The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested.

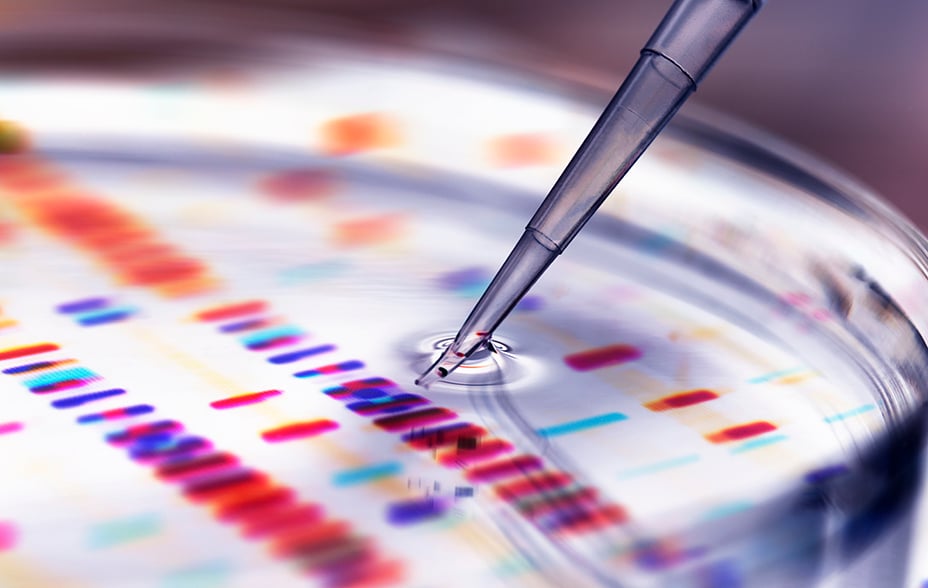

The term ‘in vitro diagnostics’ (IVD) means tests on biological specimens in test tubes or Petri dishes, as opposed to ‘in vivo’ (in the body). IVD is not yet part of our daily vocabulary, though Covid has familiarised us with its technologies such as the lateral flow test, or reverse-transcription polymerase chain reaction – PCR tests for short.

The pandemic has demonstrated the crucial role of diagnostics in identifying and curbing pathogens, especially ones that are initially asymptomatic. But IVD is not just about infectious diseases. It is critical to all areas of healthcare, underlying 70 per cent of all clinical decisions: in early diagnosis and post-treatment monitoring, as well as being increasingly integral to the trend toward personalised medicine.

Kobe-headquartered Sysmex is a leading global manufacturer in this market and has been one of the strongest performers in the portfolio since its purchase in early 2019. Although Sysmex has had some positive exposure to Covid, from PCR kits and antibody tests, the pandemic actually hurt business due to a decline in its mainstay routine testing procedures. The company has, however, continued to deliver robust growth throughout this period thanks to the attractive razor-and-razor-blade model (in which the primary product is sold cheaply while supplementary products achieve high margins). It operates this within the three core niches it dominates: haematology (diagnosis of blood diseases), haemostasis (coagulation testing) and urinalysis. The model involves the sale of closed-system instruments (such as analysers) with high-margin consumable test kits (reagents or assays). In addition, the company benefits from tailwinds such as volume growth from demographic trends that demand rising spending on more patients with acute needs and the broader adoption of diagnostics to avoid wasteful treatments.

We have already witnessed a doubling of Sysmex’s share price since we bought, it but we believe that advances in genomic technologies will usher in the next wave of diagnostics growth and it should deliver a further doubling over the next five years. Sysmex now emphasises three new and expanding areas of opportunity. The first is within life sciences, where it uses liquid biopsy testing to profile the genome of cancers. This allows the company to develop ‘companion diagnostics’ (CDx) for personalised therapy outcomes, where drug treatments depend on the specific mutations of the tumour. The second is in molecular analysis, an equally exciting area where it deploys its core strength in blood testing to measure for beta amyloids, biomarkers for notoriously hard-to-detect Alzheimer’s – an affliction expected to hit over 140 million people by 2050. Finally, Sysmex is adding new end markets for its robotic-assisted surgical system Hinotori (‘phoenix’ in Japanese), which is already being successfully used to treat gynaecological and digestive diseases.

We believe that sustained earnings growth from haematology and haemostasis – from next-generation machine launches, and direct distribution models – will allow Sysmex to invest heavily within these emerging areas of future growth. In time we may even get to know their HISCL system for Alzheimer detection, or their OncoBEAM cancer test, as they become ever more commonplace and accessible.

Risk factors

The views expressed in this article are those of Thomas Patchett and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Japanese Equities Composite | 16.0 | 18.9 | -1.1 | 13.1 | 10.6 |

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 14315 10006355