Your or your clients’ capital may be at risk.

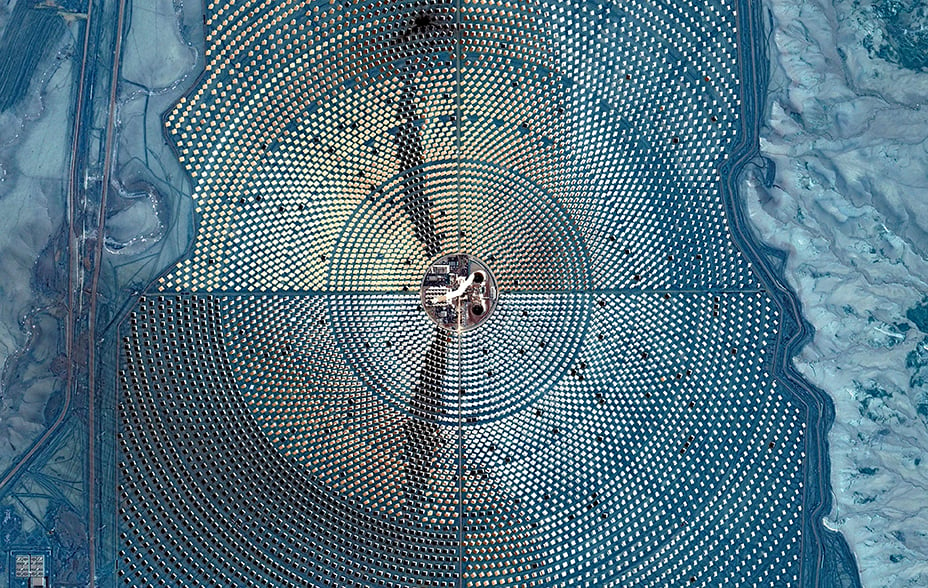

Decarbonisation and new energies offer vast long-term investment opportunities. This decade will be crucial as we seek to slow the pace of physical climate change. Scaling the solutions we need now, investing in the ones we might need 10 years later, and transforming the essential industries we currently rely on all need to happen simultaneously and faster than ever before.

As long-term investors attracted by the potential of disruptive innovation, we already hold a range of solutions innovators and key transformers for our clients – from synthetic biology and battery makers to mining companies and high-voltage cable manufacturers. We suspect that companies such as these will create markets and take share from others by delivering goods and services that enable decarbonisation. Knowing more about the scale and distinctiveness of each company’s potential contribution to carbon reduction can provide investment insight into the prospect for profitable growth and competitive edge relative to peers.

Over the last three years, our Climate team has been developing and testing a methodology to estimate the emissions ‘avoidance’ enabled by a company’s products.

Avoided emissions are not a new concept. Put simply, they are the change in emissions released from doing something different to the status quo. What complicates this are the assumptions that must be made about the difference between the two and how these relative pathways might change over time. The diagram below gives a very simple example of how avoided emissions work. Without the solution, society’s emissions rise. With the solution, they fall. Of course, pathways vary significantly between companies and types of solution, and both the emissions of the baseline scenario and solution can be dynamic.

We’ve explained this process in more detail within our Avoided Emissions Methodology paper, but outline some of the core principles of our process below:

Forward-looking

We take a forward-looking approach to any estimates, first understanding how a company’s product or service might be reducing emissions today and then forecasting how that might change over the next 10 years. This process is inherently tied to investment research, using growth assumptions from company analysis to also inform our avoided emissions calculations.

Dynamic baselines

The rate of change is happening faster than we could imagine. As such, a company’s output in one year will be displacing a different set of products 10 years down the line. We expect our energy supply to decarbonise, as well as the ways in which we source and process raw materials. All of this contributes to a changing emissions baseline that meets Paris-aligned ambitions to half emissions by 2030 and achieve net zero by 2050. Using dynamic baselines allows us to model this in our calculations, ensuring each individual year is calculated against the most realistic baseline in that year.

Attribution

No one single company is responsible for the avoided emissions from a climate solution. Taking an electric vehicle, for example, the manufacturer may put the car together and, in some cases, may be relatively vertically integrated, but there is a plethora of companies within a car’s value chain that have also contributed. From the company that made the wiring harness, to the miner that provided the lithium for the battery. This needs to be reflected in an avoided emissions calculation, but mapping out every company involved would be extremely challenging. We, therefore, take a subjective approach with three categories of attribution: 50 per cent for critical companies, 35 per cent for core companies and 15 per cent for those that are supporting. The framework for how we organise these companies is explained in more detail within our Avoided Emissions Methodology paper.

How do we use avoided emissions?

As we continue to develop the methodology we are learning more about how avoided emissions data can be used in different stages of an investment process and to achieve a variety of objectives.

It can be used to gain a better understanding of the scale of new markets that might emerge for companies. Understanding the importance and how it is positioned in the value chain can also add insight in relation to margins and pricing power.

For impact driven strategies, we can use these estimates to understand the potential climate impact. It can also be used to compare potential impact between companies where we are clear about the assumptions we have made, and to understand where in a value chain the greatest opportunity for carbon reductions might be.

Importantly, we don’t see the use of avoided emissions calculations as an ‘offset’ to any actual financed emissions from other companies within investment portfolios and we ensure that we use robust and peer reviewed data inputs where available. As more and more companies start to estimate avoided emissions themselves, we can support them in developing best practice.

What’s next?

We’re publishing this methodology to share our work more broadly, acknowledging that this is still an emerging field that we want to contribute to. We’re continually developing our approach and learning as we put more companies through the process, working directly with Matthew Brander and Michelle O’Keeffe of the University of Edinburgh’s Carbon Accounting department. We’re keen to hear feedback, work with others who are developing similar approaches and continue using this data to better understand potential solutions to reducing the impacts of climate change.

To read our full Avoided emissions methodology paper please click here.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in December 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 79703 10041222