Key points

- Industrial automation is expanding rapidly as manufacturers seek greater efficiency, precision and safety

- For industrial pioneers such as Atlas Copco and Keyence cultural qualities and organisational structure are as crucial as technical advantages in specialised markets

- Family and founder influence promotes cultural continuity, helping leaders build deep relationships and address specific market needs

As with all investments, your capital is at risk

When investing in leaders in industrial efficiency, understanding 'soft' cultural qualities counts at least as much as knowing what gives firms a hard technical advantage in specialised markets.

With products and services vital to the smooth running of modern life, International Growth's industrial pioneer holdings include Sweden’s Atlas Copco (vacuums, compressors, tools, power) and Japan’s Keyence (sensors, machine vision, automation and consultancy). In their different ways, both companies share an enduring strand of family and founder influence, aligned with an ownership model that benignly influences culture and flow of dividends.

Other holdings have included global leaders in temperature and air quality sensors, energy cables and vacuum valves and many others.

Out of sight and out of mind for many, the global industrial automation and control systems market was estimated to be worth $206bn in 2024. It is projected to reach $379bn by 2030. Demand for efficiency, precision and safety across manufacturing industries is growing at an annual 11 per cent, in an age sometimes dubbed the ‘fourth industrial revolution’ or ‘Industry 4.0’. It involves multiple digital technologies, machine learning, the Internet of Things and the construction tools much in demand for upgrading tired or obsolete infrastructure, particularly in the US.

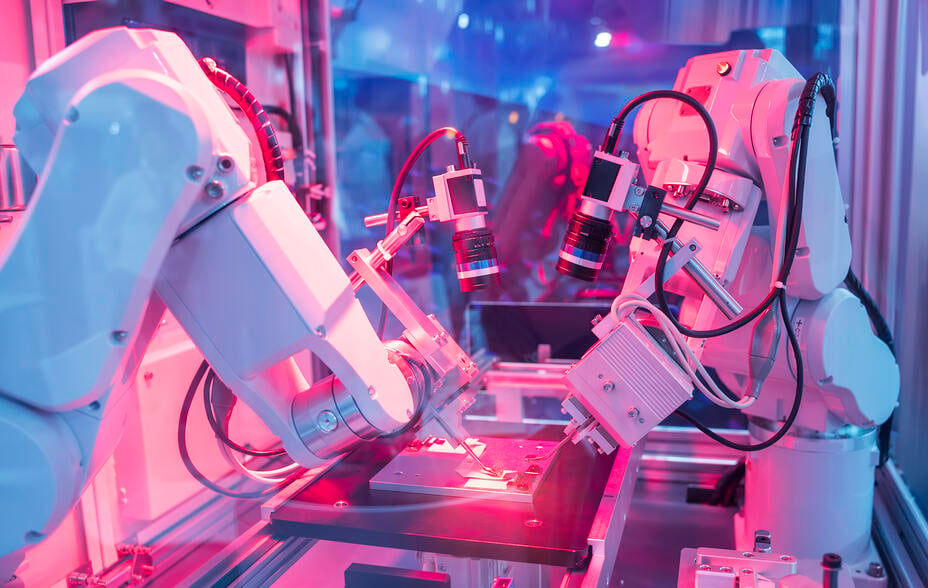

Industrial automation allows businesses greater consistency and accuracy, facilitating better, faster and around the clock operations, as robots tackle ever-more complex parts of the manufacturing processes.

Serving widely different markets, the industrial pioneers in our portfolio tend to share strong relationships with their industrial partners, whose specialised needs they understand and anticipate. As investors, we value the knowledge gained from these close links, their investment in research and development and their opportunistic awareness of adjacent opportunities.

Behavioural and cultural qualities make them formidable competitors and allow them to consolidate high margins, to ramp up profitability, and erect high barriers against would-be disruptors – all prized attributes for investors.

Take Atlas Copco, Sweden’s largest company by market capitalisation and nearly 50 per cent larger than the next biggest, Volvo. Founded in 1873 to service the railways, the firm has a daunting competitive edge in a sprawling array of industrial componentry, thanks to its knowledge, scale, and a lean, decentralised culture. For 77 years of that history, it has been chaired by members of Sweden’s powerful Wallenberg family, whose long-term interests have ensured cultural continuity.

Atlas’s equipment is essential to industries as diverse as medical research, food production, and renewable energy. Its secret ingredient is a decentralised structure that promotes agility with a crucial ability to collaborate with its customers. Atlas aspires to be one of the “unsung heroes” of modern manufacturing, “whose products power the machines that power the world.” Its equipment provides behind-the-scenes workhorses that make industrial processes safe and efficient. For example, its air compressors drive tools and machinery in factories and construction sites. Its vacuum pumps create controlled environments for delicate tasks like electronics manufacturing or food packaging. Its tools, whether precise or heavy-duty, help assemble everything from cars to appliances quickly and accurately and speed up maintenance and repairs.

Meanwhile, Atlas’s radically decentralised structure empowers employees with autonomy and responsibility, encouraging them to respond swiftly to market changes. Each business unit is accountable for its own results, fostering trust and alignment with company goals, chiefly the importance of continuous improvement. Many businesses claim that as a virtue, but Atlas’s longevity and growth trajectory speak volumes.

Osaka-based Keyence is a more recent portfolio addition. It is a leading supplier to the world’s factories of super-advanced automation and inspection equipment designed to make manufacturing smarter and more precise. Its products include minutely sensitive sensors that detect the flow and pressure of liquids or gases, sophisticated machine vision systems that inspect and identify defects or guide robots, and precision measuring instruments used for dimensional checks and quality control. It’s one of Japan’s most profitable companies.

Founded in 1974 by Takemitsu Takizaki, its 3-D scanners can reverse-engineer components to allow the rapid creation of replacements, while its laser markers etch codes or labels on products, digital microscopes reveal microscopic details, and barcode readers improve tracking and traceability. Keyence components have become integral to manufacturing industries including electronics, semiconductors, automotive, packaging, and pharmaceuticals, anywhere where exact measurement, rapid inspection, or automation is critical.

But Keyence stands out for its direct-sales-derived focus on understanding customer needs – chiefly the need to avoid disastrous production line failures. Outsourcing its own manufacturing, its focus is on developing salespeople and product support teams, which are tasked with understanding ‘the needs behind the needs’, including companies’ ‘pain points’, which help it anticipate and develop future products. This dynamism was embedded by the founder, specimens from whose personal collection of fossils adorn Keyence HQ as an implicit warning of the dangers of complacency. Takizaki has continued to exert influence in an honorary chairman’s role, and by holding a substantial stake in the company.

As one of the best-paying companies in Japan, Keyence can attract top talent. As with Atlas, that’s useful for enriching depth of product knowledge. It works hard at promoting the values of honesty, transparency, and fairness, focusing not on individual sales targets but on actions that will promote the greater good of the whole.

For the best pioneering industrial companies, the strength of their intellectual property and the decades over which they’ve refined their cultural intelligence prime them to benefit most from the massive growth opportunities brought in the current wave of industrial innovation wherever AI and other technologies, still in their infancy, may lead.

Risk factors

This communication was produced and approved in September 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

169201 10057245