Filters

Insights

Yarak: culture in the age of AI

What happens to great company cultures in the age of AI, where knowledge can be compressed, and decisions are pushed toward algorithms?

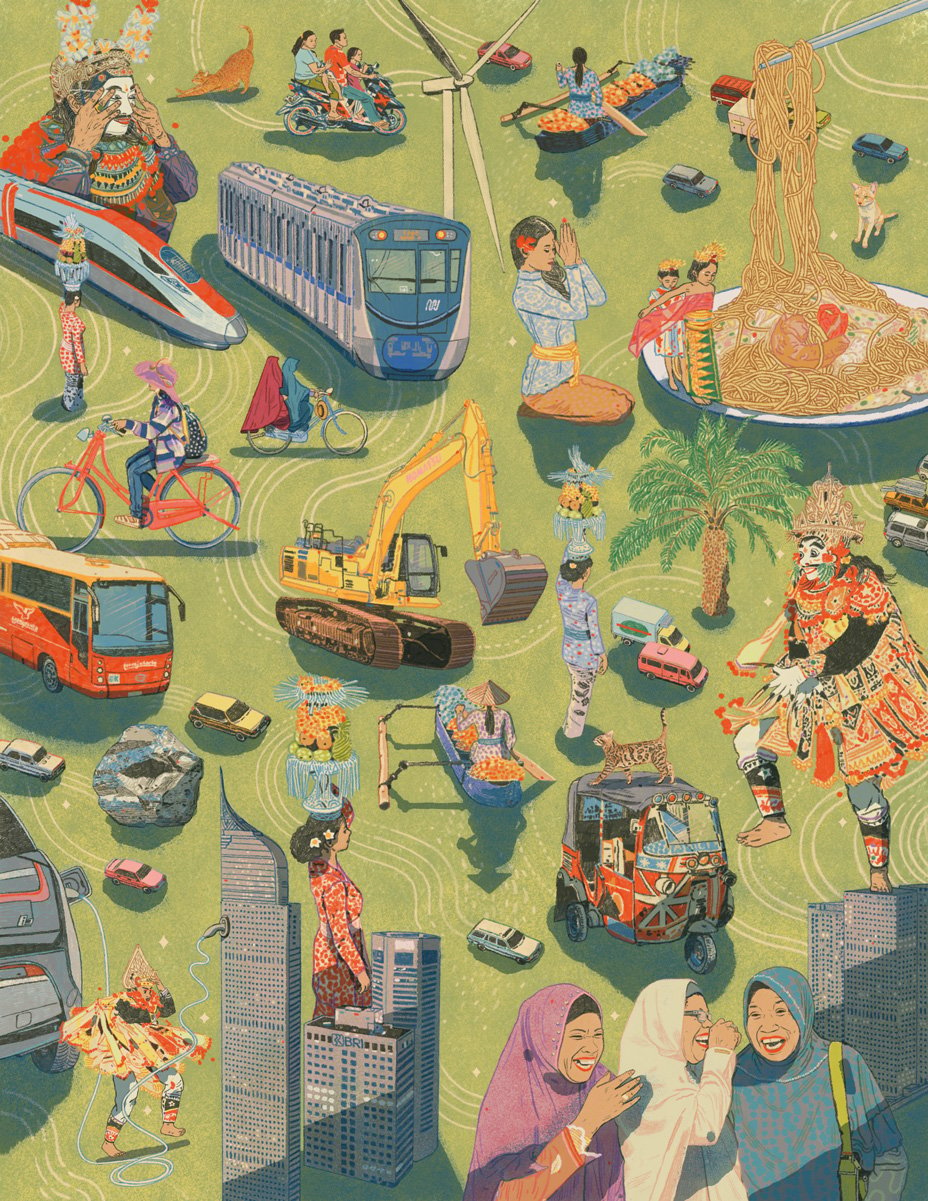

Emerging market companies leapfrogging western rivals

Investment manager Alice Stretch explores disruptive businesses in Asia and Latin America.

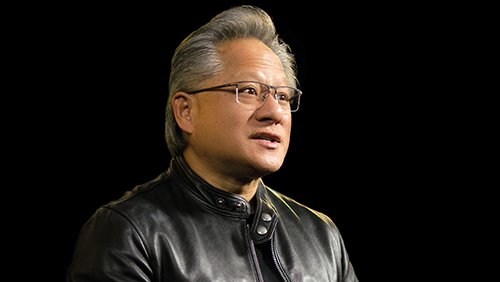

The world is about to get ‘weird’

Why avoiding US growth stocks is perilous: AI infrastructure, asymmetric returns and the paradigm shift.

Private growth: the underappreciated opportunity

Why the asset class offers patient investors access to exceptional companies.

Private companies: from Anthropic to Zetwerk

Why we invested in the AI lab and supply chain specialist, among other companies operating in private markets.

Synthesis in risk management

Discover how Baillie Gifford balances modern risk analytics with long-term growth investing.

Amazon: Stock Story

Jon Henry gives three key reasons why tech giant Amazon remains a special investment.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

When machines feel human

When machines speak, do we meet minds, or our own reflection?

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

Netflix: Stock Story

Ben James delves into Netflix's transformative journey from a DVD rental service to a global streaming giant.

Wise: Stock Story

Thomas Hodges highlights how Wise’s fast, low-cost money transfers enhance global payments.

Silicon Valley and beyond: innovation at source

Innovation thrives in the US’s tech and biotech clusters, where science and entrepreneurship meet.

