Key points

- Like a ship’s keel, bonds provide stability while helping to drive our Managed funds forward

- Active bond selection across global markets enhances returns whilst diversifying equity risk

- Holdings like UK property investor Telereal and Peruvian government bonds deliver resilient income and growth potential

As with any investment, your capital is at risk.

In sailing, a ship’s keel is far more than a stabilising frame – it’s a backbone that gives the boat balance and efficiency. While the sails capture the wind’s driving force, the keel translates that sideways pressure into forward motion, keeping the boat upright and moving smoothly through changeable seas.

Our Managed fund range works in much the same way. While equities are the sails, harnessing the growth of the world’s most innovative companies, our actively managed bond portfolio is the keel: a source of stability that also enhances the portfolio’s forward progress. By actively managing our fixed income allocation, we aim to deliver diversified, resilient and strong return across different market environments.

At a glance: what the bond portfolio aims to do

- Smooth the journey: lower day-to-day volatility than equities and helps dampen drawdowns for the overall fund.

- Diversify: returns are driven by different forces from equities (interest rates, inflation, credit spreads and currency), offering additional tools when equity markets are unsettled.

- Generate resilient income: focus on issuers and countries with resilient cashflows and sensible valuations.

How we invest in fixed income

Across the Managed fund range, fixed income is run as a single, joined-up portfolio with a clear philosophy.

Our fixed income allocation is actively managed, focusing on the best ideas of our research teams. We invest across global governments and corporate credit, unconstrained by benchmarks. Every bond is hand-picked to play a role.

We are return-seeking and income-focused. Our belief is that bond markets, like equity markets, ultimately reflect long-term fundamentals: within our bond allocation, we look for resilient income and potential capital upside, and we take the time to see those opportunities through.

The portfolio is built to diversify: we manage interest-rate sensitivity (duration), credit risk and currency exposure so that the bond portfolio improves the risk-adjusted returns of the whole fund. A limit of 0.25 beta to the equity portfolio ensures this balance.

Clear architecture, active content

We organise the portfolio in a simple way that supports active selection, typically with a balanced mix of government bonds and corporate bonds. Government bonds provide stability and macro-diversification, while corporate bonds provide additional income and capital-growth potential.

- Developed and emerging market bonds: we invest in developed markets such as US Treasuries and UK Gilts, complemented by carefully selected emerging market bonds where higher yields and structural reforms can enhance returns.

- Investment-grade core with selective high yield: most corporate holdings are investment grade, with a meaningful but measured allocation to high yield where detailed research identifies resilient underlying businesses.

Macro tools such as active duration and currency exposure are used actively, but they are sized to support, not overwhelm, the underlying security selection. Baillie Gifford’s Global Bond team decides how much interest-rate sensitivity and which currencies we want exposure to, based on macro views and the balance of risks.

Thoughtful risk constraints provide reassurance that the bond portfolio improves the risk-adjusted returns of the whole fund. It is rated BBB – solidly investment grade – with an attractive yield typically about two percentage points higher than a passive bond index. Duration typically sits between 6 and 6.5 years, balancing income generation with interest-rate sensitivity.

The portfolio’s equity beta is capped at 0.25, meaning the sensitivity of its return profile is deliberately kept low to equities, helping the portfolio act as a diversifier rather than an additional source of equity-like risk.

A process that earns its keep

Alpha generation in bonds starts with repeatable habits. Our process has four building blocks:

- Research depth: Our experienced specialist Credit and Global Bond teams are responsible for selecting investments in corporate and government bonds respectively. Each team has a structured research agenda, targets fresh ideas, and moves each proposal through a template that forces clarity on the investment case, risks, milestones and sizing.

- Debate and decision-making: teams challenge assumptions and stress-test the downside. We focus on what needs to happen for our investment thesis to play out, as well as what can go wrong and what would make us change our mind.

