Insights

Filters

Insights

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

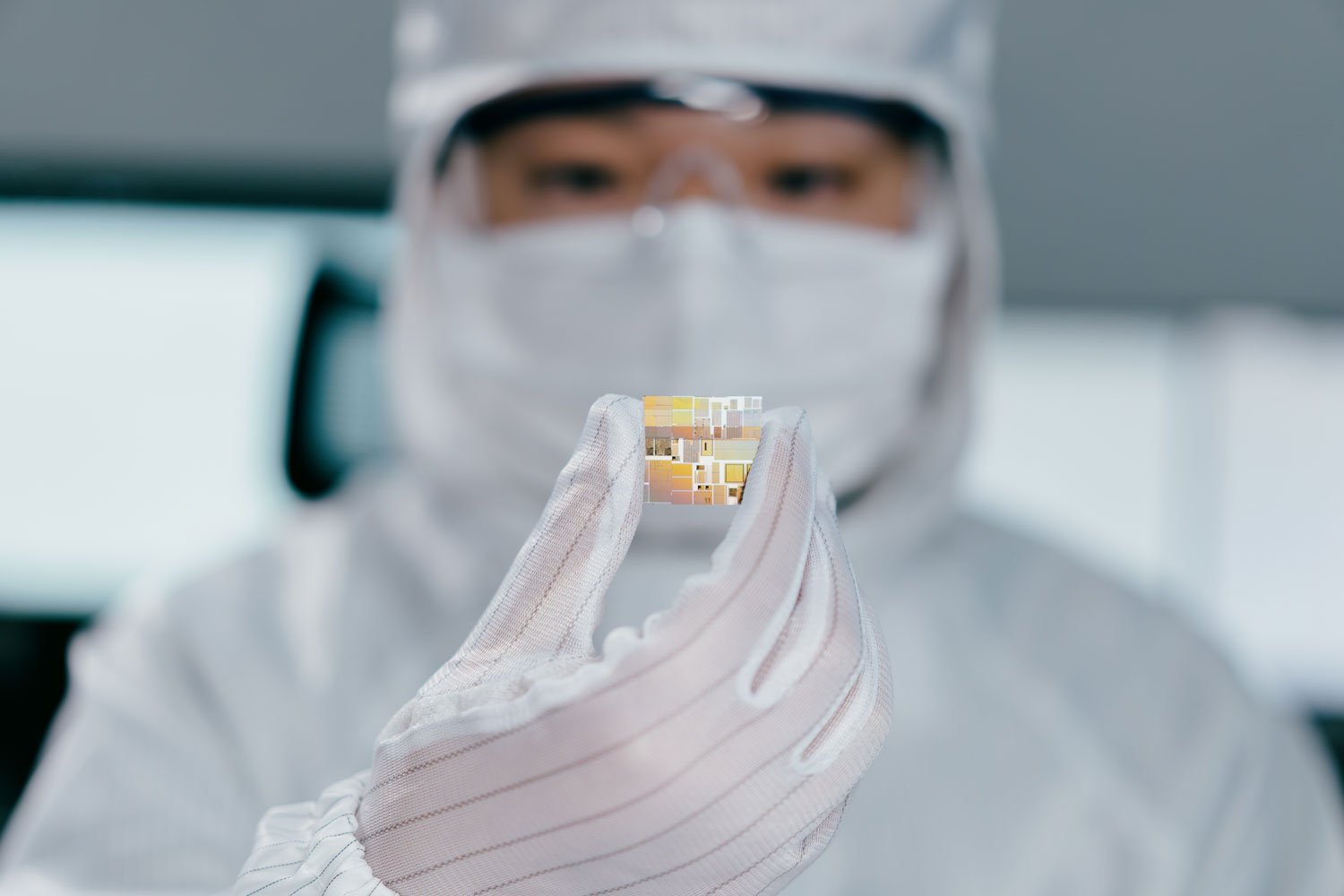

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

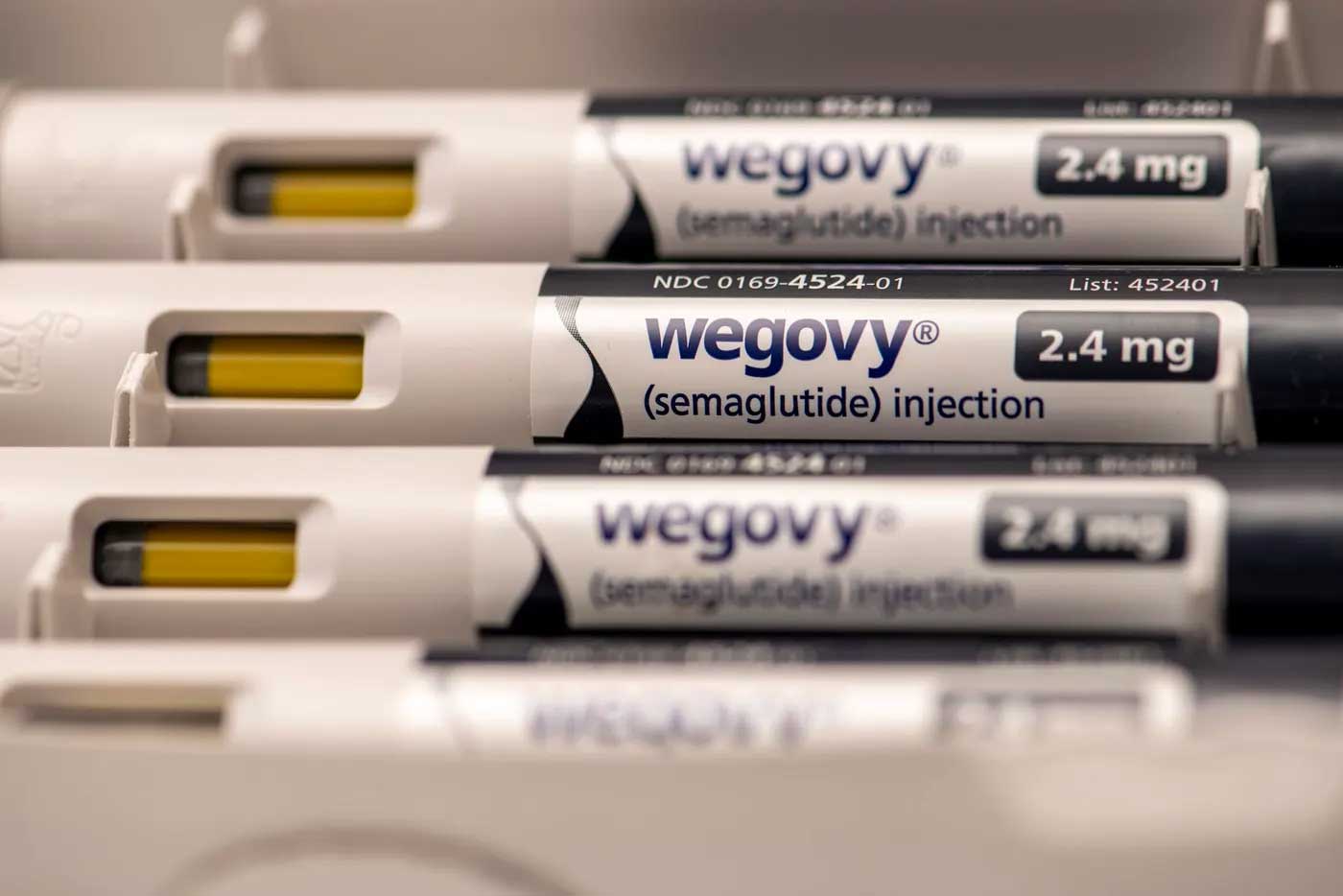

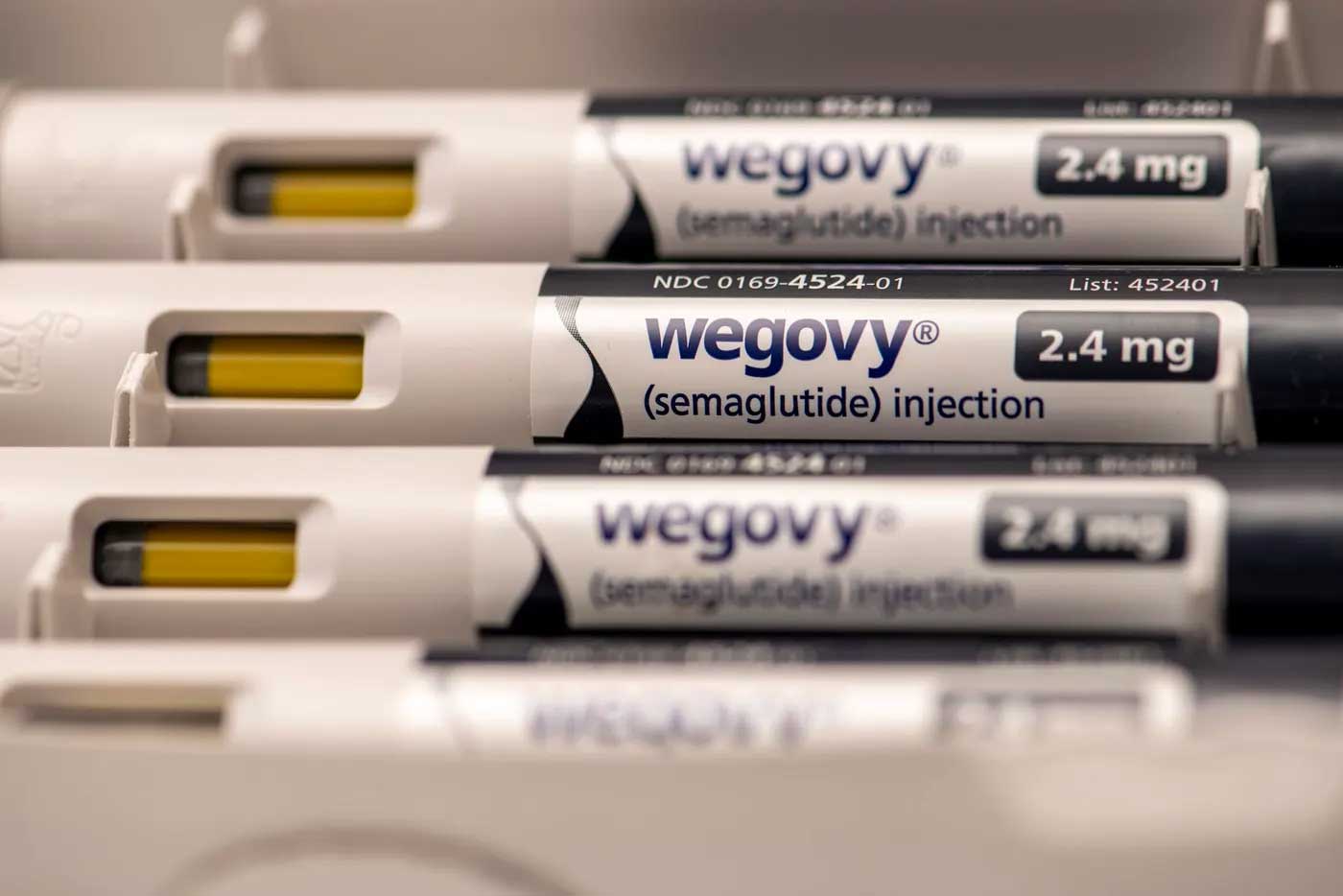

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

