Key points

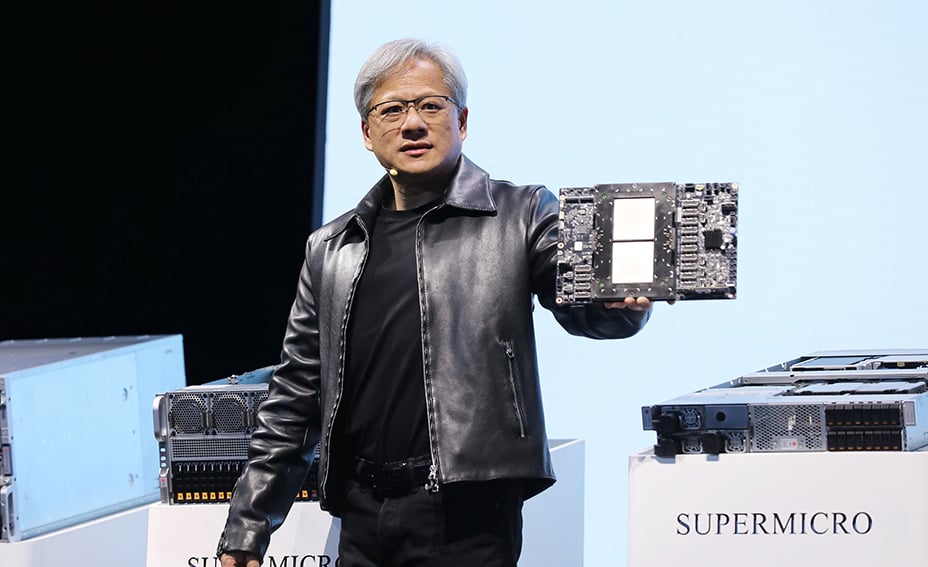

- Advances in AI have been made possible thanks to huge gains in computation, driving demand for NVIDIA’s chips and other accelerated computing products

- New AI models may do more to reinforce the standing of the large tech platforms than disrupt them

- Healthcare and education are among sectors set to benefit, but long-term investors still need to consider companies on a case-by-case basis

All investment strategies have the potential for profit and loss, capital is at risk.

WATCH: Investment manager Kyle McEnery discusses artificial intelligence and related investment opportunities in his Disruption Week webinar

It’s almost a year since ChatGPT took the world by storm. Many have described the chatbot’s arrival as a ‘tipping point’ for artificial intelligence thanks to its creative proficiency in natural language and, more recently, imagery. But if we step away from this moment and take a broader view, our perspective changes.

“The notion that we can capture intelligence in a machine has been around for a very long time,” says Kyle McEnery, an investment manager at Baillie Gifford who specialises in AI.

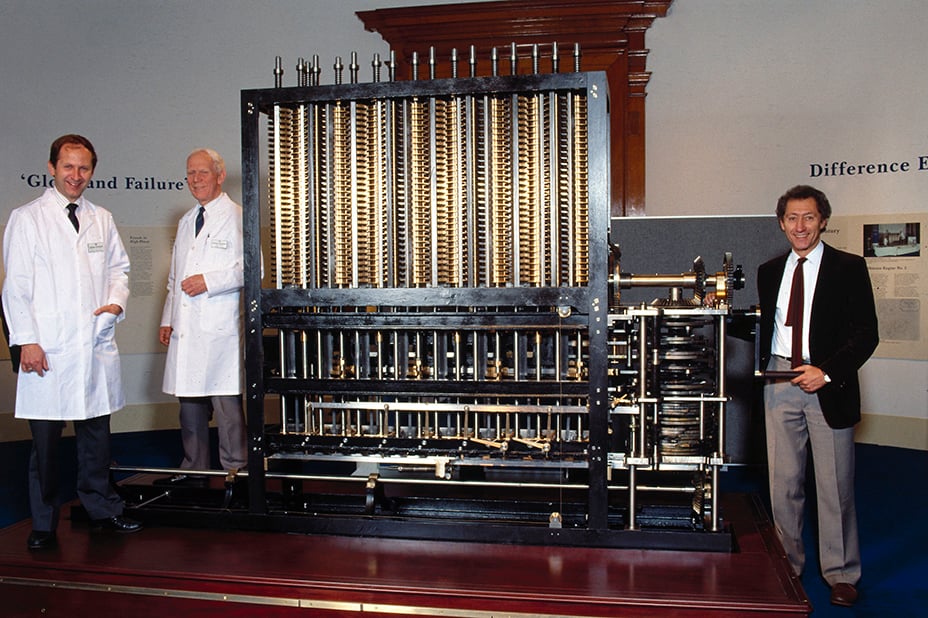

“In the 1800s, we had Babbage’s difference engine and its mechanical wheels. In the 20th century, vacuum tubes. Then, we built circuits in silicon. Machine learning got going when we connected the resulting computers to create the internet, generating lots of data. And they continue to get faster and faster and smarter and smarter.

“Yes, it’s amazing that they can now generate artwork and produce text, but there was a time when it was amazing that computers could do partial differential equations. My point is that to understand what’s happening today, it helps to see it as part of a big wave that’s been building for a long time.”

