Key points

-

Rapid investment may be overestimating near-term demand, even as AI’s long-term potential remains vast

-

Market concentration, leverage, and circular funding echo past speculative cycles

-

Durable value lies in infrastructure leaders, productive applications, and China’s industrial AI approach

As with any investment, your capital is at risk.

It is too early to tell whether we are in an AI bubble or a boom. Both involve rapid increases in valuations and investment; the difference lies in how expectations meet outcomes. A boom builds productive capacity, and rising profits justify higher valuations. A bubble detaches from cash flows, as optimism outpaces earnings.

Both phases bring risk. As Carlota Perez (scholar, researcher, and international consultant) observed, technological revolutions, from railways to the internet, don’t shield investors from losses. Each began with a frenzy of capital and competition, when infrastructure was built at an unsustainable pace and investment overshot near-term demand. The pain that followed created the foundations for long-term productivity gains.

Whether AI proves a bubble or a boom, today’s trillion-dollar capex cycle probably overestimates near-term demand. That does not diminish AI’s transformative potential, but the question remains: who will capture the value? History suggests the surplus from technological shifts often leaks from infrastructure builders, which become commoditised, to users and society at large. The internet, containerisation and electrification all created vast wealth but little profit for many of their builders. As capacity rises and prices fall, infrastructure becomes indispensable yet unprofitable. AI may follow the same path.

We are already seeing this in the US: the cost of building and running frontier models is enormous, and competition is intense. It is becoming increasingly likely that profits from large language models (LLMs) development are competed away before they can justify current valuations. Instead, as model performance converges and open-weight alternatives proliferate, value is likely to accrue to companies applying AI productively, or to consumers enjoying cheaper, better services.

Systemic fragility

Some argue this end state is decades away and that vast new markets still lie ahead. Perhaps. But US financial conditions make even a modest reset risky. Fragility stems from unprecedented concentration in both markets and the real economy. A handful of AI leaders dominate the S&P 500, and unprofitable tech valuations are at record highs. Meanwhile, a record share of US household savings sits in stocks, mostly in passive funds tracking the same few companies. The top 20 per cent of earners, who drive more than half of consumption, are also the most exposed to equities. When both economic growth and market wealth hinge on a narrow theme, fragility rises.

Leverage compounds the risk. Private-debt assets under management now exceed $3tn (up 50 per cent in five years), private equity holds $2.5tn in dry powder, and credit spreads remain tight. Investors are chasing yield, and AI companies are tapping it. OpenAI’s trillion-dollar compute commitments span Oracle, AMD, Nvidia and Broadcom, suppliers that have, in turn, invested back into OpenAI, inflating each other’s valuations. These circular arrangements recall the 1990s telecom boom, where balance sheets funded demand and market caps soared without matching profits.

International markets: a different approach

Although the AI build-out appears US-centric, its effects will be global: if exuberance fades, few markets will be spared. Our best defence, as international growth investors, is to own resilient, adaptable businesses and focus on areas of the AI value chain where value can endure.

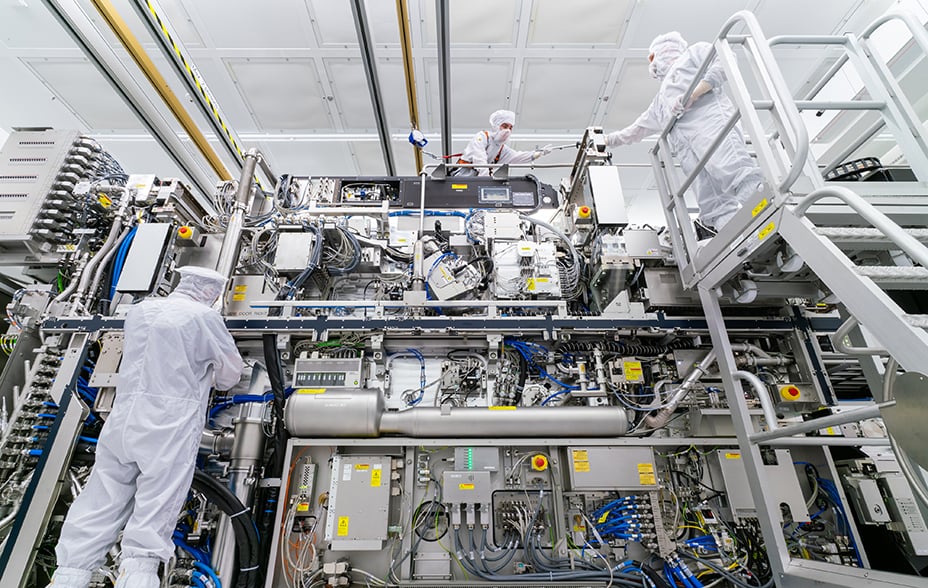

ASML's unique lithography systems are built in ASML’s cleanrooms and shipped to customers around the world.

© (ASML) All Rights Reserved

We favour infrastructure leaders such as TSMC and ASML, with entrenched customers and pricing power even in downturns. Samsung Electronics, another long-term holding, is once again being recognised by the market for its key position in memory chips, but, in our view, remains undervalued. Plenty of other names in the semiconductor supply chain remain attractive. Beyond infrastructure, opportunity lies in applications. For innovative software companies such as SAP, Adyen, monday.com, MoneyForward and Shopify, AI is an opportunity to realise efficiency, improve products and strengthen their competitive advantage.

China’s alternative to the AI theme

China offers a complementary and more balanced approach to playing the AI theme than the US. Strategically, AI seems not to be perceived by the country's leadership as an end in itself, but as an enabler of industrial and electrification goals. By prioritising open-weight systems and embedding AI into manufacturing, China links intelligence with action. Already dominant in batteries, magnets and power electronics, it is positioning itself at the intersection of intelligence and production. This may prove less speculative and more durable than the Western focus on compute.

We are exposed to this theme through Tencent and Tencent Music Entertainment, but we continue to explore opportunities in adjacent sectors, robotics, power electronics and biotechnology, where intelligence, energy and manufacturing converge.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

178703 10058606