing on a tightrope between interest rate rises and recession. In many ways, emerging market central banks have been the orthodox actors in the world.

The commodity influence

Long run investors in emerging markets will understand the impact of commodity prices on many key emerging market countries, which have proven to be both a help and hindrance in the past. The direction of key commodity prices undoubtedly influences today’s strong macro starting point. Today we think this can be exploited as a ‘help’ for active investors in emerging markets rather than a hindrance.

The global green transition is predicted to lead to huge demand increases for certain commodities by several multiples. These commodities include copper, lithium, cobalt and nickel, used in products such as electric vehicles, renewable power and infrastructure. The great news for emerging market investors is that much of the world’s largest, lowest-cost deposits of these materials are in emerging markets.

Take copper, for example. Demand could increase as much as three times by 2040 according to the International Energy Agency. Despite that, investment into new and maintenance supplies of copper is actually predicted to fall in the coming years, and it takes decades to make a new copper mine operational. This discrepancy should mean rising prices.

High materials prices won’t just be good for miners – it will be good for exporting economies too, especially in many Latin American countries or in Asian markets like Indonesia. When these economies are booming, they become a richer hunting ground for investors.

Challenging misconceptions

We’re often asked whether the best way to access emerging markets is to invest in multinationals with revenue exposure to them. For example, recent results posted by luxury goods companies in Europe show the significant influence of China on their businesses.

But, using this as an avenue to access the rise of the emerging market consumer, misses a key opportunity. Directly investing in emerging markets allows the portfolio to be exposed to the rapid catch up occurring across developing markets.

To our mind, there aren’t many better examples of this than in the growth of online business models. Developed markets have enjoyed internet penetration above 75 per cent since 2010, so it’s no surprise that tech stocks such as Amazon, Apple, Google, Meta and Microsoft sit at the top of the MSCI World Index. However, emerging markets have been closing the gap rapidly, with internet penetration doubling in the same period. That means billions of consumers have been brought online, drastically improving the opportunity set for online companies.

Internet usage

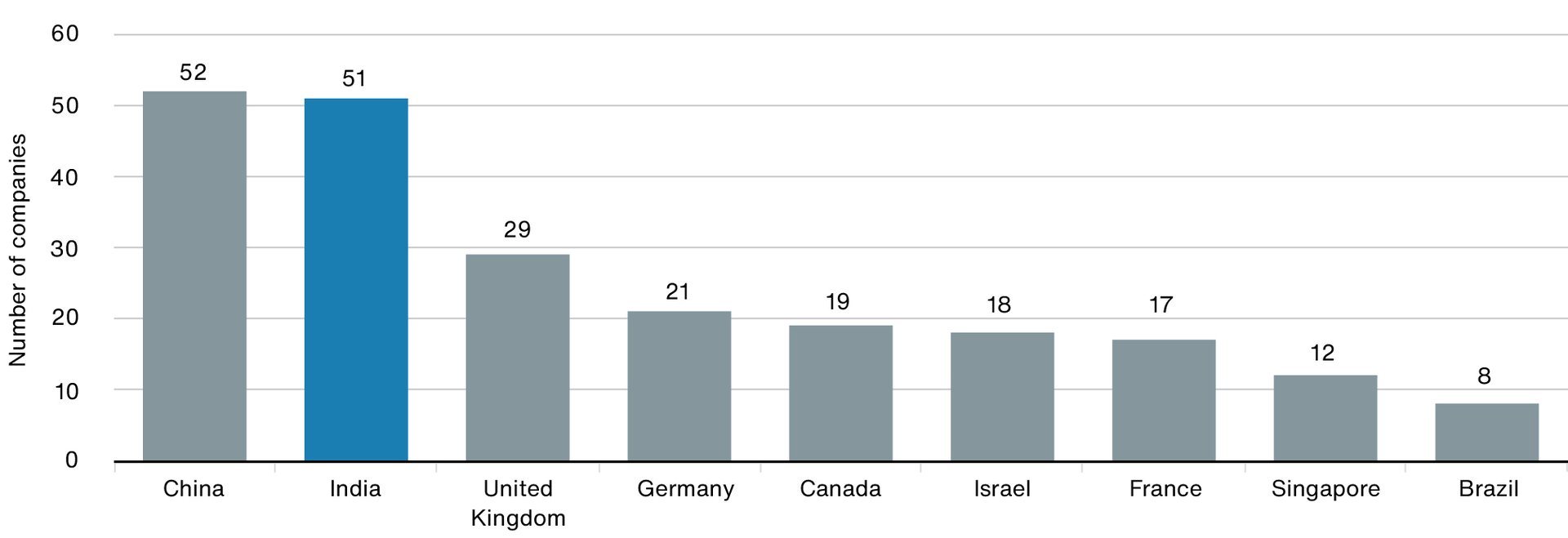

As you can see in the chart below, the number of private companies valued at over $1bn rising out of emerging markets has grown considerably in recent years. Many of these are companies with online business models. We’re starting to see some of these evolving and listing on stock markets in their own right.