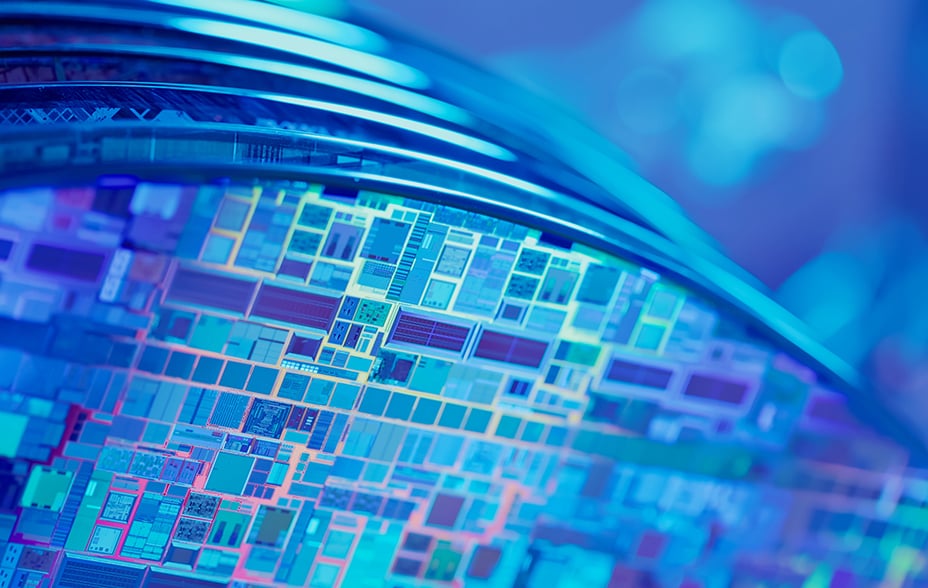

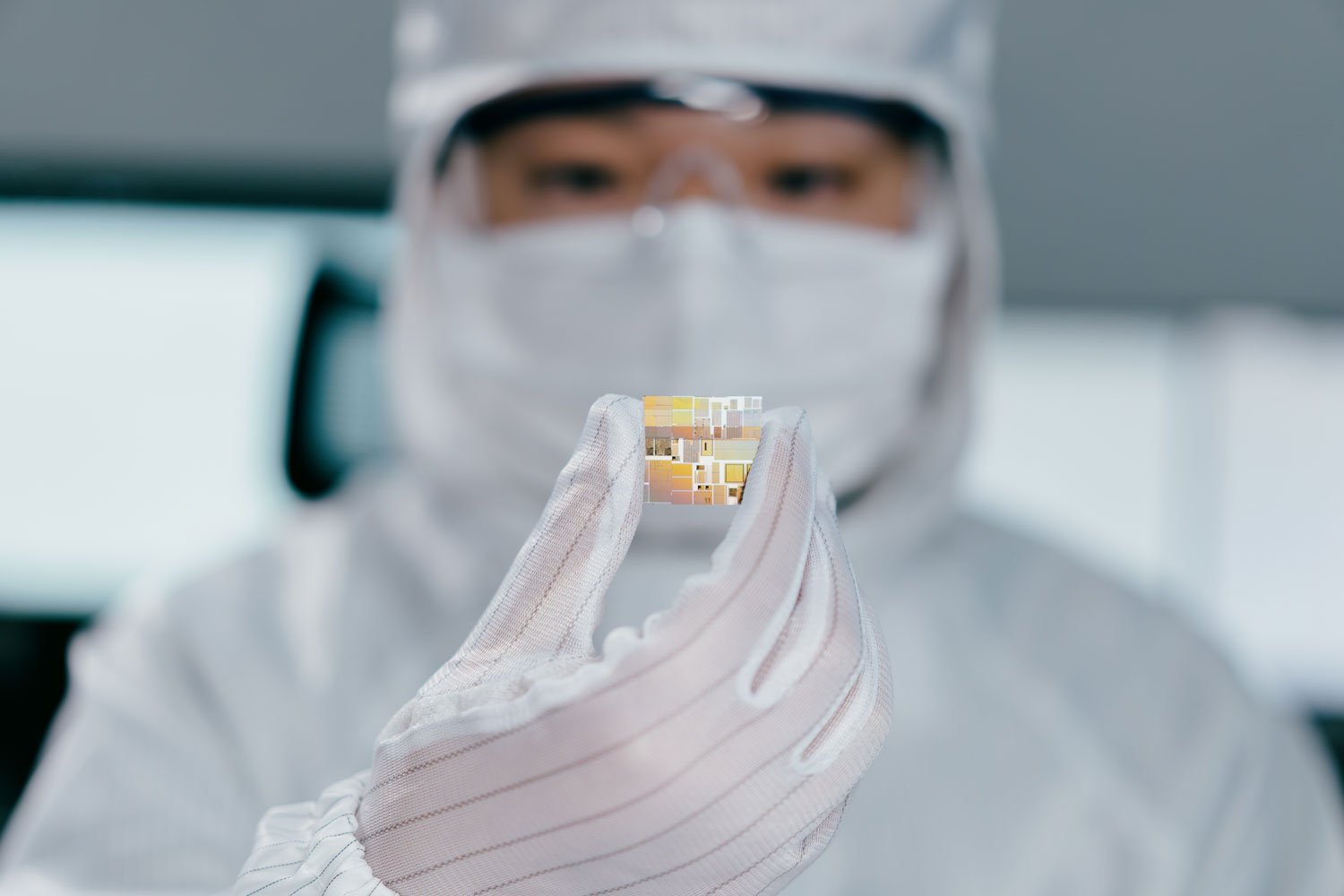

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

Tencent: Stock Story

Fernanda Lai explores how Tencent became the super-app pioneer connecting over one billion users.

Emerging markets, from imitators to innovators

From driverless taxis to digital banking, emerging markets are leading a new wave of innovation that’s reshaping industries worldwide.

Any other business: your Disruption Week 2025 questions answered

Baillie Gifford's strategy specialists address your remaining queries from Disruption Week 2025.

Private companies shaping the modern world

Private innovators are reshaping how we code, build and connect – long before they reach public markets.

Discovering Europe’s winners

Amid uncertainty, Europe’s most dynamic companies are proving that innovation can flourish where few expect it.

Why we are backing Anthropic

Our investment thesis for the AI frontrunner.

Humanoid: Japan and the rise of the machine

Humanoids have been a long time coming, allowing Japan to build a world-class edge in robotic components.

Fragmenting systems, cultural change

US culture is becoming chaotic, wreaking havoc for many but creating opportunities for certain types of businesses.

Our best international ideas

Andrew Brown travels the globe through Sweden’s MIPS, Kazakhstan’s Kaspi.kz and Japan’s Keyence.

Our best ideas in China

Ben Buckler highlights Meituan (autonomous delivery), Midea (smart homes) and CATL (EV batteries).

Our best UK ideas

Chloe Darling-Stewart on why the UK’s Autotrader, Moonpig and Genus are hidden treasures.

Our best private growth ideas

Rachael Callaghan introduces us to growth-focused private companies BillionToOne, Stripe and Vinted.

Beyond the benchmark: why being different pays off

Our chief executive on the importance of long-termism, optimism and conviction – and what comes next.

Lights, camera, AI

From storyboard to final cut, Runway is changing how films get made.

BYD’s right to win

The electric carmaker’s drive to follow success in China with global expansion.

