Capital at risk

International Alpha

We believe the best way to navigate an uncertain world is to build a diversified portfolio of outstanding companies with deep competitive advantages and excellent stewardship.

An emphasis on quality

We invest across four types of growth: quality compounders, rapid growth, through-cycle winners and capital allocators. Our aim is to build a portfolio which can withstand economic cycles and take advantage of unpredictable events.

International Alpha Q3 update

Investment manager Jenny Davis reflects on recent performance, portfolio changes and market developments.

Embracing every shade of growth

International Alpha is distinctly long term. We aim to outperform the MSCI ACWI ex-US benchmark by 2-3 per cent per annum over rolling five-year periods.

Our portfolio contains 60-90 holdings. We seek to take advantage of market inefficiencies by investing across different types of growth company, which given our time horizon allows us to take advantage of their idiosyncratic growth opportunities.

We find these companies through bottom-up research, holding on for the long term to capture the potential benefits of compounded growth.

A promising process

The International Alpha portfolio has a high active share, a genuinely long-term approach and a blend of high-quality growth companies that looks to exploit market inefficiencies by investing across all shades of growth. To do this we:

- Take a long-term perspective, resulting in low portfolio turnover

- Invest from the bottom up, supported by in-depth fundamental analysis

- Have a quality-growth orientation

- Follow a patient, repeatable process, drawing on the best ideas from firm-wide research

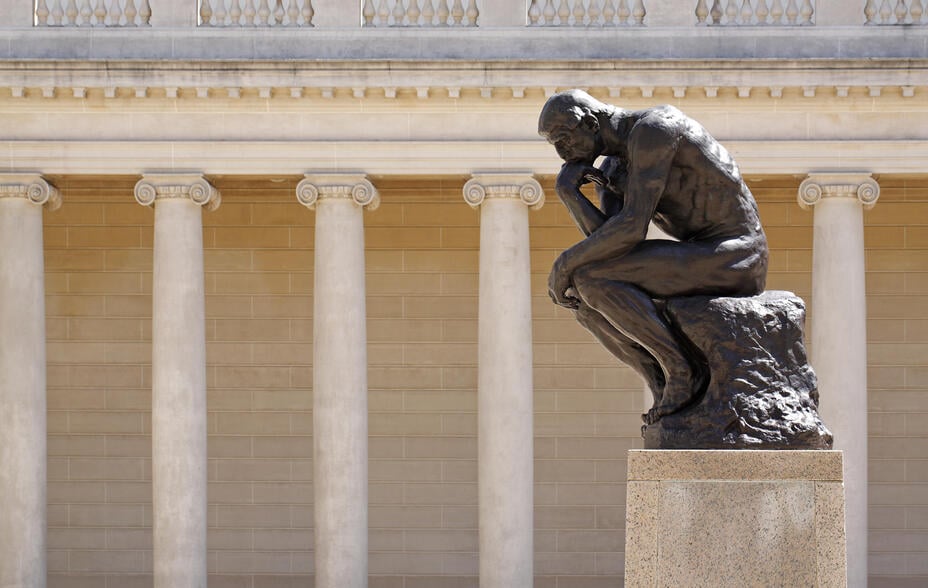

To invest in growth is to say that society will achieve more tomorrow than it does today… Curiosity should be at the heart of all good investment research.

Meet the managers

Documents

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 November 2025

| # | Company | Fund % |

|---|---|---|

| 1 | TSMC | 5.9% |

| 2 | Tencent | 4.3% |

| 3 | Samsung Electronics | 3.4% |

| 4 | MercadoLibre | 3.1% |

| 5 | Ryanair ADR | 2.9% |

| 6 | CRH | 2.6% |

| 7 | Sony | 2.2% |

| 8 | DSV | 2.2% |

| 9 | Deutsche Boerse | 2.1% |

| 10 | Danone | 2.1% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

International viewpoints: the quality derating

Why overlooked quality businesses with competitive moats compound returns through any cycle.