Internet access has drastically changed the opportunity set in emerging markets, and the IT sector index weight has almost doubled since 2009. Emerging markets often lack legacy infrastructure such as locally accessible superstores, so new technologies are adopted much faster. This ‘leapfrog’ effect means we believe ecommerce penetration will reach much higher levels in emerging markets than the global average.

Ex US Unicorns created in 2021 and 2022

Source: CB Insights. A unicorn is a private company with a valuation of over $1 billion. Data as of 31 December 2022.

The China conundrum

The giant panda in the room for emerging market investors is, of course, China. Investing in the country over the past few years has been a painful experience. Geopolitics, regulation and extended Covid lockdowns have fuelled the emerging market pessimists’ fire. Investing in the country has undoubtedly become more challenging, but we think it’s instructive to look at the numbers.

China is the world’s second-largest economy, boasting 11 per cent of global market cap, 25 per cent of listed stocks and 23 per cent of big winners across global stock markets (by which we mean 100 per cent total return, in USD, over five years). Despite this, the entire country has a smaller weighting in the MSCI ACWI than just one company – Apple. Is that really right?

We are not eternal bulls on China. We’re not investing in Chinese GDP growth, or the Chinese index as a whole. We are stock pickers, and the simple fact is that we believe China is a rich hunting ground for stock pickers. The country has an ambitious entrepreneurial culture, supported by bold industrial policies and is far too big to ignore.

Are there risks? Yes, of course. But that’s why we need to be selective and not stop our consideration at the risks. There are huge opportunities here too. China already dominates in globally significant industries – batteries, solar and electric vehicles to name a few. Despite the pessimism of many, our suspicion is that China’s relevance to global investors will continue to increase over the next decade.

China plus one?

Who and where we buy things from has come under the microscope since the pandemic. There is an endless number of new buzzwords flying around this trend: ‘deglobalisation’, ‘near-shoring’, ‘friend-shoring’, ‘China plus one’, or even ‘China exit’.

That in itself is often a signal to apply some caution. Again, we must look at the data to understand what this trend means for China and the emerging markets. What it shows is that since the pandemic, nominal exports from the country have been accelerating, not decelerating.

Export index, nominal export value

China has become the world’s factory over the last 20 years, and it will likely take a similar timeframe to replace it. These changes will be driven by economics, not just geopolitics.

Who stands to benefit from this transition? The answer is alternative regions with low-cost labour and competitive advantages such as Vietnam, India, Indonesia and Mexico.

Vietnam has been a success story of the last decade, gaining traction well before this trend hit headlines. It offers similar manufacturing expertise to China at a fraction of the cost. However, it can’t match the scale of China’s labour force.

Conversely, India, now the most populous nation in the world, measures up in size but lacks expertise. Apple, for example has moved 5 per cent of iPhone production there, with suggestions that this could reach 25 per cent soon.

Shifting tides

As you might expect, we strongly advocate for active investment in all regions. We mustn’t forget that in 1987, it was Malaysia, not China, that dominated over 30 per cent of the Emerging Markets Index. Back then, China commanded less than 1 per cent, similar to Malaysia’s weighting now. The idea that the index is risk-free is an illusion.

While our clients tend to judge us on long-term relative returns, we are extremely conscious that what matters to their portfolios is long-term absolute returns.

We are not emerging market ‘perma-bulls’ and have not even always been emerging market enthusiasts. But given some of the trends outlined here, we are strongly of the view that the prospects for improving absolute returns look better than they have for some time.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions. This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but isc lassified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|

MSCI Emerging Markets Index |

-1.6 | 10.9 | 18.6 | -27.8 | 12.2 |

|

MSCI ACWI |

1.9 | 11.0 | 28.0 | -20.3 | 21.4 |

| 1 Year | 3 Years | 5 Years | 10 Years | |

|

MSCI Emerging Markets Index |

12.2 | -1.3 | 0.9 | 2.5 |

|

MSCI ACWI |

21.4 | 7.4 | 7.0 | 8.1 |

Source: MSCI. Past performance is not a guide to future returns.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226. Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司 (‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

10040628 77022