Unknown quantities

Prof Diane Coyle explains why you can’t measure progress with yesterday’s tools.

The age of resilience

Why companies must be built to survive before they can thrive.

Tour de France: the Japanese connection

Bicycle parts maker Shimano is primed for a gear shift in performance.

50 years of partnership with charities

How our long-term investment approach and partnership structure benefit charitable organisations.

The European Renaissance

Why strong growth prospects, political stability and fiscal momentum are making European assets appealing.

Emerging markets: the next engines of global growth

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

Death, discounts and Darwin

The investment trust sector is alive and well, with discounts being a structural advantage.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Has ‘ESG’ reached its expiry date?

Our new head of ESG explains why she thinks the term needs a rethink.

UK growth: opportunities amid tariff turbulence

How adaptable firms in growth-driving sectors can prosper over the long term despite trade restrictions.

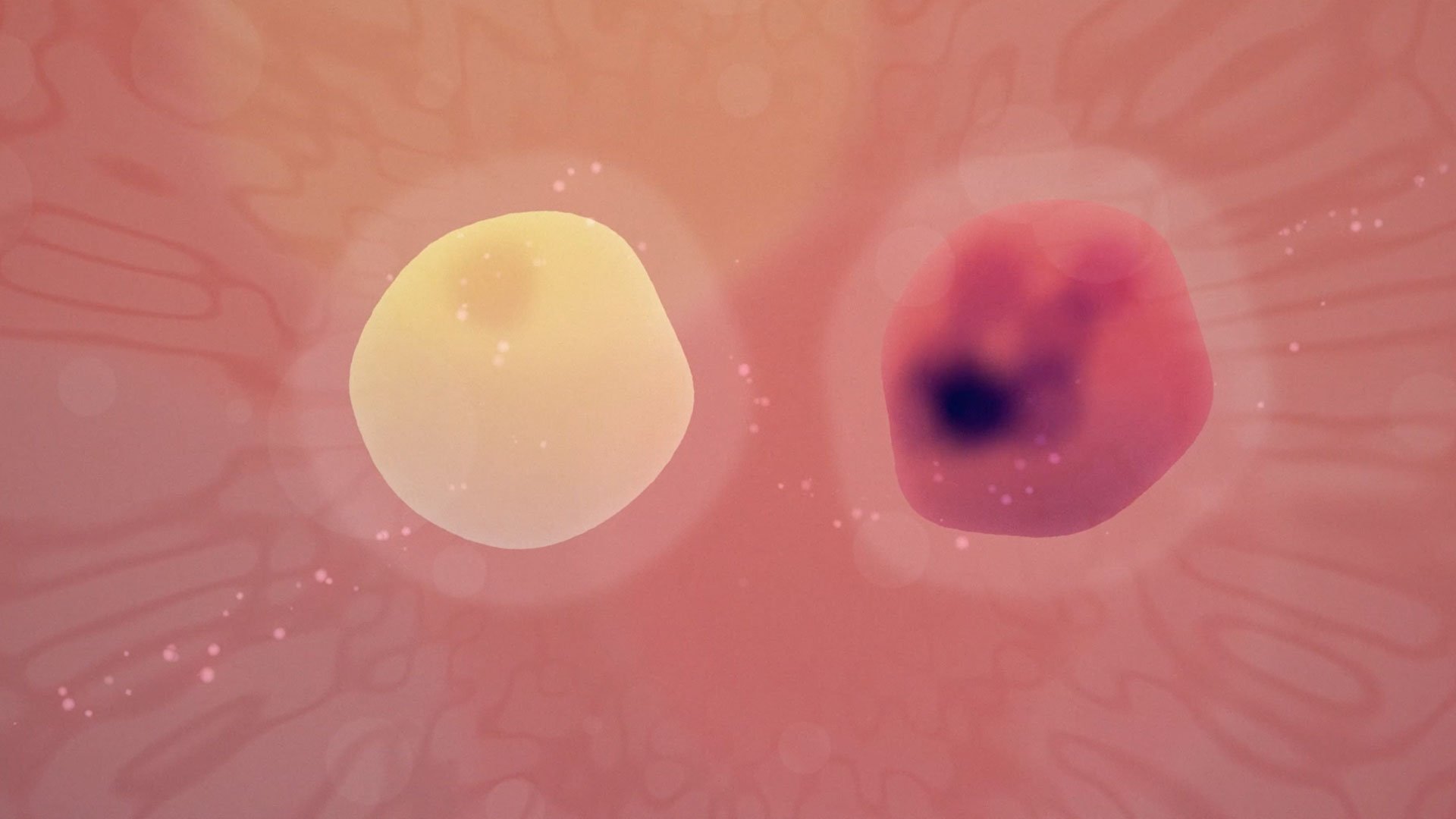

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Cloudflare: Stock Story

Ben James highlights how one cybersecurity approach is redefining digital infrastructure.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

Why ants, scaffolding and long jumps matter to growth investors

Kirsty Gibson shares frameworks to analyse the cultures of exceptional growth businesses.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Trip notes: Kazakhstan

Sizing up super-app Kaspi.kz in Almaty.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

Watch this space: Tim Marshall on the future of ‘astropolitics’

Author Tim Marshall explains how space is set to become the new arena for rival powers.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Nubank: Latin America’s digital disrupter

Charting the app-based lenders’ long-term growth.

Joby Aviation readies for take-off

How a flying taxi firm could launch a transport revolution.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

Climate scenarios: preparing for uncertainty

How scenario analysis and climate adaptation can unlock exciting investment opportunities in resilient companies.

Private growth: Looking over the overlooked

Learn more about the key features and attributes of the growth equity asset class.

A long-term manifesto, revisited

Why exceptional growth companies must be brave enough to ignore short-term market pressures.