International Alpha: why we do what we do

Why international diversification outperforms: the investing lessons from banana monocultures and resilient portfolios that weather any market.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

Tencent: Stock Story

Fernanda Lai explores how Tencent became the super-app pioneer connecting over one billion users.

International viewpoints: bubble or boom, trouble is brewing

Is AI in a bubble or a boom? Explore how market concentration, leverage, and global strategies shape the next phase of artificial intelligence.

International Alpha Q3 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: the Asian century

The Asian century is now a structural reality. Explore manufacturing dominance, innovation in chips/EVs/ecommerce, key companies, and risks.

International Alpha Q3 update

Investment manager Jenny Davis reflects on recent performance, portfolio changes and market developments.

Our best international ideas

Andrew Brown travels the globe through Sweden’s MIPS, Kazakhstan’s Kaspi.kz and Japan’s Keyence.

The power of exceptional companies

Lawrence Burns and Paul Taylor reveal how they identify exceptional companies that drive market returns.

International viewpoints: the case for global supply chain champions

Learn about companies like ASML, TSMC, Adyen and SAP and their irreplaceable positions in enabling digital innovation.

Skin in the game: the power of persistence

Why ‘inside ownership’ makes companies more likely to focus on efforts that will pay off in the future.

Nibblers and gobblers: the art of acquisitive growth

Companies like Constellation Software and DSV have defied the odds to create substantial shareholder value through disciplined acquisition strategies.

International viewpoints: enduring value – investing in brands built to last

Can businesses that blend heritage, stewardship and steady reinvention outperform their flashier, short-term-focused rivals?

International Alpha Q2 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: digital disruptors

MercadoLibre and Sea Ltd are examples of underappreciated digital disruptors driving global growth.

International Alpha Q2 update

Investment manager Chris Davies reflects on recent performance, portfolio changes and market developments.

Beyond the familiar: the case for international

Discover how venturing into unexplored investment territory is yielding hidden gems.

A new age of discovery: the case for international

Explore how international equities offer unique opportunities in transformative markets.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

International viewpoints: the end of the road for range anxiety

Explore how electric vehicle innovations are ending range anxiety with faster charging and longer battery life.

International viewpoints: US vs international debate

Signs are pointing to a shift from US to international markets. When has this happened before, and what’s ahead?

International Alpha Q1 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q1 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

International viewpoints: Shifting tides toward international markets

The US stock market has outperformed international markets in recent years, but signs suggest a change in this trend.

International viewpoints: Europe's tech tailwinds

The European technology sector excels in niche markets, creating growth opportunities in global value chains.

International Alpha Q4 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q4 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: demographic crisis

Meet the problem-solvers already active in healthcare, retirement funding and workforce productivity.

International viewpoints: power players

Companies rising to new energy challenges in diverse ways, and the economies driving demand.

Luxury brands show promise amid slump

How brands like Hermès, Gucci and Ferrari defy downturns with heritage and innovation.

Our best ideas in Asia

Qian Zhang covers Samsung, Delhivery and Bank Rakyat, three companies at the heart of global structural trends.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

The importance of focus

Why focus and patience are crucial elements when investing and identifying growth companies.

MercadoLibre: Latin America’s unbanked

MercadoLibre offers hope to Latin America’s 178 million unbanked population.

International viewpoints: semi-cap resilience

Why our long-term conviction in ASML, Tokyo Electron and TSMC stands up to recent sector volatility.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

International Alpha Q3 update

Investment manager Jenny Davis reflects on recent performance, portfolio changes and market developments.

International viewpoints: the quality derating

Why overlooked quality businesses with competitive moats compound returns through any cycle.

International Alpha: why we do what we do

Why international diversification outperforms: the investing lessons from banana monocultures and resilient portfolios that weather any market.

SMC: Stock Story

Sarah Clark explores how SMC powers automation with precision pneumatics with engineering excellence.

Adyen: Stock Story

Beatrice Faleri explores Adyen, the one-platform engine for unified commerce.

TSMC: Stock Story

Qian Zhang unwraps TSMC, the company powering modern life.