- Collaborative asset allocation: our teams work separately and together. We join forces to determine asset allocation between corporate and government bonds at regular junctures, using a combination of quantitative and qualitative inputs.

- Macro alignment: a regular macro process links bottom-up research with the global backdrop to ensure overall thematic exposures and risk levels align with our macro views.

The result for our Managed funds is a focused list of roughly 100-125 active bond positions sized by conviction, liquidity and correlation, and not by the index.

Risk constraints

Our fixed income allocation includes risk constraints, designed to keep bonds as a diversifier:

- Equity sensitivity is capped, where the equity beta limit is 0.25.

- Credit and country risk is managed through limits on credit quality and concentration.

- Interest-rate sensitivity is actively managed within limits to balance income generation with the risk of rate moves.

How we think about credit and government bonds

Rather than separate taxonomies, we think about both credit and government bonds using the same three classifications:

- Compounding income: resilient cashflows at sensible valuations; the workhorse income generators.

- Structural improvers: corporate issuers or countries where reforms, governance upgrades or balance-sheet repair steadily strengthen credit quality.

- Event-driven / Diversifiers: situations where a specific catalyst, refinancing or macro-shift can drive a step change in yields, or where positions are held for their diversifying characteristics.

Typically, the majority of bonds will fall in the first two categories, with capital-upside, event-driven ideas typically a more modest proportion of risk.

Credit: a resilient source of income and growth

Income is the most consistent and largest contributor to the total return of the bond portfolio over time. The Credit team assesses the resilience of this income from the bottom up, focusing on three questions:

- Prospects: what is the company’s ability to generate cash over a multi-year horizon?

- Sustainability: is the business compatible with a durable future, including relevant regulatory and environmental factors?

- Capital structure: is the company financed appropriately, and what protections do bondholders have if conditions deteriorate?

A good illustration of 'compounding income’ is Telereal, one of our larger holdings. Telereal owns the telephone-exchange buildings that Openreach uses to maintain its nationwide broadband network. BT pays the rent, and the bonds share BT’s BBB credit rating, while being secured against the underlying property. Because this is an older, asset-backed transaction, the bonds have offered higher income than BT’s own unsecured debt (at the time of writing, around 8 per cent versus 5 per cent), while benefiting from essential infrastructure and stronger counterparty relationships.

We also seek out mispricings, where we see good capital upside as well as income. Within this bucket, Mitchells & Butlers is a good example of a ‘structural improver’. It is a leading managed pub and restaurant operator in the UK and has shown resilience through multiple challenging periods. Its covenant structure requires it to use its cash flows to repay debt over time, steadily strengthening the balance sheet. From today's strong starting point, a shift to a more balanced, shareholder-friendly financial policy is on the cards. For this to happen, a full early refinancing of its debt will be required which will crystallise capital gains for bondholders, on top of the income on offer.

Government bonds: cushioning risk, diversifying return

Developed market sovereign bonds are often held for what they do best: cushioning portfolio drawdowns. We add emerging market sovereigns selectively where reforms are credible and external accounts are improving, so we can earn real income and capture capital upside.

The Global Bond team evaluates countries through a consistent disciplined lens: growth prospects, governance and ‘government balances’ (including inflation, fiscal balances and the balance of payments). Countries can experience shocks. Those that weather the storms typically have stronger fiscal and current accounts, domestic savings that support stability, the capacity to generate resilient growth, and governments that can effectively respond to challenges.

We complement on-the-desk research with country visits to test assumptions against on-the-ground reality, and attendance at IMF and World Bank meetings to meet policy makers.

A long-held 'compounding income’ investment has been Peruvian government bonds. Peru is a relatively small market, but one which has consistently outperformed due to its rock-solid fundamentals: one of the lowest debt burdens in the world, large foreign exchange reserves that help minimise currency volatility, low inflation and a key role as a supplier of copper to the world. Despite these strong attributes, Peruvian bonds still offer resilient income of around 6-7 per cent, a pick-up of nearly 5 percentage points over local inflation.

