Key points

- Baillie Gifford’s Cautious Managed Fund aims to provide the same investment approach as the long-established Managed Fund but with lower risk

- The portfolio holds growth stocks like Amazon, Spotify and TSMC but with more bonds to smooth the journey

- The approach provides flexibility for clients when market conditions and risk appetites change

As with any investment, your capital is at risk.

Clients often want different levels of risk, even when they share the same long-term investment goals.

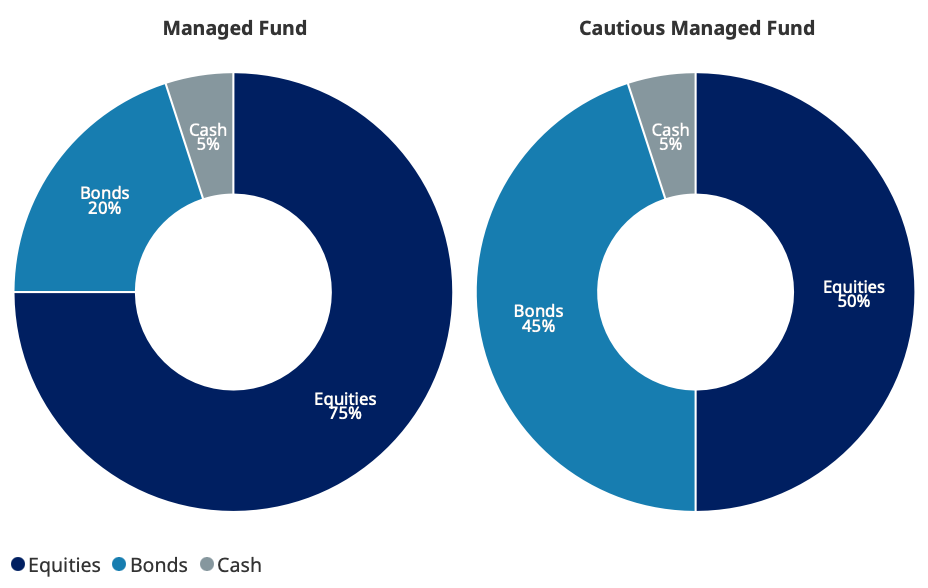

That’s the simplest way to think about our new Cautious Managed portfolio alongside our original Managed Fund. Both funds are built from the same core components – equities, bonds and cash – and managed by the same team using the same philosophy.

The difference lies in how those components are balanced to suit different risk appetites.

The Managed Fund has a starting allocation of 75 per cent in equities, designed for clients comfortable with higher volatility in pursuit of long-term growth. Cautious Managed dials down equity exposure to a starting point of 50 per cent, supported by a higher allocation to bonds (45 per cent) and cash (5 per cent). This structure aims to reduce volatility during periods of market stress while still allowing clients to participate meaningfully in long-term growth.

Why now?

Clients’ circumstances and attitudes to risk evolve over time, and many want the flexibility to adjust their exposure as conditions change. After a long period of ultra-low interest rates and supportive markets, the return of inflation, interest-rate uncertainty and geopolitical tension has been a reminder that volatility can re-emerge quickly. For some investors, this has prompted a reassessment of how much risk they are comfortable taking.

Cautious Managed is designed for clients who value the Managed Fund philosophy but prefer a steadier pattern of returns. Its higher bond allocation is intended to provide more predictable returns, reduce the depth of equity market drawdowns, and give managers the flexibility to rebalance into opportunities when markets are unsettled. The result is an approach that keeps clients invested for long-term growth, with the aim of smoothing the journey along the way.

The same ingredients, different balance

Crucially, nothing about the underlying building blocks changes. Cautious Managed uses the same ingredients as the Managed Fund – equities, bonds and cash – calibrated to deliver a lower-risk profile.

In equities, we continue to back companies with durable competitive advantages and long growth runways, asking what a business could look like five to ten years from now and why the market may be underestimating that future. Both funds draw on the same underlying portfolio of around 200 global equities, giving access to some of Baillie Gifford’s best regional ideas, including companies such as Amazon, Spotify, TSMC and M&S.