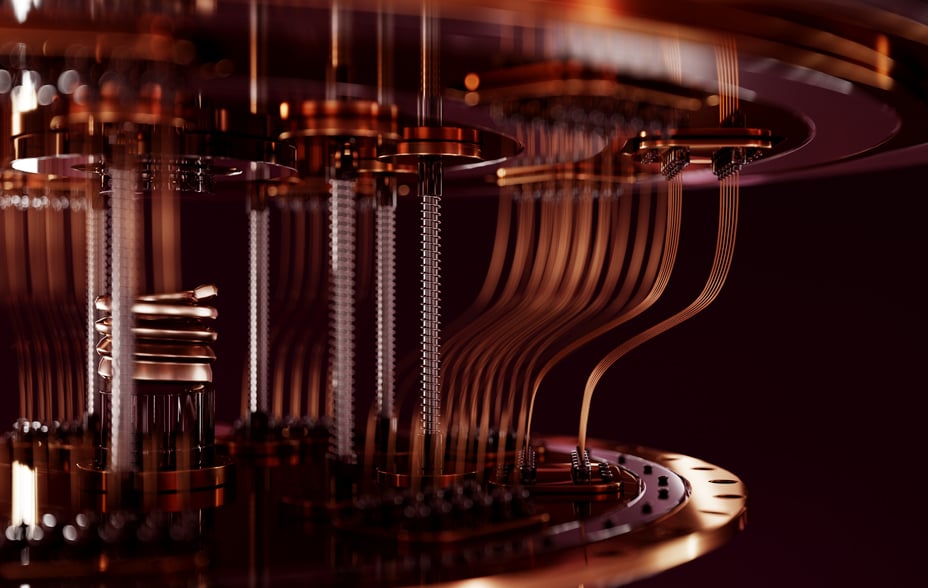

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

The G of ESG: governance reimagined

Why we don’t follow the crowd when assessing a company’s governance behaviours and structures.

5 inevitable and investable long-term growth drivers

Ways the world will change, from smarter robots to medical breakthroughs achieved at speed.

The concentration conundrum: challenge or opportunity?

In today’s era of US mega caps, is market concentration a challenge or an opportunity?

Stock story: Ecolab

Learn how Ecolab is helping customers around the world be better stewards of water.

Emerging markets: new opportunities

Why increased resilience and strong growth prospects merit a closer look.

Private investments: unlocking growth

The three Rs – relationship, reputation and research – are key to private company investing.

Any other business: Disruption Week questions 2024

Baillie Gifford's strategy specialists address your remaining queries from Disruption Week 2024.

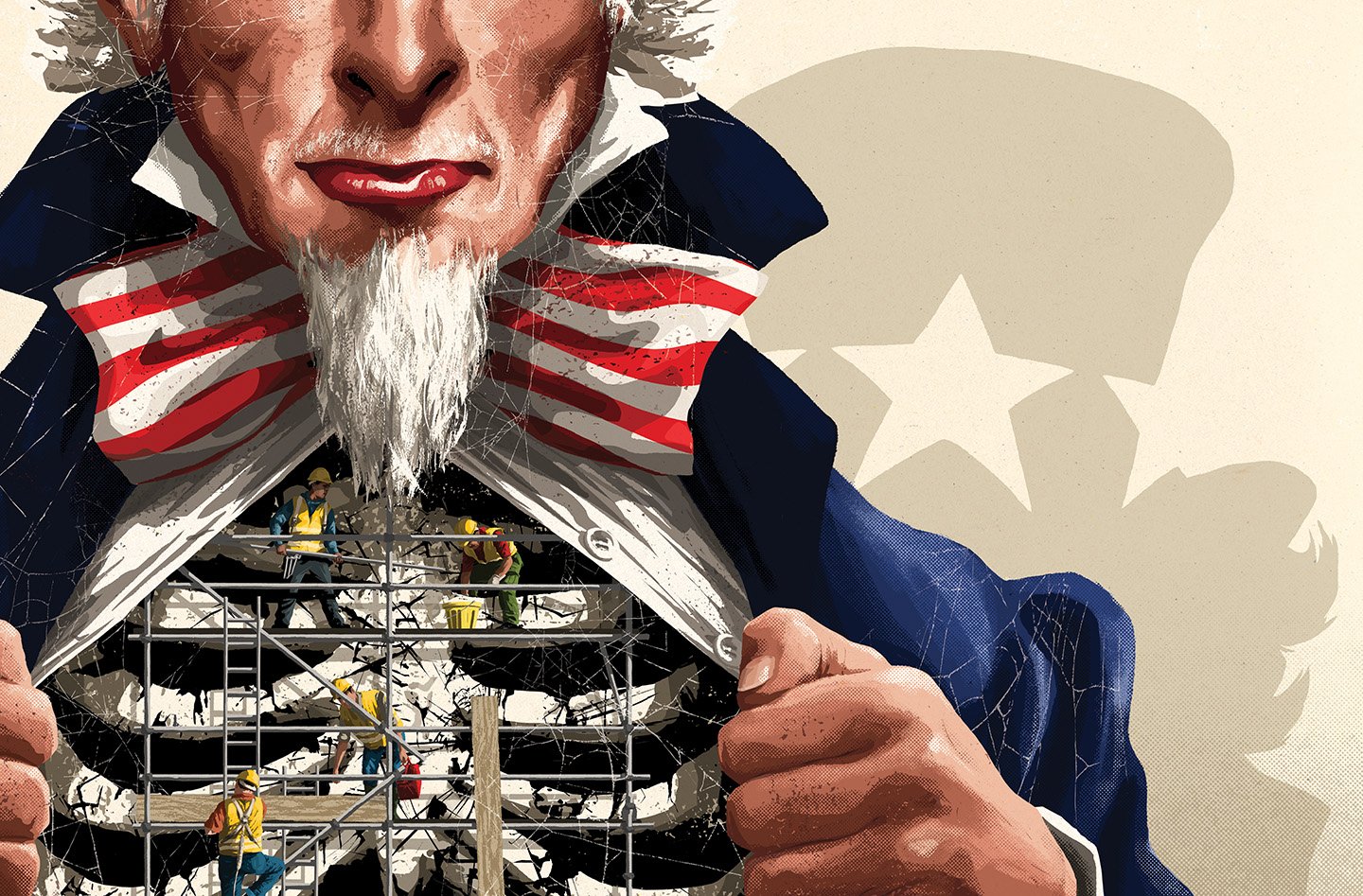

The great US infrastructure rebuild

Finding gold amid the grit of the US drive to repair its essential networks.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

Why not just invest in the index?

Partner Stuart Dunbar explores why as an active manager Baillie Gifford can add value beyond investing in an index over the long term.