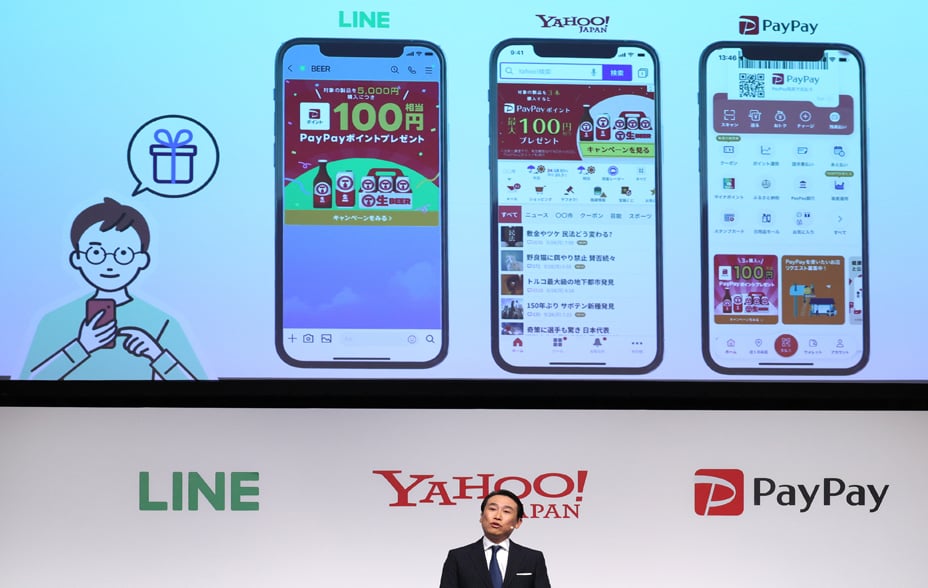

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

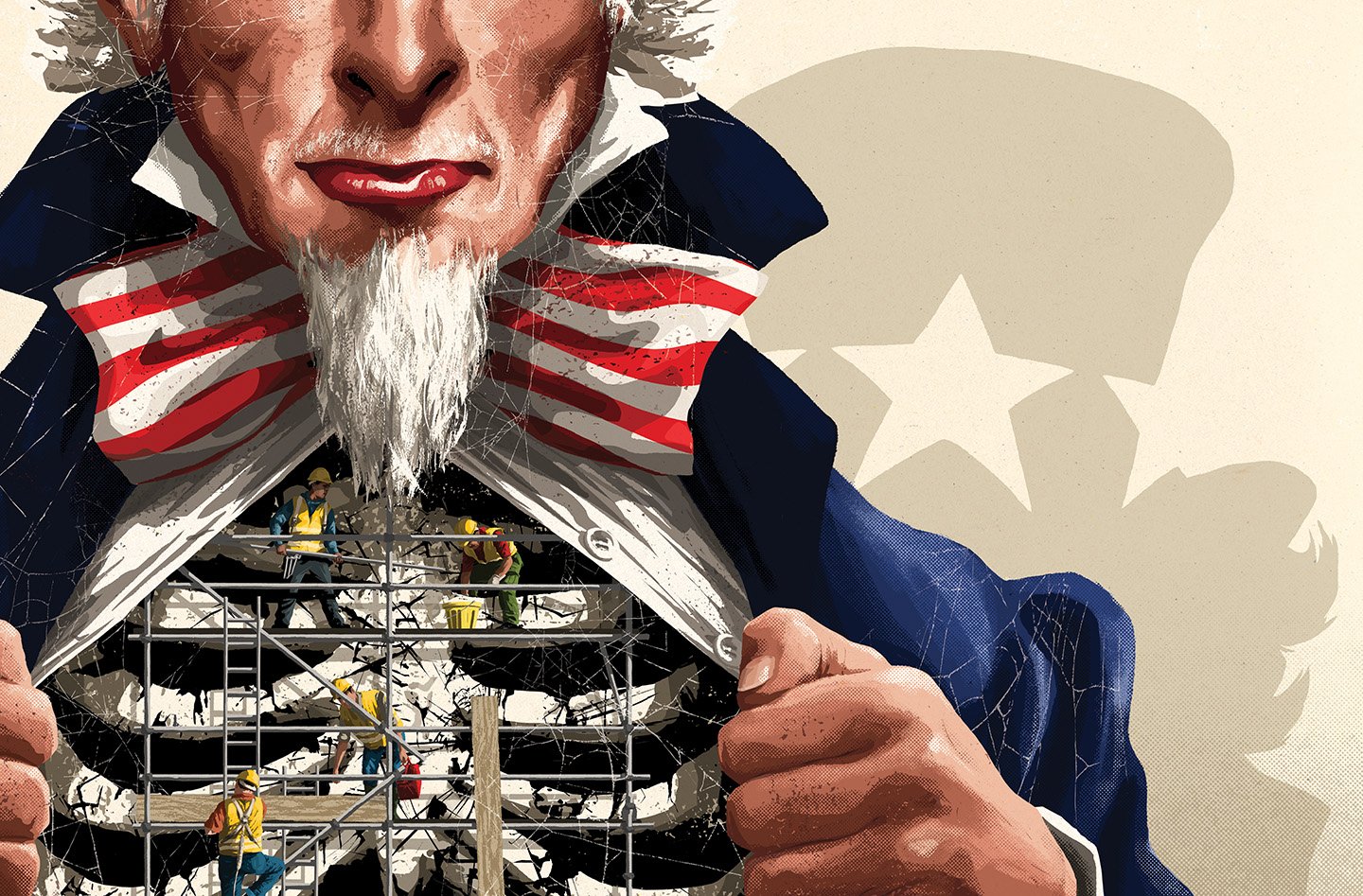

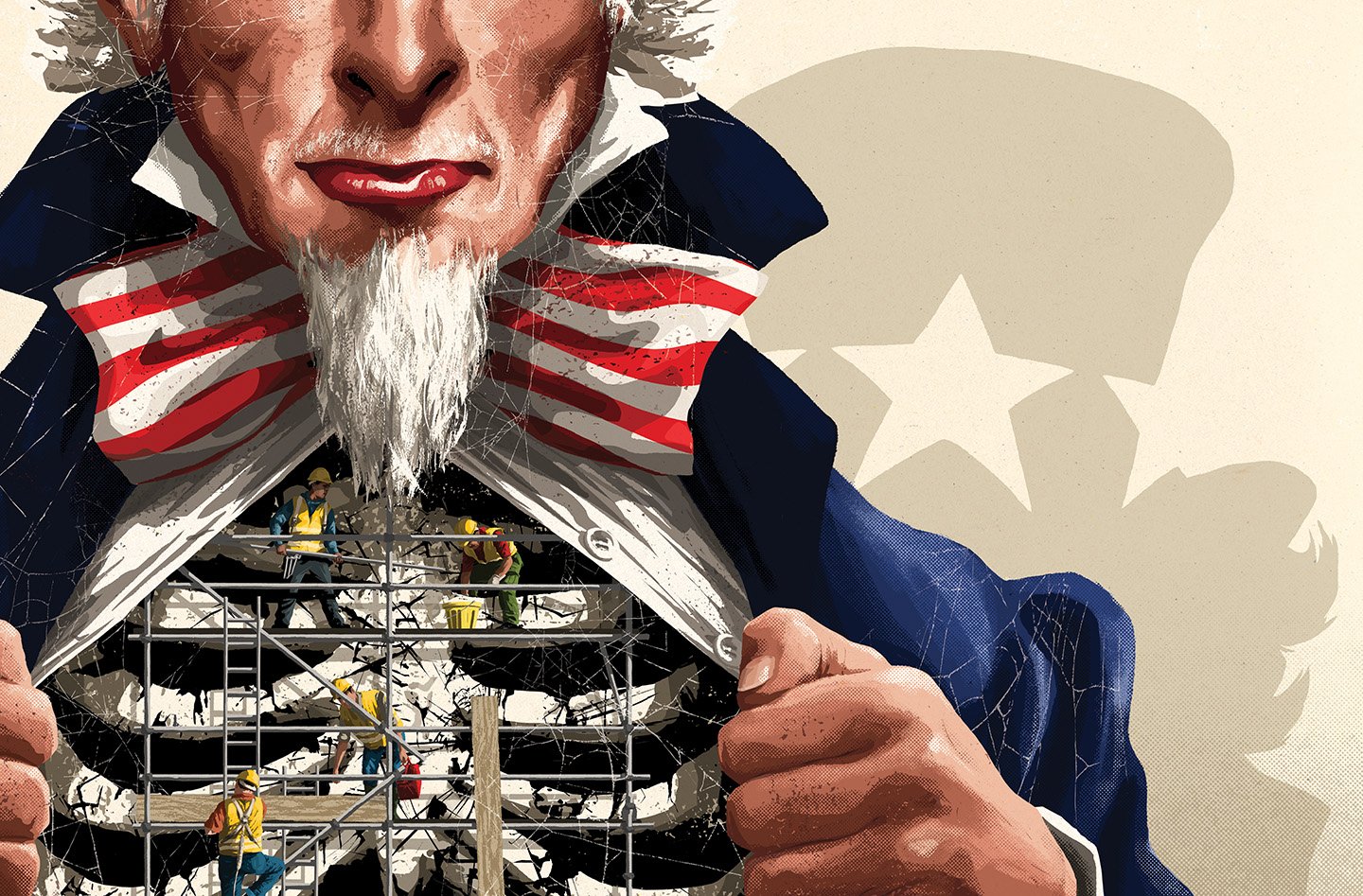

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

The money migrators

