Michelle O'Keeffe and Ed Whitten assess the impact companies have on people and the planet. © Chris Close

Please remember that the value of an investment can fall and you may not get back the amount invested.

The prospect of helping the world become a better place while making a solid return on your money might sound too good to be true.

Yet it can be a reality.

You can support companies that aim to be transformational for climate change, education and food, among other issues.

One way to do so is via ‘impact investment’ funds. As the name suggests, these funds only put money into companies with a positive measurable impact.

The Positive Change Strategy shows how this works in practice. Edinburgh-based investment management company Baillie Gifford runs it.

The Strategy invests money in companies that:

- contribute to a more sustainable and inclusive world

- offer products and services that are likely to be adopted because they are better than alternatives

“It’s all about changing the status quo,” says Michelle O’Keeffe, a senior impact analyst with expertise in climate change.

“None of the companies we invest in are going to solve the world’s problems on their own.

“Yet together, they provide a brilliant combination of businesses addressing challenges in a way that excites customers.”

Renewable Energy

Many of the companies held in the Strategy are focused on the environment.

The Danish renewable energy giant Ørsted is one example. This business transformed from being an oil and natural gas company to the world’s largest offshore wind developer.

“Its goal is to become a fully renewable energy provider,” says O’Keeffe. “Ørsted has invested heavily in offshore wind, even when it was an unproven technology, and it has played a significant role in creating the industry.”

“It’s doing a huge number of exciting things, such as developing floating offshore wind turbines for places where it can’t get down to the seabed.

“From a technical perspective, this is ridiculously complicated. But it gives much more capacity for power generation.”

Precision agriculture

Back on dry land, US firm Deere & Co, the maker of John Deere tractors, is among the Strategy’s biggest holdings.

It has pioneered digital techniques to reduce the use of chemicals in farming that are responsible for greenhouse gas emissions.

“Machines with cameras and sensors are fitted onto tractors that can identify whether something’s a plant or a weed, says O’Keeffe.

“They then apply the smallest amount of pesticide or herbicide needed for that individual plant.”

The Positive Change Strategy also has a stake in the world’s bestselling electric car manufacturer.

“Tesla has been successful because it’s built cars that people want to drive”, says O’Keeffe.

“Yet there’s much more to its success. For example, while it manufactures batteries, it also recycles them. This presents a huge opportunity to refine the process from end to end.”

Learning a new language

The companies mentioned so far aim to improve environmental factors. Yet plenty of investments in the Strategy target social issues.

DuoLingo is one example. The US-based gamified app teaches languages through free and paid-for subscriptions. ‘Superlearners’ who pay for extra quizzes and add-on features effectively subsidise other users.

It currently offers 41 different languages – and counting.

“It’s a very engaging product,” says Edward Whitten, the Fund’s other senior impact analyst, who has particular interest in firms tackling social challenges.

“We’ve seen its adoption go viral in many countries.

“Learning a new language for some people lets them do jobs that they wouldn’t be able to get otherwise. It raises incomes and the potential for economic growth.”

Another holding, Nubank in Brazil, provides access to basic banking services in Latin America. Many of its customers would otherwise be unable to have a current account.

That means they wouldn’t have a debit or credit card, have no place to safely keep their earnings and be unable to borrow money to improve their lives.

“Nubank provides free bank accounts in a place where traditional banks charge fees, which many can’t afford to pay,” Whitten says.

“It’s impactful because financial services help people become more resilient and self-sufficient. Currently, 50 million customers benefit.”

“Anitta is under 30, which is very rare for a Brazilian board of directors. She’s very passionate about social issues and you can see that in her social media presence.

“It’s valuable to have the voice of the youth at a strategic level.”

Positive Change Strategy’s managers play another crucial role – as influencers.

Fund management companies, including Baillie Gifford, can use their influence as large shareholders to take part in what’s known as ‘engagements’.

These range from one-to-one conversations with management to votes at yearly shareholder meetings. And they provide a way to encourage companies to improve their behaviour.

“We take pride in looking after the savings of individuals who want to help drive change,” says O’Keeffe.

“And we want to use the opportunity to help where we can.”

Measure and report

She highlights a common area in which companies need help – determining and disclosing their effects on the world.

“Measuring and reporting impact tells the company, and its investors, the level of good it’s doing,” O’Keeffe explains.

“It also sets a benchmark they can aim to improve each year.

“High standards of impact reporting even help with recruiting the right kind of people. Many workers are looking for a job with a real mission.”

For example, the Positive Change Team has been in touch with Deere about its sustainability reporting.