Resurgence of insurance-linked securities

Exploring the ILS resurgence: capital cycle shifts, disaster impacts and sustainable economies

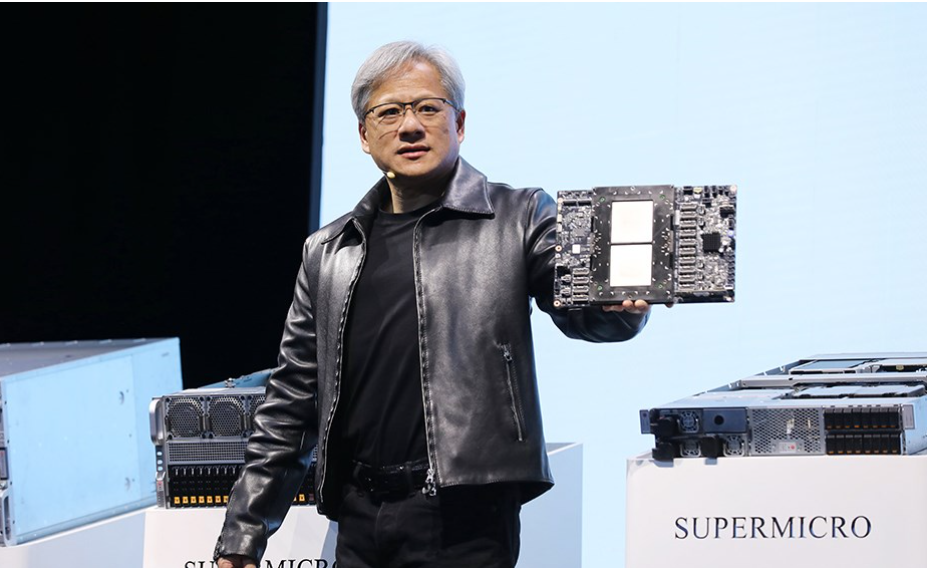

Semiconductor chips: the global tech battle

Companies and countries are vying for influence on the technology powering computation.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Do elections matter for stock returns?

What the past tells us about a new US president’s impact on growth companies.

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

Our best ideas in Japan

Thomas Patchett unwraps Softbank, Rakuten and Eisai, three companies driving new opportunities in Japan.

Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks in the US.

Our best ideas in Asia

Qian Zhang covers Samsung, Delhivery and Bank Rakyat, three companies at the heart of global structural trends.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

Our best disruptive ideas

Bill Chater spotlights three companies making world-changing breakthroughs: Alnylam, Axon and SpaceX.

Our best balanced ideas

Lucy Haddow shares the growth potential of salad bar Sweetgreen, car dealer Inchcape and airline Ryanair.

Future Stocks: Our best impact ideas

Rosie Rankin explains why Nubank, Xylem and Grab can both improve lives and offer investment returns.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Ahead of the game: rethinking play’s importance

Kelly Clancy makes the case for why play is more important than you might think.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Creo Medical: at the spearhead of surgery

The Welsh company cutting surgery waiting lists – and costs.

Why technical leaders have an advantage

How the leaders of Meta, Shopify, Roblox and Spotify’s expertise helps them put AI to use.

Trip Notes: Seoul and Mumbai

Lawrence Burns sees great growth firms in action in South Korea and India.

PsiQuantum: the leap to quantum computing

PsiQuantum’s efforts could revolutionise medicine, energy use, farming and more.

Beyond Silicon Valley

The US’s new hotbeds of innovation are increasingly based outside California.

SWCC Showa: rewiring Japan

How an ultra-traditional Japanese engineering firm became key to Japan’s power overhaul.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

MercadoLibre: Latin America’s unbanked

MercadoLibre offers hope to Latin America’s 178 million unbanked population.

Stock story: Diploma

Iain McCombie explores Diploma's journey to distribution excellence

The rise of cloud computing

From data lakes to Databricks, cloud storage will be key to driving progress and future innovation.

Wise: Growing global money transfers

Charting rising cross-border money payments and the opportunity for remittance service Wise.

Japanese changemakers shaping the future

The firms taking advantage of four transformational opportunities.

Starlink: internet for mobile dead zones

Low-orbit satellites could be the answer for the three billion unable to access the internet.

Extraordinary times and opportunities

James Budden explains why now is the time for growth, as markets weather exceptional volatility

Environment: making sense of the E in ESG

How companies’ relationships with climate, energy and the environment relate to long-term growth.

Academic collaborations that count

The experts helping us gain an investment edge when thinking about farming, human rights and AI.

Lessons from a time traveller

A journey through time uncovers the deep transitions that can reshape our world.

AI: driving a new healthcare paradigm

Why AI could be key to us living longer and being in better health in the future.

Streamlined for success

How efficiency drives at Meta, Shopify and Block could fuel their long-term growth.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Private equities: time to turn to growth

Why high interest rates help rapid growth private companies with proven products stand apart.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Five years of health innovation

Investors take note: technology and innovation are revolutionising treatments and patient care.