How cross-border payments company Remitly takes the tension out of cash transfers.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by nearly nine out of ten Scottish Mortgage companies.

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

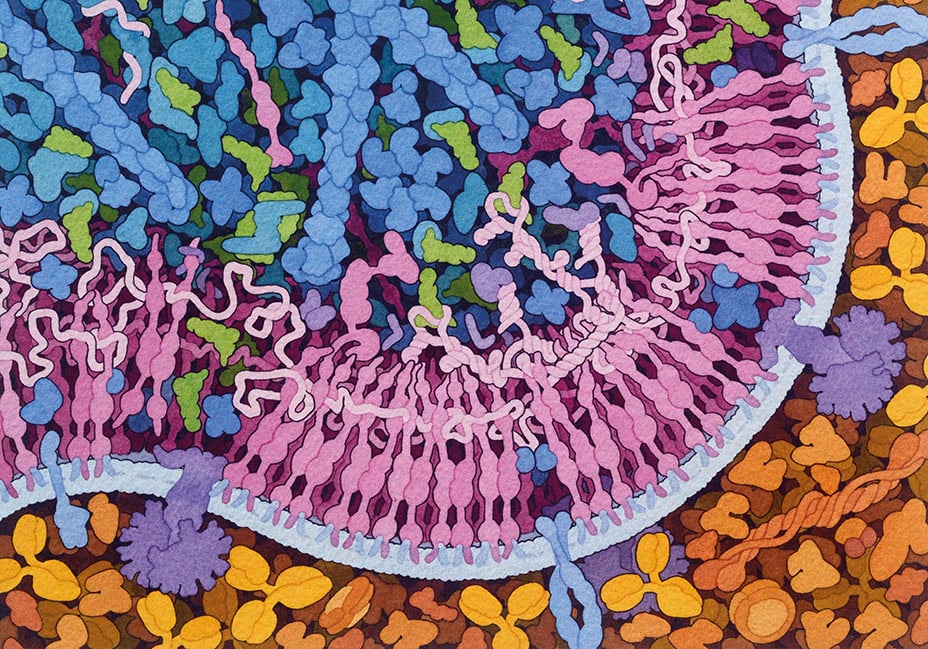

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Enduring good

What values are important to you? And are they reflected in your investments?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

How Amazon pioneered a new path

The new wave of companies blending physical and digital processes together.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