In fixed income, we run a global best-ideas portfolio spanning developed and emerging government bonds, corporate credit and active currency positions. Within government debt, opportunities are identified by focusing on the long-term path countries are on. The team currently favours parts of Latin America in emerging markets, where disinflation and high real yields offer attractive potential returns, and New Zealand in developed markets, where resilient yields can provide stable income as interest rates fall.

Currency and interest-rate positioning is set through regular macro debates that balance structural trends against cyclical forces. In corporate bonds, we focus on resilience as a key driver of long-term returns. Every investment is underpinned by forward-looking research into a company’s prospects, mirroring the discipline we apply in equity selection.

Cautious Managed Fund portfolio

Based on Cautious Managed and Managed Fund’s strategic asset allocation. Totals may not sum due to rounding.

The same philosophy, people and process

Both funds are underpinned by the same philosophy, managed by the same team and governed by the same investment process. This gives advisers the flexibility to move between Managed and Cautious Managed as a client’s risk appetite or capacity for loss changes without changing the manager, the method or the conviction.

Robust and repeatable

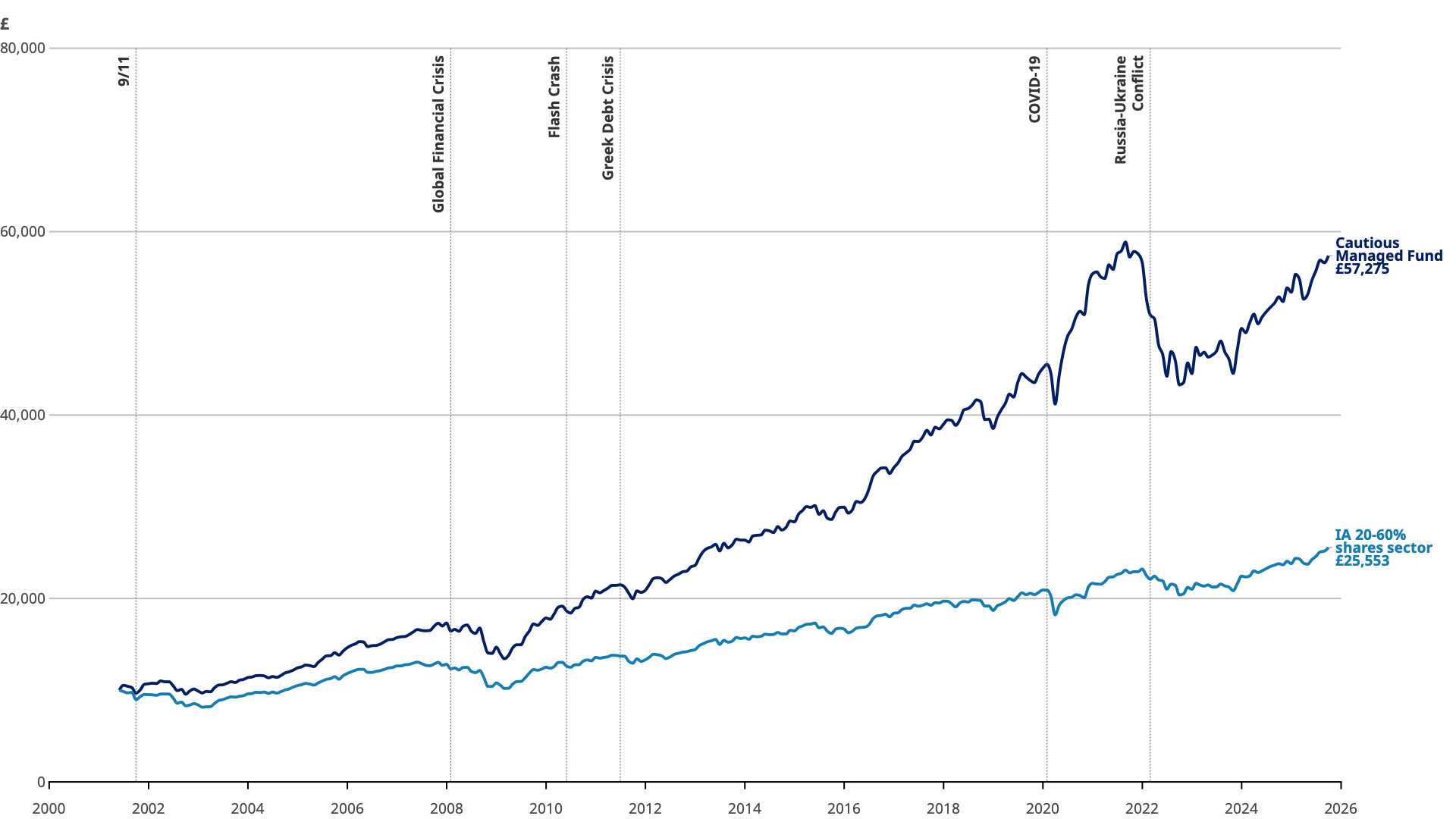

We launched the original Managed Fund in 1987, navigating market booms and busts, pandemics and geopolitical shocks over the decades since. Our disciplined approach is tried and tested. Portfolios are constructed through our Policy Setting Group, combining high-conviction ideas with pragmatic diversification and independent risk oversight. That same rigour is applied to Cautious Managed, allowing it to benefit fully from the experience embedded in the Managed Fund.

Simulated long-term performance

Source: Revolution, Bloomberg. Net of fees, sterling. Simulated Performance to 31 July 2025, Cautious Managed Fund returns thereafter.

Based on an initial £10,000 investment. Simulated portfolio comprises 50% equities, 45% fixed interest and 5% cash split. Equity and fixed interest components are comprised of the following: Baillie Gifford UK Equity Core Fund, Baillie Gifford American Fund, Baillie Gifford European Fund, Baillie Gifford Emerging Markets Growth Fund, Baillie Gifford Developed Asia Pacific Fund, and Baillie Gifford Strategic Bond Fund. Comparator Benchmark: IA Mixed Investment 20-60% Shares Sector from UK Investment Association universe. 31 May 2001 to 30 September 2025.