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

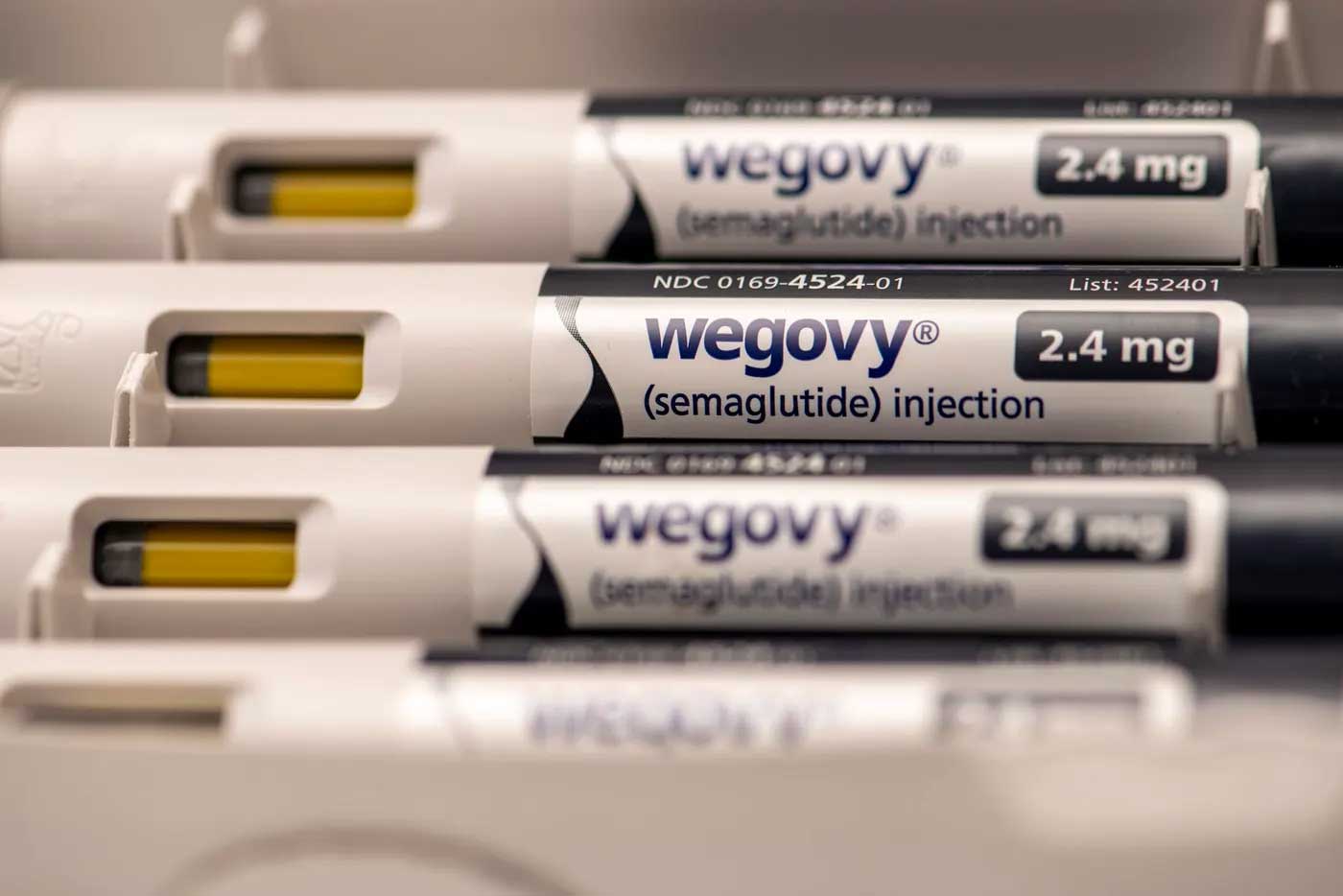

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Remitly: easy global remittance

The mobile app that busts stress and high charges for workers sending money back home.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by founder-led companies.

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Enduring good

What values are important to you? And are they reflected in your investments?

The 3 traits of great growth stocks

Why real-world problem solving, financial discipline and adaptability are critical to growth.

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

How Amazon pioneered a new path

The new wave of companies blending physical and digital processes together.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

Legally bond: finding underestimated resilience

By keeping an open mind, we hope to find opportunities other credit investors might overlook.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Can we mine sustainably?

Minerals are key to the energy transition. We believe mining responsibly will bring rewards.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

Change as a growth driver

We live in changing times. And that will create opportunities for long-term growth investors.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Navigating a turbulent Turkey

Turkey may be volatile, but there’s opportunity in currency forwards and competitive companies

The real deal in property

In a challenging environment, discover a European property sector company bucking the trend.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Actual investing: the test of time

Stuart Dunbar reflects on the long-term case for Actual investing.

Moderna’s new challenge

The mRNA technology behind the Covid vaccine is being directed against other diseases.

Why the long-term matters

There’s safety in being one of the crowd but it could stop you from seeing potential rewards.

Indonesia powers a green transition

The island nation’s natural wealth makes it crucial to a low-carbon future.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

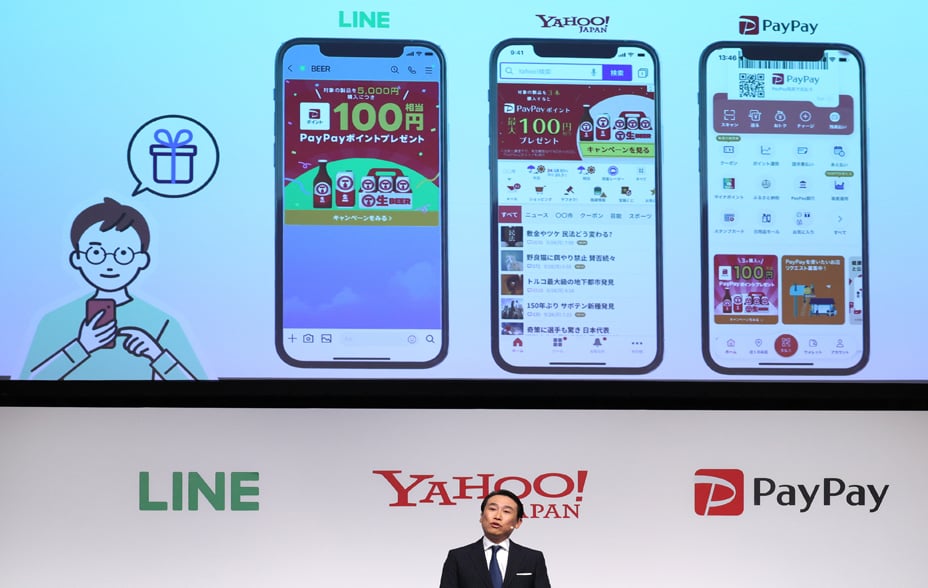

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Recursion Pharmaceuticals: finding new drugs using data science

How Recursion Pharmaceuticals is using AI to turn the hunt for new medicines on its head.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

Climeworks: fighting global warming

Climeworks helps us remove CO₂. We invest in it because we think it can combat climate change.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Why small is big in Japan

Praveen Kumar on the lesser-known players thriving in the shadow of the country’s big brands.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Making sense of the metaverse

Author Matthew Ball on the next-generation internet and the companies building its foundations.

Re-awakening utilities

Utility companies which can adapt to climate change and the shift to renewables bring the best chance of returns.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

China’s changing automotive landscape

The rise of EVs spells opportunity for supply chain providers, from battery makers to semiconductor foundries

AI: Frightening or fascinating?

Investors discuss how AI software could transform healthcare, advertising, manufacturing and more.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Chip War

How semiconductors bring a competitive world together.

The dawn of artificial intelligence

How AI is disrupting all kinds of industries, creating investment opportunities in its wake.

Nintendo: investing in the home of Mario

Why Fusajiro Yamauchi’s business remains a fascinating opportunity for growth investing.

A theory of radical change

Why a ‘deep transition’ may have started to deliver a more sustainable age.

Rethinking where growth comes from

Partner Dave Bujnowski offers a radical new perspective on the disruptive ‘engines’ powering today’s growth.