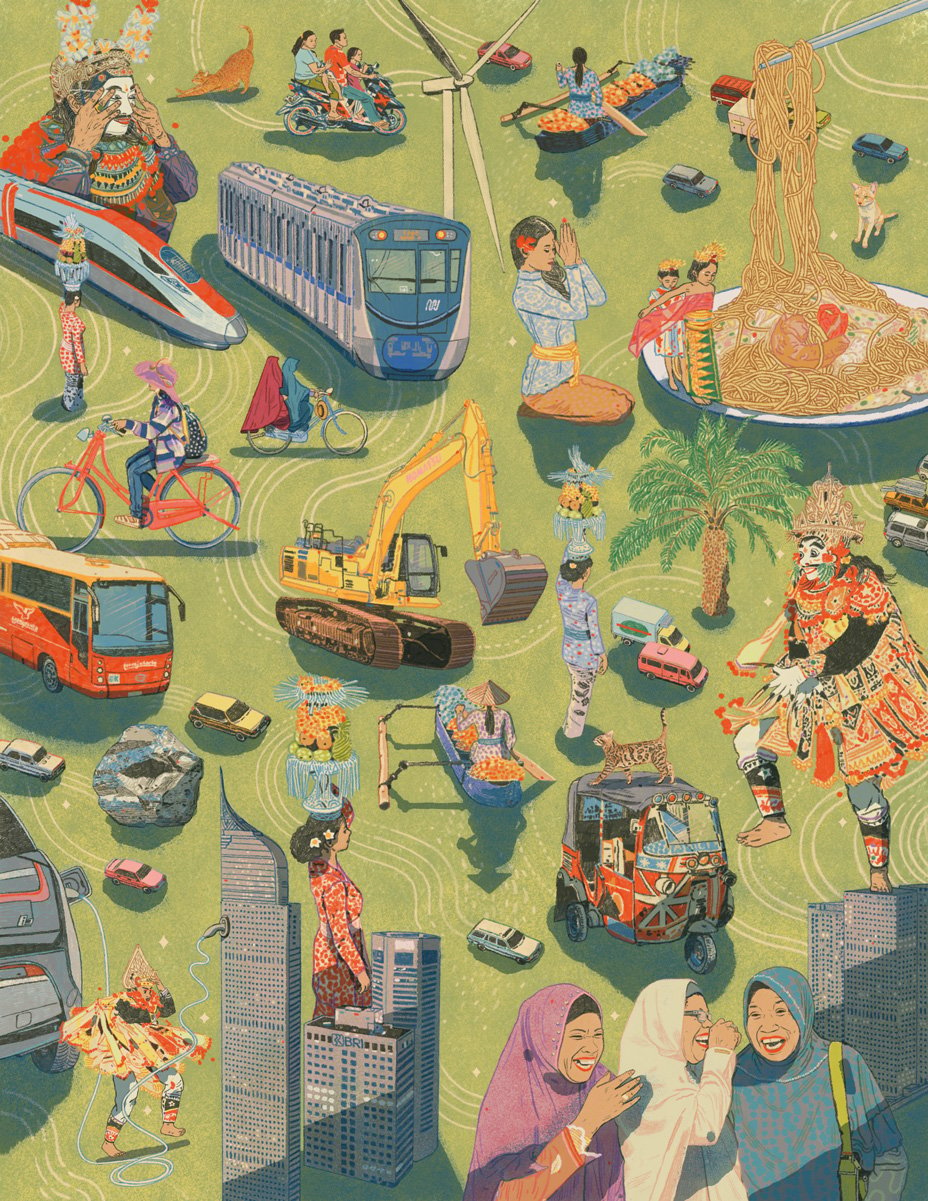

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

A net zero initiative update

A reflection on Baillie Gifford’s commitment to the climate transition.