London’s Science Museum built a version of Babbage’s ‘19th century computer’ based on the inventor’s designs. © SSPL/Getty Images

As a long-term investor, Baillie Gifford is wary of getting swept up in the hype around AI but mindful of its transformative potential. It’s impossible to know how the technology will affect individual companies’ fortunes over the next five to ten years and beyond. However, at his recent Disruption Week webinar, McEnery shared some of the emergent themes influencing his thinking.

Brute force

For most of its past, work on artificial intelligence focused on teaching machines how to think by encoding rules and facts into their software. This became known as ‘symbolic AI’. The idea was that by showing machines how to manipulate symbols and facts, they could learn how to reason the way we do.

However, history has repeatedly demonstrated that a ‘brute force’ approach involving massive amounts of computation tends to be more effective at dealing with complexity.

As the computer scientist Rich Sutton observed in his 2019 essay, The Bitter Lesson, while it may feel more satisfying to build knowledge into agents, “breakthrough progress eventually arrives by an opposing approach based on scaling computation” – or, in simple terms, chucking enough processing power and data at the problem that computers can use the examples to find solutions themselves.

“We started getting better results when we stopped trying to be so clever and just started using machine learning, taking our hands off the wheel to see what the AI models could learn,” McEnery adds.

ChatGPT’s underlying large language model follows this trend. Its maker OpenAI has improved on it by building larger models that learned from bigger data sets – effectively all the accessible text on the internet – requiring more computing resources. Humans are still involved in fine-tuning, but the point remains that access to increased computer power is critical.

“This learning paradigm is very hungry,” comments McEnery.

“That means that computing company NVIDIA’s chipsets and other accelerator hardware need to continue getting better because we’ve got to the point that you can’t do machine learning at scale without them.”

But McEnery makes the additional point that for specialist AI applications you also need to have access to information-rich examples.

“You can argue that the intelligence is in the data,” he explains.

“So the most important question becomes: where can you get high-quality data and lots of it? And when you answer that you can identify which elements of society can be highly affected by machine learning.”

This is where companies like Ginkgo Bioworks can gain an advantage. It is working with Google Cloud to build AI models to help it ‘engineer biology’ based on its proprietary DNA database, containing about two billion protein sequences.

Another example is Wayve, a self-driving technology startup whose technology is being tested by the grocery delivery firm Ocado. Wayve recently trained a generative AI model using thousands of hours of driving data it had collected in London. The model lets the firm create new high-definition road traffic footage by providing descriptive text prompts. This will allow Wayve to validate how its self-driving system copes with unusual situations and improve it via unlimited examples.

Disruptive or not?

The history of technology is full of tales of disruptive innovations’ destructive effects on incumbent businesses. Combustion engines spelt the end for most horse-drawn carriage makers. Ecommerce has driven scores of department stores to close. And online search has devoured yellow pages business directory publishers.

However, generative AI – the ability to create text, images and other output to human-like levels – may buck that trend, at least regarding the tech giants and their platforms.

“It’s costing about a billion dollars to train some of these models,” says McEnery. “That’s why OpenAI has tied up with Microsoft, and Anthropic, a rival AI assistant maker, has partnered with Amazon and Google.

“But it’s not just about money. Distribution matters. So, Microsoft has an advantage in having millions of users for its Office apps users as it rolls out its GPT-powered Copilot features. Google leads in search, which could help its Bard chatbot. And Meta’s new image-creation tools and AI features for advertisers should benefit from its ownership of Facebook, Messenger and WhatsApp.”

In the words of tech analyst Ben Thompson, generative AI could become a ‘sustaining technology’, improving the performance of existing products, rather than a ‘disruptive’ one that displaces them, at least in its early stages.

“But that’s not to say there won’t be a shake-up,” adds McEnery. “And the most interesting prospect of that happening would be if the distributing channels changed in some way.”

Accelerated advances

More broadly, AI has the potential to create long-term value by making it easier and cheaper for companies to bring new products to market and improve on their current efforts.

“Healthcare’s an interesting example,” says McEnery, “because it’s always been hard and very expensive. But we’re seeing companies like Recursion Pharmaceuticals and Exscientia use AI to rewrite the economics of drug discovery.”

Education is another sector where the effects of the technology are already visible. Duolingo, for example, has started using GPT-4 to let its subscribers improve their foreign language skills by roleplaying situations with a bot. Likewise, Coursera has an AI-powered tool in development to help educators structure new classes and generate content for them based on its existing library of online lessons.

And this is just the start. From moviemaking to video game creation, automated transport to smart energy grids, the applications for artificial intelligence appear almost limitless.

As long-term investors, we can benefit from continuing to take a patient approach, considering each business on its own merits and recognising that these AI developments have been a long time in the making and will play out over many years.

“No good companies are based solely on technology,” reflects McEnery.

“They are based on solving problems. So, we’re not going to invest in companies just trying to develop AI or models for their own sake. It all comes back to who will benefit from the technology’s use and what will the knock-on effects be.”

Discover more about Kyle McEnery’s thoughts about AI’s investment opportunities by watching the video at the top of this article of his Disruption Week webinar.

Words by Leo Kelion

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

72111 10040182