Tapping global brainpower

How Baillie Gifford’s mutually beneficial network of academic connections makes us see the world differently.

Small islands, lots of energy

How Orkney’s renewable energy projects can inform our investment choices.

Cultivating change in the meat industry

Demand for meat is growing, but traditional production is costly. Could in vitro agriculture be our panacea?

The search for ‘jumper-stretching’ stocks

Tim Garratt considers how we value exciting businesses and reflects on what we lose when we fail to imagine.

Investing in decarbonisation

Spotting companies with potential in the renewables, energy storage and carbon reduction sectors.

China’s leapfrog shopping apps

Smartphone-centric retailers drive innovation.

Study guides

Academic partnerships that generate new ideas

What makes companies resilient to inflation?

Baillie Gifford’s Risk Team has been considering how firms can reduce their vulnerability to rising prices.

The fight for your free time

Disruptive change within the entertainment world creates a wealth of opportunity.

Why it’s not over for growth stocks

Growth stocks have crashed down to earth. Has growth had its day or will it come back stronger?

China’s energy paradox

How should you consider the country – carbon culprit or climate saviour?

Investment Stewardship

It’s not that we do ESG, but how we do it. The ESG Team list 2021’s key stewardship activities.

ESG v sustainability

The questions we should consider to avoid being led astray by ESG risk scores.

India’s data-driven growth stocks

Baillie Gifford spots investment opportunities in a smartphone-transformed nation.

China’s move to renewable energy

Solar power and cheap green energy makes for a promising future.

A dream within reach

New technologies, plummeting costs and our own changing behaviours all promise progress in the energy transition– just don’t expect it to come in a straight line.

Actual ESG

Investing in great growth companies to make a big difference.

Long-term investing and market volatility.

James Budden on holding your nerve through short-term setbacks and supporting exceptional growth companies.

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

Sustainable companies, global challenges

Learn about the up-and-coming sustainable companies radically shaping a more prosperous future.

Riding Growth Waves Webinar.

Good investing takes quick reactions as well as a long-term vision.

The university shaping global tech

Why so many tech founders and CEOs have emerged from the Indian Institutes of Technology.

Glasgow Climate Pact

For Global Stewardship, climate opportunities go hand in hand with climate challenges

What’s a business for?

Today’s investment managers should support companies doing the most to benefit society.

Towards Net Zero: Reflections on COP26

Tim Garratt, Michael Pye and Caroline Cook reflect on the investment implications of arguably the most significant meeting of world leaders this millennium, COP 26.

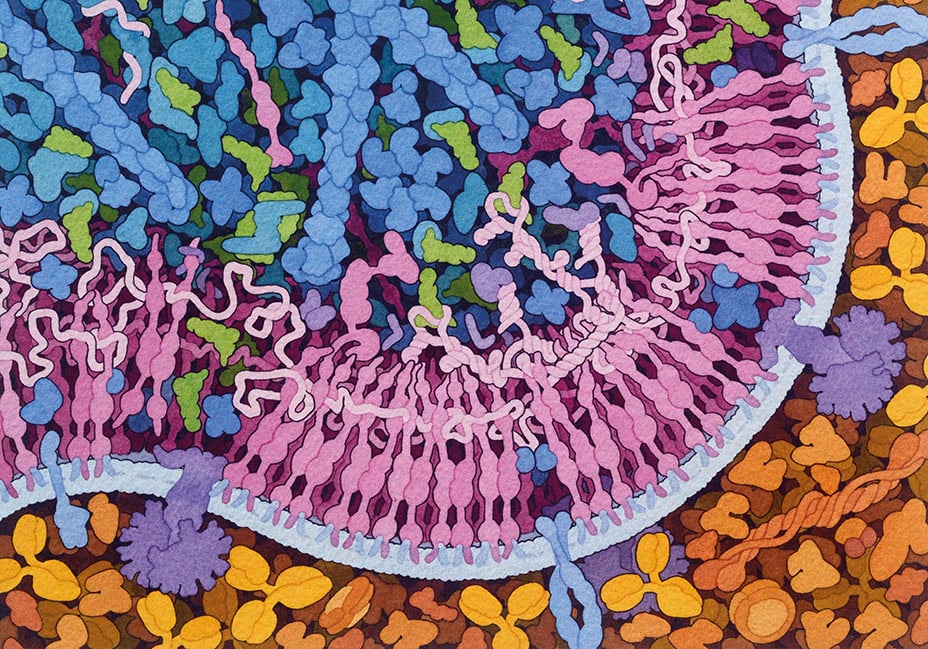

The Biological Revolution

The use of information science to unlock biology is revolutionising our health and wellbeing.

How to surf the waves of growth

Good investing takes quick reactions as well as a long-term vision.

Mapping Veganville

Can plant-based foods save the planet? Investment manager Brian Lum explores changing attitudes.

Healthcare’s biotech revolution

A convergence of technologies is paving the way for advances in our understanding of biology.

The future of transport

Electric cars on the road and flying taxis in the air will change the way people commute and live.

The switch to sustainable food

Plant-based proteins, hi-tech tractors and vertical farms are set to disrupt agriculture.

Digital payments in a cashless future

Disruptive fintechs are paving the way to a world without physical money.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Lessons from Bessembinder

What a US academic taught us about the companies that outperform.

India’s ‘missing’ female workers

Women dropping out of employment should weigh on investors’ minds.

Supporting ESG improvers

Investors can have the most impact by focusing on sustainability laggards, not leaders.

Misguided metrics

Why emerging markets firms struggle to get high ESG scores

Time travel investing

Evaluating emerging market stocks by taking a mental leap into the future.

Disruption Week: Investing in Firms Shaping the World of Tomorrow

From futuristic wireless technology to healthcare innovation and new forms of food production, the Long Term Global Growth Team’s investment manager Michael Pye considers the advances that may define life in 2040.

What Picasso can teach us about investing

Cubism changed art by depicting objects from multiple perspectives. Investors can learn from this approach by looking beyond the narrow confines of the financial industry and seeking a wide range of viewpoints rooted in the real world, argues Tom Coutts, partner at Baillie Gifford.

The future of mobility - Part 2

A wave of revolutionary new technologies is set to transform the way we travel from A to B. In this short series, Thaiha Nguyen, a Baillie Gifford investment manager, takes an in-depth look at the business of personal transport on the brink of change.