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

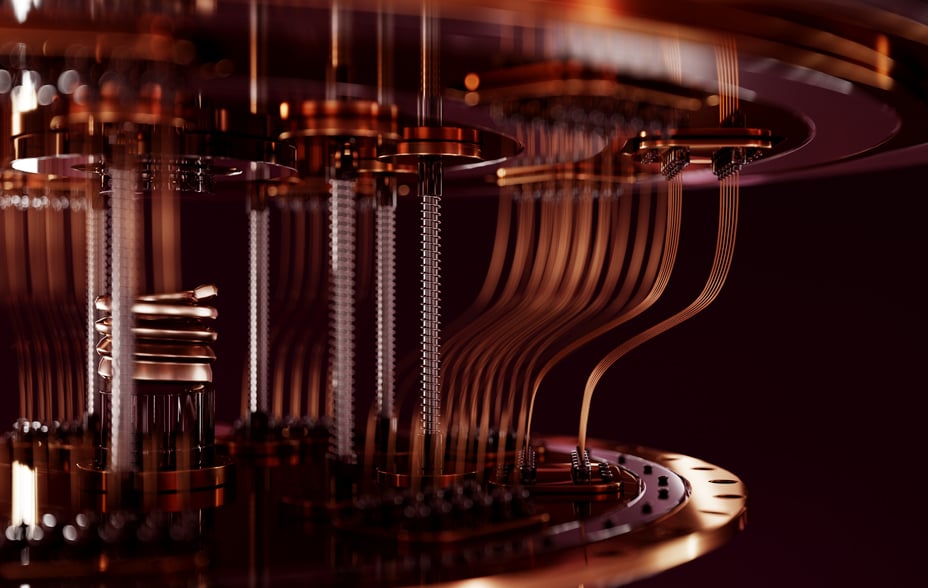

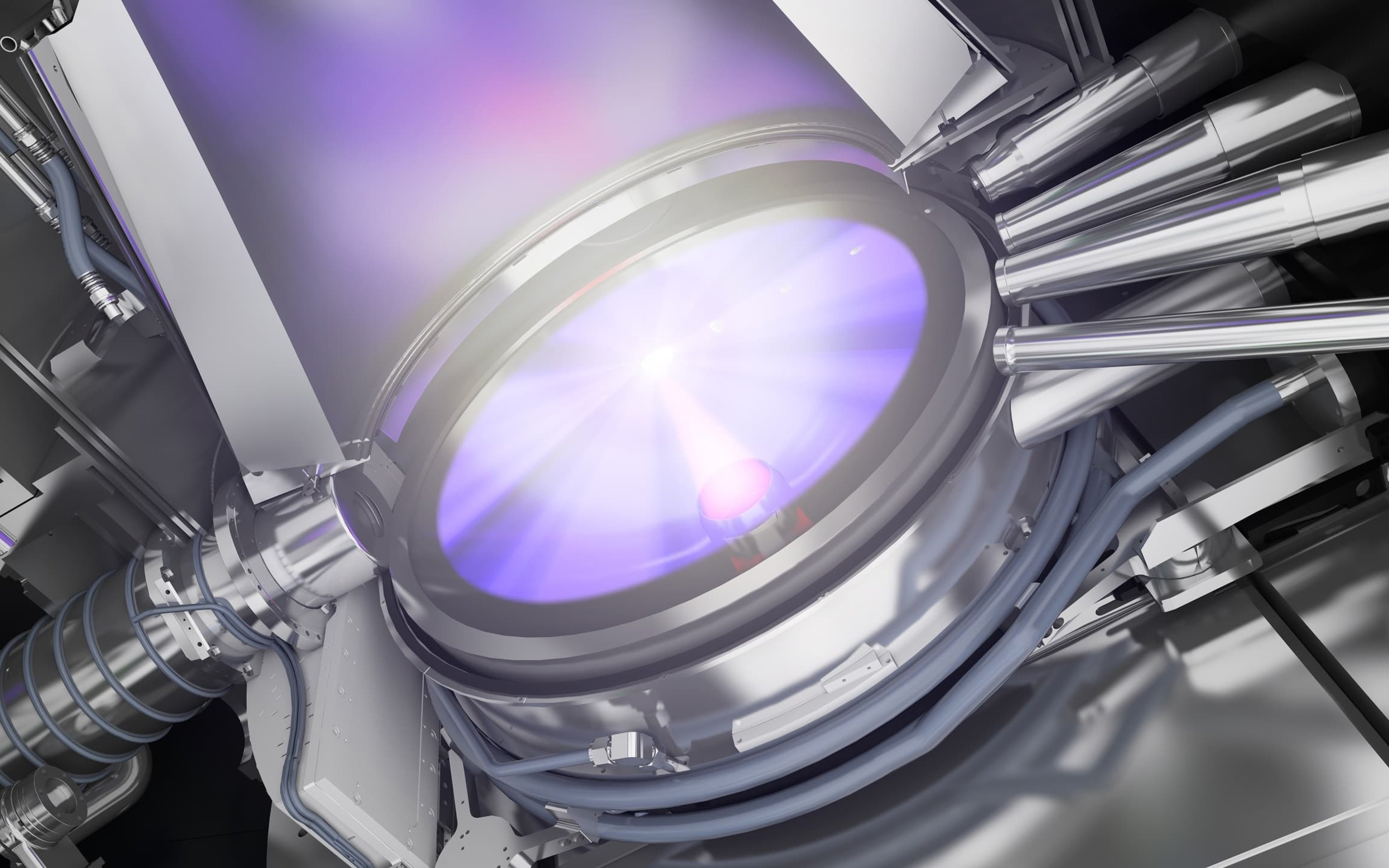

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

Change as a growth driver

We live in changing times. And that will create opportunities for long-term growth investors.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Actual investing: the test of time

Stuart Dunbar reflects on the long-term case for Actual investing.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Indonesia powers a green transition

The island nation’s natural wealth makes it crucial to a low-carbon future.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Recursion Pharmaceuticals: finding new drugs using data science

How Recursion Pharmaceuticals is using AI to turn the hunt for new medicines on its head.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

Climeworks: fighting global warming

Climeworks helps us remove CO₂. We invest in it because we think it can combat climate change.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Why small is big in Japan

Praveen Kumar on the lesser-known players thriving in the shadow of the country’s big brands.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Making sense of the metaverse

Author Matthew Ball on the next-generation internet and the companies building its foundations.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

China’s changing automotive landscape

The rise of EVs spells opportunity for supply chain providers, from battery makers to semiconductor foundries

AI: Frightening or fascinating?

Investors discuss how AI software could transform healthcare, advertising, manufacturing and more.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Chip War

How semiconductors bring a competitive world together.

The dawn of artificial intelligence

How AI is disrupting all kinds of industries, creating investment opportunities in its wake.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

A theory of radical change

Why a ‘deep transition’ may have started to deliver a more sustainable age.

