Key Points

- Heart disease, including heart attacks and strokes is still the world’s number one killer

- The past decade has seen big advances on several fronts in how we tackle the problem

- From more accurate diagnoses to flushing calcium out of our arteries, emerging technologies are offering new hope of progress

Please remember that the value of an investment can fall and you may not get back the amount invested.

As both her parents were pharmacists, health and medicine were a normal part of dinner-table conversation when investment manager Rose Nguyen was growing up.

Today, she channels that interest into seeking out innovative health companies. Nguyen hopes the great convergence of science and technology will revolutionise how we diagnose, treat and prevent disease.

It’s an urgent task. According to the British Heart Foundation, in the UK alone, around 460 people die of heart disease every day, while 7.6 million are living with a heart or circulatory problem. Nguyen is optimistic, however, that progress can be made on heart disease, the world’s biggest cause of death.

Heart attacks, strokes and other life-threatening conditions, often caused by plaques and fatty deposits restricting blood flow, are Nguyen notes, “the result of many complex genetic, environmental and lifestyle factors, differing vastly from person to person.”

This makes them resistant to generic cures, meaning that risky surgery can often be the only option.

Until the last decade that is. Recent advances in genomics are helping to replace ‘one-size-fits-all’ with therapies tailored to the patient.

Diagnosis

Spotting heart disease, Nguyen admits, remains challenging because patients often dismiss the symptoms – shortness of breath, fatigue and chest pain – as symptoms of old age.

This is compounded by how inaccurate today’s diagnosis methods are. “One of the most common tests,” Nguyen notes, “is to put a patient on a treadmill and see how their heart performs under stress.”

Unfortunately, 20–30 per cent of patients return from a stress test with their disease still undetected. But technology is solving this problem.

Nguyen notes, “CT scans can capture the image of a patient’s heart, and artificial intelligence can reconstruct a 3D computer model of the heart and calculate the exact blood volume that flows through each artery.”

Already approved in the UK and the US, this technology helps doctors pinpoint where the blockages are, leading to more accurate diagnoses.

Treatment

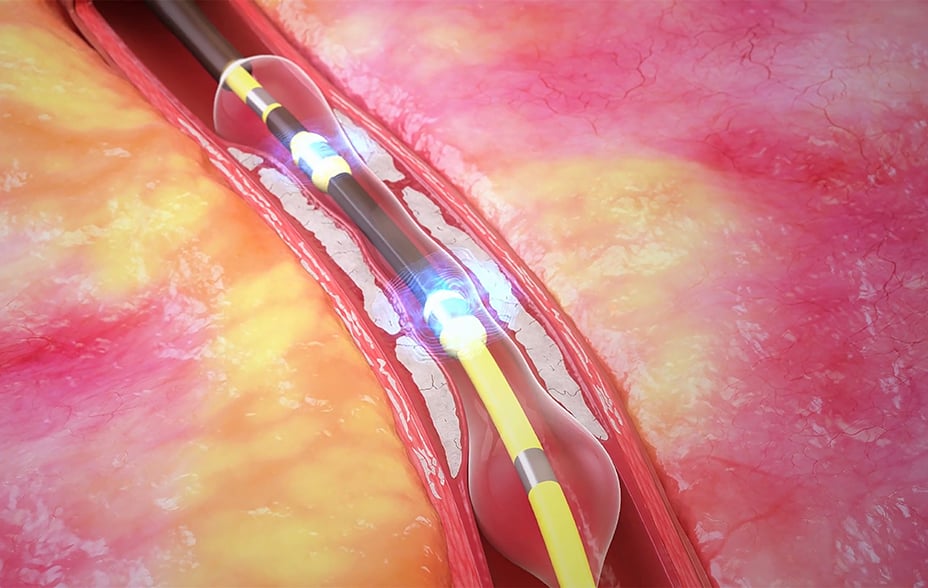

There are other technologies, more surprising perhaps, that Nguyen believes have promise. She picks out Shockwave Medical, founded in 2009, “The founders’ idea was to reimagine the ‘lithotripsy’ technology used to break up kidney stones so that it can break up calcium inside the arteries and blood vessels.”

Many were sceptical. But working without funding in their garage with bulky makeshift prototypes assembled from second-hand parts such as an ultrasound imaging machine purchased on eBay, the founders achieved the seemingly impossible. “Their challenge was to figure out how to make this machine fit into a catheter that can go inside an artery.”

Nguyen explains how the founders demonstrated such a delicate operation. They released electrical charges inside eggs from the family henhouse to prove that the method can leave the membrane intact while shattering the eggshell.

She met its CEO, Doug Godshall at its San Francisco headquarters in 2019. Nguyen was impressed. “I talked to many physicians and cardiologists and their feedback was overwhelmingly positive.”

“It’s very rare in medical technology to have this combination of novelty, safety, effectiveness and ease of use,” she says. It’s a step towards a future where surgeries are totally non-invasive. “There are research teams developing nanorobots that can march through our bloodstream breaking up the calcium inside our arteries guided by MRI imaging.”

Prevention

Such technologies are good news for those who need medical interventions to prevent heart attacks. Because while adopting a healthy lifestyle is one of the most effective ways to protect against disease, it may not be enough for those whose genes put them at higher risk.

Nguyen cites the work of Verve Therapeutics which addresses the genetic causes of heart disease by ‘editing out’ risky genes to lower the chance of heart attacks, the first time it has been used in humans, after trials on primates. The company showed that after extracting the problematic PCSK9 gene, the level of ‘bad cholesterol’ in the monkeys’ bloodstream was reduced by more than 70 per cent.

“I’m impressed by these results and hopefully they will translate into humans as well.”

Nguyen admits not everyone is comfortable with permanently turning off a gene in the human body. However, she highlights human genome studies that confirm that many people are born without this gene and are not disadvantaged by it, they just have a “much lower chance of heart attacks than the average population.”

There are also already approved drugs targeting this gene, which increases her confidence that editing it out will be safe. Nonetheless, Nguyen asked Verve Therapeutics to explain why humans would have a gene that didn’t serve any purpose.

They hypothesise that the gene may have played a role in the very early days of human evolution when food was scarce, but “now we have the opposite problem of excess food and not enough energy burn.”

Nguyen’s passion for investing in healthcare is obvious. “It is very close to my heart,” she says. “The pace of innovation in healthcare and life sciences is accelerating at a very rapid rate. As an investor, there is no better hunting ground for great ideas.”

Words by Gillian Christie.

If you’d like to find out more about the companies inspiring optimism on progress against heart disease? Listen to the podcast here.

Important information and risk factors

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

A Key Information Document is available by visiting bailliegifford.com

27942 10016913