Tencent: Stock Story

Fernanda Lai explores how Tencent became the super-app pioneer connecting over one billion users.

International viewpoints: bubble or boom, trouble is brewing

Is AI in a bubble or a boom? Explore how market concentration, leverage, and global strategies shape the next phase of artificial intelligence.

International Alpha Q3 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: the Asian century

The Asian century is now a structural reality. Explore manufacturing dominance, innovation in chips/EVs/ecommerce, key companies, and risks.

International Alpha Q3 update

Investment manager Jenny Davis reflects on recent performance, portfolio changes and market developments.

Our best international ideas

Andrew Brown travels the globe through Sweden’s MIPS, Kazakhstan’s Kaspi.kz and Japan’s Keyence.

The power of exceptional companies

Lawrence Burns and Paul Taylor reveal how they identify exceptional companies that drive market returns.

International viewpoints: the case for global supply chain champions

Learn about companies like ASML, TSMC, Adyen and SAP and their irreplaceable positions in enabling digital innovation.

Skin in the game: the power of persistence

Why ‘inside ownership’ makes companies more likely to focus on efforts that will pay off in the future.

Nibblers and gobblers: the art of acquisitive growth

Companies like Constellation Software and DSV have defied the odds to create substantial shareholder value through disciplined acquisition strategies.

International viewpoints: enduring value – investing in brands built to last

Can businesses that blend heritage, stewardship and steady reinvention outperform their flashier, short-term-focused rivals?

International Alpha Q2 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: digital disruptors

MercadoLibre and Sea Ltd are examples of underappreciated digital disruptors driving global growth.

International Alpha Q2 update

Investment manager Chris Davies reflects on recent performance, portfolio changes and market developments.

Beyond the familiar: the case for international

Discover how venturing into unexplored investment territory is yielding hidden gems.

A new age of discovery: the case for international

Explore how international equities offer unique opportunities in transformative markets.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

International viewpoints: the end of the road for range anxiety

Explore how electric vehicle innovations are ending range anxiety with faster charging and longer battery life.

International viewpoints: US vs international debate

Signs are pointing to a shift from US to international markets. When has this happened before, and what’s ahead?

International Alpha Q1 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q1 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

International viewpoints: Shifting tides toward international markets

The US stock market has outperformed international markets in recent years, but signs suggest a change in this trend.

International viewpoints: Europe's tech tailwinds

The European technology sector excels in niche markets, creating growth opportunities in global value chains.

International Alpha Q4 update

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International Alpha Q4 investor letter

The International Alpha Team reflects on recent performance, portfolio changes and market developments.

International viewpoints: demographic crisis

Meet the problem-solvers already active in healthcare, retirement funding and workforce productivity.

International viewpoints: power players

Companies rising to new energy challenges in diverse ways, and the economies driving demand.

Luxury brands show promise amid slump

How brands like Hermès, Gucci and Ferrari defy downturns with heritage and innovation.

Our best ideas in Asia

Qian Zhang covers Samsung, Delhivery and Bank Rakyat, three companies at the heart of global structural trends.

Our best ideas in Europe

Thomas Hodges uses Lonza, Topicus and Soitec to illustrate why Europe is more exciting than headlines suggest.

The importance of focus

Why focus and patience are crucial elements when investing and identifying growth companies.

MercadoLibre: Latin America’s unbanked

MercadoLibre offers hope to Latin America’s 178 million unbanked population.

International viewpoints: semi-cap resilience

Why our long-term conviction in ASML, Tokyo Electron and TSMC stands up to recent sector volatility.

International viewpoints: global EV trends

Analysing market dynamics, industry challenges and future trends of EVs’ global adoption.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Tilting the odds in your favour

The Magnificent Seven’s reputation goes before them but that’s not enough to save them.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority.

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Any general enquiries regarding Baillie Gifford should be directed to the relevant individual as noted in the Contact Us section.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with.

This website is informative only and the information provided should not be considered as investment advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.