Rethinking where growth comes from

Partner Dave Bujnowski offers a radical new perspective on the disruptive ‘engines’ powering today’s growth.

Tapping global brainpower

How Baillie Gifford’s mutually beneficial network of academic connections makes us see the world differently.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

Small islands, lots of energy

How Orkney’s renewable energy projects can inform our investment choices.

Cultivating change in the meat industry

Demand for meat is growing, but traditional production is costly. Could in vitro agriculture be our panacea?

The search for ‘jumper-stretching’ stocks

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Investing in decarbonisation

Spotting companies with potential in the renewables, energy storage and carbon reduction sectors.

China’s leapfrog shopping apps

Smartphone-centric retailers drive innovation.

Study guides

Academic partnerships that generate new ideas

What makes companies resilient to inflation?

Baillie Gifford’s Risk Team has been considering how firms can reduce their vulnerability to rising prices.

The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Why it’s not over for growth stocks

Growth stocks have crashed down to earth. Has growth had its day or will it come back stronger?

China’s energy paradox

How should you consider the country – carbon culprit or climate saviour?

Investment Stewardship

It’s not that we do ESG, but how we do it. The ESG Team list 2021’s key stewardship activities.

ESG v sustainability

The questions we should consider to avoid being led astray by ESG risk scores.

The long view

The enduring power of Moore’s Law and other factors that might matter in the next decade of investing.

India’s data-driven growth stocks

Baillie Gifford spots investment opportunities in a smartphone-transformed nation.

China’s move to renewable energy

Solar power and cheap green energy makes for a promising future.

A dream within reach

New technologies, plummeting costs and our own changing behaviours all promise progress in the energy transition– just don’t expect it to come in a straight line.