“As a mature company, we would like to see impact related targets in its reporting,” says O’Keeffe. “The company has demonstrated its commitment to innovation and intent towards increasing yields for customers, so enhanced reporting is the next step.”

At Tesla’s request, Baillie Gifford also provided feedback on challenges around the electric vehicle maker’s reporting of health and safety data, supply chain audits and other matters.

“We raised the point that its first impact report was light on data and encouraged better information,” adds O’Keeffe.

“The next one was much improved.”

Long-term planning

Investment managers also use these interactions to express support for companies’ far-sighted plans. Even if they are likely to put a dent in near-term profits.

“As long-term investors, we are not just thinking about short-term numbers. We want to give companies the confidence that they have shareholders that support the CEO’s long-term vision for maximum impacts,” says O’Keeffe.

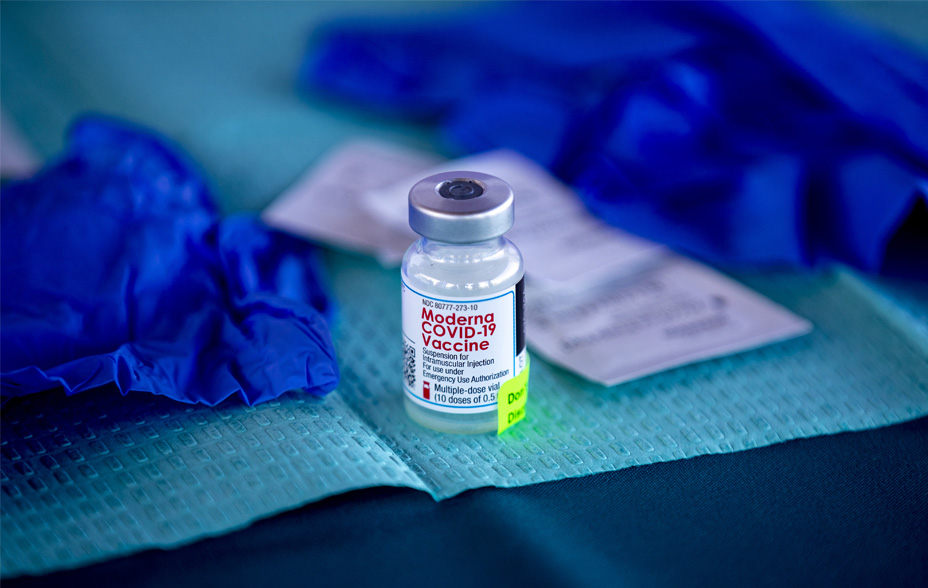

One example is Moderna, the pharmaceutical firm put on the map for its Covid-19 vaccine.

“We’ve been talking to management at Moderna to emphasise our support for its global public health plans, including plans to establish a vaccine manufacturing facility in Kenya,” says Whitten.

“That’s not an easy thing to do. It’s going to cost a lot of money and Moderna is going to have to train a lot of people in mRNA technology. That’s very exciting.”

The Strategy also has a stake in FDM.

The UK-based recruitment firm focuses on helping people return to work after breaks, often post-maternity leave, as well as those switching careers after leaving the armed forces.

The attention FDM gives to racial, ethnic and gender diversity in recruitment made it an attractive investment. But the Strategy’s managers urged it to reconsider one of its other practices.

“Previously, it wasn’t paying trainees,” Whitten explains.

“We made our concern clear to the firm last year, and it finally committed to paying. As one of the voices telling FDM’s management team this is the right thing to do for the longer-term, we were delighted with the move.”

Impact investing is seen as the future by many investors who want to make a difference.

And when “companies succeed in having a great impact,” O’Keeffe notes, “they also increase their chance of maximising returns.”

Risk factors

The views expressed in this article are those of the Positive Change Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in June 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this report are for illustrative purposes only.

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

Positive Change Composite Net |

34.0 |

1.6 |

47.5 |

65.7 |

-38.4 |

|

MSCI ACWI |

11.3 |

6.3 |

2.6 |

39.9 |

-15.4 |

| 1 year | 3 years | 5 years | Since inception* | |

| Positive Change Composite Net | -38.4 | 14.6 | 15.4 | 18.4 |

| MSCI ACWI | -15.4 | 6.7 | 7.5 | 8.6 |

Source: Baillie Gifford & Co. Changes in the investment strategies, contributions or withdrawals may materially alter the performance and results of the portfolio. *Inception date 31 January 2017

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a 'wholesale client' within the meaning of section 761G of the Corporations Act 2001 (Cth) ('Corporations Act'). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a 'retail client' within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 26529 10014032