Cautious Managed is intended as a lower-risk alternative built on the same long-standing process, designed for clients who want exposure to long-term growth but with a smoother return profile. Clients can choose the level of risk that suits them, confident that both options are actively managed, thoughtfully constructed and built to stand the test of time.

Past Performance

Cautious Managed Fund simulated annual past performance to 30 September each year (%)

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| Cautious Managed Fund | 11.6 | -24.4 | 6.4 | 14.8 | 8.5 |

| IA Mixed Investment 20%-60% Shares Sector | 12.2 | -10.6 | 4.2 | 12.0 | 7.4 |

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Cautious Managed Fund | 19.5 | 10.6 | 9.6 | 5.6 | 17.2 |

| IA Mixed Investment 20%-60% Shares Sector | 12.1 | 6.2 | 2.6 | 4.0 | -1.2 |

Source: FE, Revolution. Net of fees, total return in sterling.

Simulated Performance to 31 July 2025, Cautious Managed Fund returns thereafter. Total returns in sterling, net of fees.

Simulated portfolio comprises 50% equities, 45% fixed interest and 5% cash split. Equity and fixed interest components are comprised of the following: Baillie Gifford UK Equity Core Fund, Baillie Gifford American Fund, Baillie Gifford European Fund, Baillie Gifford Emerging Markets Growth Fund, Baillie Gifford Developed Asia Pacific Fund, and Baillie Gifford Strategic Bond Fund.

Comparator Benchmark: IA Mixed Investment 20-60% Shares Sector from UK Investment Association universe. The manager believes that this is an appropriate comparison for the Cautious Managed Fund given the investment policy of the Fund and the approach taken by the manager when investing in the Fund's portfolio.

Past performance is not a guide to future returns.

Important information and risk factors

This article was produced in December 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, and Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further details of the risks associated with investing in the Fund can be found in the Key Investor Information Document or the Prospectus, copies of which are available at bailliegifford.com.

184804 10059726