Actual ESG

Investing in great growth companies to make a big difference.

Long-term investing and market volatility.

James Budden on holding your nerve through short-term setbacks and supporting exceptional growth companies.

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

Sustainable companies, global challenges.

Learn about the up-and-coming sustainable companies radically shaping a more prosperous future.

Riding Growth Waves Webinar.

Good investing takes quick reactions as well as a long-term vision.

The university shaping global tech

Why so many tech founders and CEOs have emerged from the Indian Institutes of Technology.

Glasgow Climate Pact

For Global Stewardship, climate opportunities go hand in hand with climate challenges

What’s a business for?

Today’s investment managers should support companies doing the most to benefit society.

Towards Net Zero: Reflections on COP26

Tim Garratt, Michael Pye and Caroline Cook reflect on the investment implications of arguably the most significant meeting of world leaders this millennium, COP 26.

The Biological Revolution

The use of information science to unlock biology is revolutionising our health and wellbeing.

Mapping Veganville

Can plant-based foods save the planet? Investment manager Brian Lum explores changing attitudes.

Healthcare’s biotech revolution

A convergence of technologies is paving the way for advances in our understanding of biology.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Lessons from Bessembinder

What a US academic taught us about the companies that outperform.

India’s ‘missing’ female workers

Women dropping out of employment should weigh on investors’ minds.

Supporting ESG improvers

Investors can have the most impact by focusing on sustainability laggards, not leaders.

Misguided metrics

Why emerging markets firms struggle to get high ESG scores

Time travel investing

Evaluating emerging market stocks by taking a mental leap into the future.

Disruption Week: Investing in Firms Shaping the World of Tomorrow

From futuristic wireless technology to healthcare innovation and new forms of food production, the Long Term Global Growth Team’s investment manager Michael Pye considers the advances that may define life in 2040.

Actual ESG

The logic of long-term investing means that companies harming the planet and its people will ultimately be losers.

The Atlases of the modern economy

You can’t predict the future, but you can prepare for it by investing in those businesses that will help create it. Jenny Davis turns to history to provide some context as to why she believes the unsung heroes of the modern economy will be the titans of the future.

A View from the Midst of the Pandemic

Technological developments over recent decades mean reality has outpaced the science fiction of his youth since Mark Urquhart joined Baillie Gifford almost 25 years ago.

The Second Space Age

Fifty years after Apollo 11, can a fresh wave of innovation in space technology open new frontiers and promising investment opportunities? Investment manager, Luke Ward looks across the gulf of space and gives us his views.

Learning from Academia

Our support of inquisitive people plays a crucial role in our investment research. Discover more in our academia anthology.

Corporate Scandals That Changed the Course of Capitalism

Civil society has increasingly questioned and challenged corporate behaviour and activity since the 1960s. This film documents a number of corporate disasters that have caught the public attention over the last 75 years, and have led to some profound changes.

A case for growth

Growth investors have had a good decade. Dave Bujnowski explains why he remains convinced that, despite suggestions to the contrary, growth investors look set to enjoy more of the same over the coming years – provided they look in the right places.

Bricks and clicks

With online companies currently dominating sales, it is widely expected that the need for tangible stores will continue to decrease, but Baillie Gifford has spotted a rise in forward-thinking companies who are utilising physical spaces to provide an innovative and interactive shopping experience.

The Death of Alzheimer’s

As lifespans increase, more of us will inevitably encounter Alzheimer’s. Thankfully, new advances mean that we may be approaching a breakthrough in treating the disease. The Death of Alzheimer’s asks how Baillie Gifford can support this effort.

Let's Talk About Actual Investing

The task in hand is to remind our clients what investing actually means. Stuart Dunbar makes a passionate plea for 'actual' managers to demonstrate that we have our clients' best interests at heart.

The unpopular case for active management

The active investment industry as a whole appears to have done a better job of enriching itself than adding value for clients. Is it worth defending? Stuart Dunbar thinks so.

Swimming against the tide

Home to many of the world’s greatest companies, the United States should be the active investment manager’s dream. Not so for everyone, it seems. Swimming against the tide of passive and mediocre active investment strategies, Head of US equities Tom Slater endorses a genuinely active, long-term approach to investing in the American dream.

Does anyone remember what 'investing' actually means

Stuart Dunbar discusses the woes of what our industry has become alongside the potential opportunities presented by its somewhat over-evolved state.

An End to Cancer?

Investment manager Julia Angeles strikes an optimistic note as she explores some of the recent developments in healthcare, which one day she hopes will bring an end to cancer.

A long-term manifesto

Investment Manager Iain Campbell does not claim that Baillie Gifford’s investors are cleverer, have better systems or information, or that they work harder, travel further or construct more complex spreadsheets. Rather, he elaborates on an identifiable market inefficiency that our unusual structure and long-term philosophy allows us to exploit.

Why growth, why now?

Recent insights

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

The money migrators

How cross-border payments company Remitly takes the tension out of cash transfers.

Important information

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority.

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Any general enquiries regarding Baillie Gifford should be directed to the relevant individual as noted in the Contact Us section.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with.

This website is informative only and the information provided should not be considered as investment advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.