We also use government bonds as ‘diversifiers’. Our underweight position in Japanese government bonds is one example, reflecting our view that Japan is in a rate-hiking rather than rate-cutting cycle. In practice, this underweight can help offset risk elsewhere in the portfolio at a time when many other bond markets are more likely to see falling yields.

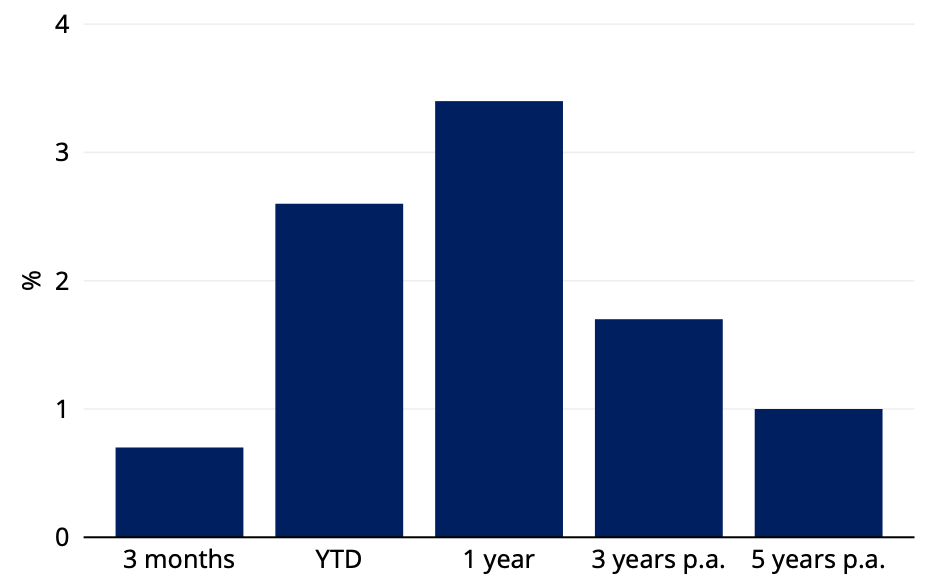

Managed Fund fixed income – relative performance

Source: Revolution and relevant underlying index provider(s). As at 30 November 2025. All investment strategies have the potential for profit and loss. Past performance is not a guide to future returns. The returns presented above are gross of fees. The results do not reflect the deduction of investment management fees; the return will be reduced by the management fees and any other expenses incurred in the management of the account.

What you should expect

- A genuinely active, selection-led bond portfolio with a clear mandate to add returns whilst being a diversifier to equities.

- A balanced architecture spanning government bonds and corporate credit, across developed and emerging markets, with an investment-grade core and measured high-yield exposure.

- A repeatable investment process where ideas move through research, debate, decision and ongoing monitoring, supported by a macro framework that focuses on resilience through the cycle.

- Patient ownership where income is allowed to compound and selective capital gains can build as company and country fundamentals improve.

Past Performance

Annual past performance to 30 September each year (%)

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| Baillie Gifford Managed Fund B Acc | 16.5 | -28.2 | 6.4 | 16.0 | 9.8 |

| IA Mixed Investment 40%-85% | 16.8 | -9.6 | 5.0 | 13.8 | 9.9 |

The Fund has no target. However you may wish to assess the performance of both income and capital against inflation (UK CPI) over a five-year period. In addition, the manager believes an appropriate performance comparison for this Fund is the Investment Association Mixed Investment 40-85% Shares Sector.

Source: FE, Revolution. Net of fees, total return in sterling.

Past performance is not a guide to future returns.

Important information and risk factors

This article was produced in December 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, and Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further details of the risks associated with investing in the Fund can be found in the Key Investor Information Document or the Prospectus, copies of which are available at bailliegifford.com.

185003 10059729