The future of mobility – Part 3

A wave of revolutionary new technologies is set to transform the way we travel from A to B. In this short series, Thaiha Nguyen, a Baillie Gifford investment manager, takes an in-depth look at the business of personal transport on the brink of change.

The future of mobility - part 4

A wave of revolutionary new technologies is set to transform the way we travel from A to B. In this short series, Thaiha Nguyen, a Baillie Gifford investment manager, takes an in-depth look at the business of personal transport on the brink of change.

The future of mobility – Part 1

A wave of revolutionary new technologies is set to transform the way we travel from A to B. In this short series, Thaiha Nguyen, a Baillie Gifford investment manager, takes an in-depth look at the business of personal transport on the brink of change.

Actual ESG

The logic of long-term investing means that companies harming the planet and its people will ultimately be losers.

Humans, a growth species

On the back of humanity's innate ability to innovate, invent and improve, Hamish Maxwell is reminded of why growth investing yields such promise over the long-term.

Why most things believed about investing are wrong

Investment manager Lawrence Burns shares the views of brilliant minds outside the industry that will reshape your view of what equity investing is all about.

Innovation: why it’s crucial for sustainability

Lee Qian, Investment Manager in Baillie Gifford’s Positive Change Strategy, tells us why we should harness innovation and economic growth to create a more prosperous, sustainable and inclusive world.

The Atlases of the modern economy

You can’t predict the future, but you can prepare for it by investing in those businesses that will help create it. Jenny Davis turns to history to provide some context as to why she believes the unsung heroes of the modern economy will be the titans of the future.

A View from the Midst of the Pandemic

Technological developments over recent decades mean reality has outpaced the science fiction of his youth since Mark Urquhart joined Baillie Gifford almost 25 years ago.

The Second Space Age

Fifty years after Apollo 11, can a fresh wave of innovation in space technology open new frontiers and promising investment opportunities? Investment manager, Luke Ward looks across the gulf of space and gives us his views.

Dominators vs disrupters - the future of industrial robotics

The big four incumbents in robotics are gearing up for a challenge. In a reshaping global industry, they are readying themselves for the march of the cobots.

Learning from Academia

Our support of inquisitive people plays a crucial role in our investment research. Discover more in our academia anthology.

Corporate Scandals That Changed the Course of Capitalism

Civil society has increasingly questioned and challenged corporate behaviour and activity since the 1960s. This film documents a number of corporate disasters that have caught the public attention over the last 75 years, and have led to some profound changes.

From universal rights to global goals

The 75-year backstory to responsible investment.

Bricks and clicks

With online companies currently dominating sales, it is widely expected that the need for tangible stores will continue to decrease, but Baillie Gifford has spotted a rise in forward-thinking companies who are utilising physical spaces to provide an innovative and interactive shopping experience.

The whole story

In Baillie Gifford we have a very different perspective on 2018, and hence the future, than the one you will be used to reading about.

The death of Alzheimer’s

As lifespans increase, more of us will inevitably encounter Alzheimer’s. Thankfully, new advances mean that we may be approaching a breakthrough in treating the disease. The Death of Alzheimer’s asks how Baillie Gifford can support this effort.

Graham or growth?

In his latest paper, James Anderson discusses Ben Graham’s book The Intelligent Investor, the seminal work on Value investing that remains as valid today as it did when he wrote it seven decades ago. James considers the author’s views and their implications for Growth investing in the current environment.

Let's Talk About Actual Investing

The task in hand is to remind our clients what investing actually means. Stuart Dunbar makes a passionate plea for 'actual' managers to demonstrate that we have our clients' best interests at heart.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the October 2018 issue,

The unpopular case for active management

The active investment industry as a whole appears to have done a better job of enriching itself than adding value for clients. Is it worth defending? Stuart Dunbar thinks so.

Looking back going forward

Twice a year we produce a Long Term Global Growth magazine called Looking Back Going Forward, which contains investment articles which we trust will be of interest. We are pleased to bring you the April 2017 issue.

Swimming against the tide

Home to many of the world’s greatest companies, the United States should be the active investment manager’s dream. Not so for everyone, it seems. Swimming against the tide of passive and mediocre active investment strategies, Head of US equities Tom Slater endorses a genuinely active, long-term approach to investing in the American dream.

Does anyone remember what 'investing' actually means

Stuart Dunbar discusses the woes of what our industry has become alongside the potential opportunities presented by its somewhat over-evolved state.

An End to Cancer?

Investment manager Julia Angeles strikes an optimistic note as she explores some of the recent developments in healthcare, which one day she hopes will bring an end to cancer.

A long-term manifesto

Investment Manager Iain Campbell does not claim that Baillie Gifford’s investors are cleverer, have better systems or information, or that they work harder, travel further or construct more complex spreadsheets. Rather, he elaborates on an identifiable market inefficiency that our unusual structure and long-term philosophy allows us to exploit.

Actual investing revisited

Recent insights

Yarak: culture in the age of AI

What happens to great company cultures in the age of AI, where knowledge can be compressed, and decisions are pushed toward algorithms?

Emerging market companies leapfrogging western rivals

Investment manager Alice Stretch explores disruptive businesses in Asia and Latin America.

The world is about to get ‘weird’

Why avoiding US growth stocks is perilous: AI infrastructure, asymmetric returns and the paradigm shift.

Private growth: the underappreciated opportunity

Why the asset class offers patient investors access to exceptional companies.

Private companies: from Anthropic to Zetwerk

Why we invested in the AI lab and supply chain specialist, among other companies operating in private markets.

Synthesis in risk management

Discover how Baillie Gifford balances modern risk analytics with long-term growth investing.

Amazon: Stock Story

Jon Henry gives three key reasons why tech giant Amazon remains a special investment.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

When machines feel human

When machines speak, do we meet minds, or our own reflection?

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

Netflix: Stock Story

Ben James delves into Netflix's transformative journey from a DVD rental service to a global streaming giant.

Wise: Stock Story

Thomas Hodges highlights how Wise’s fast, low-cost money transfers enhance global payments.

Silicon Valley and beyond: innovation at source

Innovation thrives in the US’s tech and biotech clusters, where science and entrepreneurship meet.

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

Tencent: Stock Story

Fernanda Lai explores how Tencent became the super-app pioneer connecting over one billion users.

Important information

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority.

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Any general enquiries regarding Baillie Gifford should be directed to the relevant individual as noted in the Contact Us section.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with.

This website is informative only and the information provided should not be considered as investment advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.